The long and the short of IT

“You can’t fatten a pig by weighing it”

I sat through a detailed, entertaining presentation by noted UK Tech entrepreneur, investor, and philanthropist Rob Wirszycz speaking to Simon Perriton about The Entrepreneurial Journey. Mr Wirszycz is a gold mine of first-hand practitioner accounts, ‘bon mots’ and a play book for a successful career. I did a double take when Rob said “You can’t fatten a pig by weighing it”. Shame-faced: I, and the wider investment community, spend lots of time cuckolding KPIs but the phrase reminds that benchmark data does not in itself achieve business growth. Our take-away: I need to better monitor underlying growth drivers as much as performance. Mr Wirszycz also argued that “Selling is not about telling, it’s about asking, and buyers are liars” and we need to “eat the frog on your plate” . . this was too much in one session. Let’s revisit these themes over the coming months.

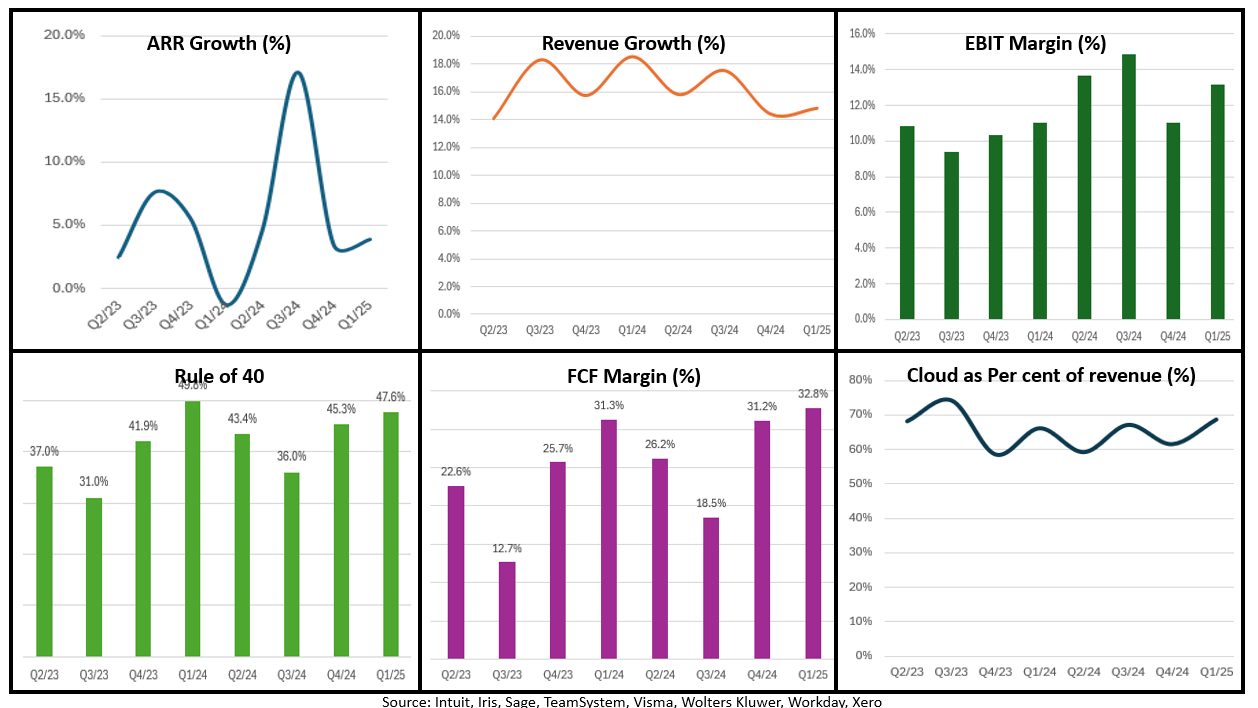

In this edition; H1 Valuation trends; will AI-agents pay taxes when staff don’t; latest Glassdoor round-up (turn that frown upside down) and the growth hack at private tech companies. Meanwhile, the latest Tech Universe results/updates span UK Software (Dotdigital, Intercede); IT Professional Services (Accenture, TPXimpact, Made Tech); UK Hardware (Filtronic); Recruitment (Korn Ferry, SThree); Financial & Accounting (Visma - a perfect IPO for London); Gaming (Devolver). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

Latest tech sector discussion points

1. Valuation at the half-way mark: Valuation flat - markets moving better

The markets have become somewhat immune to the on again/off again tariffs, the wobbling geo-political backdrop and the reluctance of the 10-year gilt yield to give way. But balancing this, there is greater interest in low valuations and the UK’s stable political and economic backdrop. Earnings have been generally positive as forecasts take a ‘glass half empty’ approach so there is potential estimate upside in H2/25. This is all coupled with buying from overseas investors.

Net/net: Everyone is exhausted by the onslaught of ‘all-over-the-place’ news YTD2025 and H1 finishes positively.

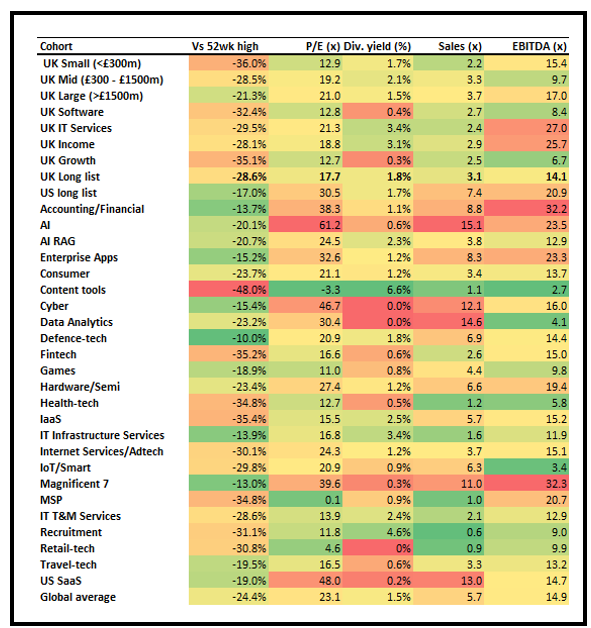

Tech Universe Valuation heat map

Source: Company data, Yahoo Finance, Technology Investment Services

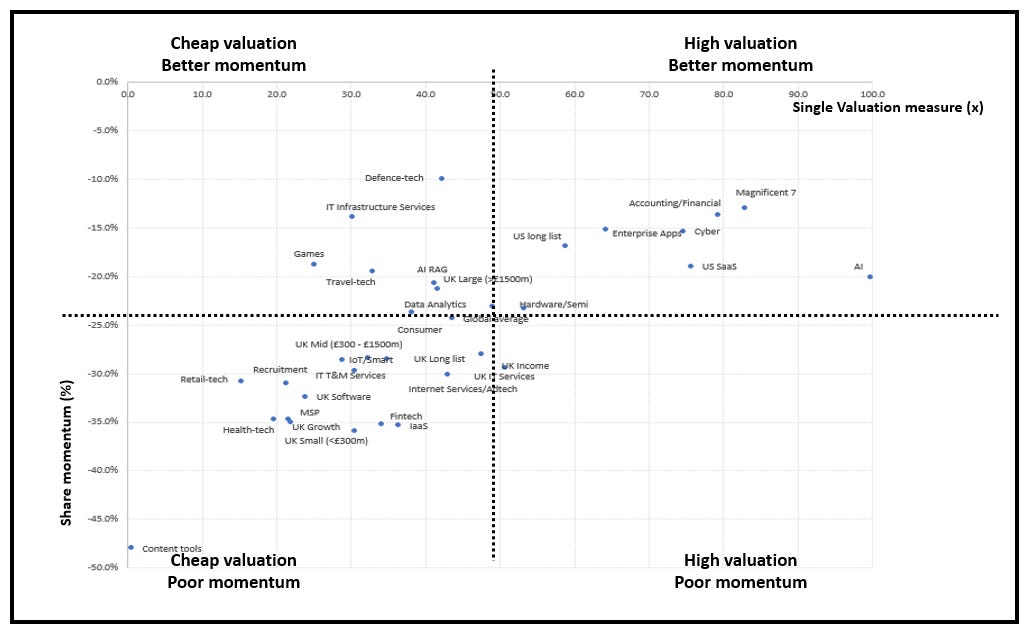

Tech Universe Share Momentum and valuation: Sectors in and out of favour

Source: Company data, Yahoo Finance, Technology Investment Services

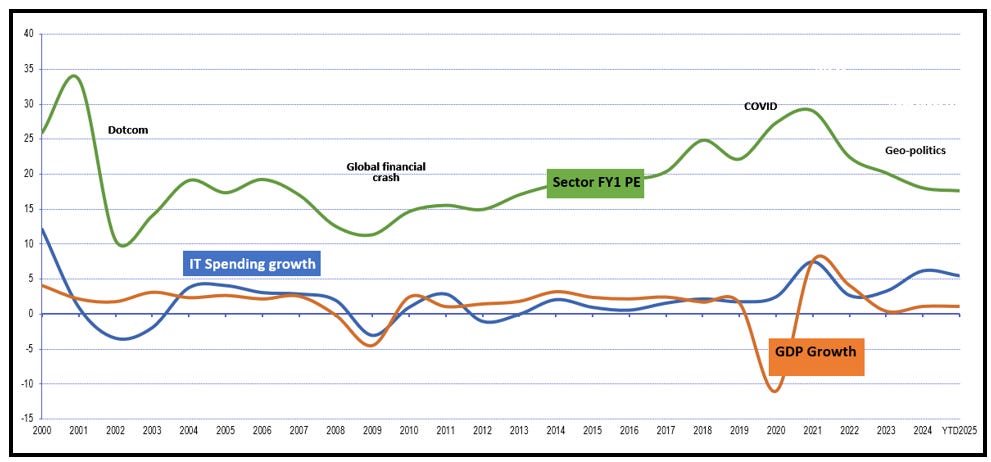

UK Tech PE, IT spend & GDP - over time (brothers by similar mothers)

Source: Company data, Yahoo Finance, Technology Investment Services

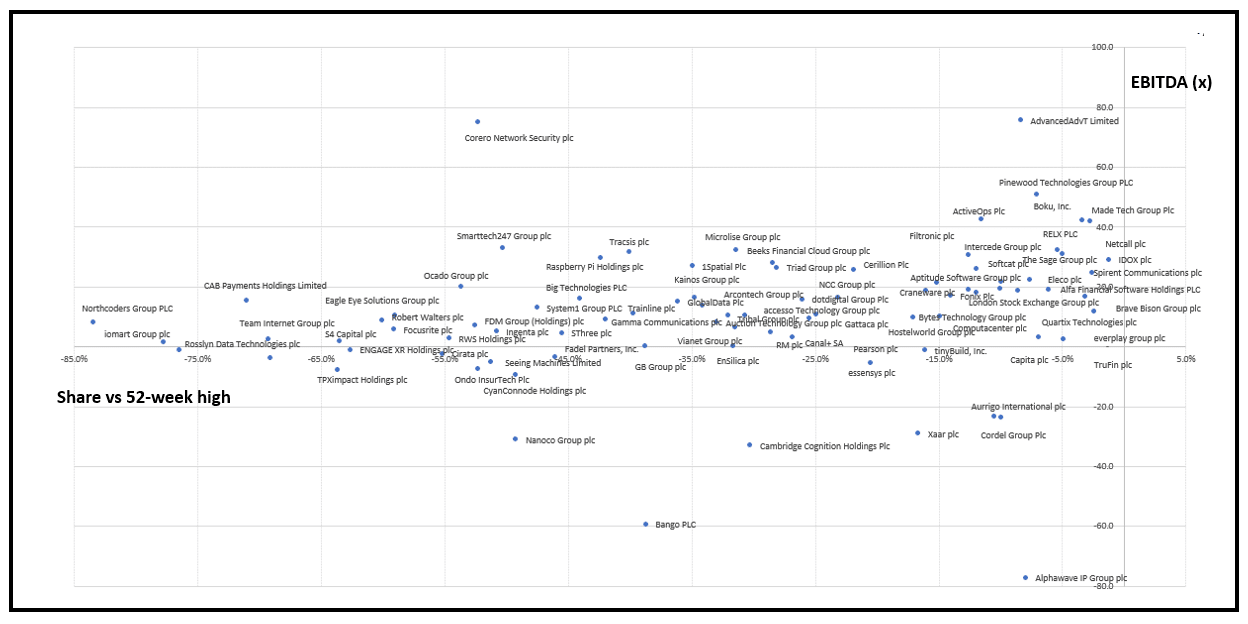

UK Shares EBITDA vs Share price momentum

Source: Company data, Yahoo Finance, Technology Investment Services

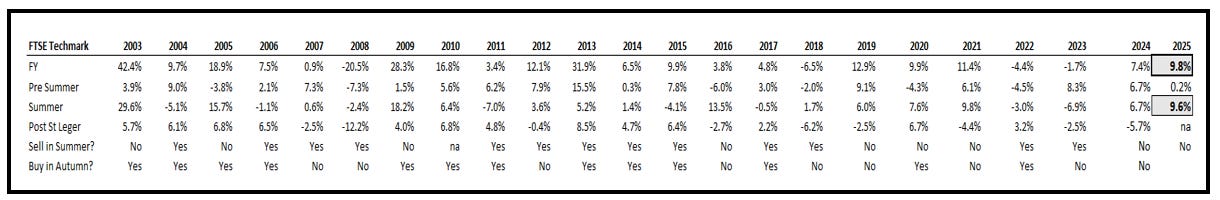

Sell in May? Nope not this year (and the sector still enjoys strong valuation support)

Source: Company data, Yahoo Finance, Technology Investment Services

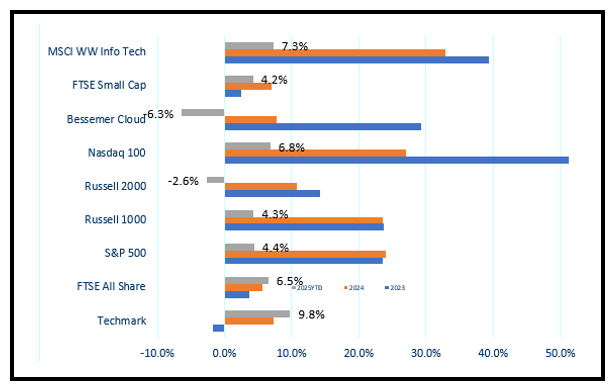

Index performance: A strong recovery in the UK Techmark - the fall of US Cloud continues (beware an AgenticAI fall-out)

Source: Company data, Yahoo Finance, Technology Investment Services

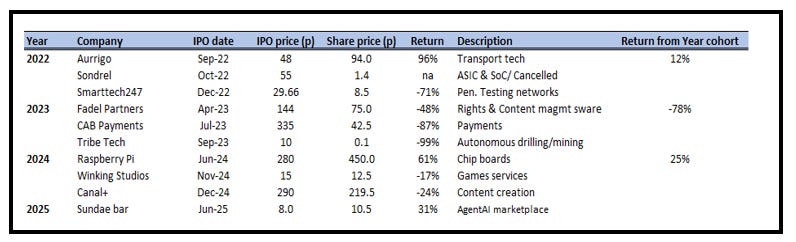

Recent IPO performance - Getting better

Source: Company data, Yahoo Finance, Technology Investment Services

2. Will AI-agents pay taxes?

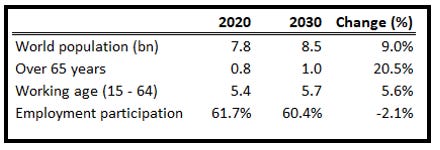

Between 2024 and 2027 we are ‘Peak 65’. Then, the final wave of baby boomers retire. In the US 4.1m ‘grey beards’ are to quit the workforce each year. The over 65s already out-number children in America. In the UK there are c165,000 new 65-year-olds per year between 2025 and 2030. The UN estimates that by 2030, 1 in 6 people globally will be aged 60 or over, compared to 1 in 8 in 2015.

This aging population has significant implications for healthcare, retirement planning, and workforce demographics prompting investors to re-shuffle portfolios. Somewhat fortunately, evidence indicates that employers are already disproportionately laying off staff in their 50s, and AI is eliminating jobs so maybe the boomers wont be missed. AI is also expected to create new jobs: the World Economic Forum opines that 78m new jobs will be created by 2030, when all the boomers are over 65. However, right now this ‘happy’ scenario is misplaced.

Today AI is cutting swathes through entry-level roles. It is not back-filling those boomer gaps. In addition;

In Q1/25 the unemployment rate for recent US college graduates was 5.8%, the highest since 2021 and higher than the 4.2% national average unemployment rate.

There are fewer entry-level jobs in the professional (a.k.a white-collar) sector.

Companies are pulling their internships programs - these are often a prerequisite for gaining a full-time entry-level job.

Some firms now have an ‘AI-first’ approach, initially testing whether AI can handle tasks before resorting to hiring humans.

We appreciate that graduate unemployment will usually spike during an economic slowdown and the economy is currently fragile. However, our concern is that the ‘career ladder’ is being broken, and so too is ‘trust’ – note last year (i.e. before the madness) Tesla rescinded its summer internship offers. That AI is replacing, or reshaping, many entry-level tech roles is not a surprise, neither is it the case that companies are taking a short-sighted view and reducing hiring (big tech reduced graduate roles by 25% in 2024). However, when taken together the moves leave a large ‘gap’ in managerial/project management roles as the boomers leave, with no one being trained to fill the 2025 - 2030 employment gap - before those anticipated AI jobs become significant. This will also leave a big hole in public finances as the employment participation rate continues to decline.

We are reminded of Darko Matovski CEO/Founder of Causalens. He argues that one of these future casualties is the US$500bn data analytics market as AI agents capture the current US$100bn spend on SaaS analytical, ETL and consulting tools, and the additional c.US$400bn spend on data engineers, analysts, scientists and visualisation professionals whose roles are lost to AI. The future for employees, says Mr Matovski, is continuous upskilling and retraining, something that companies fail to do. Not to be out-done Salesforce Marc Benioff also talks about his real-world AI use cases changing Salesforce staff.

2030 projections indicate a continued downward trend in the global labour participation rate driven by demographic shifts (Peak 65) and slower population growth. We shudder to think whether this adequately factors in AI adoption. Investors need to think about ‘going long’ on life time education service providers while they fret about the longer term prospects in the SaaS, Professional Services and Recruitment cohorts.

Back to our discussion point

With Peak 65, folks who paid taxes become net ‘takers’. With many jobs lost to AI, and with it lost tax revenue, there is no system where AI autonomous agents pay taxes. Currently any taxes related to AI and robots are paid by their human carers or corporate owners. The idea of granting a legal personality to AI, in order to tax them, has been discussed, but not implemented. The EU Parliament considered a robot tax (February 2017) but rejected it, concerned that it might stifle innovation. There was an opposing coterie of right-wing parliamentary groups (ALDE, EPP, and ECR), and the EUnited Robotics and the German Mechanical Engineering Industry Association argued that taxing robots would be a "job killer" by increasing costs for companies adopting automation. South Korea has a form of robot tax by reducing incentives for firms to deploy robots. The difficulties of implementing the Digital Services tax may well pale in comparison. This debate will rise again.

Global population 2030 guestimates (bn)

Source: Various, Technology Investment Services

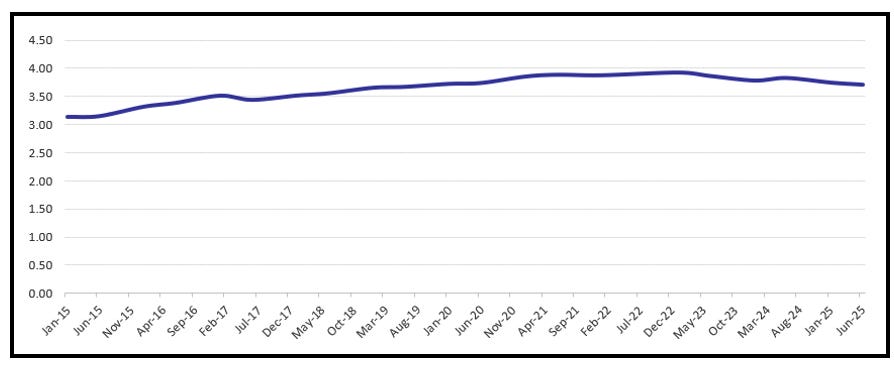

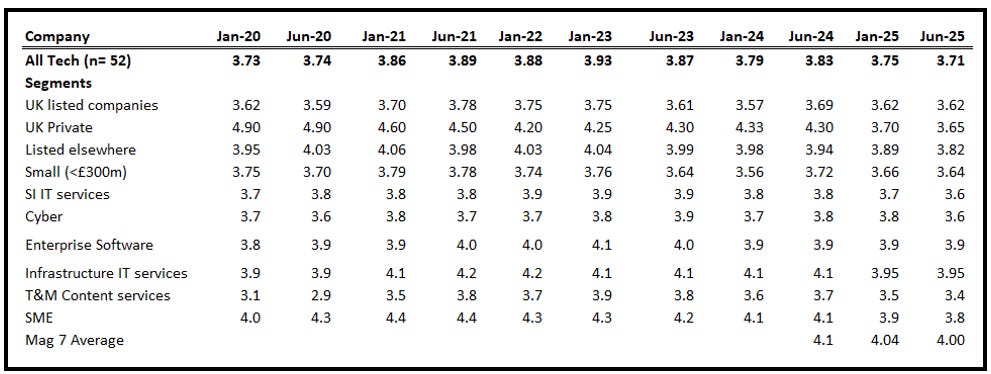

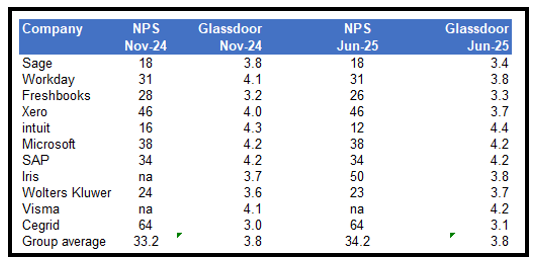

3. Glassdoor: Turn the frown upside down - no chance

A happy team delivers quota, creates happy customers and a sustainable business. Company culture is important. From our latest review Glassdoor continues to trend downwards. The high point was January 2023 and the ‘Happy Index’ has been sliding since then. January 2023 also marked the last high point in IT Full time and Contractor salaries. This might be more coincidental than causal.

From the individual segments that we track, staff at the Mag 7 are the happiest (although the rate is drifting backwards) while the T&M content group – where financials have been deteriorating due to technology change - are the unhappiest.

Once again we are reminded: As staff think - why work at a ‘2’ when you can work at a ‘4’, investors and customers need to heed that view.

The numbers we track: Glassdoor

Source: Glassdoor, Technology Investment Services

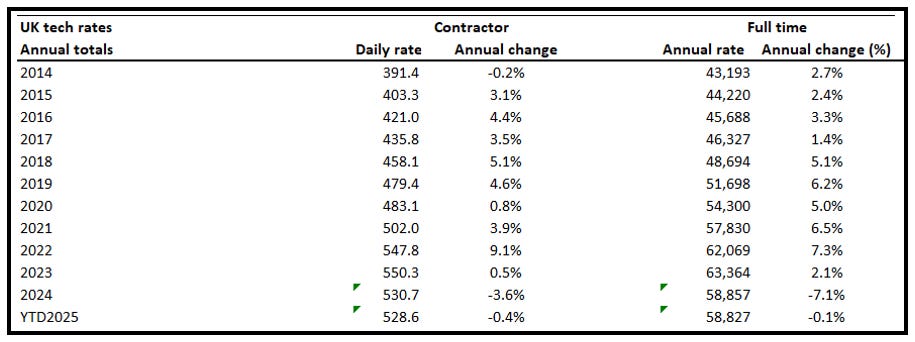

Tech Salaries: Peaked in 2023

Source: ITJobswatch.co.uk, Technology Investment Services

4. The Private company growth hack

I was honoured to be a judge at the inaugural Private Business Awards. These awards celebrate the best UK private companies who are “proud to be private”. Generally, there are few differences between public and private companies (public companies have public company costs/private companies carry more debt etc). However, there is one huge difference: Growth.

The private tech group under consideration was comprised of 76 companies which spanned the entirety of the tech universe. Their reported average Y/Y revenue growth was 37.6% (the base data being the latest reports filed at Companies House). That is way ahead of public company and market growth rates. For example; the 2023/24 FY reported growth rate was 7.6% at our UK software cohort, UK Hardware 11.9%, UK RAG 0.3%, UK Professional Services 1% and 5.5% at UK Managed Services.

Private companies are better growers and are turbo-charging growth through acquisitions. By contrast, public companies are buying back their own shares, making themselves more illiquid, and so creating future problems. Some public companies have little room to manoeuvre because private company valuations are higher than their own, others are victims of group think, or lazy advisory. Public companies need to do better growth.

Note: The short list for the Tech Business of the year is announced. Winner at the Awards on 11 September. More info/begging letters to Jo Thomas, MD Ford Sinclair

Latest Sector Cohort scenarios and company updates

UK Software

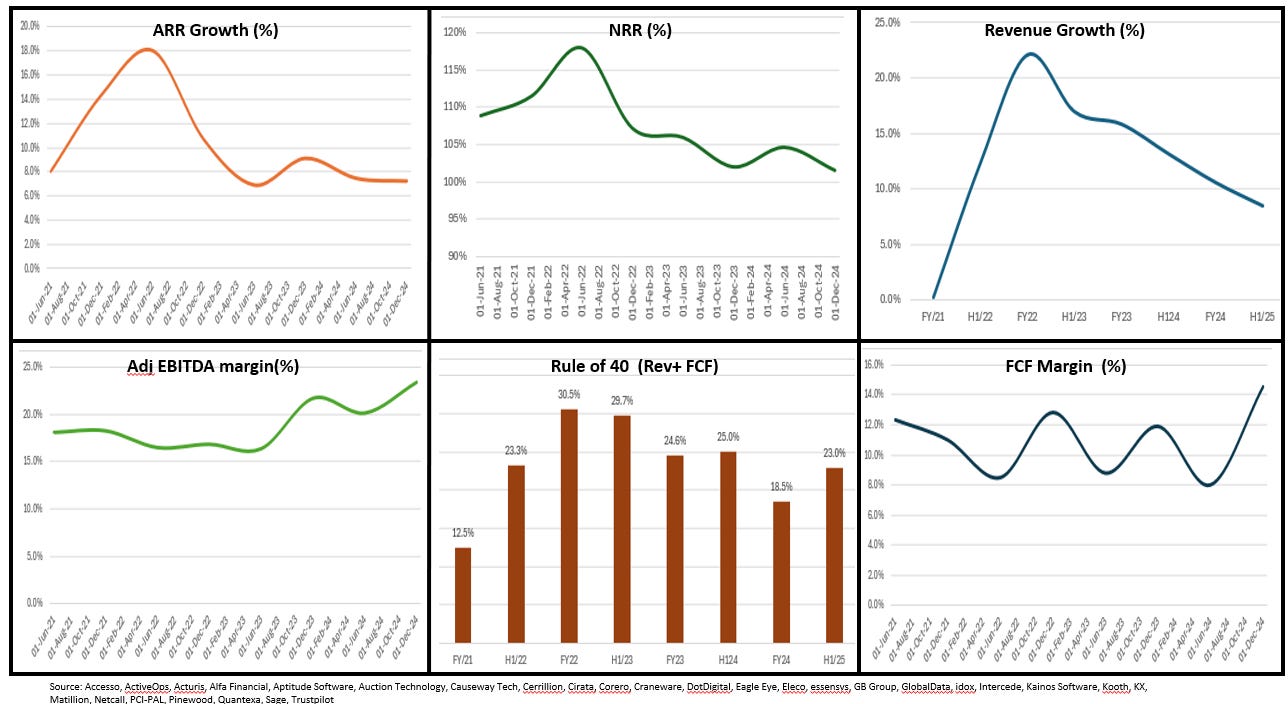

Cohort scenario: These companies are typically smaller than their US counterparts, but all sell and compete globally. In addition to being smaller they typically have poorer KPIs (notably cash-based, ARR, NRR) but have better profitability. The comparative KPI mix may on its own account for the lower valuation and support the view that ‘venue’ has little to do with the valuation. The group is cheaper and pays a dividend/income in addition to share buybacks.

UK Software cohort: KPI Dashboard

Source: Company data, Technology Investment Services

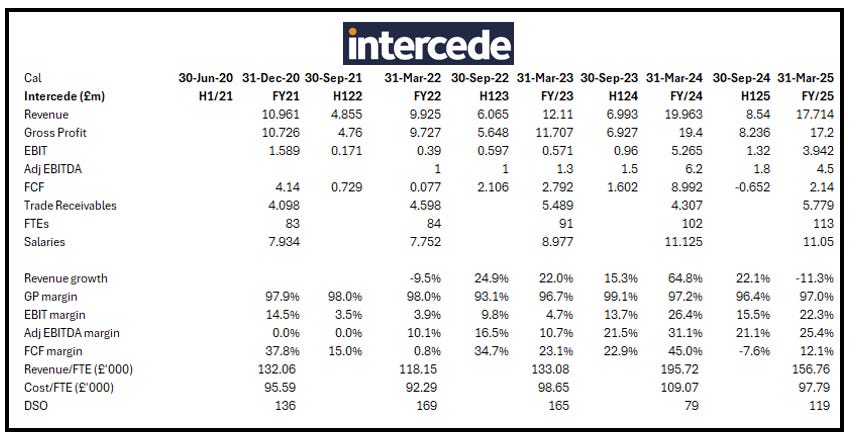

Intercede. Revenue -11.5% Y/Y to £17.7m; gross profit -11.3% Y/Y, EBIT £3.9m from £5.3m last year – the reason is partly explained by a £6m perpetual inked last year - which of course was going to re-occur. Note in revenue mix: Software licenses are 14% of revenue, from 38% last year. Operating expenses down 6.4%, with FTEs to 113, 102 last year. Ongoing investment in MyID SecureVault software saw a further £0.3m capitalised. Cash balance increased to £18.7m. operating cash £2.9m, £9.6m last year. Key Contract Wins & Renewals included:

US$0.9m CMS deal with a new Asian government client, plus US$0.56m in support services.

First SecureVault subscription with the same client (US$0.5m over two years).

Deals with a leading Middle Eastern airline, a Kuwaiti bank, and a U.S. government-backed enterprise.

Renewed important contracts with U.S. federal agencies, including one over US$1.4m.

Expanded usage with long-standing clients, such as a Middle Eastern university increasing MFA users to 19,000.

Chair Royston Hoggarth commented that the company is “maintaining our momentum, even amid ongoing global uncertainty and challenges”.

The numbers we track: Intercede

Source: Company data, Technology Investment Services

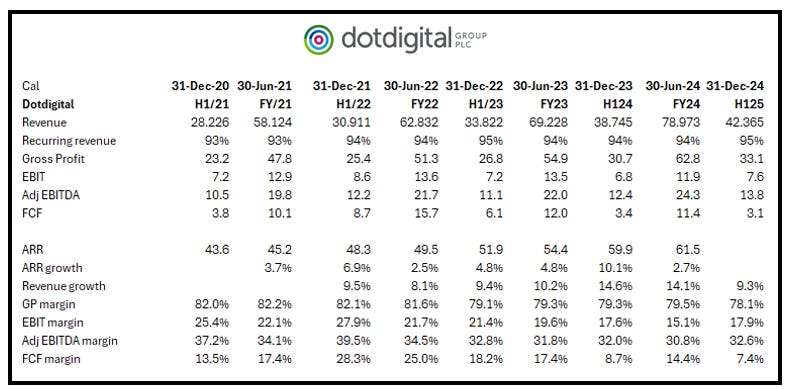

Dotdigital. Acquires Social Snowball Holdings, Inc. a SaaS US-based influencer, affiliate and referral marketing platform for e-commerce brands and issues a trading update and outlook. Anything to attract the kids.

Acquisition. Social Snowball turns prospects, customers, influencers and affiliates into brand advocates. Advocates get a unique, trackable link or code to share with their audience and when one of them makes a purchase using that link or code, the advocate earns a commission or other reward. Social Snowball is available through Shopify and has >1,500 active subscription-based customers. The hope is that the deal enhances the Group-wide value proposition and enables Average Revenue/Customer expansion.

Dotdigital is spending US35m (initial US$20m cash, followed by an earnout) and the deal is billed as being immediately earnings enhancing. For FY ended 31/12/2024, Social Snowball achieved US$3m revenue, growing 200% with a £0.4m loss. The company is cash flow positive for H1/2025.

Current Trading & Outlook. The Board expects FY25 revenue in line with market consensus after adjusting for a £0.7m revenue impact of a legacy contract non-renewal. The full revenue impact is FY26. The impact to current FY25 and FY26 expectations (before the Acquisition) for Adj EBITDA and Adj PBT “will be minimal”.

Milan Patel, CEO Dotdigital: "Social Snowball brings a highly complementary asset to our product portfolio, enhancing our market position as a one-stop-shop for seamless, cross-channel marketing automation and creating valuable cross-sell opportunities."

The numbers we track: Dotdigital

Source: Company data, Technology Investment Services

IT Professional Services

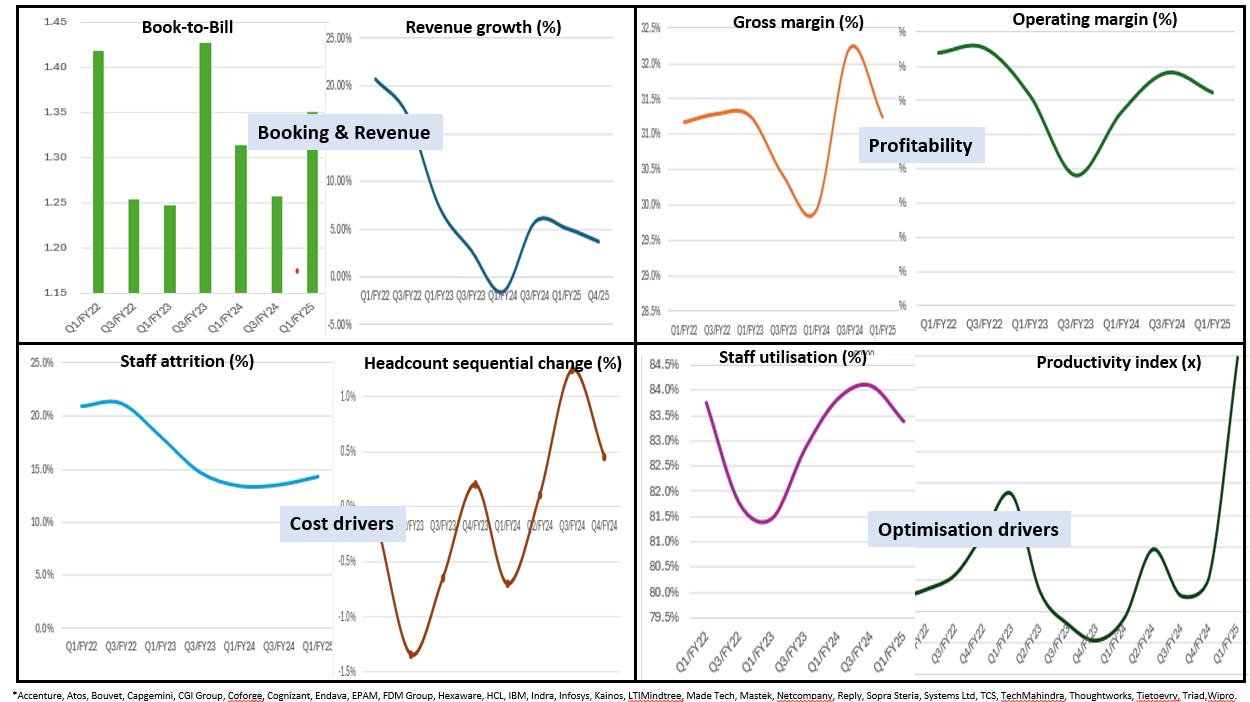

Cohort scenario. The cohort has reported on Q1 trading across our 3.6m FTE Professional Services cohort. Contrarily, given the economic backdrop, we see grounds for optimism. The Q1 KPIs suggest that the recovery is slowly on track with revenue, margin and FTE growth - although the early reports are from offshore companies so there might be an underlying share gain story which has yet to properly ‘surface’. Generally, bookings have recovered (this is happening globally) and revenue growth c5% looks achievable as the IT Professional Services cohort slowly emerges from the aftermath of the Covid and immediate post-Covid environment which saw the industry over-hire. Since then, staff attrition dried up impacting profitability. However, more recently attrition has been shuffling upwards, the industry has some pricing power (i.e. inflation clauses) and so revenue growth has been rekindled. In addition, (i) GenAI has given the industry a new secular growth driver and a new twist to Digital Transformation programs, and (ii) the sector will benefit from the increased Defence spend. From the KPI dashboard the industry is slowly starting to rehire and re-train existing staff which in the short-term dents utilisation. Shares in the cohort are cheap reflecting the past two difficult years, rather than the dashboard which is starting to telegraph a recovery.

IT Professional Services cohort: KPI Dashboard

Source: Company data, Technology Investment Services

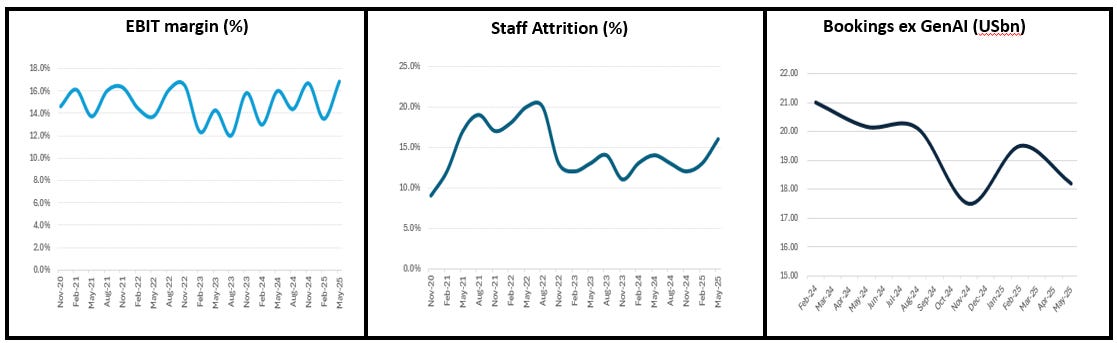

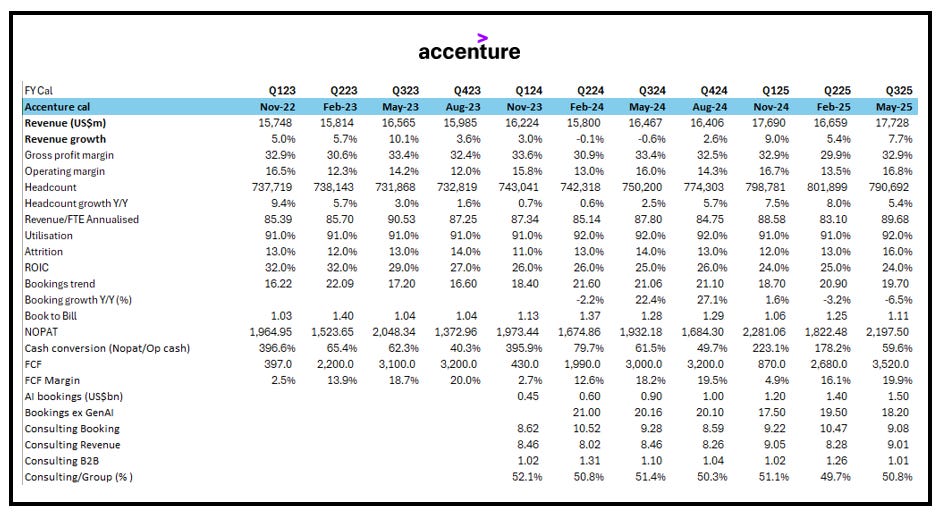

Accenture. The IT Professional sector bellwether suffered from a decline in Bookings and heightened uncertainty in the buying environment as Q3 results came in short of bookings consensus. The share price sank 11% on the print. There are longer term concerns about the role of IT Professional Services companies with the impact of GenAI - however, with these we are reminded of similar fears in the early days of desktop to cloud migration - remember customers usually don’t have the skills.

Accenture revenue +8% Y/Y to US$17.7bn, EBIT margin +80bps at 16.8% (note the positive trend line in our chart), FCF US$3.5bn. Chair and CEO Julie Sweet commented on the 30 clients with quarterly bookings greater than US$100m, broad-based growth and continued expansion of GenAI leadership. The share price reaction was not solely about the bookings miss; new bookings, US$19.7bn, was -6% Y/Y, GenAI new bookings US$1.5bn indicates a slowing of the growth trajectory (see chart on Bookings ex-GenAI for the worry). Also Gross margin, 32.9%, eased from 33.4% last year; the FTE count was down 11.2k sequentially as Attrition creeps upwards and the Consulting Book-to-Bill was touching lows, down to 1.01x. Guidance to FY revenue growth to be 6% to 7% (effectively raising the bottom end of the guidance range) with a forex tailwind contributing 0.2% of that 1% uplift. EBIT 15.6%.

There was a Hat tip for the UK revenue growth on the analyst call (first time in a long time).

The three horse at Accenture

Source: Company data, Technology Investment Services

The numbers we track: Accenture

Source: Company data, Technology Investment Services

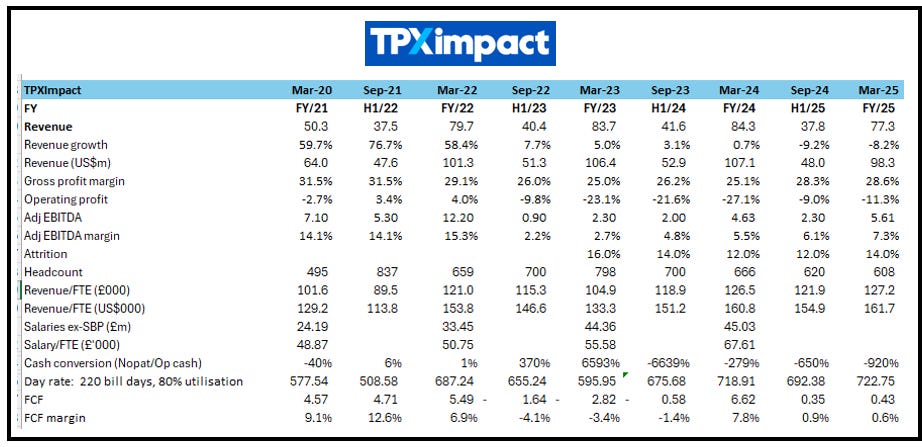

TPXimpact. FY revenue was ahead of expectations and shares responded positively, well, all of +2% on the day. Nonetheless, revenue was down 8.2% Y/Y to £77.3m due to softer public sector demand post-government change and funding constraints. Pleasingly: Gross margin improved to 28.6% from 25.1% (still below cohort average) and Adj EBITDA +21.3% Y/Y to £5.6m, so the EBITDA margin popped up to 7.3%. Statutory EBIT loss reduced to -£8.7m, from -£22.8m last year. Note:

A B-Corp company with superb female representation, 51% - a sector best.

The company is using AI to deliver more value to the client (not quantified).

The Public Sector is mostly using Frameworks for pricing and the company has not seen any widespread shift to value-based pricing. Day rates flat for several rates, but the company has got cost-of-living increases.

Following a 9% reduction in FTEs (note: pretty much mirroring the revenue fall), and admin expenses unchanged, £18.0m. Net debt increased to £8.5m but Net Debt/EBITDA improved marginally to 1.51x (prior 1.54x), and it was at the lower end of target leverage range of 1.5-2.0x. The company flagged a “strong start: profitability ahead of FY25 YTD with £19m in new business booked and a robust pipeline which underpins the company confidence”.

Of the FY26 targets: £6–7m Adj EBITDA, net debt reduced to £7–8m and growth in public investment recovery and expansion into responsible AI, automation, and adjacent markets. CEO Bjorn Conway: “While our financial results reflect the impact of contract delays and spending reviews, we have taken decisive steps to protect profitability and create a more efficient, sustainable business. . . As we enter the final year of our three-year plan, our strategy is clear: to strengthen our revenue base, accelerate profitability and unlock new growth opportunities, all guided by the values and purpose that define who we are.” While the market is “a bit lumpy” the company is off to a good start for FY26 with £19m in new business secured. Pleasingly the CEO flagged that he will initiate a new strategic review in the Autumn to plot out the next three years. For us, this is a positive as the prior restructuring was more internally focused and now TPXimpact needs to make its offer better address a changing demand-side. Our quick tip: Copy Endava and create a advisory board to give punch to the process.

The numbers we track: TPXimpact

Source: Company data, Technology Investment Services

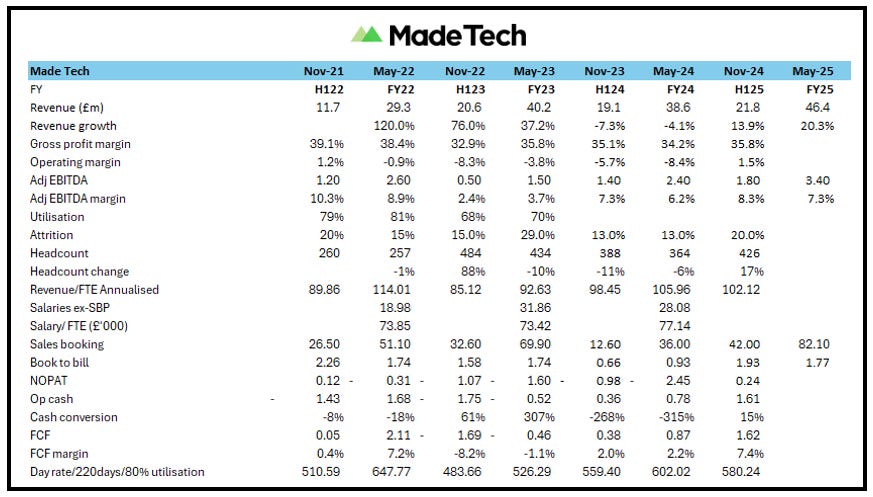

Made Tech. A trading update (FY ended 31/5) sees FY trading ahead of current market expectations. Made Tech guides to FY revenue c.£46.4m +c.20% Y/Y and Adj EBITDA c.£3.4m +c.42% Y/Y growth. Net cash £10.4m (FY24: £7.6m). Made Tech won c.£82.1m in new Sales Bookings (FY24: £36.0m) with recent wins including a £8.4m three-year contract with the Ministry of Justice's Legal Aid Agency and others at the Department of Health and Social Care. The Contracted Backlog grew impressively to c.£92.0m (FY24: £60.6m).

Decoding CEO Rory MacDonald’s commentary:

He sees Positive Demand side drivers “The UK Government's renewed focus on digital transformation and data as a growth asset through the recently announced Spending Review, the State of Digital Government report, the UK's Modern Industrial Strategy and the Strategic Defence Review has reinforced a growing long term market opportunity with clear demand for modern digital technology and the potential for sustained returns”.

He has carved Made Tech into a more disciplined business: “With a strong balance sheet, significant cash position, tight cost control measures, and future revenue underpinned by a strong Contracted Backlog, we believe Made Tech is well placed to continue driving organic growth and to accelerate progress through targeted inorganic growth opportunities where appropriate."

Note: Long-standing COO Chris Blackburn is to step down from the Board as an Executive Director from 25 July 2025 to pursue new opportunities and will remain with the business until the end of August as part of an orderly handover. Mr Blackburn, with the business for 13 years, commented: “I leave the business in excellent health and will continue to follow the story as a committed shareholder. The market opportunity has never been so attractive and I wish Rory and the team all the best for the future.”

The numbers we track: Made Tech

Source: Company data, Technology Investment Services

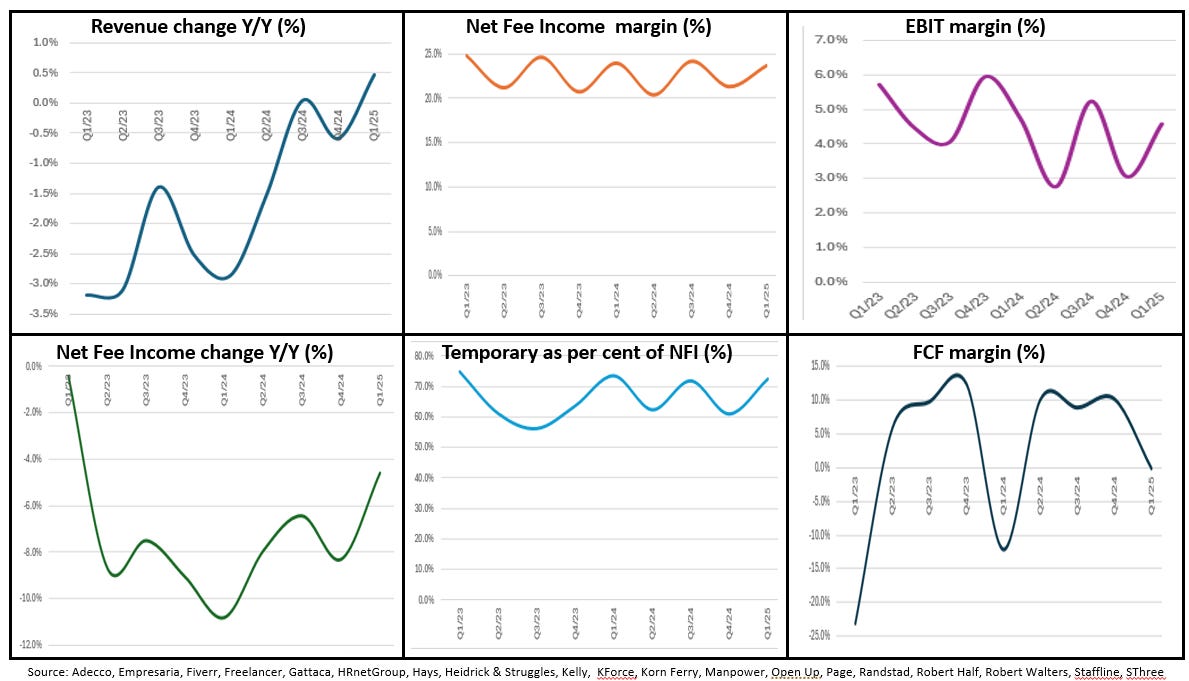

Recruitment

Cohort Scenario: The KPIs have yet to record any improvement. Recruitment (i.e. Staff, i.e People), as much as technology, is the front-end of the tech economy. From our latest results rollcall the strategic messages from the Recruitment cohort remain downbeat and recovery talk is deferred - but this is not a universal truth - there are pockets of growth and service innovation. In addition, the companies spent 2023 and 2024 downsizing and re-shaping their offer. Now they are better able to meet expectations (given their reduced cost bases and doing more contractor sales). As a positive, all agree that there is a digital skills gap which is a barrier to economic growth. Companies also flag the shortage in tech talent, but slow hiring and slow willingness to move employer has created a bottleneck. While a volatile market, the industry is telegraphing that C-suite turnover is consistent with historical levels. We remind that the impact of AI is contributing to the malaise (i.e. more acceptance of blended environments – so for IT development “organizations won’t just have more developers, they’ll have more production ready code generated by AI and more applications built and deployed by agents”). Our message to investors: Look East, and this week specifically to HRnetGroup. Recruitment remains one of the cheapest cohorts. It usually is at this point of the economic cycle. The lesson from the past is that the pricing here can ‘turn on a penny’ following any economic/MSI data.

Recruitment cohort: KPI Dashboard

Source: Company data, Technology Investment Services

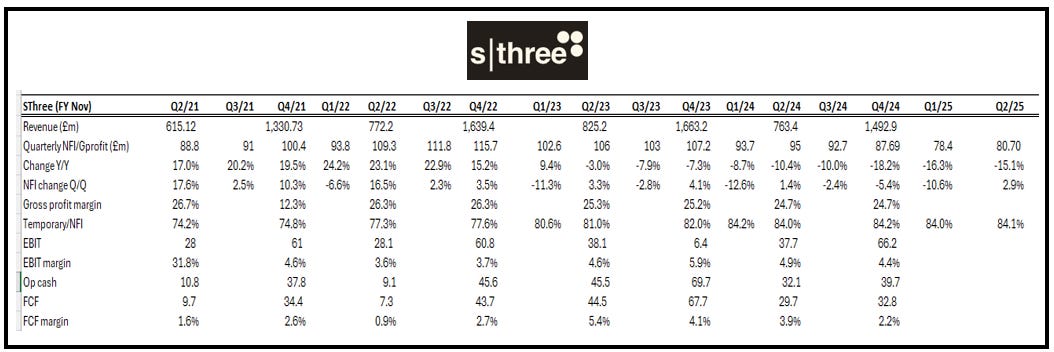

SThree. Unlike Hays, SThree (STEM specialist – technology is 45% of the revenue mix, 48% Y/Y) was more positive for its H1 Trading update. But here too the narrative of ongoing decline - net fees were -14% Y/Y, Contract (84% of total) -14% Y/Y and Permanent placements -13% Y/Y. The contractor order book, £164m, -8% Y/Y. The UK was -28% Y/Y, Germany (-14%) and the Netherlands (-22%) saw declines in Technology and Engineering due to macroeconomic pressures and strong prior-year comparisons. However there was a slight sequential improvement in Q2 driven by better US performance in Engineering.

SThree completed a £20m share buyback, cash was £3m better since February at £48m and is on track to make a further £6m of in-year savings. The company’s Technology Improvement Programme (TIP) remains on schedule, now active in 8 out of 11 markets (80% of group net fees) Here the company is “embedding cutting-edge technology (process automation and bespoke AI-enabled tools) more deeply in its organisation”. CEO Timo Lehne highlighted “sector-leading visibility” from contract extensions and early positive momentum in the US as he reiterated FY25 PBT guidance of £25m.

The numbers we track: SThree

Source: Company data, Technology Investment Services

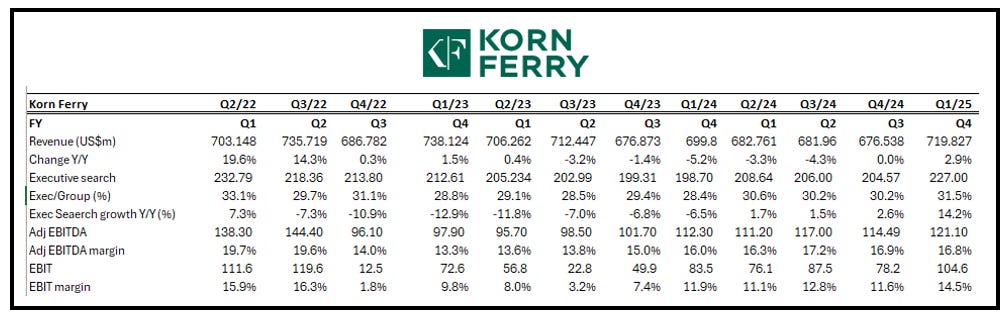

Korn Ferry. “Even amid the ever-changing global economic and political dynamics, we continue to deliver on our financial and strategic objectives,” concluded CEO Gary D. Burnison as Korn Ferry unveiled Q4 FY fee income of US$712.0m, +3% Y/Y - ahead of US$699m consensus. There was some disappointment in guidance which was shy (1%) of expectations. The big positives were twofold:

EBIT margin 14.5% (stunning) up from 11.9% Y/Y.

Q4 Executive Search (i.e. the sum of the individual Executive Search reporting segments) Fee revenue, US$227.0m, was +14% Y/Y due to an increase in the number of engagements billed and an increase in weighted-average fee billed per engagement. On the call CEO Gary Burnison talked about new client wins across industrial, semiconductor, and financial services sectors and multi-year, large-scale engagements with cross-selling (77% of clients purchasing 2+ solutions). The growth was broad-based in North America, EMEA and APAC regions. CEO cautioned that “growth is elusive” with longer sales cycles and a challenging labour market, but the result in Executive Search area bright spot for the wider cohort.

The numbers we track: Korn Ferry

Source: Company data, Technology Investment Services

UK Hardware

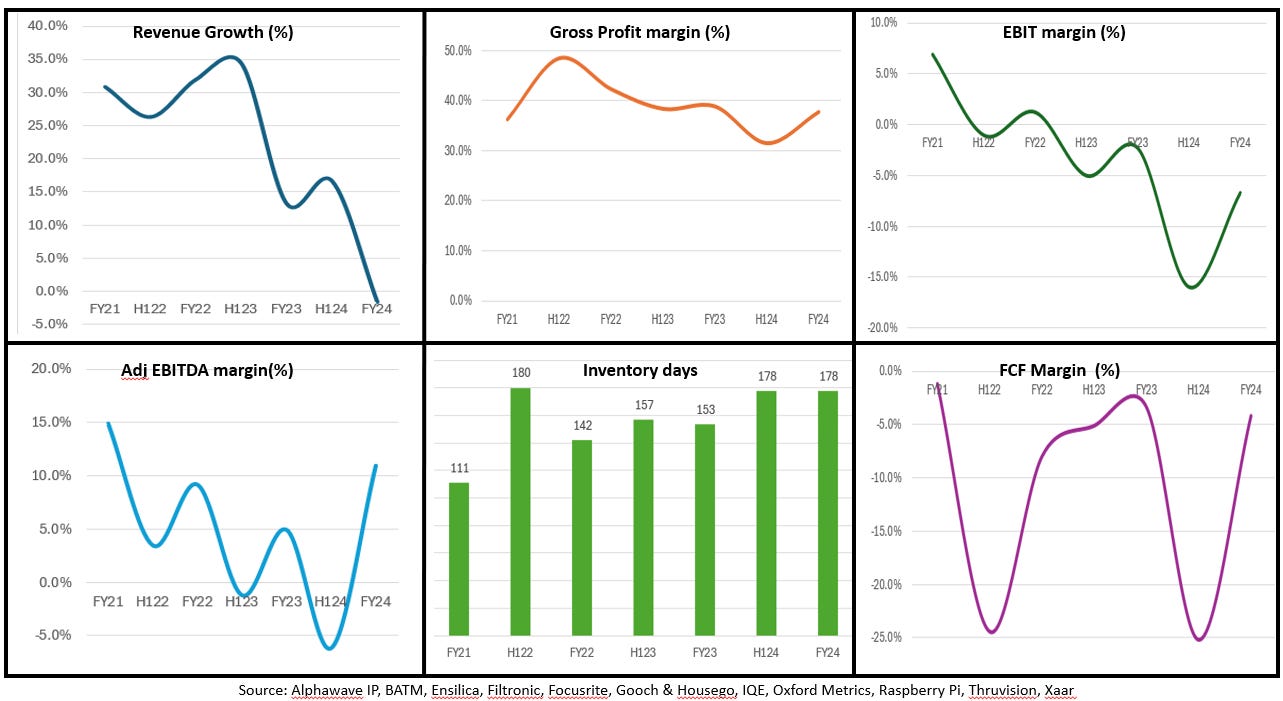

UK Hardware cohort: KPI Dashboard

Source: Company data, Technology Investment Services

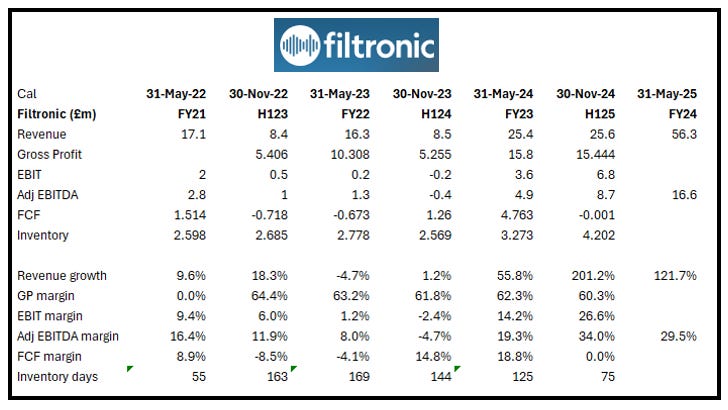

Filtronic. “And the beat goes on” with positive Trading update (FY ended 31/4) peppered with evidence of a broadening customer base (addressing the classic weakness in the business). Revenue and Adj EBITDA “marginally ahead of market expectations” with revenue c. £56.3m (FY2024: £25.4m) so +120% Y/Y building on the prior year +56%. Adj EBITDA “no less than £16.6m” (FY2024: £4.9m). Cash (31/5) £14.5m (30/11/2024: £7.2m).

Positively: Broadening customer engagement with “more established segments of the European space market” (contract wins with Viasat and the European Space Agency), supplying technology for the direct to device market, in addition to Airbus for its system on the OneWeb constellation. In the Aerospace and Defence a recent £0.8m order from Leonardo reflects a “deepening relationship and entry into a new project”. Rising European defence spending coupled with macro tailwinds such as RF engineering shortages, demand for sovereign capability, and market convergence further strengthen Filtronic's position in this sector.

For technology insertion Filtronic launched Prometheus V-band Amplifier at the IMS industry show. This is billed as a “major technological advancement for long-range mission critical satellite communications”.

For FY26 there is a “healthy” order book providing “significant order coverage” to meet FY26 market expectations. The sales pipeline includes geostationary and medium Earth orbit opportunities across a range of end-use applications, in addition to low Earth orbit satellite opportunities. CEO Nat Edington said that the focus for FY2026 will be to “broaden the customer base, complete key technology developments and relocate to a new facility” – which doubles the operational footprint.

The numbers we track: Filtronic

Source: Company data, Technology Investment Services

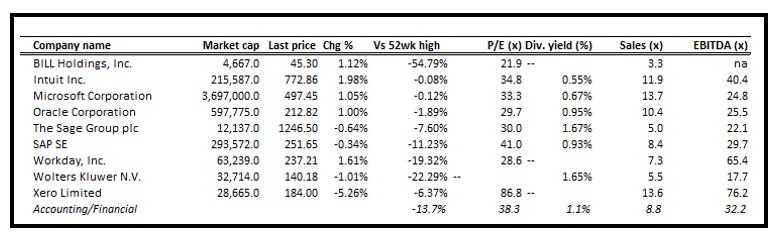

Financial & Accounting

Financial & Accounting cohort: KPI Dashboard

Source: Company data, Technology Investment Services

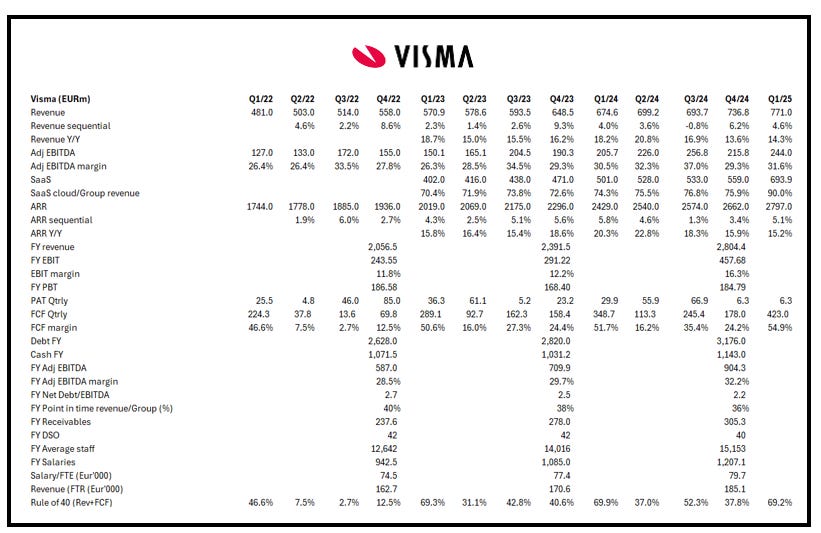

Visma. Visma is reportedly considering a London listing next year. Visma is a Sage look-alike (accounting, payroll and HR software) with the notable difference being that it has accomplished a better cloud migration (see our data file below). Visma has 16,400 employees and 2.1m customers across Europe and Latin America serviced from its Oslo HQ. Those customers are Small business (34% of revenue), Medium (18%) and Public Sector (20%). While it has a high portion of SaaS, the ‘over time’ revenue is only 64% of total.

Playing to our theme of private companies making more acquisitions; Visma made 33 acquisitions in 2024, with 11 alone in Q4/24. The strategy of buying cloud companies has diluted the ‘desktop’ component in the revenue mix and so makes the company a more attractive investment proposition (just in time). The latest acquisition (3 June) was Kanta, a provider of compliance software for French accounting offices. The deal illustrates Visma’s M&A playbook: buy complementary accounting solutions with a clear ‘wallet share’ approach – the approach is just like Cegrid in France, and many others. As always, the risk is the post acquisition integration goes awry. While organic growth in 2023/24 was 11.9%, the headline figure was 17.3%. Net debt/EBITDA (2.4x, FY2024) is comfortable although the interest payment means that PAT (and by this EPS and dividend potential) is reduced as a great EBITDA shrinks as it walks down the P&L. Hence investors will get shunted over to cashflow and will be encouraged to look to EBITDA and FCF-based valuations.

For us, this is an easy IPO to execute; investors are already educated and have spare cash; London attracts global investors so the pool is deeper than expected. The UK comp (Sage) is on a multi-year valuation high. While Sage is doing some amazing pricing deals right now, any deflation will be invisible by the time of the IPO. Plus the Visma KPIs look better than Sage - so an easy read-across. Sage needs to work just a bit harder to convince investors of its ability to drive shareholder value. However, both get a favourable legislative tailwind next year as UK tax filings have to use accountancy software.

Note:

The Visma definition of ARR is the run rate revenue from customer relationships that are contractually recurring (subscription) or “structurally repeatable by nature” such as revenue derived from a per payslip or per e-invoice charge.

Investors with long memories may well recall that the current owner HgCapital took Visma private from the Oslo stock exchange in 2006. Then it stepped in as a white knight after Visma received a bid from Sage. The Visma board initially recommended the Sage deal but withdrew support following a strong trading period. It tried to get Sage to increase its £334m offer, Hg got Visma for £382m (a risable 28% premium to the undisturbed price). Hg went on to sell Visma in 2010 to KKR for £1.2bn, only to lead the £4.2bn buyback from KKR and Cinven in 2017.

Be mindful of the impact of AgenticAI in this segment.

Other KPIs

Source: Comparably, Glassdoor, Technology Investment Services

Where to point the IPO valuation: Easy peasy - here are the guardrails

Source: Company data, Yahoo Finance, Technology Investment Services

The numbers we track: Visma

Source: Company data, Technology Investment Services

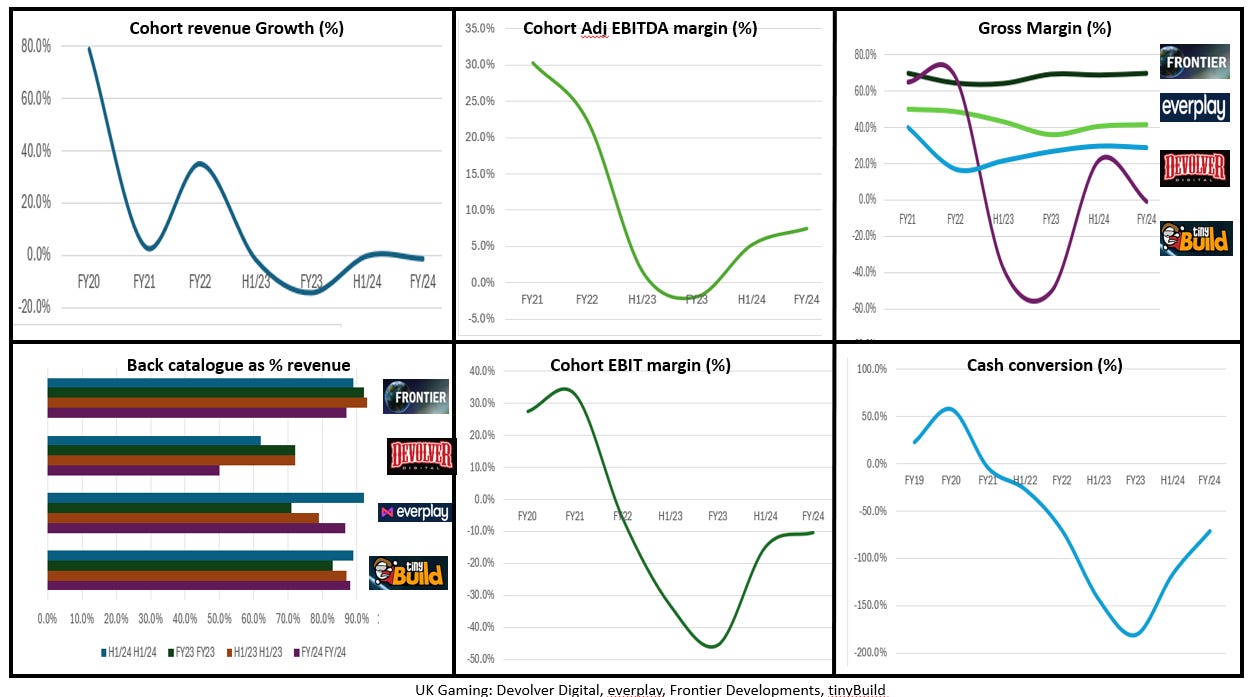

Gaming

Gaming KPI cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Devolver. A short and sweet Trading Update from Devolver which continues the steady drum beat of positive news from this oversold cohort. Devolver says that its current financial performance is in line with consensus FY25 expectations.

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.