To Hollywood for the Oscars, New York the Met Gala, London the PLC Awards, the blue ribbon award for LSE. Here the big guns glam up (14/3). As always there is a strong tech contingent. This years red carpet was adorned by Computacenter (nominated for three Awards), Bytes, Chemring (tech company of the year), Darktrace, Moneysupermarket.com, Ondo Insurtech, Sage and Trainline. From our RAG list, the LSE, Relx and TrustPilot. Chair of the Judging Panel, and founder of the plc Awards, Ian Restall, commented that “in the 39th year of the awards we celebrate exemplar companies who offer growth with purpose”. The night belonged to Mike Norris CEO Computacenter. Mike sauntered home clutching CEO of the Year. On this bleary morning Computacenter cohort Bechtle prints finals - revised IT Infrastructure Services dashboard below furnishing more evidence that Mike has another banner year in the offing. The shackles bonding ‘higher for longer’ (interest rates) with ‘lower for longer’ (tech valuation) are prised apart only slowly amid improving economic news, for now the tech economy remains fragile. Popcorn ready, here we smooch up and shine a light on those plc awards tech contenders. Winners all.

A center thru the PLC Awards tech list

Bytes Technology Group plc: Nominated for tech business of the year

Bytes delivered an excellent operational performance in 2023, despite ongoing macro challenges. The group attributes its success to the continued strong demand from its corporate and public sector customers for security, cloud adoption, digital transformation, hybrid datacentres and remote working solutions, allowing Bytes to invest in the business. The group is well placed to capitalise on AI products, which are one of the defining trends in the IT services sectors.

ESG: Bytes has an ESG combined score* of C-

Chemring Group plc: Nominated and AWARDED tech business of the year

Chemring has been supplying the world’s most demanding customers – in aerospace, defence and security – with innovative solutions for over 100 years. Following the incorporation of Roke, the group provides technology, engineering and advisory services to Government and high-value engineering companies. Last year was another year of strong performance for Chemring as demand grew for its mission-critical products and services. This was achieved through continued investment at every stage of the value chain, from R&D through to design, manufacture and in-service support for its sensors and detection systems, countermeasures, precision engineering and products. Chemring reported a record order intake in 2023 and enjoyed its highest order book in over a decade, making it well placed for future growth.

ESG: Chemring has an ESG combined score* of B-

Website & Results presentation

Computacenter plc: Nominated for tech business of the year / CEO of the Year AWARDED/ Company of the year

Computacenter is the leading independent technology and services provider. The groups help its customers to Source, Transform and Manage their technology infrastructure to deliver digital transformation, enabling people and their business. Computacenter has an integrated offering, providing three complementary entry points for its customers, which have helped the group achieved its long-term growth. The increasing pace of technological change and the diversity of the technology landscape has made Computacenter’s technology vendor independence even more critical to its customer. Last year was the group’s eighteenth consecutive year of adjusted EPS growth, the 19th is pre-announced (results 20/3) and we think that the 20th is doable - as do consensus estimates.

ESG: Computacenter achieved carbon neutral status for Scope 1 and 2 emissions in 2022, making it one of the first companies in its industry to reach this milestone. Computacenter has an ESG combined score* of B

Darktrace plc: Nominated for business of the year

Darktrace is a global leader in cyber security AI and its core mission is to free the world of cyber disruption. The group’s technology continuously learns and updates its knowledge of business data and applies that understanding to optimise the state of optimal cyber security.

ESG: Darktrace has a combined ESG score* of C-

London Stock Exchange Group plc: Nominated for growth business of the year

London Stock Exchange Group is one of the world’s leading providers of financial markets infrastructure, delivering financial data, analytics, news and index products to more than 40,000 customers in 190 countries. LSEG has a compelling growth story, with growth rates of its Refinitiv Data & Analytics businesses tripling in under three years. In December 2022, LSEG and Microsoft launched a 10-year strategic partnership for next-generation data and analytics and cloud infrastructure solutions, enabling LSEG to provide customers with new AI-driven insights, based on trusted and validated data, combined with straight-through execution and risk management. The group’s Capital Markets revenues accelerated in the third quarter of 2023 and its Post Trade businesses also enjoyed significant growth.

ESG: LSEG has an ESG combined score* of B-

Moneysupermarket.com Group plc: Nominated for tech business of the year award

Chester-based Moneysupermarket.com operates a tech-led savings platform and leading UK brands including price comparison sites, cashback and a consumer finance content-led brand. The group covers a broad range of verticals including Insurance, Money, Home Services and Travel, amongst others. In 2022, Moneysupermarket.com helped its users to save an estimated £1.8bn on their household bills. The group is made up of several brands including MoneySavingExpert, Quidco, TravelSupermarket and Decision Tech and it is these strong brands that have helped the group capitalise on its performance. Interim results report a good trading performance and market share gains, in addition to signficant revenue growth in its Insurance and Travel markets.

ESG: Moneysupermarket.com has a combined ESG score* of B-

Sage Group plc: Nominated for tech business of the year award

Based in Newcastle, Sage is the market leader for integrated accounting, payroll, and payment systems. Sage’s social and mobile technology provides live information so its clients make fast, informed decisions anytime, anywhere in the world. The group has recently reinvigorated its business by selling non-core assets, reinvesting in products, strengthening accountant relationships, and shifting to the cloud. The group’s products are gaining traction, with 10% organic revenue growth this year and in particular, the Sage Intacct cloud product is seeing significant growth, which validates the quality of its technology. Through R&D investment, Sage is expanding its platform approach and introducing AI tools.

ESG: Sage has a combined ESG score* of B-

Trainline plc: Nominated for tech business of the year award

Trainline operates an independent global rail and coach travel platform, enabling trip planning, booking, and management through its website, app, and B2B partners. The group runs UK and international consumer sites, along with technology solutions for travel companies and train operators. Trainline is now Europe’s #1 most downloaded rail travel app. The group is driving this shift to e-tickets, with industry penetration in UK increasing to 46%, due to its relentless focus on continually innovating and improving the customer experience of purchasing digital rail tickets. Trainline’s interim results reported significant market share in key European countries including Italy and Spain, in addition to a 23% year on year increase in group net ticket sales.

ESG: Trainline has a combined ESG score* of C

Website & FY Trading update (14/3)

Trustpilot Group plc: Nominated for tech business of the year

Trustpilot is headquartered in Copenhagen. The group brings businesses and consumers together, to foster trust and inspire collaboration. Trustpilot has disrupted the service review industry by empowering customers to honestly rate companies. Over 213m consumer reviews of businesses and products have been posted on Trustpilot and these numbers are growing by more than one review per second. In addition to its free service, Trustpilot provides paid software modules for businesses, providing increasing levels of functionality and offered on a SaaS basis. The group has a proven track record of delivering growth over many years, demonstrated by its compound annual growth of 40% in total cumulative reviews.

ESG: Trustpilot has an ESG combined score* of B

Ondo Insurtech plc: Nominated for Breakthrough of the Year

Ondo is the first InsurTech to IPO in the UK. The group has proven it’s possible to use advanced technologies, such as LeakBot, to protect properties and actually prevent bad things from happening in the first place, giving homeowners peace of mind in a much more sustainable way than the traditional risk transfer model of insurance. During the period, Ondo took notable steps to enter the US market, which holds considerable growth potential for the group. In June 2023, Ondo announced that premium US insurer, Mutual of Enumclaw, had signed a contract to distribute its LeakBot system to homeowner insurance customers in Washington State. This was shortly followed by a transformative contract signed in November with Nationwide. As a Top 10 US homeowner insurer and Fortune 100 company, the Nationwide contract is a breakthrough opportunity for Ondo in the US.

RELX plc: Nominated for Company of the year

RELX is a global provider of information-based analytics and decision tools. The group’s products help researchers advance scientific knowledge, doctors and nurses improve the lives of patients and businesses and governments to prevent fraud. RELX, formerly known as Reed International and Reed Elsevier, reported a very strong trading performance once again, delivering consistent solid growth for its 35th year. RELX has employed AI technologies for well over a decade to develop and deploy its analytics and decision tools, and its long-term growth trajectory continues to be driven by the shift in the business towards these. As a result of group’s strong growth and increased cash flow, RELX was able to increase its interim dividend by 8%.

ESG: RELX has an ESG combined score* of A-

Website & FY Presentation (15/2)

Computacenter: Any changed view Following Bechtle? Nope.

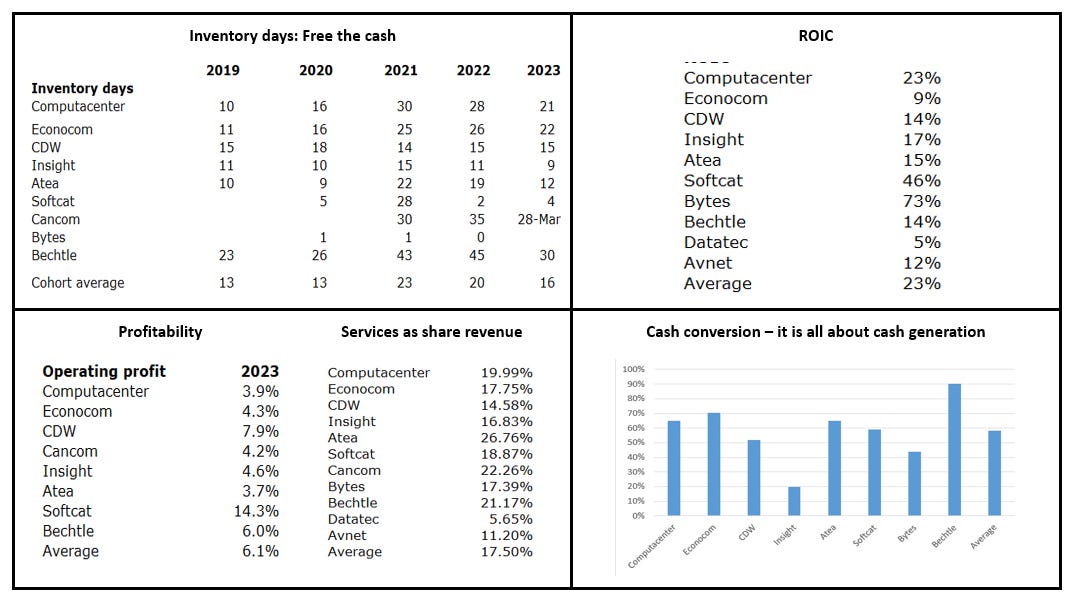

Bechtle announced final results (15/3). Among the headlines were revenue growth +6.8% Y/Y to €6.4 bn, EBT +6.7% to €374m a flat margin 5.8%. For us the interest is the continued effect of the industry wide inventory unwind which is leading to better cash (inventory soaks up working capital - dah) and better distributions. Note Bechtle shaved off 15 days of inventory (see below).

Dr Thomas Olemotz, CEO: “The economic tension at the beginning of 2024 is very obvious. However, we are confident that the macroeconomic situation will gradually improve in the course of the year, especially in the second half of the year. This is also likely to result in increased willingness on the part of our medium-sized customers to invest. More than once, we have furnished evidence of our ability to achieve profitable growth even in challenging times”.

In our view.

Computacenter will achieve 20-years of unbroken EPS growth (to 31/12/24). To be sure, the IT spend macro is fragile, the UK is weak, services margin are lower, and when announced the GII backlog may underscore some caution. Yet, there is optimism everywhere: (i) the valuation remains cheap, and the longer-term de-coupling has not been addressed; (ii) Services margins, a drag on 2021 & 2022 profitability are nudging better. (iii) The evolving skills pyramid means Computacenter better competes for Managed Services where volume means margin positive tailwinds. (iv) Our alternative RoV scenarios (Q3/2024) means the DPS yield range is 6% -12%. Computacenter offers something for every investor. To wit: ‘Value’ folks get the progressive dividend; deeper value folks get those special returns (ROV); transformation investors get a model focused on unlocking larger profit streams; ‘growth’ guys get the new digital services and geos. ‘Risk averse’ that an unrivalled EPS track record and ESG investors get the circular economy. Learn more finals 20 March.

The data

The PLC Awards 2023 The Winners

Tech company overview and your fellow investors

Source: Company data, Yahoo Finance, Analyst (Priced LSE close 14/3)

IT Infrastructure Services dashboard

Source: Company data, Analyst (Priced LSE 15/3)

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.