What happened to Cloud Computing after the attention caravan trundled elsewhere? The GenAI tsunami dominates mindshare and seemingly all paths to shareholder value. GenAI may be the oasis, but cloud remains a central IT motion. It is big. To wit: FY2023 cloud infrastructure services spending grew 18% to US$290.4bn. Cloud has become a ‘sleeves rolled up’ technology used by CIOs to spear issues around data center modernisation, IT technical debt, network management, sustainability, data sovereignty, AI and ML workloads, compute & store migration from on-prem to cloud, repatriation of applications from public cloud to the private cloud (and vice versa), oh and to address compute with GenAI LLM. Sage interim results (16 May) reminded us of the importance of cloud. But Sage is only a jumping off point as we review the IaaS providers hyperscalers: AWS, Google, Azure, Oracle, Alibaba, IBM along with independents Equinex, Rackspace, Digital Reality. The debut of Chat GPT-4o told us that LLMs are increasingly power hungry and are escalating cloud demand. Even as our IaaS dashboard shows mixed KPIs (below) the direction of travel is more positive. Our favourite is Beeks Financial Cloud as we think about these ‘bricks and mortar’ investment plays.

Sage and the long, long cloud migration

Sages share price sank (-9.5%) in the wake of H1 print (16/5) which saw it deliver 10% revenue growth, in line with guidance, which (better) translated to 18% profit growth leading the margin (always a weak point at Sage) to climb 160bps to 22.0%. Yet guidance disappointed. For us, the issue is more prosaic. To wit: Sage’s product cloud migration is poorest of its peers. Twelve years into its cloud migration 32% of recurring revenue is cloud. Of the £219m incremental ARR won in the 12 months to H1/2024, £190m was from new customers (£180m Y/Y), £29m from a very large installed base, but with low NPS rates (see below) customers can find better cloud endorsement elsewhere. However, as with peers (say SAP) stronger cloud migration does not translate to ratings or shareholder value creation.

IaaS: A GenAI investment play

AI workloads are driving incremental cloud computing growth for IaaS vendors. For these cautious times recap that the IaaS business model is ‘visible’, subscription-based, highly profitable and cash generative (see our Dashboard). The IaaS community spans the hyperscalers Google, AWS, Azure, Alibaba and the ‘rest’. The rest includes the application-led IaaS, think IBM, Oracle, SAP, network-led datacenters from the telecos (like BT, Telefonica, Vodafone, Huawei) the independent providers, such as Rackspace, Equinex and Digital Reality and vertical specific players such as Beeks Financial in financial services. While infrastructure vendors design and build more efficient hardware for the demands of AI model training and (soon) inference, IaaS vendors have to scale but also respond to higher compute power requirements up—from 10kWto over 100kW per rack which increases demand for power and pressurises cooling demands.

Global data center electricity to add a Sweden or Germany by 2026

Data center electricity usage is set to double by 2026 according to the annual electricity report from the International Energy Agency (IEA). It concludes that data centers consumed 460TWh in 2022, which could rise to more than 1,000TWh by 2026. The authors blame the rise of power-intensive cloud workloads such as AI and cryptocurrency mining. In 2022 data centers represented 2% of all global electricity usage with compute power and cooling the two most energy-intensive processes within data centers.

The caution is that the rapid growth of AI-related services means investing in power-hungry GPUs so that the rate at which electricity usage will increase by 2026 depends on “the pace of deployment, range of efficiency improvements, as well as artificial intelligence and cryptocurrency trends”. So the rise could be to somewhere between 650TWh and 1,050TWh or adding an extra ‘Sweden’ at the low end, or a ‘Germany’ at the highest. In the US, home to 33% of the world’s data centers, consumption is expected to rise from 200TWh in 2022 to 260TWh in 2026 and be 6% of all power usage. In Ireland by 2026, data centers could account for 32% of all power consumption due to a high number of new builds planned, compared to 17% in 2022. Note:

Calls to limit the number of new data center projects were rejected by the Irish government last year.

The number of GPUs required to train GPT-4 depends on the number of parameters in the model. The training of GPT-3, which has 175 billion parameters, was done on 1024 GPUs. Training a 100T parameter model on the same data, using 10,000 GPUs, would take 53 years. However, a PC with only one GPU can train GPT with up to 18bn parameters, and a laptop can also train a model with more than one billion parameters.

Into the mix renewable power sources become more important. Data centers with 100% renewable-powered will soon become more of a standard and data center builders will look ever more closely at geography for cooler climates with access to solar, wind, and hydro power.

A canter thru some of the cohort

Alibaba Group Q4 & FY results (14 May)

“This quarter’s results demonstrate that our strategies are working and we are returning to growth. . . We are also excited by the accelerated growth of customers and cloud computing revenues related to our AI products”, said CEO Eddie Wu. Q4 revenue from Cloud Intelligence Group was RMB25,595 m (US$3,545m) +3% Y/Y as core public cloud offerings (elastic compute, database and AI products) recorded “double-digit year-over-year growth in revenue”. Alibaba reduced prices across more than 100 public cloud products in Q4 and following that (April 2024) extended price reductions to overseas public cloud offerings as “AI-related revenue experienced accelerated growth and continued to record triple-digit growth year-over-year”.

Alphabet/ Google Cloud Q1 (25 April)

CEO Sundar Pichai, CEO, said: “Our results in the first quarter reflect strong performance from Search, YouTube and Cloud. We are well under way with our Gemini era and there’s great momentum across the company.”

Amazon/AWS Q1 (30 April)

AWS revenue + 17% Y/Y to US$25.0bn with operating income US$9.4bn vs US$5.1bn Y/Y. Andy Jassy, Amazon President and CEO. “The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate)”.

Azure (Microsoft) Q4 results (25 April)

Revenue in Intelligent Cloud was US$26.7bn, + 21% Y/Y and in portfolio, Server products and cloud services revenue increased 24% driven by Azure and other cloud services revenue growth of 31%. Microsoft Cloud revenue was US$35.1bn, +23% Y/Y.

Digital Realty Q1 (2 May)

Q1 Revenue US$1.3bn, -1% Y/Y, with Adj EBITDA US$711m+6% Y/Y with Funds From Operations US$451m or US$1.41/share, vs US$1.60/share Y/Y. “Digital Realty saw accelerating demand in the first quarter, executing on a number of multifaceted AI-oriented opportunities, while continuing to support hybrid multi-cloud requirements,” said President & CEO Andy Power.

Equinex Q1 (8 May)

The quarter was the 85th consecutive quarters of revenue growth and was the longest streak of any S&P 500 Company. Q1 revenue grew 6% Y/Y to US$2.1bn as Equinex closed 3,800 deals across 3,100+ customers. “Accelerated hyperscale demand” due to continued cloud and AI activity. Operating income, US$364m +5% sequentially and a 17% operating margin with Adj EBITDA, US$992m, +8% sequentially and a 47% margin. Charles Meyers, President & CEO, Equinix:” The rapidly evolving AI landscape continues to serve as a catalyst for economic expansion, creating immense potential for Equinix as our customers recognize the importance of digital initiatives in driving long-term revenue growth and operational efficiency."

Oracle FYQ3, period ended 29 February (11 March)

Q3 Cloud Infrastructure (IaaS) revenue US$1.8bn, + 49% Y/Y as Group revenue was +7% Y/Y. CEO Safra Catz commented that the company expects to continue receiving large contracts reserving cloud infrastructure capacity because the demand for Gen2 AI infrastructure substantially exceeds supply. In addition Oracle is opening new and expanding existing cloud datacenters “very, very rapidly”.

Rackspace Q1 results (9 May)

Q1 9 May saw Rackspace deliver revenue, US$691m, -9% Y/Y of which Private Cloud, US$268m, was -15% Y/Y as Public Cloud, US$422m, was -5% Y/Y. The operating loss -US$653m, increased from -US$581m Y/Y, with operating cash -US$90m. While the numbers disappointed, CEO Amar Maletira was “pleased” as they topped the high-end of guidance for revenue, operating profit, and EPS. Rackspace is in the middle of a turnaround with a healthcare vertical strategy in Private Cloud and GTM execution in Public Cloud. “Our goal for 2024 is to position the business to generate consistent revenue and profit growth.”

The data

Datapoints used to train LLMs

Source: OurWorldinData

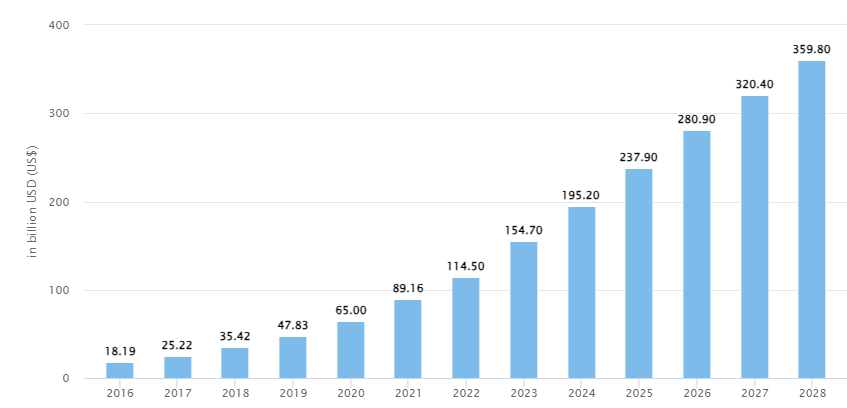

IaaS Market size (US$bn)

Source: Statistica

IaaS Dashboard

Source: Company data, Analyst (George O’Connor)

The increasing power requirements for Nvidia chips

Source: CBI Insights

Valuation heatmap

Source: Company data, Yahoo Finance, Factset, Analyst (George O’Connor)

Sage: Cloud migration & NPS

Source: Company data, Comparably, Analyst (George O’Connor)

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.