Welcome to ‘The Long and the Short of IT’.

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same.

Need more: Let’s chat at Progressive Equity here where I am delighted to be a contributing analyst and visit my website.

“History repeats itself, first as tragedy, second as farce.”

Oops, its coming around again. LSE Total Shareholder Return has inched into positive territory (YTD +2.1%, vs -9.7% Y/Y), indices are positive and the daily rush of Trading Updates inform us that companies are ‘in line’; with very few howlers. Outlook commentaries are generally positive but punctuated by caution. Global political turbulence is heightened in an election year when 4bn people are being woed. Nonetheless, inflation is stuttering down, the labour market is nudging towards normal and ‘higher for longer’ thinking has moderated: WACC is cheaper.

UK tech stocks are “cheap”. But no one wants a value trap just when a faltering macro might dampen demand. For now ‘sentiment’ is more important than ‘fundamentals’. Sometimes these ‘sendamentals’ move in kilter, often they don’t. For now sentiment is negative. But with consensus pricing an economic soft landing accompanied by H2 interest rate cuts there is a more benign scenario which could make for a bumper year: How so?

Valuation. Valuation has become a tailwind and a volte face from the past number of years (see below). The ‘higher-for-longer’ cost of capital may lead to some ‘lower-for-longer’ valuation thinking but valuation has just turned better - this draws in buyers.

Corporate actions. ‘Cheap’ company valuations attract financial and corporate buyers, and a ‘bouncing along the bottom’ economy means more M&A and share buybacks. The lesson from history (see below) is that largely irrespective of the economic cycle buyers will pay a low as possible premium to the undisturbed (share) price. Recap: corporate, not financial, buyers are better for exiting shareholders.

A new tech cycle. GenAI is a tsunami washing though the tech sector, erasing all other drivers, swamping organizations, boards, investors. While it made little impact on wider global IT spending, Nvidia’s hockey stick financials illustrate buyer momentum. This year is already punctuated by operational progress with meaningful sales in 2025 or margin upside from GenAI productivity improvements - buyer ROI is 12 months. While customers and revenue have appeared (Microsoft Q2/FY24: 53,000 Azure AI customers) for now, investors should expect further GenAI definition, inference, snazzy product debuts and the evolution of use cases based on real world POCs. The AI ecosystem remains undeveloped. OpenAI is the first mover but its laughable internal struggles donate market to competitors. The AI moat is the foundation models (GPT, Google Gemini (LlaMa becomes Gemini, 8 Feb), Claude, Cohere, PaLM etc) which are difficult to switch-out once a service is trained. Hence, we suspect a new push on developers to get them switching to other contenders Mistral, Stability AI, Aleph Alpha - good news for consumers/bad for investors is that this will be deflationary.

Legacy companies are not following the ‘loser’ playbook. Our valuation heat map begs questions of the valuation losers (below). All tech cycles have winners and losers (To wit: Nasdaq Composite Index performance in 2023 (+43%) was not just dominated by the Magnificent Seven, but Nvidia which accounted for under half of the gain). Of note in this transition, legacy vendors are adopting AI technology rapidly…we wonder if they could unpick the fate of former legacy companies (DEC, BUNCH, Mosaic etc)?

Early sights on the newbies. The structural GenAI winners are being ‘born’ now. The later stage of any technology transition sees the emergence of the ‘natives’. They will ‘do new things’, accelerate dis-intermediation; some will be dashed, others re-born, others will crumble under the weight of technical debt, but new companies await. Note from history, Asos and Ocado were founded in 2000, long after the birth of the underlying technology, and neither were seen as ‘tech’ companies.

A productivity driver. GenAI makes many current technologies ‘legacy’, users have imminent technical debt and are over-staffed. A report from the International Monetary Fund, IMF, (here) concludes that c40% of global employment is exposed to AI. Advanced economies are at greater risk as c60% of their jobs are exposed to AI, due to prevalence of cognitive-task-oriented jobs, about half may be negatively affected by AI, whilst the rest could benefit from enhanced productivity through AI integration and the co-pilot payback. UK productivity needs a boaster jab.

The Regulatory backdrop – mixed messages. Recent proposed changes to the UK listing regime run counter to a more broad-based trend of increased governance and regulation. There is more and deeper scrutiny by the CMA on M&A transactions and international regulatory trends are creating new requirements around AI governance, accountability, ethical deployment, and stakeholder involvement. That said running concurrently are steps to unpick regulation. To wit: In December, the Financial Conduct Authority confirmed it would merge the premium and standard segments of the market and end rules that require firms to win shareholder approval for major deals. Remember: In 2023, the volume of IPOs slipped 8% Y/Y as cash raised slumped 33% Y/Y. That said, poor performance by existing LSE IPO ‘newbies’ must dampen investor interest - there should be a hippocratic oath for IPOs.

End note:

“First come the innovators, then come the imitators, then come the idiots”. The quote attributed to Warren Buffet reminds us of the challenges ahead. With consensus of an economic soft landing equities nudging to price an optimistic scenario, there will be downside risk in a volatile year. We are reminded by industry analysts Gartner that; “(AI) Hype does not equal revenue”. Cautions abound, recoveries are uneven, but the lesson from history is that this is one of those rare times when the multi-year opportunities beckon.

Thanks for dropping by dear investor. George

The data

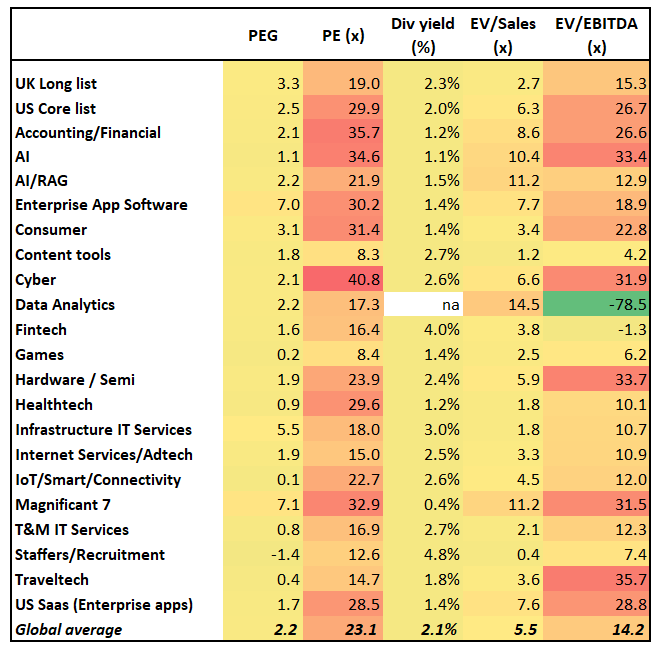

Tech valuation snapshot by cohort

Tech TSR over time

UK Tech valuation over time (x)

Exploring Valuation, IT Spend, GDP since 2000

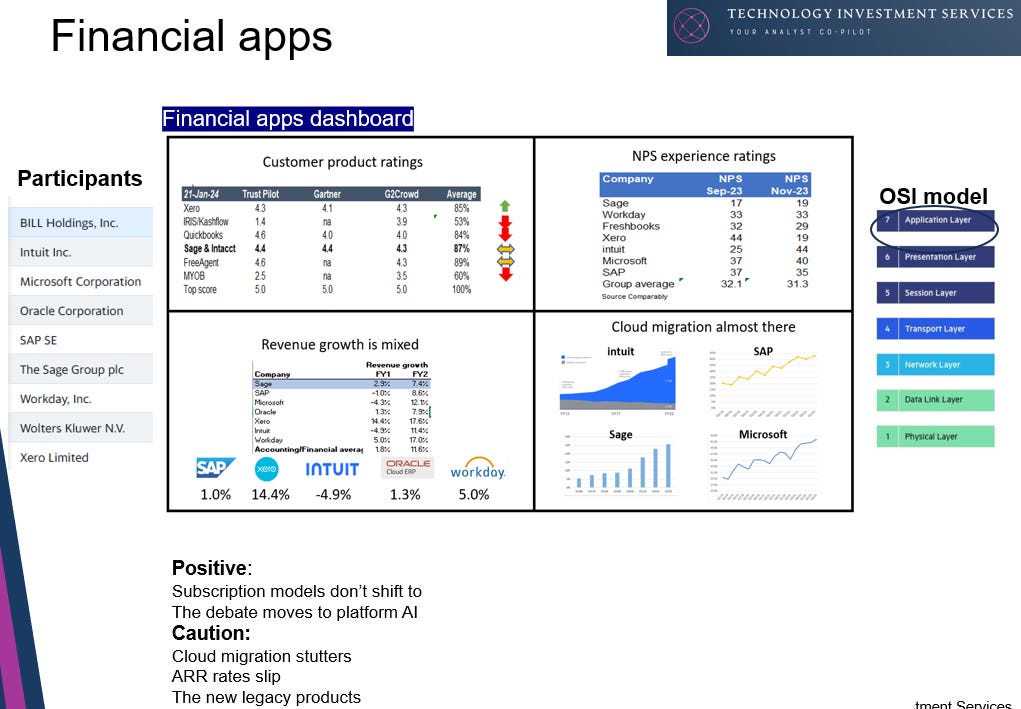

A canter thru some of the tech cohorts:

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice and opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security.

Need more: Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and visit my website.