The long and the short of IT

From Peak AI Bubble, to Peak Musical Chairs via Peak Merry-go-Round

No pizza boxes, no late night coding hacks, and very few beards. The inaugural Private Business Awards was a slick grown-ups affair. We dined at the Savoy. Celebrating the very best of British Private companies who are so often over-looked, the nominees long list (c850) showed time after time that these are big roaring successes. These awards are a new ‘must attend’ in the calendar. The star prize went to Cycle Pharma, Tech company was awarded to Flagstone. But this was a first amongst equals Awards. You can hardly stitch a sequin to separate the short list category. An inspired move by BDO’s Kyla Bellingall. Super job, Chair of judges Ian Restall, event organisers Jo Thomas, Julia Peachy and Izzy Alder. Meanwhile . . . AI peak bubble is turning into peak musical chairs as Oracle shares are +50% on a few dropped comments on RPO traction. Mr Market is in panic fretting about missing out on NBT. We ask: Is greed replacing fear?

Tech Universe results and updates from the past week span Data & Analytics (Adobe, Rubrik - marking the end of Q2 for this cohort); IT Infrastructure Services (Computacenter); Managed Services (Gamma); UK Hardware (Concurrent Technologies, IQE), UK Software (Accesso, Cirata, GetBusy, PCI-PAL); Gaming (Frontier Developments); IaaS (Oracle); Recruitment (Korn Ferry); IoT/Smart (Seeing Machines). Read on. Data insights (not navel gazing or ‘vibes’) inform our evolving views on the tech-economy.

The tech drivers and Points to Ponder

1.Private Business Awards: My night on the tiles

Source: Private Business Awards, Technology Investment Services

The Private Business Awards, sponsored by BDO (THANK YOU), is a comprehensive awards programme designed to seek, select and reward the very best of Private Businesses in the UK. Private businesses are in the shadow of UK capital markets, but UK’s 5.55m private businesses, employ 27m people and turnover c.£4.5tn. The awards aim to shine a light and reward success and achievement in this most important area of the economy.

The Star of the Night, Cycle Pharma provides treatments and services for patients with neurological, rare metabolic, and rare immunological conditions, most of which are genetic conditions. Many of their patents are children and babies.

Flagstone is a fin-tech focused on savings and enabling customers to spread their cash between hundreds of high-interest accounts, from over 60 banks. This is delivered from one platform, with one password, and is the UK's highest-rated savings platform with c.£16bn+ in assets under administration. Disclosure: I am a judge at these awards and honoured to be one.

Delighted that Progressive CEO/Founder Gareth Evans presented The Tech Company of the year Award to Flagstone.

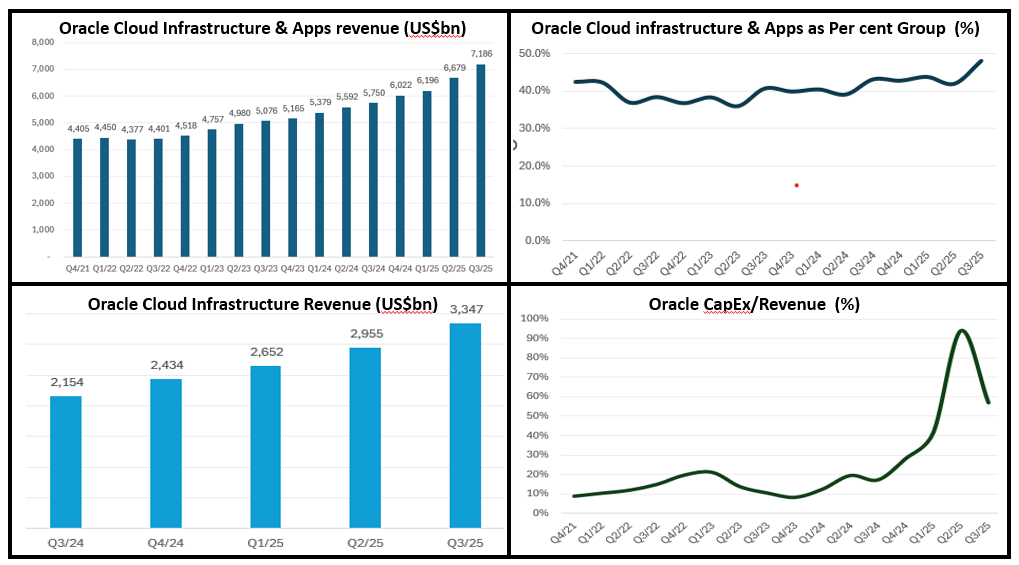

2. Oracle shares climb on FOMO time

At the print Oracle commented that which its RPO, US$455bn, +359% Y/Y (consensus was US$180bn) might impress it is nothing to the pipeline drawdown. CEO Safra Catz said that the company anticipates signing several additional multi-billion-dollar customers and RPO is likely to “exceed half-a-trillion dollars”. He added that the scale of recent RPO growth enables a large upward revision to the Cloud Infrastructure portion of Oracle’s overall financial plan. As a spoiler the expectation is that “Oracle Cloud Infrastructure revenue will grow 77% Y/Y to US$18bn, ahead of increasing to US$32bn, US$73bn, US$114bn, and US$144bn over the subsequent four years”. The shares responded positively being +c.40% making this the best day since 1992 and about to join the US$1tn club. My views:

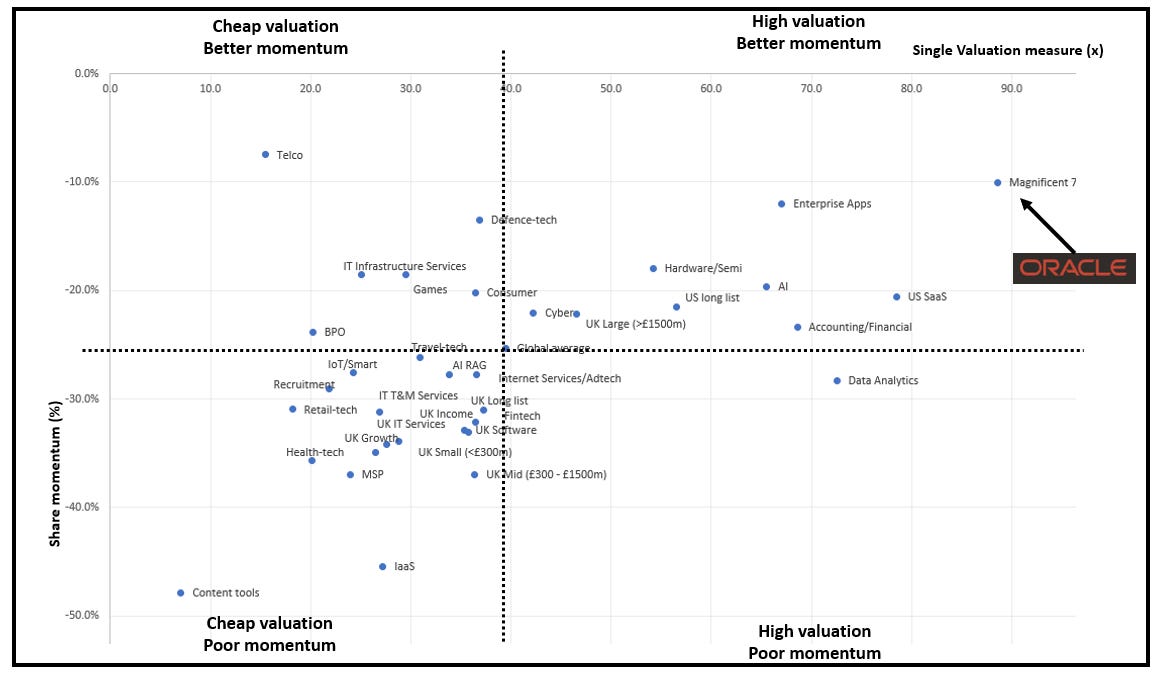

I show Oracle’s new position on the tech universe chart.

OpenAI might not be able to afford the Oracle infrastructure, should the bubble economics in AI change. Currently OpenAI is projecting 2025 revenue US$12.7–13bn, nearly tripling from the US$3.7bn reported in 2024, itself up from US$1.6bn in 2023, and US$200m in 2022.

While the ‘AI eats Everything’ effect has dented US software valuations and share 12 month share momentum, nonetheless it remains much stronger than the UK tech shares.

After hours 11 September, Adobe give data points illustrating that its AI investments were starting to pay-off. Rather than having any notional impact from AI, Adobe has an aggressive competitor, Canva. Adobe shares did not rally as per Oracle, telling me that there is not a more widespread FOMO move percolating through the sector as greed replaces fear and companies give evidence of AI investments beginning to pay off. That said, detailing AI numbers has not helped the IT Professional Services cohort, where shares remain over-sold. But it is early yet.

The difference in share momentum and valuation between Enterprise Apps vs US SaaS is that the Enterprise Apps cohort is perceived to have greater domain expertise (i.e. workflow and process) and hence competitive moat vs. the more generic/horizontal SaaS cohort.

The hardest hit of that cluster are the Data & Analytics shares. Here the general perception of AI being a stronger analytical tool and better at large scale data management.

That said my ‘surprise’ is the ‘Cyber’ group as AI widens the attack surface and introduces new rogue actors.

Tech sector cohorts Share Valuation & Momentum (the in and out of love chart)

Note: Priced pre-market 12 September Source: Company data, Yahoo Finance, Technology Investment Services

3.That IT Professional Services itch: “Three strikes and you’re in”

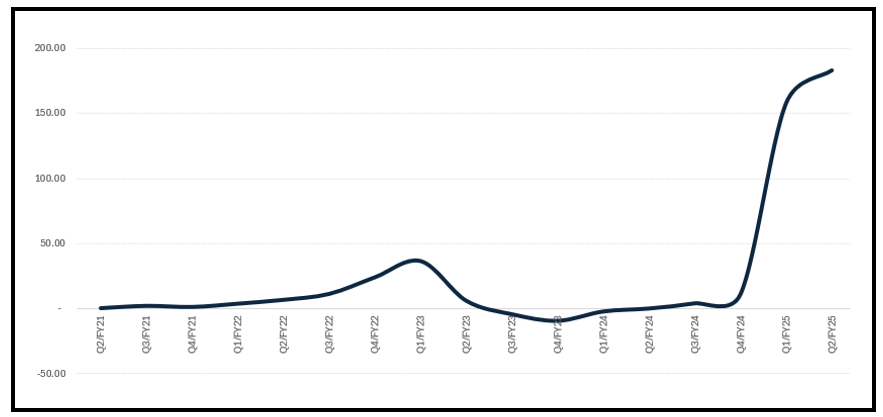

Looking at the chart (above) I am reminded that shares in IT Professional Services firms (the cohort is listed as ‘IT T&M Services’, apologies for the lack of consistency #analyst fail) continue to sag because of that omnipresent ‘AI eats Everything’ concern. There is a threat from AI-natives, and as I have commented previously new pricing and economics to contend with, but this view neglects that IT Professional Services firms are aggressive early adopters of AI.

AI is giving IT Professional Services business a new revenue streak. It is trimming cost models and thereby it has the potential to turbo-charge operational leverage. This has yet to surface in the numbers, or guidance as companies invest into the growth spurt. But if we look ‘second derivative’ there is a change. For example in Q1/25 the cohort productivity ratio rose way above historical norms. But what’s one quarter? The pattern was repeated in Q2 with the ratio improving again. ‘Two swallows do not make a summer’. Companies are not changing guidance. These shares are attractively priced and lack momentum as they follow the easy headlines. Wait for a bounce should the pattern continue in Q3. Here is the evidence so far.

IT Professional Service Productivity ratio: Something’s Up

Source: Company data, Technology Investment Services

Latest results/Company Updates

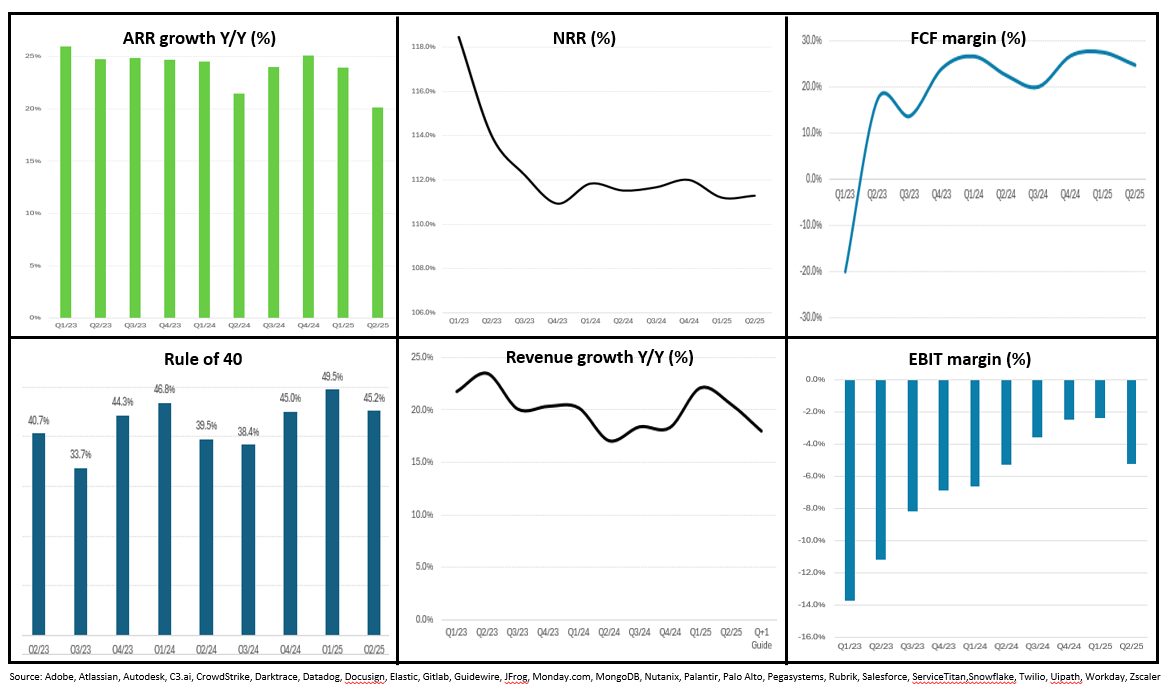

Data & Analytics

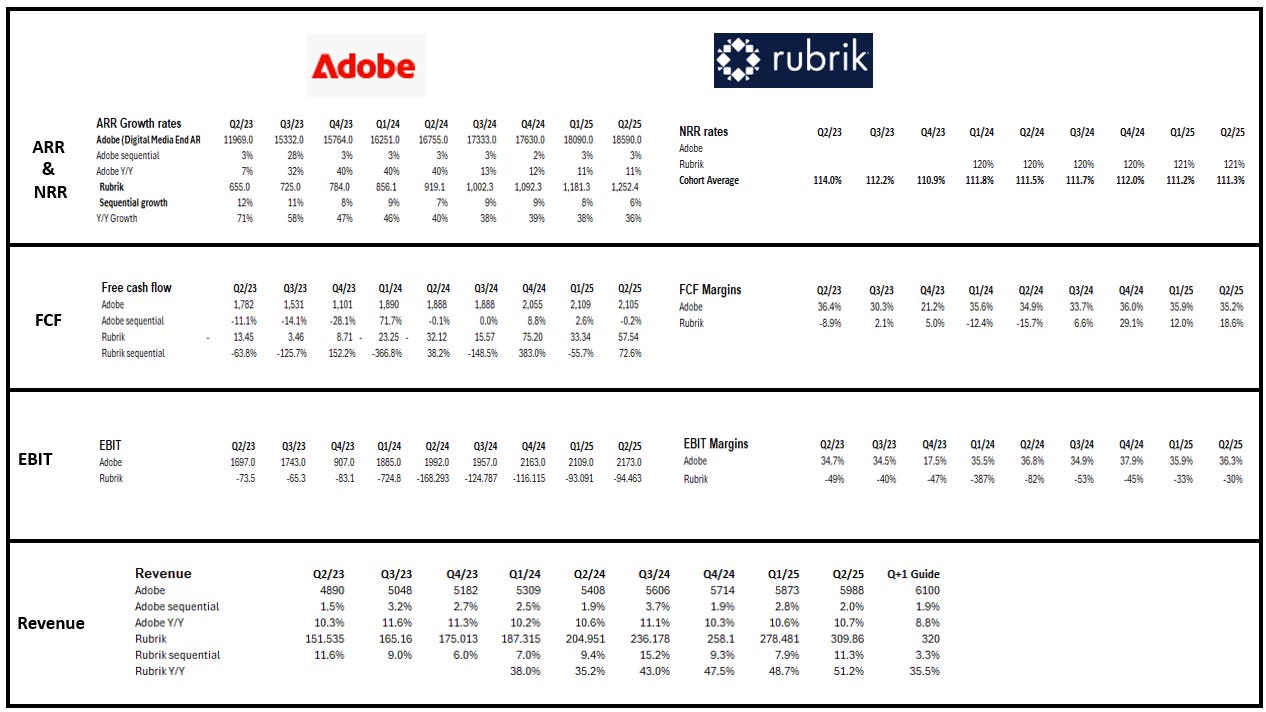

Cohort Scenario: Valuations were dented in 2024 by the ‘poaching notion’ (budgets shifted to GenAI POCs), however constituents have aggressively built AI functionality and Agentic AI functionality into core products. For 2025 this has shifted to the AI eats everything notion and the concern that new AI-native companies disrupt the traditional SaaS vendors (who themselves had ‘eaten’ prior on-prem incumbents. Evidence of the AI-affect is seen largely in the declining NRR and ARR rates. For 2025 look for earnings upgrades from expansion sales rather than any cohort re-rating, and until there is clarity on AI winners vs casualties many investors will ‘back off’ for now rather than getting drawn in by cheaper valuations.

Data & Analytics: KPI dashboard

Source: Company data, Technology Investment Services

Adobe. A salutary tale for the wider software market. Adobe posted a ‘beat and raise’ with Q3 headlined with increased guidance for FY25 Digital Media ARR growth, Group revenue, and EPS targets. Adobe has been one of the shares impacted by the ‘AI eats Everything’ notion and while shares were +1% after hours, the shares have declined 21% YTD and -40% in the past 12 months. Coming out fighting Chair and CEO Shantanu Narayen highlighted the transformative impact of AI, stating, "AI represents a tectonic technology shift and presents the biggest opportunity for Adobe in decades. Our strategy to harness AI is focused on infusing it across our category-leading applications to provide more value and deliver innovative, new AI-first products.” But the to the share recovery is the evidence that AI investments are paying off. Q3 revenue was a record at US$5.99bn +11% Y/Y, GAAP operating income US$2.17bn with GAAP net income US$1.77bn. Operating cash US$2.20bn and RPO US$20.44bn. As to the segments Digital Media revenue was US$4.46bn, +12% Y/Y with Digital Media annualised ARR US$18.59bn +11.7% Y/Y. By contrast Digital Experience revenue, US$1.48bn, +9% Y/Y with subscription revenue US$1.37bn, +11% Y/Y. AI-influenced ARR surpassed US$5bn and ‘AI-first ARR’ already exceeded the company’s US$250m year-end target. Q4 revenue guidance sales range increased to between US$6.08bn - US$6.13bn vs consensusUS$6.09bn with EPS range US$5.35 - US$5.40 vs consensus US$5.34. After hours shares rose as the underlying narrative being that AI investments, its GenAI model Firefly which powers the GenAI features in Photoshop) are beginning to pay off, but also some neat data points on adoption. Note: Over 40% of Adobe’s top 50 enterprise accounts doubled their ARR spend since the start of FY2023. Adobe has an installed base of 750m users, a huge upselling opportunity balanced with the bear concern as to whether AI can offset slowing legacy growth, and how Adobe will defend against nimbler challengers, such as Canva.

Rubrik. A delightfully strong ‘beat and raise’ print, but it was unloved by Mr Market. The numbers exceeded all guided metrics. Subscription ARR + 36% Y/Y, revenue +51% Y/Y, 2,505 customers with US$100K+ subscription ARR +27% Y/Y. Gross margin 79.5%,from 73.1% a year ago. Operating cash US$64.7m from an outflow of $(27.1)m last year making FCF US$57.5m vs US$(32.0)m outflow last year. CFO Kiran Choudary commented that the quarter was driven by “healthy new customer acquisition, robust expansion and increased efficiencies in the business”.

We like that the company acquired Predibase. This is to accelerate agentic AI adoption from pilot to production at scale. Predibase accelerates production-ready AI by giving customers an easy-to-use platform to tune models to their own data and run on an optimized inference stack. Despite the print metrics, sell-side upgrades and in fairness a positive mood following Oracle, the share fell victim to profit taking and that general caution about ‘AI eating Everything’.

The numbers we track: Adobe, Rubrik

Source: Company data, Technology Investment Services

UK Software

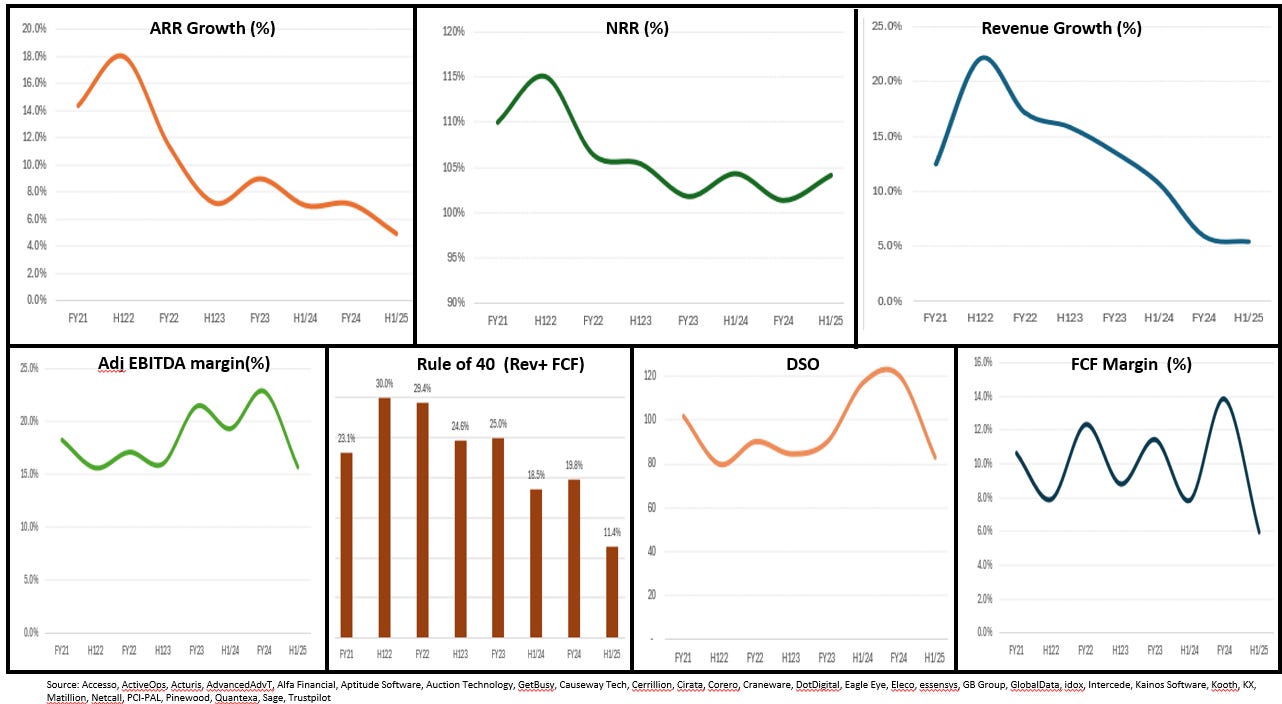

Cohort scenario: These companies are typically smaller than their US counterparts, but all sell and compete globally. In addition to being smaller they typically have poorer KPIs (notably cash-based, ARR, NRR) but have better profitability. The comparative KPI mix may on its own account for the lower valuation and support the view that ‘venue’ has little to do with the valuation. The group is cheaper and pays a dividend/income in addition to share buybacks. The GenAI impact concerns impacting the US peers are largely un-noticed in the UK, but expect it at some stage.

UK Software cohort: KPI dashboard

Source: Company data, Technology Investment Services

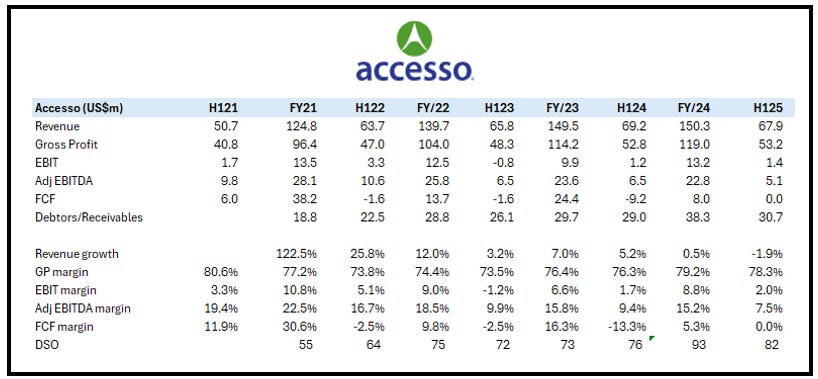

Accesso. Positively, following the latest profit warning, there is no further deterioration in the end markets (phew!). Trading post the balance sheet date (30 June) has been in line. The company had warned into the summer because extreme heat in several key markets reduced attendance and transaction volumes. Group revenue US$67.9m (H1 2024: US$69.2m) lead to Cash EBITDA US$5.1m from US$6.5m last year. In addition, the volatility in global foreign exchange rates resulted in a cost headwind from ForEx. We note that the company has looked to build better resilience into the business (i.e. it has not downsized the cost base which would have suggested structural issues) as it re-organised teams to enhance their focus on core target markets. Also products with resources have been shifted to the commercial team to expand marketing functions across lead generation, digital activities and international support. Note: 8 September Mike Evenson was named new Chief Commercial Officer. Responsible for leading accesso's global commercial strategy and ensuring alignment across sales, marketing and business development, while driving market expansion and unlocking future growth opportunities.

This should be one of those cases where investors pick up the shares on a warning, given underlying proposition and GTM look to be strengthening – the issue is the end market dynamics, sales forecast rigor and, of course, the weather.

The numbers we track: Accesso

Source: Company data, Technology Investment Services

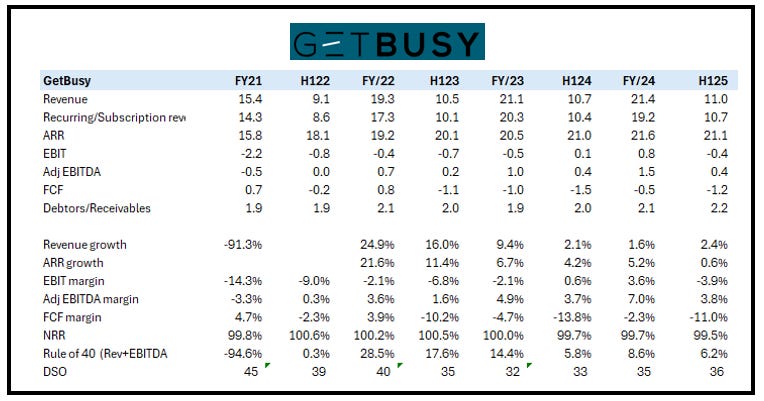

GetBusy. Numbers show some progress, but it is limited (ARR +5% Y/Y) with NRR 99.5% down 20bps Y/Y, Ad EBITDA +5% Y/Y to £0.4m and net debt of £(40k) reversing the £0.2m cash position from last year. Available funds are up to £3.0m, from £2.2m a year ago. Guidance seem optimistic with ARR growth between 7% and 10% in 2025.

The numbers we track: GetBusy

Source: Company data, Technology Investment Services

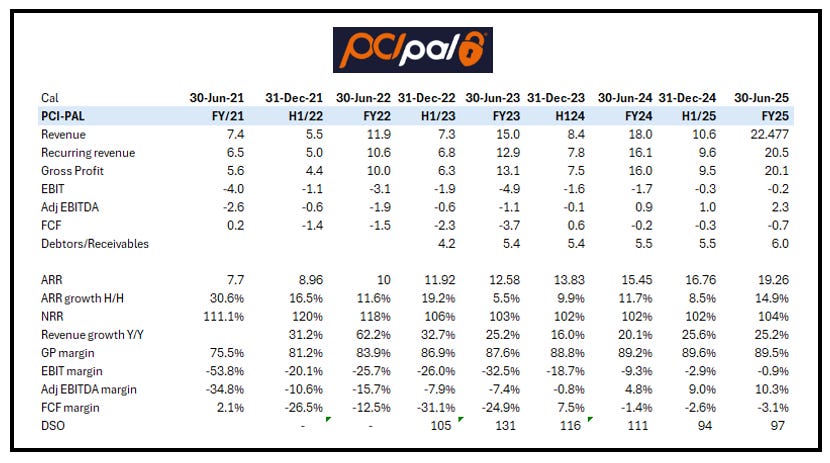

PCI-PAL. Results in line with prior trading update and Trading FY26YTD has been in line with management expectations. Some decent KPI including: ARR +25% Y/Y. 100% of secure payments revenues generated from PCI Pal's multi-tenanted global cloud platform, now servicing over 700 customers across Europe, North America, and ANZ. Increased geographic reach with first hires in mainland Europe, already contributing to new wins, including displacing a competitor at a top-50 global hotel chain. Achieved a perfect NPS score of 100 in Q4 for customers going live on the platform; CSAT of 91% rated "excellent" by global SaaS benchmarks. CEO James Barham commented that as a leader for cloud solutions, with an extensive partner ecosystem of global communications companies, and a growing number of conversational AI providers, “we are exceptionally well positioned to take PCI Pal to the next level”.

The company seems to be finding its stride following the July 2025 successful completion of proceedings in the patent lawsuit with a competitor. The Group has sustained momentum across its solutions (Key to Pay, Click to Pay, and Speak to Pay) with PCI Pal hoping that it is strategically positioned to capitalise on the growing adoption of Conversational AI solutions within contact centres, and the anticipated rise in interaction volumes that these will drive.

The numbers we track: PCI-PAL

Source: Company data, Technology Investment Services

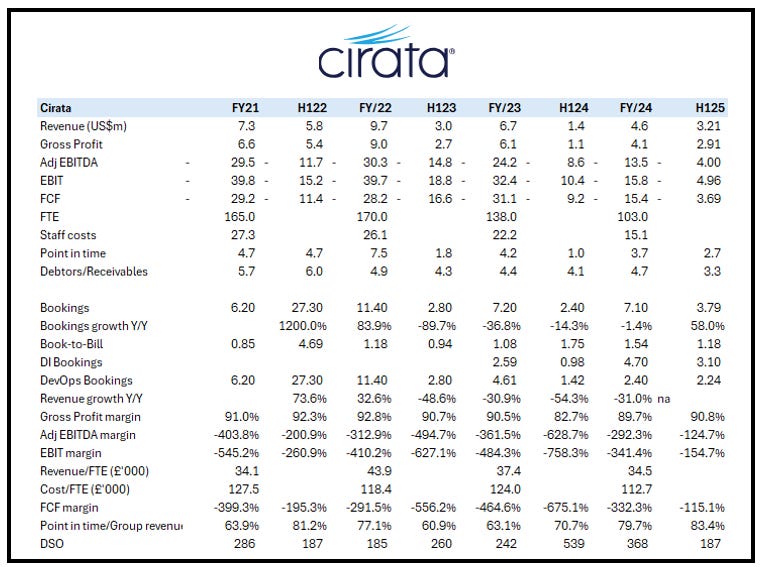

Cirata. A very neat product debut. Cirata has always been first foremost (and for many, ‘only’) a software engineering company. We note the launch of ‘Cirata Symphony’. This is billed as data orchestration platform designed to “simplify, secure, and accelerate the continuous movement and management of data within the enterprise”. The aim is to eliminate data silos (POV: that will never happen), streamline operations, and enable organisations to use AI with controls from a single, unified control plane – a lofty goal. Orchestration demands different things than ‘migration’ but data visibility (read) and being able to present data to different applications (write) is a critical need. To be sure, other vendors are doing orchestration but Cirata needs to break free of Hadoop migration, so this could be a gateway drug. Cirata clarifies that it is not just a migration tool but a “platform that enables the secure use of data across hybrid and multi-cloud environments with zero downtime”.

CTO Paul Scott Murphy says: “Cirata Symphony simplifies the inherent complexity of data environments by coordinating your data systems, working with your existing storage, compute and network infrastructure to provide secure, governed and intelligent orchestration.” We concur with CEO Stephen Kelly who says that the “future belongs to those who can move, manage, and activate data across enterprise clouds without compromise and exploit AI responsibly”. Commercial terms, RoI calculator, GA and beta customer references were not disclosed. Learn more.

The numbers we track: Cirata

Source: Company data, Technology Investment Services

Managed Services

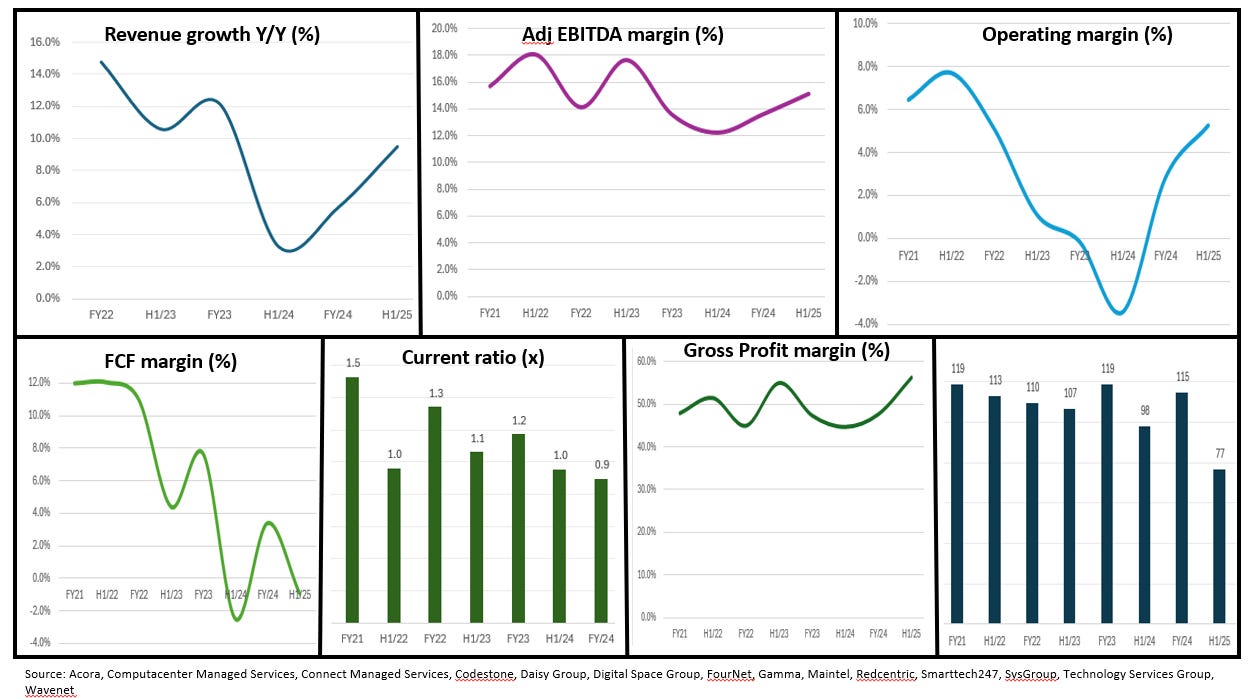

Managed Services cohort: KPI Dashboard

Source: Company data, Technology Investment Services

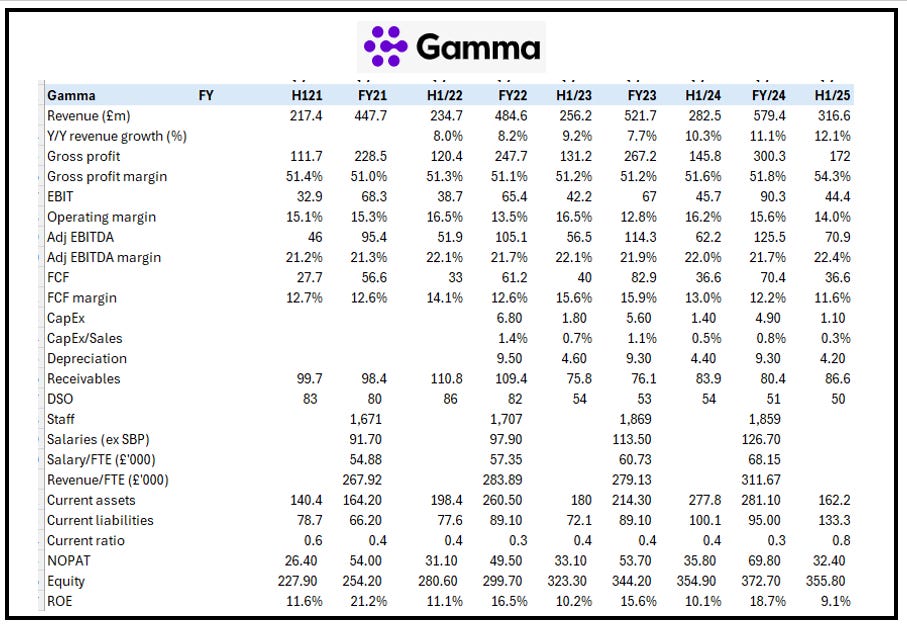

Gamma Communications. H1 results featured growth across all key financial performance metrics following the German acquisitions of Starface and Placetel, and low single digit UK revenue growth largely due to the macro-economic environment. Adj EBITDA +14% Y/Y, revenue +12% Y/Y. There was a share buyback of £45.1m which trailed the £27.3m buyback in 2024. Operationally, I note a significant increase in total Cloud seats of 587k to 1.8m. Also, progress in developing a new portal architecture in the UK and Europe. UK Channel Partners can now order Horizon, PhoneLine+, the Cisco Collaboration Suite and iPECS through a single portal. The German acquisitions of Starface and Placetel delivered double digit proforma revenue growth and resulted in gross margin improving 200 bps to 54%.

The Business units:

Gamma Business (SME): Increased gross profit to £97.4m (H1 2024: £97.1m) underpinned by volume growth. It has been well placed to offer lower priced solutions to customers impacted of the difficult macro-economic environment.

Gamma Enterprise: Grew gross profit to £30.9m (H1 2024: £28.9m) led by the BrightCloud acquisition (July 2024) with headwinds from competitive pricing pressures and customer delays in committing spend.

Germany: Increased gross profit to £34.4m (H1 2024: £9.8m) led acquisitions Starface (February 2025) and Placetel, which have performed strongly and delivered double digit proforma revenue growth.

Guidance commentary was subdued with the expectation of continued strong growth in Germany. In the UK, Gamma is implementing a combination of growth initiatives and cost reductions to offset some near-term challenges to gross profit growth and underpin our continued Adjusted EBITDA performance. CEO Andrew Belshaw commented that the German business, bolstered by recent acquisitions, has performed particularly strongly, while the performance in the UK has been “resilient in spite of a continuing challenging macro-economic backdrop for SMEs” and teases that he sees M&A as a “key tool to complement our organic growth” and the company is “well placed to maximise the M&A opportunity even in challenging macro-economic times”.

Progressive Equity colleague Gareth Evans has the results analysis and investment case in greater detail (and clarity).

The numbers we track: Gamma

Source: Company data, Technology Investment Services

Infrastructure Services

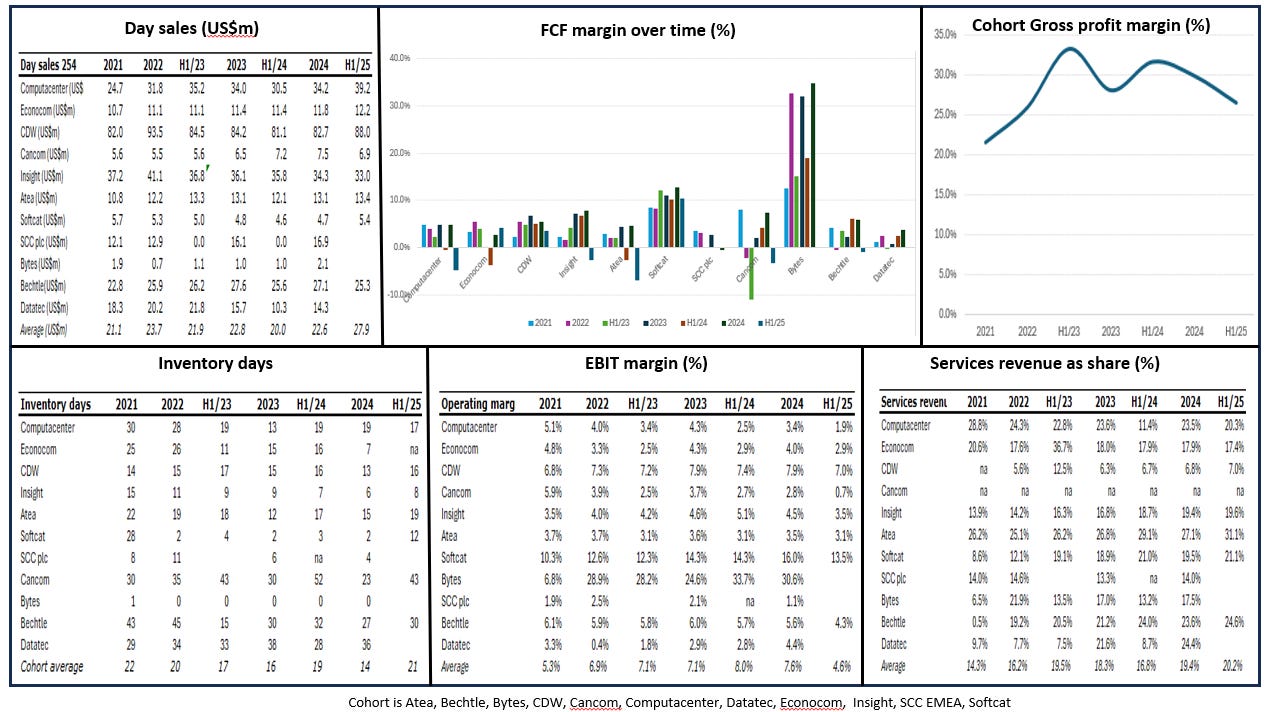

Cohort Scenario: This sector has been cautiously emerging from a cyclical downturn following demand volatility in the years following the end of the COVID pandemic. Since H2/24, demand for hardware has picked up across product categories, Day Sales are recovering, but margins (gross and operating) remain under pressure. Positively the cohort is doing more higher margin services revenue, although it will suffer from the utilisation issues common to the IT Professional Services cohort. There are multiple demand-side drivers for this cohort. The most immediate one is Windows 10 end-of-life, and IT security continuing as a top investment priority for organizations as threats of cyberattacks and data breaches continue to grow and from a regulation the EU Network and Information Systems 2 (NIS 2) Directive (a baseline of cybersecurity requirements for the public and private sector) was adopted into local law by EU countries in 2024. However, soundings from the latest batch of analyst conference calls suggests that this effect could drift into 2026 given a weaker-than-expected spending backdrop. As a caution we note that as spend returns, there will be pressure on inventory days which in turn will soak up working capital – and a feature of the latest results is that inventors are increasing. The warning from Cancom, Bytes, Computacenter, Insight was shy of consensus serves to remind us that notwithstanding a fragile macro and changes in EA that company actions determine outcomes.

Infrastructure IT Services: KPI dashboard

Source: Company data, Technology Investment Services

Computacenter. Another star performance. Very strong revenue growth (+28.5%) in a backdrop of “significant macroeconomic and political uncertainty”. The star turn was North American revenue growth which was driven by hyperscale and enterprise customers. That region now accounts for 44% of adj operating profit (before central costs) from 24% Y/Y. The UK region returned to growth, but Germany and France (Western Europe revenue was -12.1% Y/Y) were impacted by temporary lower levels of public sector activity. Computacenter had good Professional Services revenue growth, 6.5% (UK Professional Services +29.0% Y/Y with growth across workplace, cyber, cloud and apps), as the UK and North America grew strongly, with Germany stable. However Managed Services revenue declined, -1.4%, (it was -7% at FY24) but has an “improved pipeline of opportunities”. The Product order backlog (30 June) was +23.7% Y/Y driven by continued strong Technology Sourcing order intake in North America and the UK. Computacenter also spent £21.9m on strategic initiatives (H1 2024: £17.6m) to improve capabilities, enhance productivity and secure future growth. Adjusted net funds, £278.0m (down 30.8% Y/Y) followed the £200m share buyback in H2 2024 (note: Computacenter has distributed over £1bn of capital to shareholders since 2013). Points to ponder:

The infrastructure IT Services market has to deal with Microsoft changing T&Cs in the channel. This has led to a number of warnings from peer channel vendors. Computacenter is getting thru it better because it has a better model (i.e. more services, 20% of revenue).

I have been talking about the Great Re-stocking While inventory value was up (+£45.6m Y/Y), inventory days, 17, was down from 19 last year. Inventory locks-up working capital. Back in Covid times inventory days was c.30 and earlier it was 10. I had expected the combination of re-stocking, Windows 10 migration, but also the increased complexity of its solutions to increase inventory days. This was not the case - nice work Computacenter.

The strength of the US market was about enterprise and hyperscalers buying kit. Gross profit increased by 8.6% Y/Y but the effect was a lower gross profit margin, to 12.6% from 15% last year (note: the cohort average is 26.5%). That reduction in turn impacted (Statutory) EBIT which was down to 1.9% vs the cohort average is 4.6%.

(Finally) is starting to scale Circular Services with Circular Services ERP system configured for the company’s specific needs and Circular Services United States went live. To reiterate my view: The management of end-of-life as a secular growth driver/opportunity for those companies who are involved at the outset of the installed product life.

Guidance is positive with the “significant” expansion in the major customers (in parlyance ‘Podium’) customers to 197 from 183 Y/Y, gives Computacenter a healthy order backlog and it made a “strong start” to Q3, especially in North America. The broader geopolitical and macro uncertainty is expected to persist, with some recovery in public sector activity in Germany with France to remain challenging. Even after accounting for an adverse c.£4m currency translation impact, Computacenter reiterated guidance of “growth in adjusted operating profit for the full year”.

Ahead of results, CEO Mike Norris gave an inspiring presentation to the Worshipful Company of Information Technologists. Sadly the recording is not available, which is a shame as it would help investors to better ‘know’ the CEO, who is a critical element of the Computacenter investment case. Of the nuggets we were interested in the comment that Mike has earmarked two internal staff as potential successors. We see more than two, and from talking to Mike’s daughter - he is going nowhere - the business is too exciting right now.

UK Hardware

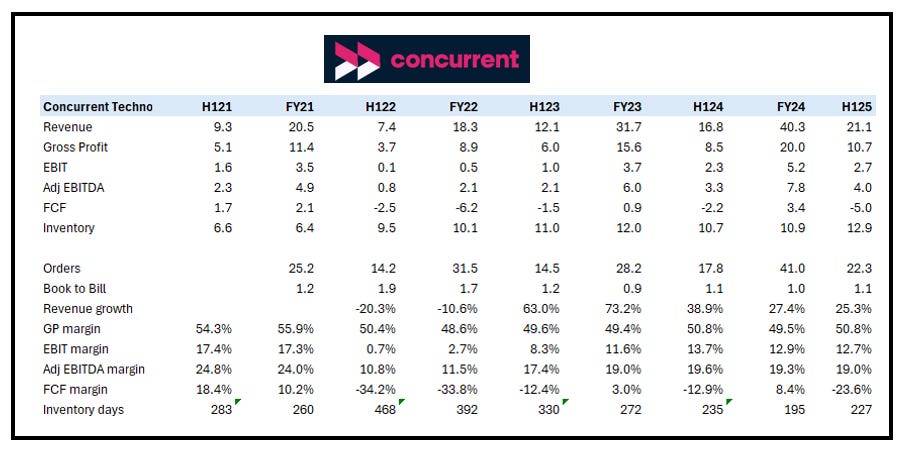

Concurrent Technologies. Very good progress on the P&L, yet the print was overshadowed by the balance sheet where closing cash -12% Y/Y to £7.8m after it was impacted by a £2.7m rise in trade debtors, £1m dividend payment, and a £2.2m increase in inventory levels (see inventory days below). The company also agreed a new £5m Revolving Credit Facility. Revenue increased by 26% to £21.1m, gross profit rose+26% to £10.7m (margin up to 50.8%). Order intake grew by 25% to £22.3m. Concurrent says that while it continues to monitor the pace at which US customers mobilise into placing orders following the recent DoD budget approval, the Board is confident in delivering a “financial performance ahead of FY25 market expectations”.

CEO Miles Adcock said that the company is closely monitoring the broader macroeconomic and geopolitical landscape, and is “well-positioned to continue delivering on its long-term growth ambitions”.

The numbers we track: Concurrent Technologies

Source: Company data, Technology Investment Services

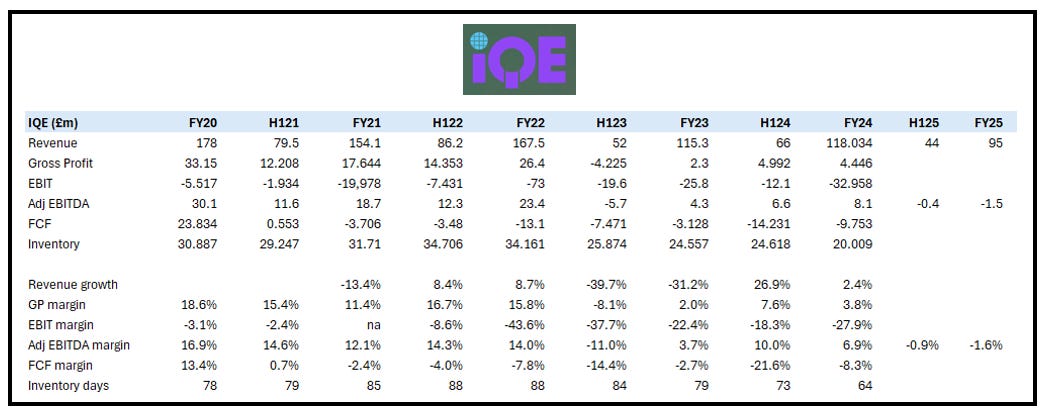

IQE. A lost cause for a long time (shares -c.85% over the past five years) issued a profit warning and is now considered to be in an "offer period" (shares weakened on the news as no one is prepared to gamble on the undisturbed premium). This time round trading was impacted by macroeconomic uncertainty with continued weakness in wireless markets. This is due to soft in mobile handset sales which is expected to persist through 2025. In addition, delays to federal funding cycles in US military and defence sectors resulted in the deferral of orders into 2026 (the excuses drawer is bursting full). Revenue for FY 2025 is guided to be between £90.0m to £100.0m, Adj EBITDA between £(5.0)m to £2.0m. H1/25 revenue is expected to be at least £44.0m with an £(0.4)m Adj LBITDA.

The Board has expanded the scope of the previously announced Strategic Review to also incorporate the potential sale of the Company and is seeking buyers. IQE is progressing negotiations with multiple parties for the sale of it's Taiwan operations. Proceeds will be used to fully repay the Group's Revolving Credit Facility with HSBC Bank and Convertible Loan Notes issued in March 2025, with the balance for working capital.

The Takeover Panel has granted a dispensation from Rules 2.4(a) and 2.4(b) of the Code. IQE is not required to identify in this announcement any potential offeror with which it is in talks, or from which an approach has been received, “unless that potential offeror has been specifically identified in any rumour or speculation”.

The numbers we track: IQE

Source: Company data, Technology Investment Services

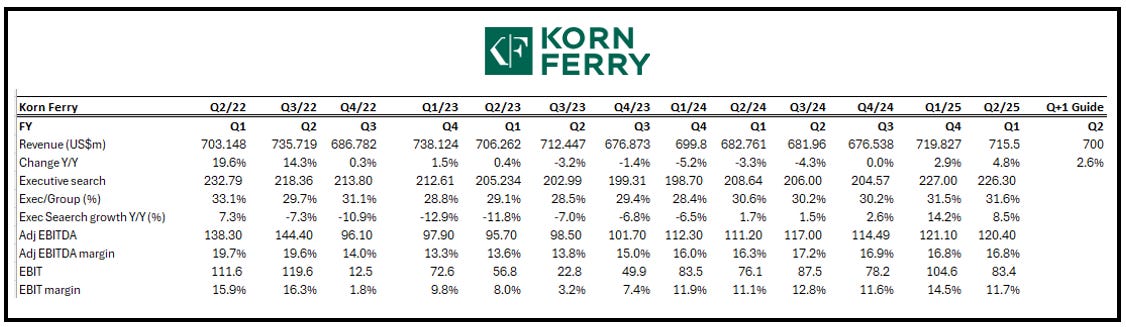

Recruitment

Korn Ferry. Ring the good news bell. Q1/26 revenue of US$715.5m, +4.8% Y/Y and so the strongest Y/Y since cal Q3/22. Better news is that growth was broad-based with Fee revenue growing in each Solution. The show was led by Professional Search & Interim (+10% Y/Y) and Executive Search (+8% Y/Y). Adj EBITDA US$120.4m, +8% Y/Y and a 16.8% margin. Korn Ferry exceeded both EPS and revenue forecasts. CEO Gary D. Burnison talked about the secret sauce as being a “far more sophisticated, holistic approach that brings together our expertise, robust IP and relevant solutions in every major region of the world to solve our clients’ most pressing challenges”. When one considers the diversification strategy coupled with the demographic shift, “the opportunity is immense”.

The diversification strategy is proven with the launch of TalentSuite, expected November 2025. TalentSuite is billed as offering a seamless integration of proprietary IP and data and talent applications into one SaaS platform, this enables clients to make better hiring decisions, structure their organisation, assess, develop, and reward their talent. It should also be a decent cross-selling tool given the focus on selling larger, more integrated solutions via the ‘We Are Korn Ferry’ GTM strategy. Interestingly on the regional data:

Fee revenue in the Americas -2% Y/Y, with growth in Executive Search and RPO being offset by slightly lower demand in Consulting, Digital, and Professional Search and Interim. Is the US starting to feel the ‘Tariff Effect’?

EMEA fee revenue +19% Y/Y with “growth in all solutions”.

APAC fee revenue +12% Y/Y also with growth in all solutions.

From the conference call:

On the macro CEO commented: “There’s been a labor recession for two years. Companies are not doing massive downsizing, but they’re letting natural attrition take its course, and they’re not replacing those hires.”

CEO referenced customer conversations around ‘what does AI do long-term in terms of how does an organization get work done and with how many people?’

Private equity has been a source of significant strength because “they have thousands of companies that are past their sell-by date”. Because of that, they’re actually having to go in and think about how you really operate the company beyond just cutting costs and increasing EBITDA.

The numbers we track: Korn Ferry

Source: Company data, Technology Investment Services

Gaming

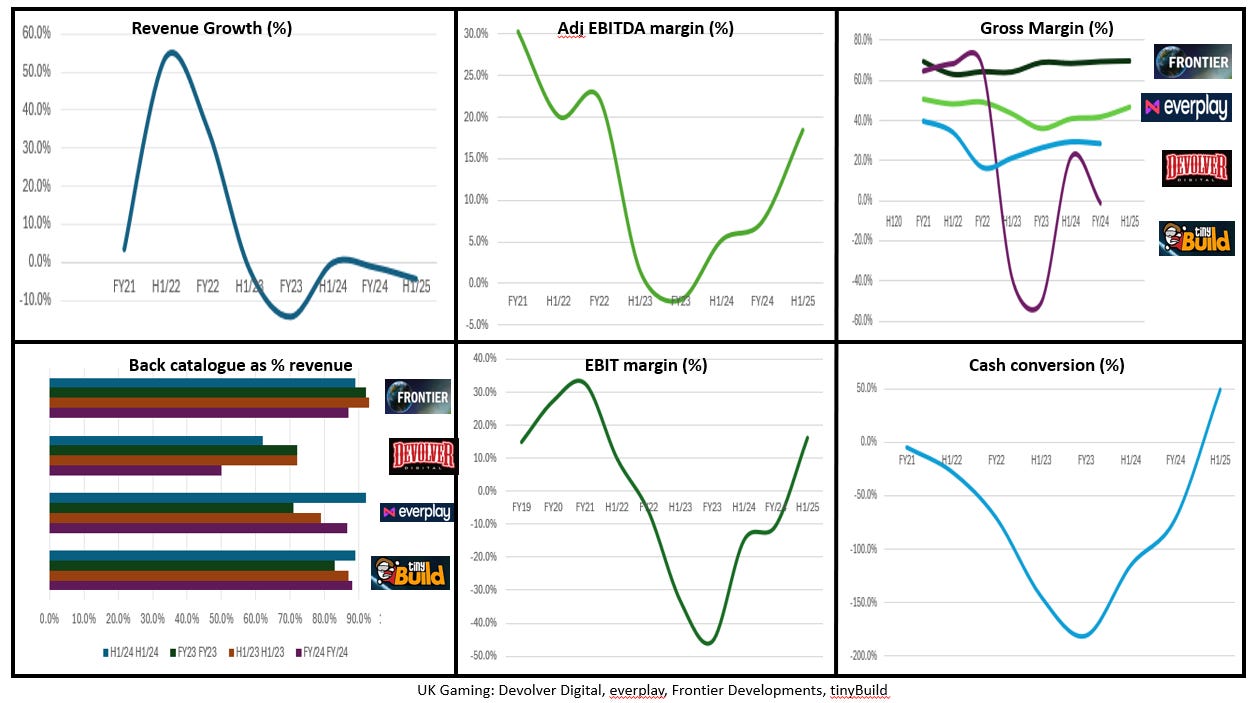

UK Gaming cohort: KPI dashboard

Source: Company data, Technology Investment Services

Frontier Developments. Recovery continues. Results in line with prior guidance with revenue £90.6m, £89.3m last year, and Adj EBITDA £9.4m, from £0.9m last year. The Cash balance is £42.5m, from £29.5m a year ago. Revenue from Frontier's genre-leading CMS games +25% Y/Y, driven by the release of Planet Coaster 2 in November 2024. Frontier's three CMS game franchises (Planet Coaster, Planet Zoo and Jurassic World Evolution) delivered 77% of total Group revenue from 62% last year. A share buyback programme of up to £10.0m was initiated in July 2025, with £4.4m spent as at 31 August 2025.

Looking into FY26 Frontier flags that there are three future CMS games in development, including a recently started project for release in FY28. For FY26, Jurassic World Evolution 3, the third instalment in the Jurassic World Evolution game franchise, is scheduled for release on 21 October 2025. For FY27, a second CMS game, yet to be announced, is in full development and is “on track”. For FY28, a third CMS game, yet to be announced, will further evolve Frontier. CEO Jonny Watts commented that the company has “executed the first phase of the long-term strategy, strengthened financial foundations, and reaffirmed leadership in Creative Management Simulation”.

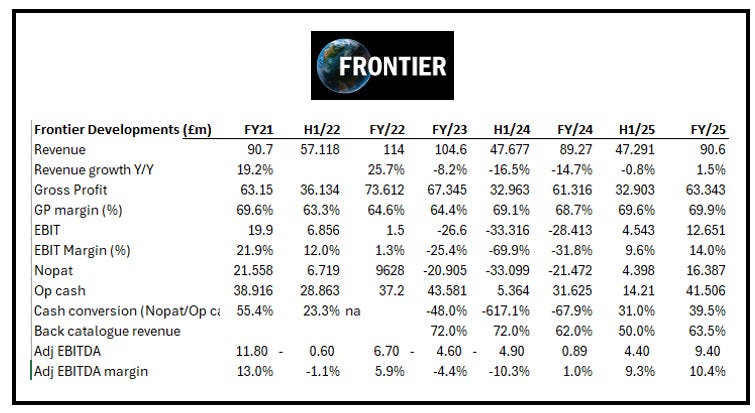

The numbers we track: Frontier Developments

Source: Company data, Technology Investment Services

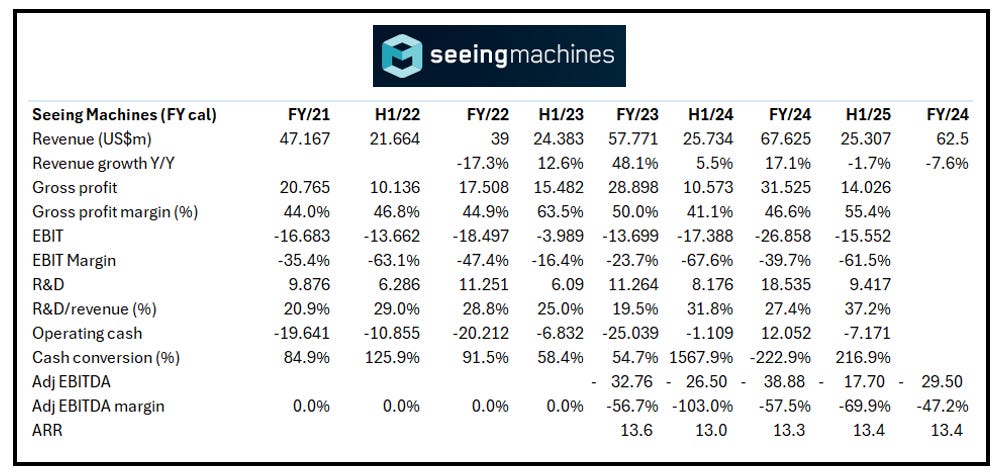

IoT/Smart

Seeing Machines. A product enhancement which expands functionality and is aligned with coming regulatory drivers with a great ‘purpose’. Seeing Machines announced a new capability for its Driver Monitoring System (DMS). It can now detect non-drowsy driver impairment, including alcohol impairment ranging from .05 blood alcohol content (BAC) to higher levels, where risk is continually elevating.

In the US, DMS has primarily been used to maintain driver engagement during hands-free driving with systems like Ford's Blue Cruise and General Motors' Super Cruise. The European Union now requires these systems to detect driver distraction and fatigue for safety. Starting from 2026, the DMS must also detect driver impairment from non-fatigue causes that include alcohol use.

In 2024, Seeing Machines submitted a plan suggested a phased roadmap for DMS adoption, as follows:

Phase One: alert the driver to indicate that the system believes he/she is impaired; encourage driver to pull over;

Phase Two: vehicle safety systems be alerted to the presence of driver impairment and would become more visible, robust and intentional;

Phase Three: the vehicle takes more aggressive action by limiting infotainment capability and entering a "limp home mode," which also limits speed, a major factor in drunk driving deaths.

Seeing Machines announces readiness to support this implementation plan.

The numbers we track: Seeing Machines

Source: Company data, Technology Investment Services

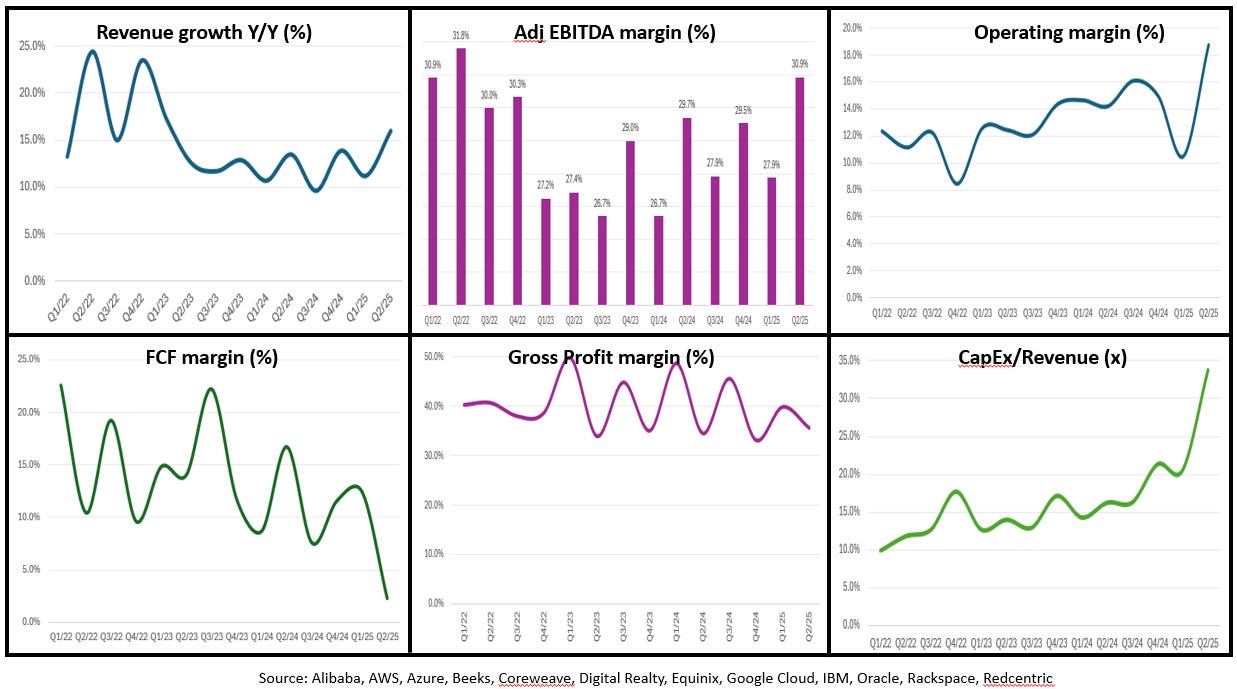

IaaS

Cohort scenario: We are in the midst of a large ‘cloud’ shift which favours the IaaS cohort. While the hyperscalers seem the obvious ‘winners,’ the IaaS segment includes an array of companies who will gain from vertical market focus, but also in the wider cloud migration, as well as the more ‘classic’ RAS (reliable, available, Secure) corporate requirements. In addition, most modern applications were designed to run on cloud, rather than on-prem systems. While the newsflow tells us that CapEx is on the increase (and it has led to lower FCF), there is less attention to improving Adj EBITDA margins which feature in the KPI dashboard.

IaaS cohort: KPI dashboard

Source: Company data, Technology Investment Services

Oracle. Remaining Performance Obligations US$455bn, +359% Y/Y (consensus was US$180bn); Q1 revenue, US$14.9bn, +12% Y/Y; Cloud Revenue (IaaS plus SaaS) US$7.2b, +28% Y/Y; IaaS/Infrastructure revenue, US$3.3bn, +55% Y/Y. This was a mega quarter at Oracle. Total Remaining Performance Obligations were up 359%Y/Y, operating income, US$4.3bn. Over the last twelve months operating cash flow was US$21.5bn, +13% as Oracle signed four multi-billion-dollar contracts with three different customers in Q1. CEO Safra Catz said that the company anticipates signing several additional multi-billion-dollar customers and RPO is likely to “exceed half-a-trillion dollars” adding that the scale of recent RPO growth enables a large upward revision to the Cloud Infrastructure portion of Oracle’s overall financial plan. This will be presented in detail next month at the Financial Analyst Meeting. As a spoiler the expectation is that “Oracle Cloud Infrastructure revenue will grow 77% Y/Y to US$18bn, ahead of increasing to US$32bn, US$73bn, US$114bn, and US$144bn over the subsequent four years”. “MultiCloud database revenue from Amazon, Google and Microsoft grew at 1,529% in Q1,” said Oracle Chairman and CTO, Larry Ellison. AI Changes Everything.” The shares responded positively being +c.40% on the results making this the best day since 1992 and about to join the US$1tn club.

The numbers we track: Oracle

Source: Company data, Technology Investment Services

Note:

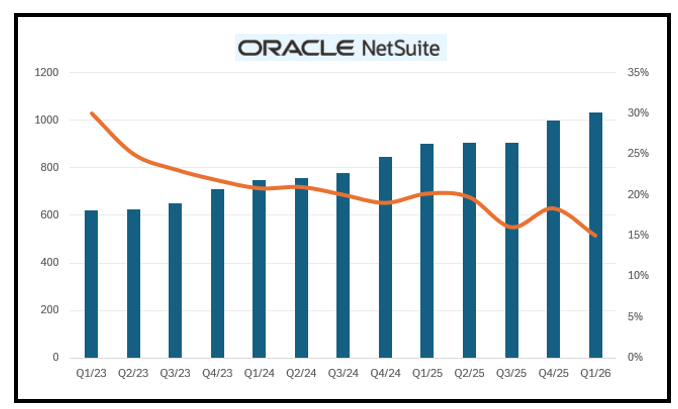

Q1 NetSuite Cloud ERP (SaaS) revenue was US$1.0bn was +16% Y/Y. Netsuite forms part of our Accounting & Finance cohort, where growth is currently 13% across the cohort.

The numbers we track: Oracle Netsuite

Source: Company data, Technology Investment Services

Dear investor,

Thank you for reading to the end. Don’t forget to subscribe if you haven’t already!

Join me again soon.

Best wishes

George

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.