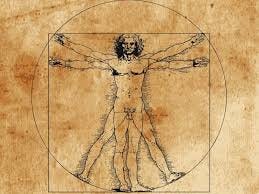

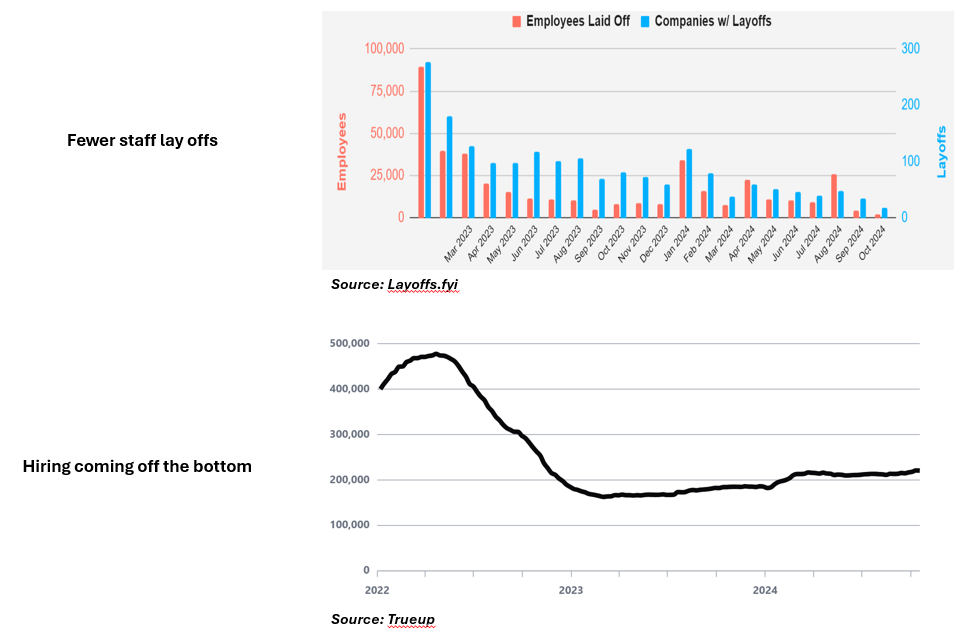

Do people matter in our burgeoning AI world? The tech industry is sending out contradictory signals. ‘Causal reasoning’ creates an authenticity imperative, some folks can do that - but what about the other humans? Of the Q3 reports to date, IT Professional Services companies added 36.7k FTEs, marking the first quarter of growth since Q4/2022 (see below) buoyed by GenAI revenue streams. But recovery is uneven. Job cuts are persistent but are drifting lower. Recruiters remain downbeat in their market prognosis (see below) even as hiring intentions improve - because of that the Recruitment cohort offers strong valuation upside. We are in the ‘Danger Zone’. The most challenging period for investors is not the beginning or middle of a recession; it is the end. As business improves (IT Professional Services cohort reported 4.7% revenue Q3 growth – the Q2 average was 2.4%), growing headcount siphons off cash when it is weakest. Hiring fuses caution and optimism. The impact of AI on employment is uncertain; as hiring intent has yet to translate to wider jobs growth. Positively for now the human remains in the loop.

Our latest results roll-call features: we look east where Infosys, HCL, LTIMindtree, Mastek, TCS and Wipro (responsible for c1.5m FTEs of our c3.5m IT Professional Services universe) report. Back to the UK for ActiveOps, Bytes and Hostelworld, on to Germany for Bechtle. Then to the front-end of the tech economy: the Recruitment sector, to the US for Manpower, before springing back to the UK for Hays, Robert Walters and PageGroup. Read on. Data insights inform our cohort dashboards and views on the global tech-economy.

Where is the human?

Hiring by Indian near & offshore firms translates to companies working their global employee pyramid even as the majority of IT Services staff are being retrained. While learning dents staff utilisation in the short term, it future-proofs the companies. The jobs market has wavered over the prospect of economic growth in these unsettled times, it is now starting to abate, but it is still tempered by anxiety after two years of on-again/off again recessionary fears. We may be blind-sided by ‘history,’ seeing economic recovery punctuated by hiring, but what if it is a jobless recovery? Almost 40% of global employment is exposed to AI, this excuses employers to delay hiring as they assess AIs productivity gain - a mid-term activity. In the past, IT automation affected routine tasks, but GenAI impacts high-skilled/knowledge jobs. PwC argues that in advanced economies c60% of jobs may be impacted by AI, split evenly between jobs where productivity is enhanced, and where AI displaces the human. That dynamic should lead to lower FTE demand, lower wages and lower hiring. This is already happening, in part: UK data shows declining salaries, but balancing this there has been a small demand recovery.

Sectors that are especially exposed to AI are experiencing nearly 5x higher growth in labour productivity, say PwC. We are reminded that growing labour productivity is a driver of economic growth and that over 80% of the 2030 workforce already in work. Global CEOs anticipate that AI will deliver significant benefits: 46% say it will increase profitability, 41% believe it will increase revenue. Dovetail that in PWC’s 2023 Global Investor Survey findings which concludes that 61% of investors believe accelerated adoption of AI is ‘very’ or ‘critically important’ to generating (shareholder) value. It illustrates the imperative that companies must have a clear AI strategy.

Tech Hiring and Firing

Source: Layoffs.fyi, Trueup.io, Technology Investment Services

Global Hiring intentions improving outlook: From Manpower Q4/2024

Source: ManpowerGroup

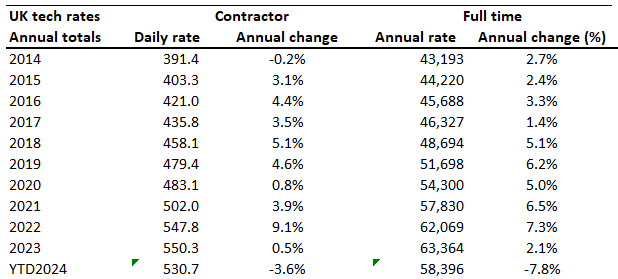

UK Tech Contractor and Full time salary since 2014 (£): Going down

Source: ITjobswatch.co.uk, Technology Investment Services

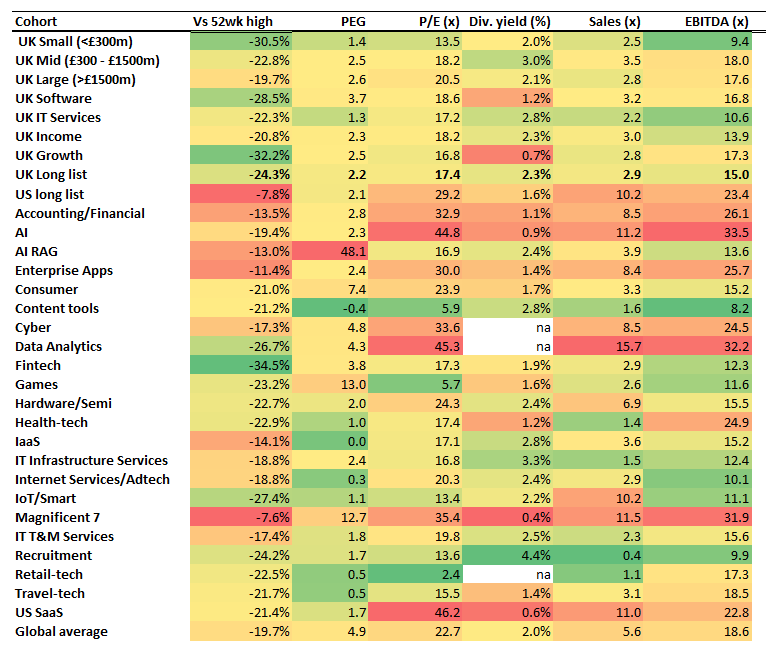

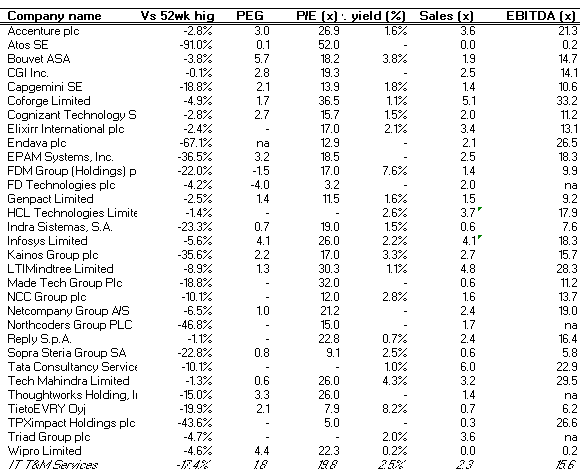

Tech Universe Valuation heatmap: Getting hot in places

Note Priced 21/10, n = 438 Source: Company data, Yahoo Finance, Technology Investment Services

The latest results roll call

Data & Analytics

ActiveOps: Busy, busy, busier

ActiveOps (Decision intelligence software for service operations) H1 Trading update (ended 30/9) was in line with full year expectations. Of the H1 highlights; 11% revenue growth to £14.3m – note the building sales momentum: H1 revenue growth was 7% last year – and the company also has sequential revenue growth. H1 revenue included 10% growth in SaaS revenue – it is £13.0m. ARR +11% Y/Y to £26.2m, NRR 108% - a decent uptick from 104% last year, with room for further improvement given the cohort (below). Cash £13.4m (H1 2024: £9.9m). From operations there were three new logo wins; two included “significant expansion potential”. Recap that at final results the company had inked three new logo wins – so here also there is evidence of a gear change. Despite seeing good levels of demand, ActiveOps cautions that “Enterprise sales cycles remain elongated in some regions” due to elections and other macro factors. Balancing this performance has been “particularly strong” in Canada, APAC and Africa regions. Also noteworthy is that ActiveOps' products can blend AI and human intelligence with information drawn from other enterprise applications to deliver “powerful insights”. This resonates with our ‘human in the loop’ notion (more here ). While some see this as a function of product life cycle maturity, for us it relates to the tech architecture. Indeed from tech insertion ActiveOps flags that ControliQ Series 4 is on track to launch in early 2025, with further advanced AI capabilities embedded in the platform. In addition:

Sadly we missed it, but ActiveOps says that it had record attendance levels at its global customer conferences in October.

There were five new sales FTEs appointed“towards the end of the period” with more in H2 with “revenue growth is expected from this investment from H2 FY26”. As an aside: We have yet to fully appreciate how GTM changes as companies migrate from ‘classic’ SaaS/ARR-sales models to native GenAI.

Executive Chair, Richard Jeffery commented: "ActiveOps continues to deliver for our customers, and I am pleased with the progress achieved so far this year. AI has the potential to transform service operations, and our platforms and people are at the forefront of making that a reality for our customers." Learn more about operations centre dynamics from ServiceNow (23/10).

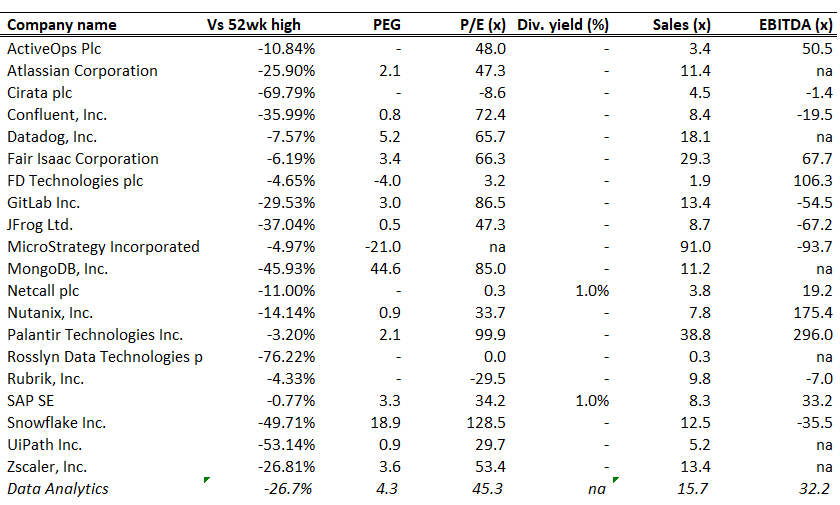

Data & Analytics: Valuation snapshot (x)

Note Priced 21/10 Source: Company data, Yahoo Finance, Technology Investment Services

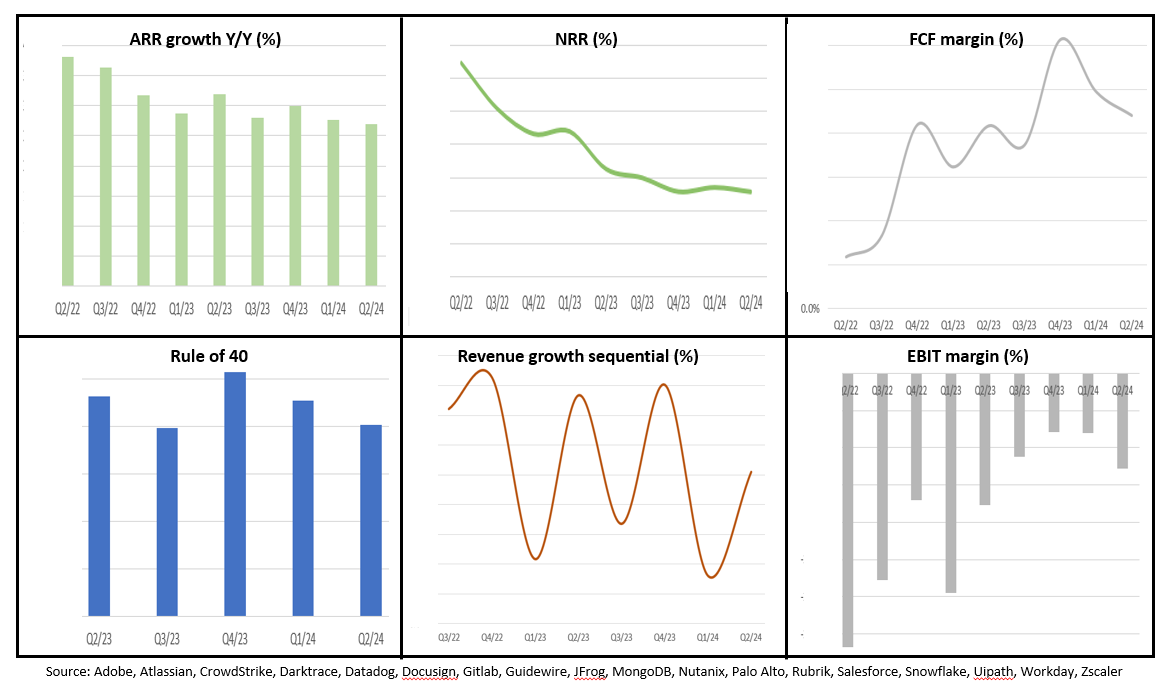

Data & Analytics Dashboard

Source: Company data, Technology Investment Services

IT Professional Services

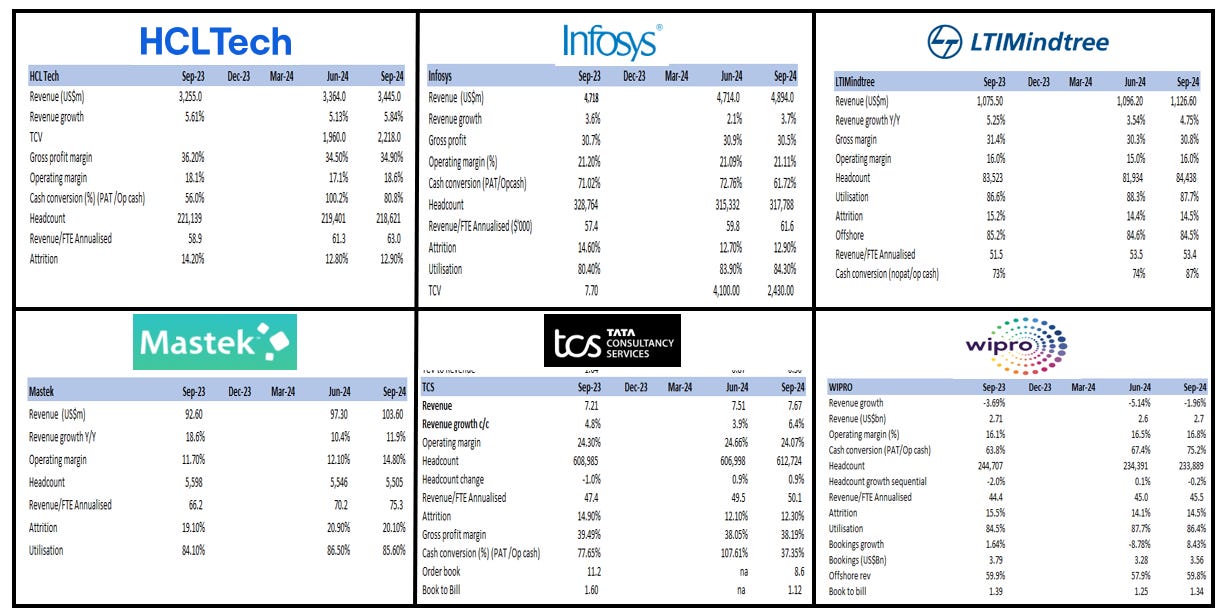

Infosys. Good sequential revenue growth, 3.1% to US$4,894m with a 21% operating margin, FCF US$839m which was +25.2% Y/Y with TCV of large deal wins US$2.4bn, 41% being net new, as there was order book burn in the quarter. Salil Parekh, CEO and MD commented that the growth was “broad-based with good momentum in financial services”.

HCL. Here too a message of improving fortunes with US$$3,445m +2.4% Q/Q, +6.8% Y/Y. Breaking the general cohort trend attrition was 12.9% from 14.2% Y/Y - we see attrition between 12 to 15% over the longer term across our IT Professional Services universe with Indian domestic on the higher side (15 - 18%). The company updated FY guidance to Revenue growth between 3.5% - 5.0% Y/Y i.e. it raised the bottom end from 3.0% to 3.5% - a small, but positive, step. Says C Vijayakumar CEO & MD: “Our GenAI offerings like AI Force and AI Foundry are resonating very well with our clients and should be drivers of efficiency, growth, and innovation over the medium term.”

LTIMindtree. Q2 was a good quarter with broad-based sequential growth experienced across all verticals and geo’s leading to 2.8% growth. Debashis Chatterjee, CEO and MD commented that “as GenAI becomes pivotal in customer interactions, there is a noticeable trend of modernization efforts focusing on transforming the data estate” – messages which chime with those from TCS.

TCS. Revenue US$7.67bn, +6.4% Y/Y with growth led by Energy, Resources and Utilities (+7.0%), Manufacturing (+5.3%) as all the Growth Markets were above company average: India (+95.2%), Middle East &Africa (+7.9%), Asia Pacific (+7.5%), Latin America (+6.8%). From the numbers the operating margin at 24.1%; and a net Headcount addition of >11k employees. K Krithivasan, CEO and MD: “We saw the cautious trends of the last few quarters continue to play out in this quarter as well. Amidst an uncertain geopolitical situation, our biggest vertical, BFSI, showed signs of recovery. We also saw a strong performance in our Growth Markets”. Note: TCS has over 612k staff on our model that puts it by headcount on a 17% global share - we track companies with 3.5m staff. (i) AI gets a look in no revenue but 600 projects and they have trained 300k staff in AI technologies. As to the shape of these contracts – TCS comments that the AI projects are now more about integration of AI into core systems - rather than isolated test cases - that is a big step forward - also laying the ground for future deals is (ii) legacy modernisation, (iii) data platform modernisation and (iv) technology landscape simplification. For us that is usually telegraphing supplier consolidation/the fewer throats to choke strategy. The downside in the numbers is the 24% operating margin - we can dream of such numbers in the UK. If we recall TCS pre-COVID their operation model was able to make margins just shy of 27%.

Wipro. Q3 revenue US$2,662.6m +1.5% Q/Q, -1.0% Y/Y with IT services revenue, US$2,660.1 m, +1.3% Q/Q, - 2.0% Y/Y. Positively Bookings US$3,561m with large deal bookings US$1,489m a sparkly +28.8% Q/Q, +16.8% Y/Y. Operating margin was 16.8%, +0.3% Q/Q , +0.7% Y/Y. Srini Pallia, CEO and MD “We continued to expand our top accounts, large deal bookings surpassed $1 Bn once again. We grew in three out of four markets, as well as, in BFSI, Consumer and Technology and Communications sectors.”

Mastek. Umang Nahata, CEO commented that the 18% Q/Q growth in North Americas was led by strong performance across sectors. The UK & Europe growth was defined by momentum in Healthcare portfolio. The company has an “AI-first approach across all operations, enhancing our delivery capabilities, and developing innovative AI-driven solutions”. Attrition remains high (20.1%) but drifted back in the period.

The numbers we track

Source: Company data, Technology Investment Services

IT Professional Services: Valuation snapshot (x)

Note Priced 21/10 Source: Company data, Yahoo Finance, Technology Investment Services

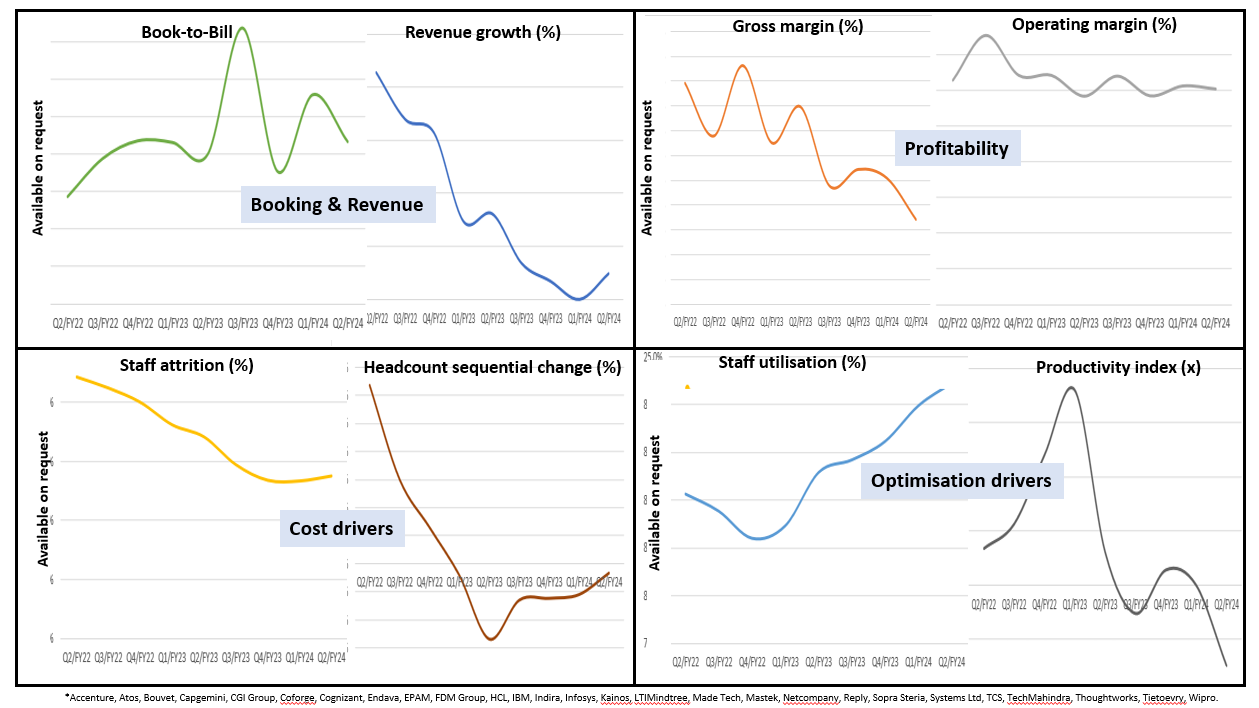

IT Professional Services Dashboard

Source: Company data, Technology Investment Services

EBIT Margins By company home N. America, Near & Offshore, Europe, since Q2/22 (%)

Source: Company data, Technology Investment Service

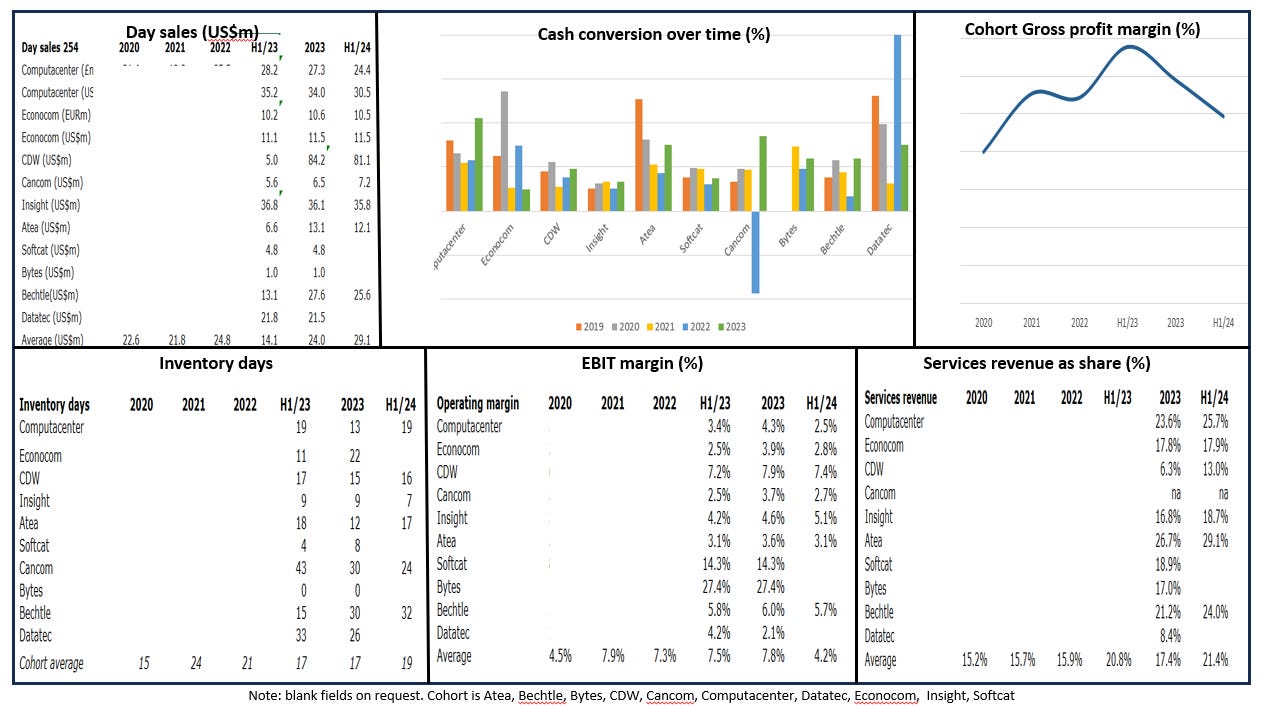

IT infrastructure Services

Bytes: Growth despite the challenges

New CEO Sam Mudd: “Despite the challenging economic climate and political uncertainty over the past six months, we have increased our share of wallet among our existing customers as they continued to invest in their IT needs. We have also expanded our client base in both the public and corporate sectors." From the numbers: (i) GII +13.7% Y/Y to £1,230.2m (ii) Revenue - 2.9% Y/Y to £105.5m due to a decrease in hardware GII (all of which is booked as revenue), (iii) Gross Profit +9.0% Y/Y to £82.1m. Operating profit +16.3% to £35.6m. From the operational narrative - Sold over 130k Copilot licenses, generating annualised GII of c£39m – so 3% of total - hardly making a ripple despite being a tech element of our ‘human in the loop’ notion.

Bechtle: More M&A – that didn’t take long

We commented on Bechtle’s aim to enter the UK top ten. A whisker after the Qolcom acquisition, Bechtle takes another step closer to achieving the goal. The happy seller was BGF. DriveWorks is a UK software developer and market leader in Design Automation and Configure Price Quote (CPQ) solutions for companies using SOLIDWORKS 3D CAD. Founded in 2001, DriveWorks has 59 staff and €6.5m revenue – oh dear, this not enough to get another rung up the UK leader board.

DriveWorks will continue to operate as an independent company, exclusively serving SOLIDWORKS resellers in 54 countries. The company also operates two subsidiaries in Australia and the USA, both of which will be retained, together with employees in France and India. More acquisitions required and buying a software author shows that Bechtle is not put off by the ‘this is what it does’.

IT Infrastructure Services: Valuation snapshot (x)

Note Priced 21/10 Source: Company data, Yahoo Finance, Technology Investment Services

IT Infrastructure Services Dashboard

Source: Company data, Technology Investment Services

Travel-tech

Hostelworld: Social de-rails the guard-rails

Sparkling. A Trading Update saw Hostelworld reaffirm FY Adj EBITDA of €21.6m. Net bookings, 5.4m +7% Y/Y driven by record performances in Asia and Central America. The Net average booking value of €13.54 -9% Y/Y, is due to a greater proportion of Asian destination bookings coupled with a slight increase in the proportion of solo customers. Net revenue €72.3m (-2% Y/Y). ‘Tut-tut’ you must be thinking, where is the sparkle? It is: (i) Direct marketing as a percent of revenue – down to 46%, from 51% in YTD '23. This was created from; (ii) the proportion of bookings from Social Members which increased to 80% (67% in YTD '23) – meaning that the social folks become more efficient to service enabling; (iii) Operating costs €18.7m, (-3% Y/Y) being 26% of net revenue, leading to (iv) YTD Adj EBITDA is €17.8m, that is +28% Y/Y and a 25% margin up from 19% in YTD '23. And of course, the improving unit economics feed down to the cash level so that cash is €7.8m, net cash position of €0.9m, with all bank debt repaid in full. Remembering that Marketing per cent of revenue was 60% of revenue in H1/22, we ponder possible scenarios for Hostelworld, given the success of its Social channels. Looking at that industry: Bumble has c25% of revenue in sales & marketing; Pinterest has 31%. As the ‘social’ model evolves Hostelworld has more potential for profit growth.

CEO Gary Morrison:" performance has been driven by strong consumer demand from Europe, the UK and North America to low-cost destinations in Asia and Central America. The strong cash generative nature of this business has seen us return the balance sheet to a net cash position in quarter three of 2024. . . . (the) impressive performance of our Social Network, as a result of which, marketing expense as a proportion of revenue has improved significantly YoY. This has resulted in a net margin growth of 10% and combined with our continued focus on cost, has delivered a 28% increase in adjusted EBITDA Y/Y.”

The Social ‘magic numbers’ at Hostelworld

Source: Company data

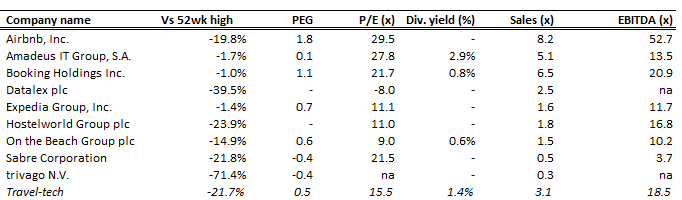

Travel-tech: Valuation snapshot (x)

Note Priced 21/10 Source: Company data, Yahoo Finance, Technology Investment Services

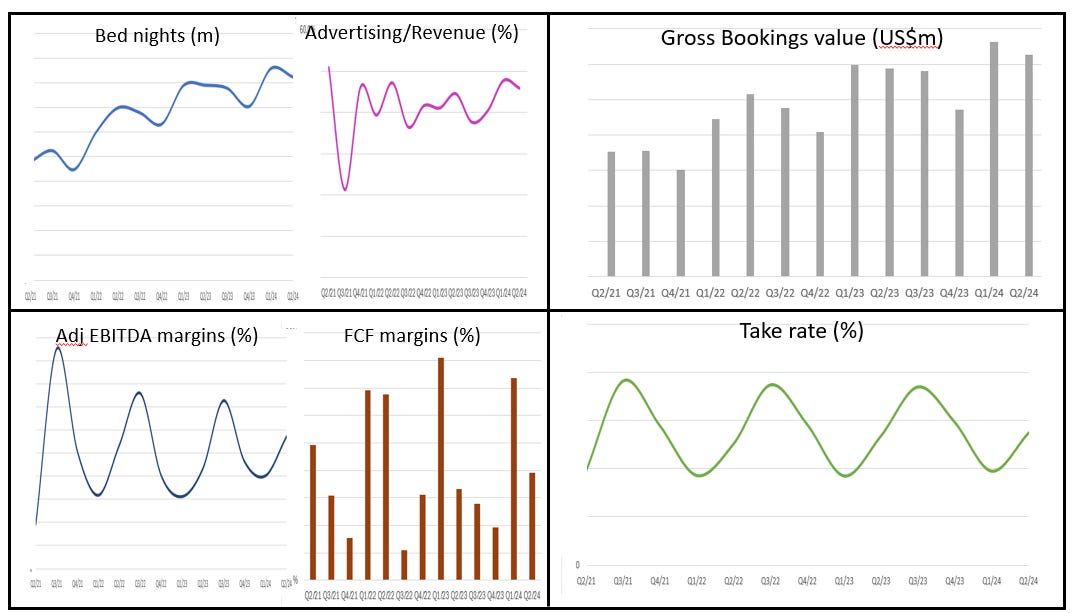

Travel-tech Dashboard

Source: Company data, Technology Investment Services

Recruitment

Hays

Group Net Fees were down 14% Y/Y with Temporary -11% Y/Y, Permanent down 21% Y/Y as CEO Dirk Hahn commented about the “tough market conditions, particularly in Perm where we see longer time to hire and low levels of confidence which we expect to continue”. From the regions- Germany: fees -13%, with Temp & Contracting -12% Y/Y, Perm -17%; UK & Ireland: fees down 20%, with Temp down 16% and Perm down 26%. Activity levels remained subdued but sequentially stable in the Private sector; Australia & New Zealand: fees down 20%, with Temp down 13% and Perm down 32%. While market conditions remain challenging, activity levels were sequentially stable; Rest of World: fees down 9% with activity stable; EMEA ex-Germany fees declined by 11%, Asia was down 10% and the Americas -2% Y/Y. Outlook guidance Near-term market conditions will remain challenging. Activity levels in both Temp and Perm are sequentially stable overall in ANZ, EMEA, Asia and the Americas, but remain at subdued levels driven by low levels of client and candidate confidence and longer time to hire.

Manpower

Q3 revenue -3% to US$4.7bn with a “challenging operating environment in North America and Europe”. Gross profit margin was 17.6% as staffing margins were resilient but permanent recruitment demand weakened. Jonas Prising, Chairman & CEO, also commented that “we continued to see solid demand across Latin America and Asia Pacific Middle East” but the current operating environment “is difficult for our industry”. Guided down Q4 earnings.

PageGroup

Group gross profit, £201.4m, -13.5% Y/Y with the September exit rate -16% as the market experienced “continued subdued levels of client and candidate confidence impacting decision making”. From the regions: EMEA -15.1% (Hardest hit: France -16%; Germany -19% with the UK -13.5%), Americas -10.3% Y/Y with the US -11%; Asia Pacific -16.8% Y/Y with SE Asia -9%; Greater China -25%; Japan -5%; India -3%. Net cash of c. £93m (Q2 2024: c. £57m, Q3 2023: c. £136m). Guidance is that for “2024 operating profit to be broadly in line with current market consensus of £58m”. Permanent 71% of Group and -18.5% Y/Y with Temporary (29% of Group) -12.0% - reflecting the general trend of the wider market

CEO Nicholas Kirk: "We continued to see challenging market conditions throughout the Group in Q3, with no improvement in September after the seasonally quieter summer months. Whilst most markets were sequentially stable, we experienced softer activity and trading in a number of European countries including France and Germany.” Also, recruitment budgets have tightened slowing the recruitment process, impacting time-to-hire. In addition, salary offers made to candidates were not as high as they were in 2022 and early 2023.

Robert Walters

Q3 Net fee income £79.9m -14% Y/Y, Asia Pacific (£35.0m) -14% Y/Y, Europe (£25.0m) -14% Y/Y with the UK -19% Y/Y; Rest of World (£7.4m) -6% Y/Y. Trading conditions were broadly unchanged from the first half, with client and candidate confidence levels yet to show signs of material improvement. As to the segments, Permanent (66% of fees) was -12% Y/Y, with Temporary (34% of fees) also down 12% Y/Y. Net cash, £50m, from £49m this time last year.

CEO Toby Fowlston: "Global hiring markets remained challenging during the third quarter, bringing the period of rebasing following the 2022 post-pandemic peak to around two years. As set out at our half-year results in August, our assumption continues to be that material improvement in client and candidate confidence levels will be gradual and not likely to commence until 2025.”

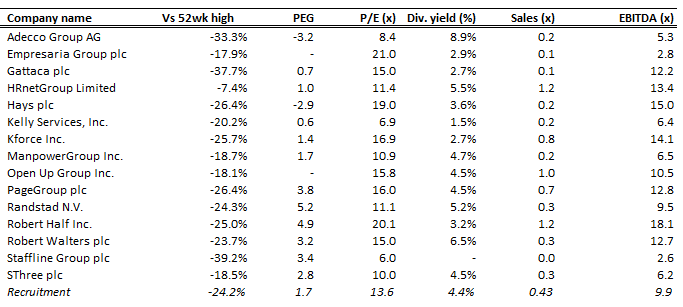

Recruitment: Valuation snapshot (x)

Note Priced 21/10 Source: Company data, Yahoo Finance, Technology Investment Services

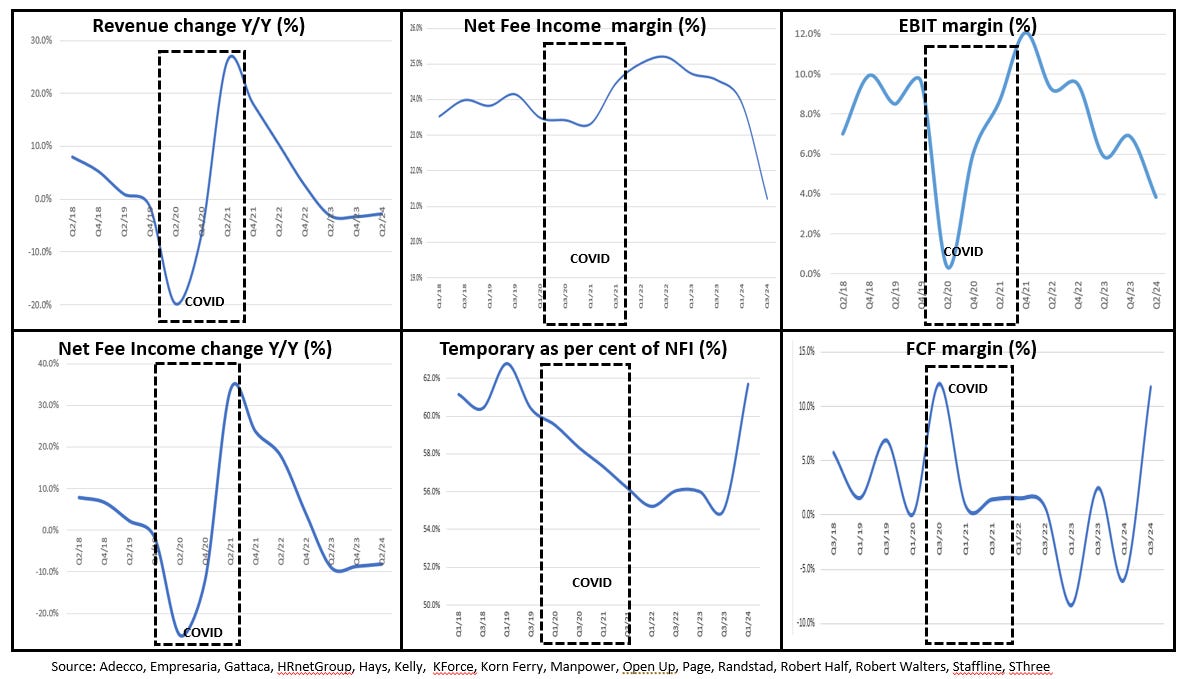

Recruitment Dashboard

Source: Company data, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.