The long and the short of IT

Gaslighting the market

In technology the next generation of winners haunt the wings, losers stand in the glare of the footlights. The capital markets community reliably over-estimates the impact of technology in the short term, only to under-estimate the long term potential, seeing winners and losers long before reality bites. One of the areas currently being bitten is IT Professional Services. This week’s Capgemini and WNS deal (see below) proves the point; this was not a cheap tactical deal, but an expensive strategic one. Despite what the lowly valuation might imply, the IT Professional Services business model is not broken - but its delivery model is being redefined. As this shape shifting accelerates, T&M-based pricing will pivot to outcomes-based. This will ensure that business models currently predicated on headcount become less viable, and valuable. But, the move has unintended consequences; shunting revenue recognition to later, cash to ‘slower’ and making valuation weaker. On that cheery note, we examine the secular impact of agenticAI.

Tech Universe results this week span UK Software (Accesso, Corero Nework); AI-RAG (Capita); IT Professional Services (Capgemini, Northcoders, TCS); IoT/Smart (1Spatial, Seco, SRT Marine); Gaming (everplay, Frontier Developments); Recruitment (Page Group); Travel-tech (Hostelworld). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

The tech drivers and Points to Ponder

The new end game for IT Professional Services

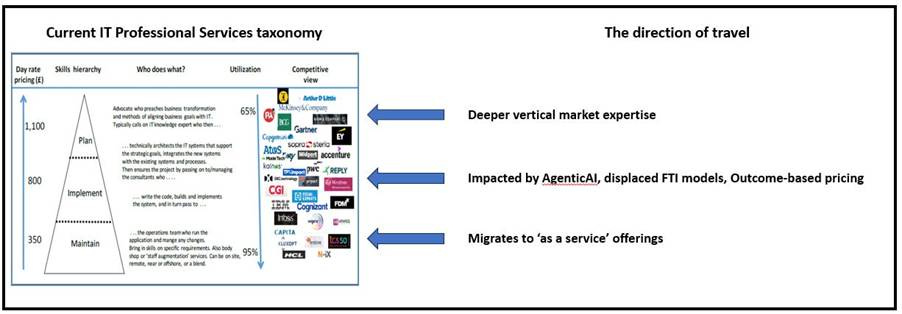

The Capgemini and WNS deal (see below) informs us that the Professional Services industry realizes that it is on the cusp of change. The firms are re-aligning their customer value proposition. The industry is migrating from headcount-based delivery to Agent count-based delivery where Agents, not consultants, give clients access to tools and data. However, as customers will continue to lack in-house expertise (simply put, the industry will be able to out-pay for staff) they will still rely on Professional Services firms. Consequently, the core business model of IT Professional Services firms is not broken, but its delivery model is being redefined.

Digital workers (Agentic agents) will increasingly simplify and accelerate AI delivery. The known-unknown is whether the digital workers can deploy production-grade systems that can handle every part of the data lifecycle from ingestion (ETL) to actionable insights (Data Analytics, visualisation) at enterprise scale delivery. Given the importance of vertical market expertise (as illustrated by Capgemini/WNS) the ‘solution’ for any given industry problem will be case specific, rather than deployed at scale. Customers will purchase agents that deliver micro outcomes (i.e. live business-critical workflows) rather than subscribe or license software or hire people.

Humans working in Professional Services firms will orchestrate agents, design the workflows, ensure alignment with strategic company goals, and intervene for escalation, problem resolution or when judgment is truly needed. Remember, agents will still be prone to hallucinations so the human remains in the loop.

IT Professional Services: Shape shifting

Source: Technology Investment Services

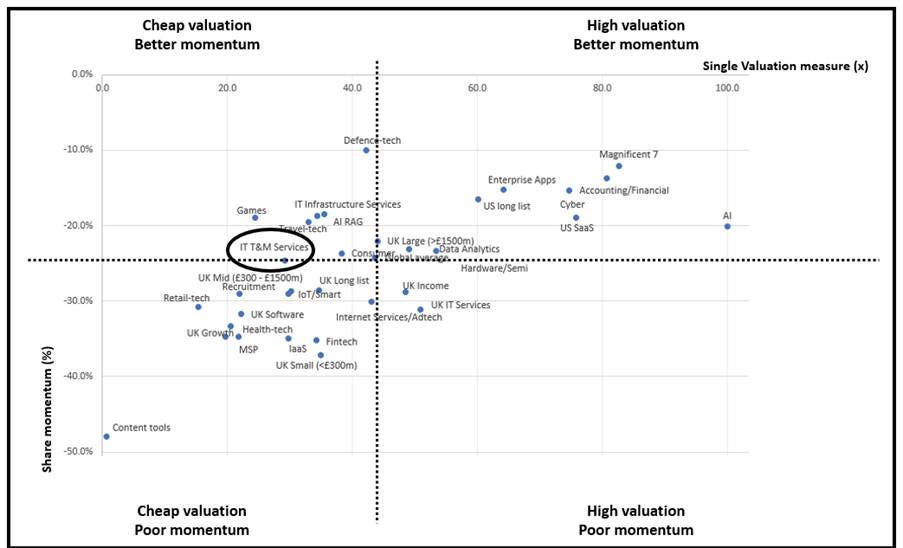

IT Professional Service T&M Valuation and Share momentum

Source: Company data, Yahoo Finance, Technology Investment Service

What are the implications for T&M business models?

We expect a pronounced move to more outcome-based pricing. This will be partly predicated on moving from T&M pricing because agents will replace delivery staff.

As an IT professional services company shifts from Time & Materials billing revenue, recognition will change significantly. This transition will impact when and how revenue is recorded. There is risk and complexity as revenue recognition migrates from a straightforward, time-based model to a more complex, contingent model. Also, Outcomes require greater judgment, stronger contract management, and systems to ensure compliance with accounting standards and accurate financial reporting. Let’s compare:

Time and Materials (T&M) Contracts

Revenue Recognition Basis: Revenue is over time as the service is delivered.

Matching: Revenue is matched to actual time and costs incurred.

Performance Obligations: Each day is a distinct obligation, fulfilled as the work is performed.

Simple accounting: Revenue tracks with billable work and client invoicing.

Outcome-Based Contracts

Revenue Recognition: Revenue is recognized when specific outcomes or milestones are achieved—not as work is performed. If the outcome is binary (e.g., success fee), revenue is recognized only when the condition is met and collection is probable.

Not matched: Revenue is deferred until the agreed outcome is delivered and accepted by the client.

Performance Obligations: Defined by the achievement of measurable results (e.g., system implementation, process improvement, cost savings).

Accounting is complexity: Revenue is only recognised when it is highly probable that the outcome will be met and the client will pay.

Where does our argument fall apart?

Many in the industry see Outcome-based pricing as a way of increasing pricing, ceteris paribus. A bigger pot, not tied to headcount, is the prize. To date, customers have been slow to move to outcome partly because they suspect that they will be charged more. However, many suppliers are also reluctant to move because outcomes are inherently riskier as tech implementations often fail to deliver on time or are fit for purpose, and in fairness customers often add ‘out of scope’ features and functionality extending schedules.

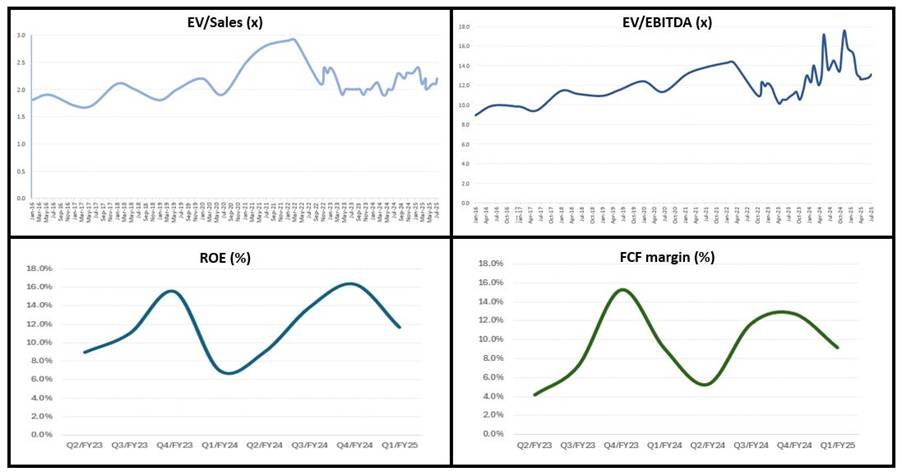

IT Professional cohort: Valuation (going nowhere) and business efficiency ratios (the H2/24 surge has since drifted lower)

Source: Company data, Yahoo Finance, Technology Investment Services

Latest company updates

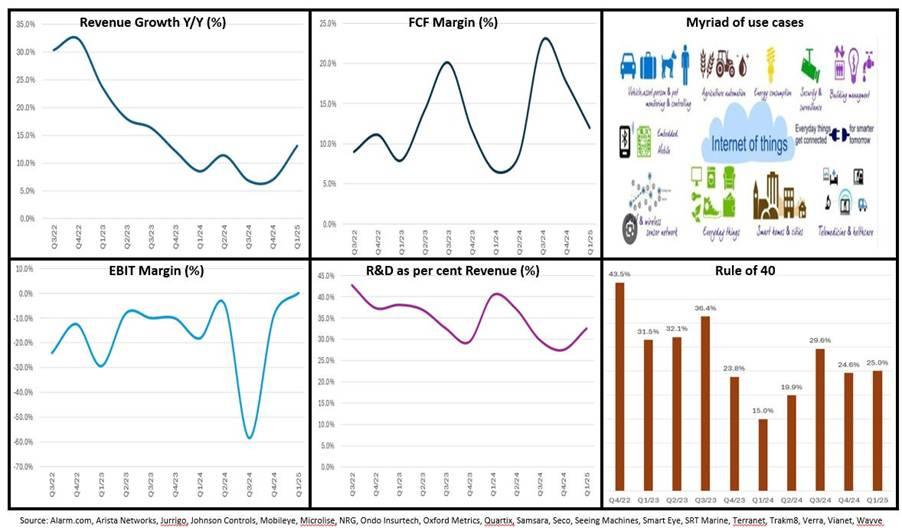

IoT/Smart

Cohort scenario. The Internet of Things (IoT) industry is substantial and growing rapidly across a number of industries, as use cases expand. The IoT market is projected to grow from US$945.6bn in 2024 to US$1,377.8bn by 2029 as the installed base of IoT connections reaches 20bn this year and 31.5bn by 2030. Central to the development are under-pin technologies such as Wi-Fi, Bluetooth, 5G, and Low Power Wide Area (LPWA) networks, and end markets in healthcare, automotive, smart homes, security, and industrial applications. However, the (investor) attention caravan has moved to GenAI and so ignores the many opportunities. The companies are at the development stage (so R&D/Revenue is a monitored KPI) as we try to understand/map the Life Cycle positioning (a typical S-curve for a product based business). While the life cycle sacrifices profitability to establish product and customer moats, pleasingly, FCF margins have recovered from the H1/24 decline (see below). The challenge now is to recognise the eventual leaders from the mere participants. There is lots of shareholder value, and value traps, in the cohort.

IoT/Smart cohort: KPI Dashboard

Source: Company data, Technology Investment Services

1Spatial. Mixed messages in the AGM with no direct reference to ‘trading in line’. Non-exec chair Andrew Roberts commented about the transition to becoming a SaaS led business and that the company has “a healthy pipeline of significant contracts across its offerings”. Positively, the UK returned to “more typical activity levels in recent months” while the “slower pace of decision making and procurement has continued in the US”. The Board remains confident 1Spatial has the right technology and team in place to grow Software Solutions and SaaS businesses in FY 2026 and beyond – rather than comment on estimates.

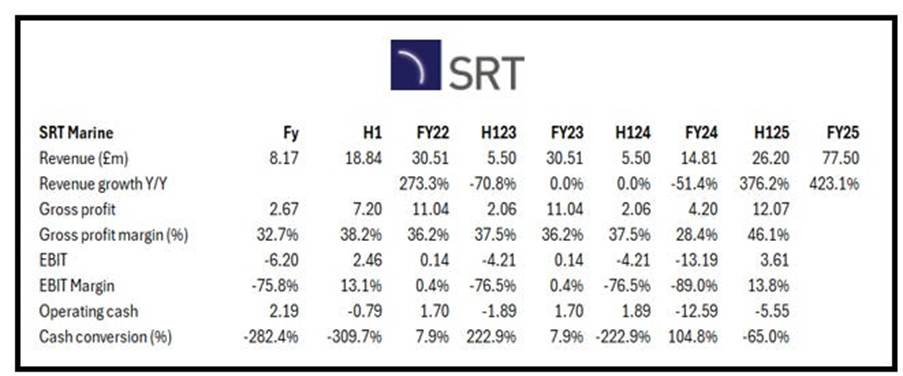

SRT Marine Systems. The rocketship posts an upbeat FY trading update, 12 months to 30/6. SRT (Integrated maritime surveillance and MDA management systems for security, safety and environmental protection) has grown revenue by a whopping 423% Y/Y to £77.5m, last year’s £14.4m pre-exceptional loss is transformed to a £4.4m profit, cash £4.2m is +50% Y/Y. This followed the US$213m system contract signed with the Kuwait Coast Guard (October ‘24) adding to the £320m active contracts being implemented. There is a validated pipeline valued at up to £1.4bn.

From technology there is a new NEXUS transceiver to start shipping in H1/FY26. The transceivers deliver navigation safety and communication devices and solutions for commercial and leisure marine markets.

Simon Tucker CEO: "This market remains in its early stages of development as marine stakeholders seek to harness digital technologies such as AI to reveal insights that enable them to enhance security, safety and sustainability and therefore I expect to continue to see our business grow substantially from this base in the future."

The numbers we track: SRT Marine

Source: Company data, Technology Investment Services

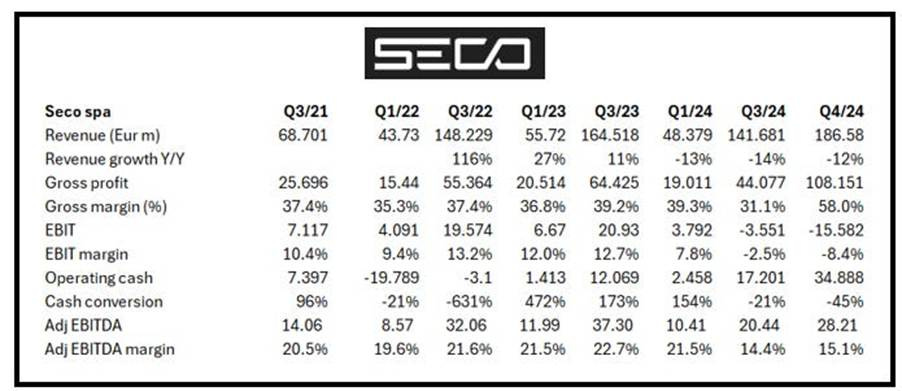

Seco spa. IoT/Smart does not exist in isolation. From the school of ‘don’t give a man a fish, but teach him how to fish’ (and catastrophise his weekends), we note the launch of the SECO Application Hub. We like this initiative for empowering customers. This is a curated app (150) marketplace designed to simplify the development and deployment of AI on edge devices. This will help users (think: industrial OEMs, system integrators companies, developers, data scientists) to accelerate adoption (build sandbox PoCs) of advanced vision, audio, speech and all kinds of data-driven applications across a “wide range of sectors, including industrial automation, healthcare, smart mobility, and retail”. Fausto Di Segni, Seco Head of IoT and AI: “We're enabling businesses to move beyond the hardware and easily deploy the intelligence that will transform their products and operations.”

The numbers we track: Seco

Source: Company data, Technology Investment Services

UK Software

UK Software cohort: KPI Dashboard

Cohort scenario: These companies are typically smaller than their US counterparts, but all sell and compete globally. In addition to being smaller they typically have poorer KPIs (notably cash-based, ARR, NRR) but have better profitability. The comparative KPI mix may on its own account for the lower valuation and support the view that ‘venue’ has little to do with the valuation. The group is cheaper and pays a dividend/income in addition to share buybacks.

Source: Company data, Technology Investment Services

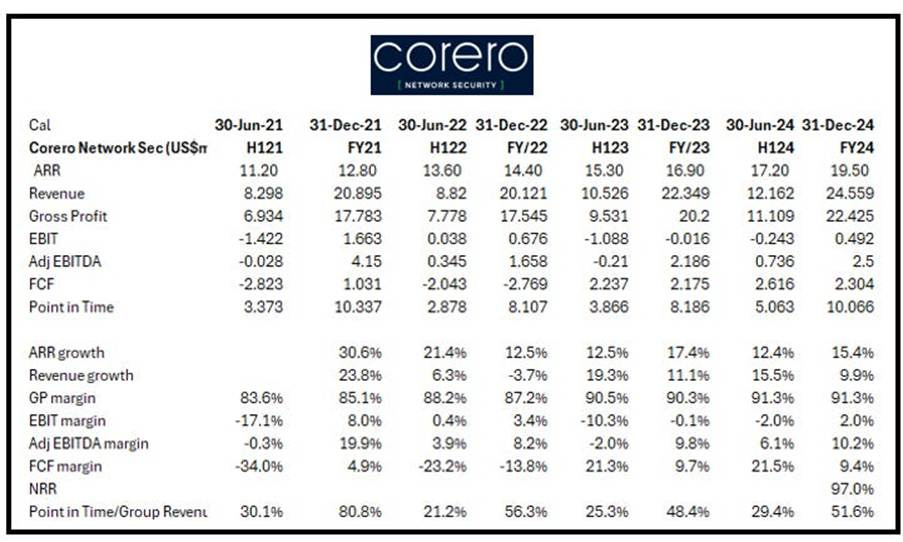

Corero. More good news from this turn-around on the move. They have announced the first two customer wins adopting CORE (Corero Observability and Resiliency Ecosystem) architecture, a next-generation platform designed to unify visibility and defensive action across disparate security infrastructure. Capabilities include Traffic Analysis, Zero Trust Access Control and Layer 7 DDoS protection focused on operational resilience. These are adjacent to Corero's traditional DDoS protection suite.

A US$1.5m expansion of its partnership with TierPoint, a provider of secure, connected data centre and cloud solutions. The agreement marks the introduction of the new CORE L7 (application-layer) DDoS protection, co-developed with TierPoint and designed to defend against complex threats without the bloat of traditional web application firewalls. This will be integrated into TierPoint's broader security platform, enhancing its ability to protect enterprise customers operating in hybrid and multi-cloud environments.

A new CORE partnership with Cooper University Health Care, a leading academic health system based in Camden, New Jersey. This three-year, US$0.3m agreement includes the first deployment of ZTAC which will provide cybersecurity protection to Cooper Health's online infrastructure, including almost 14,000 employees across three hospitals.

The numbers we track: Corero

Source: Company data, Technology Investment Services

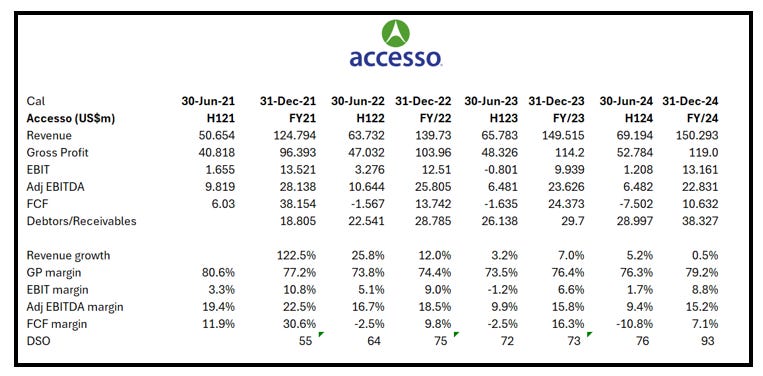

accesso Technology Group. Warns that FY25 revenue will be at the lower end of guidance due to poorer attendance across the customer portfolio (leisure and theme parks), and FY26 should be lower as well. June, July and August are the most important trading months and so far (early July) FY revenue is trending to the lower end of guidance range. Cash EBITDA margin guidance, c. 15% for FY2025 remains unchanged “reflecting continued cost discipline and operational efficiency”. In addition, a major customer does not intend to renew one of its contracts and so there will be a £6m hit to gross profit starting in 2026. However it managed to wrench out “significantly improved commercial terms” in the remaining contract. Despite the shadows over 2025 and 2026 forecasts, the company says that it is “encouraged” by the strength of the sales pipeline and a notable improvement in the commercial win rate. There are 33 customers signed for accesso Freedom including the first theme park win, implementation underway for a signature Middle East engagement, and a significant uplift in new wins. The company will review 2026 guidance at a later stage.

The numbers we track: Accesso

Source: Company data, Technology Investment Services

IT Professional Services

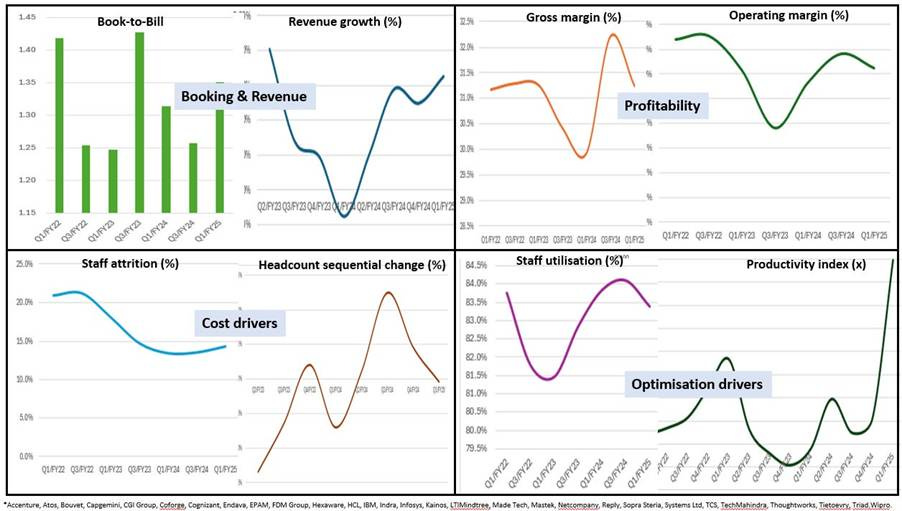

Cohort scenario. The cohort has c.3.6m FTEs. Contrarily, given the weak economic backdrop, coupled with an expected change to rev/rec we see grounds for optimism. The Q1 KPIs suggested that the recovery is slowly on track with revenue, margin and FTE growth. Generally, bookings have recovered (this is happening globally) and FY revenue growth c3-5% looks achievable as the cohort slowly emerges from the aftermath of the Covid and immediate post-Covid environment which saw the industry over-hire. Since then, staff attrition dried up impacting profitability. However, more recently attrition has been shuffling upwards, the industry has some pricing power (i.e. inflation clauses) and so revenue growth has been rekindled. In addition, (i) GenAI has given the industry a new secular growth driver and a new twist to Digital Transformation programs, and (ii) the sector will benefit from the increased Defence spend. From the KPI dashboard the industry is slowly starting to rehire and re-train existing staff which in the short-term dents utilisation. Shares in the cohort are cheap reflecting the past two difficult years, difficult macro and the uncertain impact of GenAI technologies on headcount businesses. However the dashboard is starting to telegraph an operational recovery noted by the Y/Y improvement in ROE.

IT Professional Services cohort: KPI Dashboard

Source: Company data, Technology Investment Services

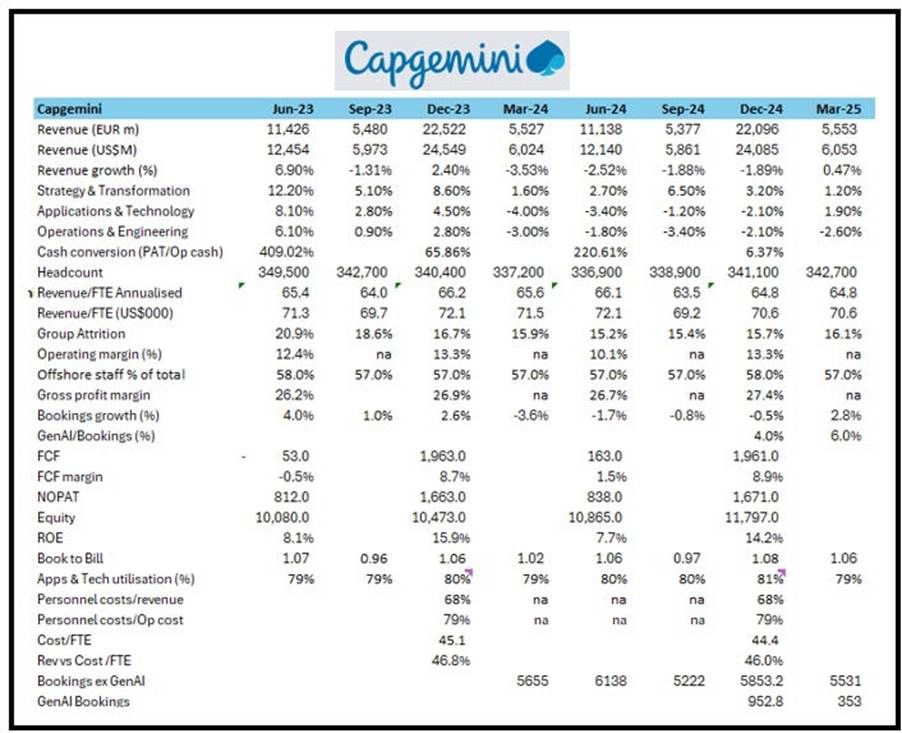

Capgemini. We confess that we like the acquisition of BPO/BPS company WNS. There are sensible reservations about a toppy price paid for a legacy asset, but on balance companies should be using these weak markets, coupled with the current tech shift, to expand & defend their customer moat. This is what Capgemini is doing as it spends US$3.3bn, c.2.2x reported sales, for WNS. The aim is to establish a leader in ‘Intelligent Operations’ (a well-used phrase). WNS clients include Aviva, Centrica, McCain and United Airlines, with North America being c.47% of Group revenue and the top three Vertical markets are Financial Services (37%), Shipping, Logistics & Professional Services (16%) and Travel & Leisure (13%). We are told that there is a strong cultural fit and common values so the post-acquisition integration is billed as being “straightforward”. WNS slips into Capgemini’s Global Business Services division. The price is a 17% premium to the undisturbed but news had already filtered into the market, being commented on by Reuters in April. The transaction was unanimously approved by both Boards. WNS adds revenues of €1.2bn, 18.5% operating margin and €0.1bn FCF. Based on cal24 the combo has €23.3bn revenue with a 13.6% operating margin.

Guidance. The deal will be immediately accretive with Capgemini’s normalized EPS growing 4% before synergies in 2026, and 7% post synergies in 2027. The Annual run-rate cost synergies are guided to €50-70m by the end of 2027. The transaction is expected to close by the end of 2025.

Deal rationale - as billed. Organisations looking to create value with GenAI and Agentic AI will “redesign their operations and business processes” as they become AI-powered companies. In turn, this will lead to a new type of business process services: Intelligent Operations. Intelligent Operations is defined as a consulting-led approach to transform and operate horizontal and vertical business processes by using Gen AI and Agentic AI.

Capgemini and WNS see themselves as already pioneering Intelligent Operations (so do other companies). Capgemini has consulting-led end-to-end transformation of processes, advanced AI tools and technology stacks, and BPS platforms, while WNS has developed a set of sector-specific AI-led solutions recently augmented by the acquisition of Kipi.ai to strengthen its data, analytics and AI capabilities.

To pay for the deal, Capgemini has bridge financing, €4.0bn covering the purchase of securities ($3.3bn), as well as the gross debt and similar obligations, c.US$0.4bn and the €0.8bn Capgemini bond redeemed in June 2025. Capgemini plans to refinance the bridge with available cash for c.€1.0bn and the balance by debt issuance.

A quick trading comment. Expects Q2 2025 Y/Y growth (constant currency) to be slightly better than the -0.4% reported in Q1 2025. Also expects for H1 2025 the operating margin to be stable Y/Y, 12.4%.

The numbers we track: Capgemini

Source: Company data, Technology Investment Services

Northcoders. Warns because it cannot predict the timing of income from Government-backed contracts. This follows the news (25 April) that Government funding would move to a fully regional model so that Skills Bootcamp programmes would be funded via localised structures. While many regional authorities have made funding awards, multiple bids remain pending, several regional authorities have yet to issue tenders or confirm exact future funding allocations. A cost reduction programme sees a £3.25m reduction in annualised fixed costs. The current cash balance is £2.25m. An uncertain buyer environment coupled with limited cash headroom.

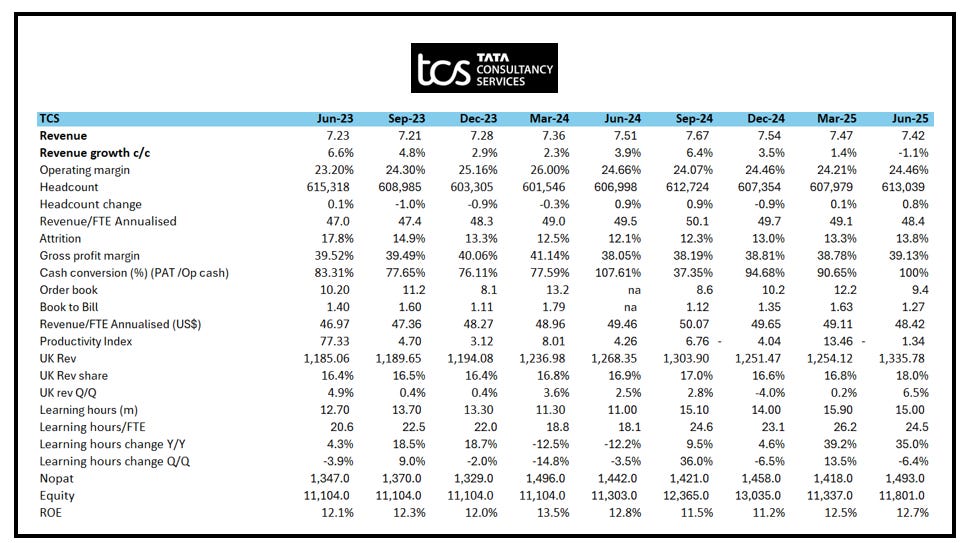

TCS. It was a rare revenue dip at TCS, revenue US$7,421m but EBIT margin was firm enough, 24.5% (24.7% Y/Y), as headcount grew, +6,071 Y/Y to 613,069. Attrition continued to climb, 13.8%. The revenue slip made a consensus miss and so shares edged lower. The execution concerns were macro-related which remains pockmarked by tariffs and geopolitics making enterprises cautious on spend. That said, the UK division enjoyed one of its strongest growth periods (Jaguar Landrover was flagged on the call). CEO K Krithivasan commented that “all the new services grew well” and there was “robust deal closures during this quarter”. Of note, COO Aarthi Subramanian commented on clients increasingly shifting their focus from use case based approach to ROI led scaling of AI – this hints at a deeper transformation adoption. Also on the call:

Concerns were surfaced about the impact of the ‘Big Beautiful Bill’.

TCS has a programme to infuse AgenticAI across the products group, but we sense a more nuanced view on the AgenticAI lifecycle - more of a “coming but still exploratory”.

Not seeing across the board price pressure

The numbers we track: TCS

Source: Company data, Technology Investment Services

AI-RAG

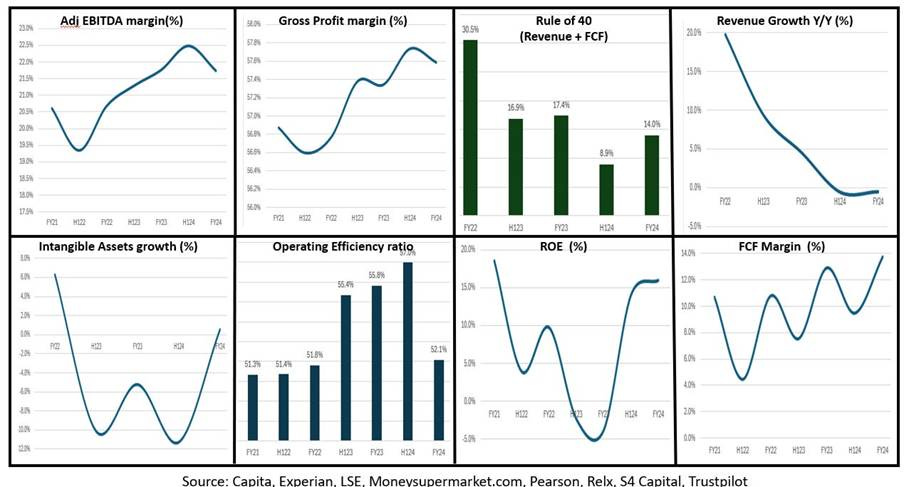

Cohort scenario. GenAI "sometimes writes plausible-sounding but incorrect or nonsensical answers", commonly referred to as ‘hallucinations’. Rather than being ‘one-off’ mistakes, hallucinations are an inherent part of GenAI, because LLMs are designed to know how words relate statistically, not what they mean. LLMs deal in plausibility, not fact. To fix this, corporates use human review, create knowledge bases which define their key concepts, and Retrieval-Augmented Generation (RAG), as they keep the ‘human in the loop’. RAG thinking dates to a 2020 whitepaper by Meta which developed a framework designed to give LLMs access to information beyond their training data. RAG enhances the accuracy and reliability of GenAI LLMs with up-to-date facts and answers and so address the need for trusted data in factual, data-centric decision-making processes. By integrating RAG with AI agents forms "Agentic RAG," which combines retrieval with adaptive decision-making. However AI RAG and Agentic AI are designed for different purposes: RAG to improve the factual accuracy of GenAI outputs, Agentic AI for autonomous decision-making and executing tasks. Our UK AI-RAG cohort is defined by companies which have a deep, long-standing, hard to get customer data, domain, workflow expertise, and they will likely develop products based on both technologies.

AI-RAG cohort: KPI Dashboard

Source: Company data, Technology Investment Services

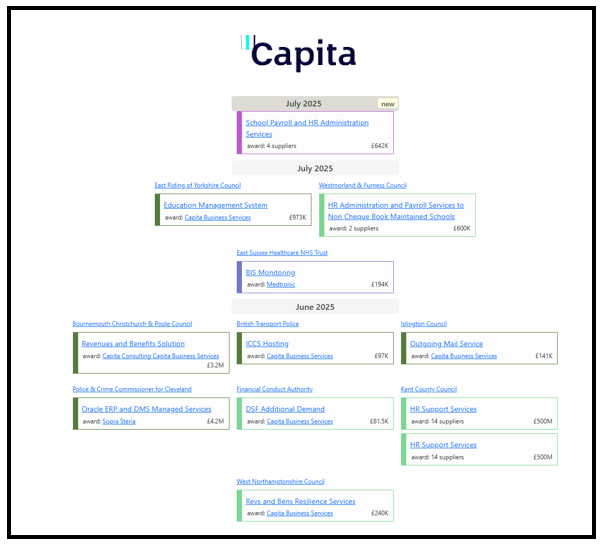

Capita. How do you create a truly differentiated platform with clear long-term staying power? Two requirements are: deep vertical market expertise, and using AgenticAI. Writing in March last year we commented that Capita deserved inclusion in our RAG list because of its deep domain expertise in the UK Public Sector where it is a Strategic Supplier, vast experience in outsourcing giving it domain knowledge of Public sector processes, while the appointment of Adolfo Hernandez put a technologist, and one very familiar with AI technologies, as CEO.

Since then Mr Hernandez has, as expected, pushed a strong technology imprint, with the speedy development and deployment of AI agents in addition to a wider corporate reorganization. More important was to do this while taking the company and customer base on that journey – too often change comes a cropper by culture. The Capgemini/WNS deal signals to the wider investment community of the rationale behind the Capita transformation. Business re-engineering (i.e. code switching) is neither straightforward nor does it move in a straight line – so far so good at Capita.

The ongoing drumbeat (kerplunk) of Public Sector contract wins at Capita

Source: Bidstats, Technology Investment Services

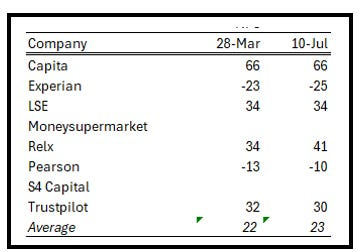

Capita: Leading our AI-RAG cohort customer NPS rates

Desk research 10 July, 2025. Source: Comparably

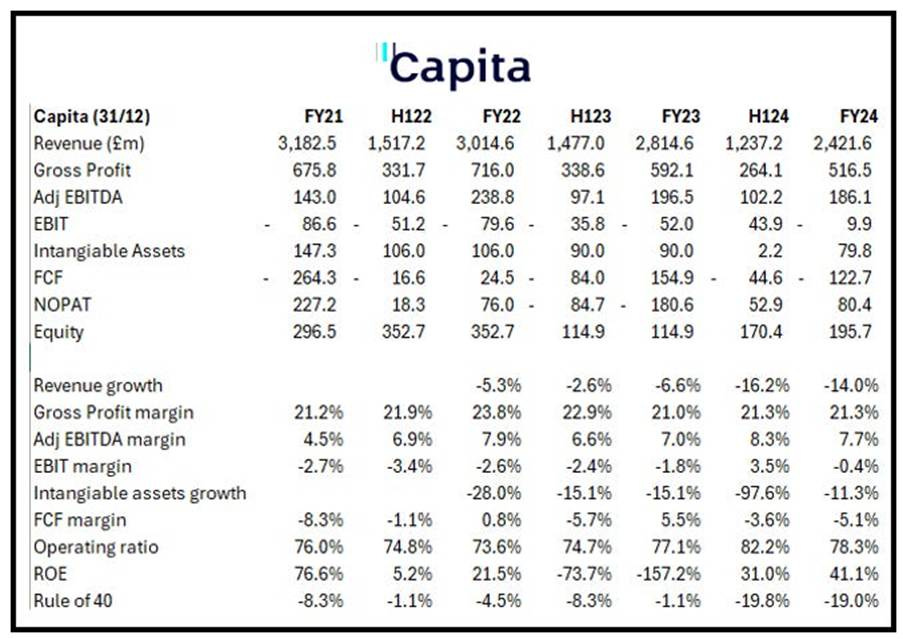

The numbers we track: Capita

Source: Company data, Technology Investment Services

Gaming

Gaming cohort: KPI Dashboard

Source: Company data, Technology Investment Services

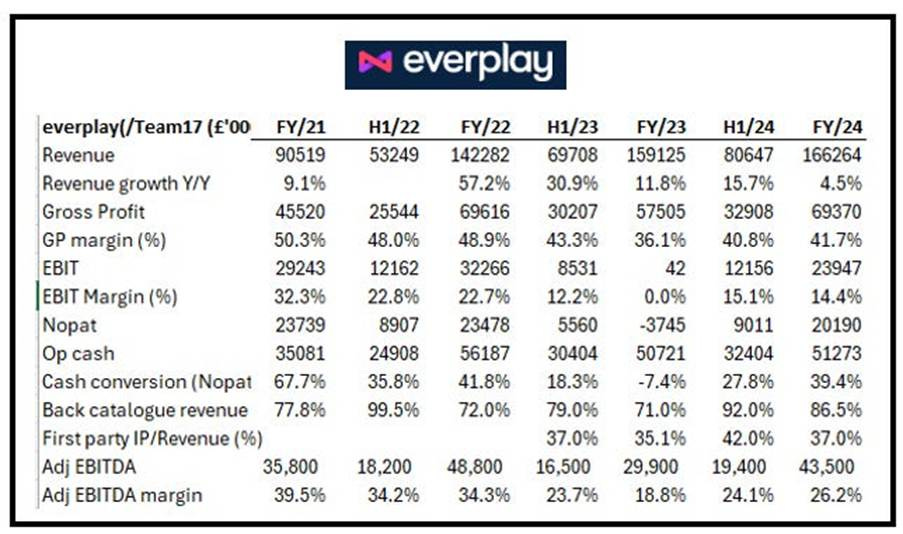

everplay group. A Trading Update says that following the debut of Date Everything!, performance from the back catalogue, and positive momentum the Board expects FY results to be “slightly ahead” of current expectations. Adj EBITDA is, as usual, H2 weighted, due to the timing of new game releases. In addition the Group completed the acquisition of all rights and assets for Hammerwatch, an action-adventure franchise (four existing titles) by Swedish studio Crackshell. The move supports the strategy to expand first-party IP footprint and evergreen franchises and it strengthens back catalogue revenue. The initial cash consideration for Hammerwatch is “less than £8.0m”.

The numbers we track: everplay

Source: Company data, Technology Investment Services

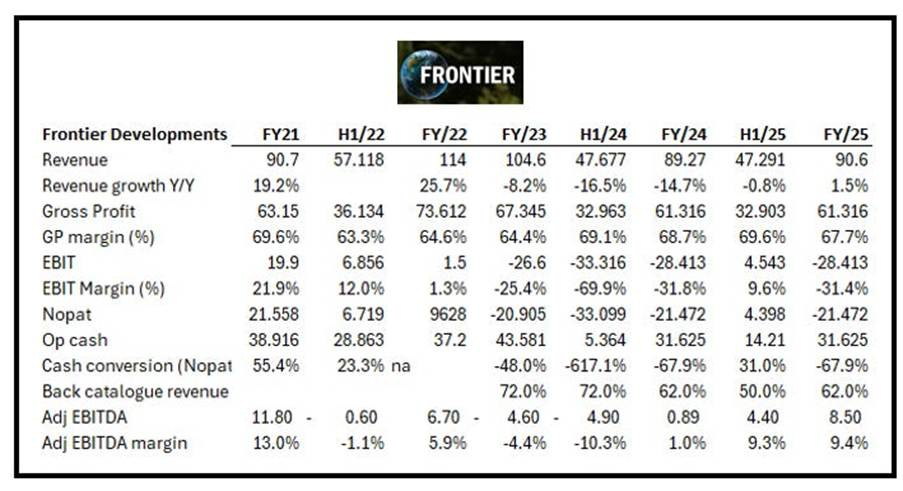

Frontier Developments. Rather than trying to make the most of the crisis (see above), Frontier joins the lazy club. Announces intention to launch a £10m share buyback programme to end 27 June 2026.

The numbers we track: Frontier Developments

Source: Company data, Technology Investment Services

Recruitment

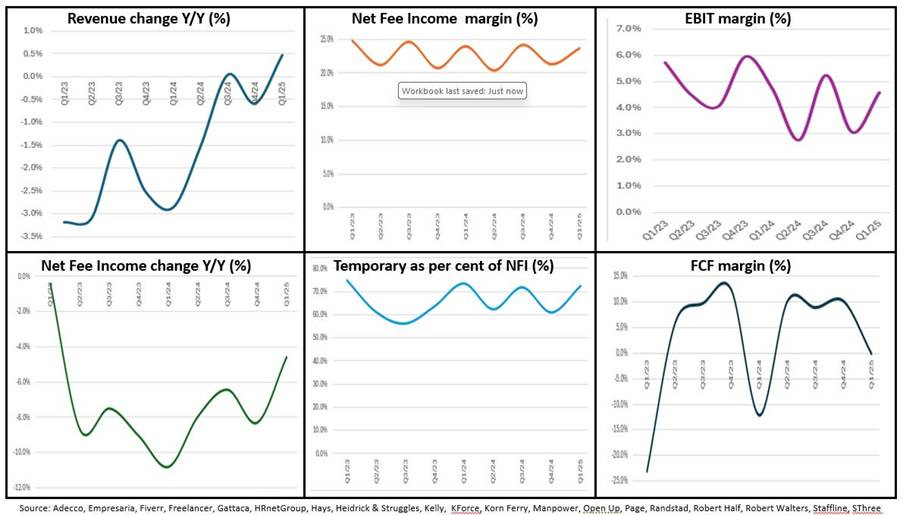

Cohort Scenario: The KPIs have yet to record any widespread improvement. Recruitment (i.e. Staff, i.e People), as much as technology, is the front-end of the tech economy. From our latest results rollcall the strategic messages from the cohort remain downbeat and recovery talk is deferred - but this is not a universal truth - there are pockets of growth (Asia and US) and service innovation. In addition, as companies spent 2023 and 2024 downsizing and re-shaping their offer, they are better able to meet expectations (given their reduced cost bases and doing more contractor sales). As a positive, all agree that there is a digital skills gap which is a barrier to economic growth. Companies also flag the shortage in tech talent, but slow hiring and slow willingness to move employer has created a bottleneck. While a volatile market, the industry is telegraphing that C-suite turnover is consistent with historical levels. We remind that the impact of AI is contributing to the malaise (i.e. more acceptance of blended environments – so for IT development “organizations won’t just have more developers, they’ll have more production ready code generated by AI and more applications built and deployed by agents”). Recruitment remains one of the cheapest cohorts. It usually is at this point of the economic cycle. The lesson from the past is that the pricing here can ‘turn on a penny’ following any economic/MSI data.

Recruitment cohort: KPI Dashboard

Source: Company data, Technology Investment Services

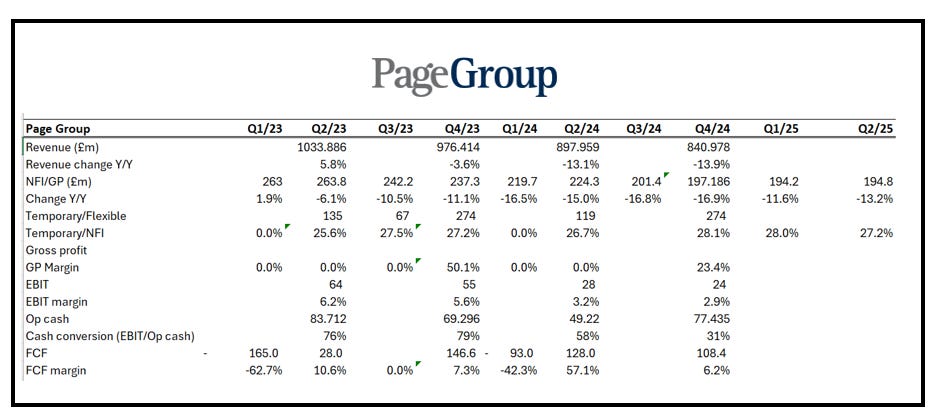

Page Group. No improvement in Europe but positively AsiaPac and the US recorded another growth quarter. Page reiterated FY profit guidance but Q2 saw gross profit fall 10.5% Y/Y to £194.8m as there was continued “subdued levels of client and candidate confidence impacted decision making”. Net cash £10m, down from £54m sequentially and £57m Y/Y. The company is “currently” expecting 2025 EBIT to be broadly in line with current market consensus, c. £22m. The conversion of accepted offers to placements remains the most significant area of challenge, as ongoing macro-economic uncertainty continued to impact confidence, which extended time-to-hire. Of note, salary levels remained strong. Temporary recruitment (-8.2%) continues to outperform permanent (-11.3%) with gross profit from permanent -14.1% Y/Y to £141.9m, with temporary -10.3% Y/Y to £52.9m.

From the regions:

EMEA (53% of Group): Q2 £102.9 gross profit was -17.8% Y/Y with France (13% of Group) -20% and Germany (12% of Group) -21% with a “worsening in market conditions”.

UK (12% of Group): Q2 Gross profit £23.0m, -14.3% Y/Y. The market is “tough but stable

Americas (19% of Group): Q2 gross profit £37.7 -5.7% Y/Y with US +14% Y/Y, Latin America -9% Y/Y with the US having the third consecutive quarter of growth.

Asia Pacific (16% of Group): Q2 Gross Profit £31.2m -3.2% Y/Y with Asia (14% of Group) +4% Y/Y with Mainland China -17% Y/Y, Hong Kong +16%, South East Asia +10%, Japan flat, India +13%, Australia -13% Y/Y . Within this region, 8 out of 12 markets delivered growth.

The numbers we track: PageGroup

Source: Company data, Technology Investment Services

Travel-tech

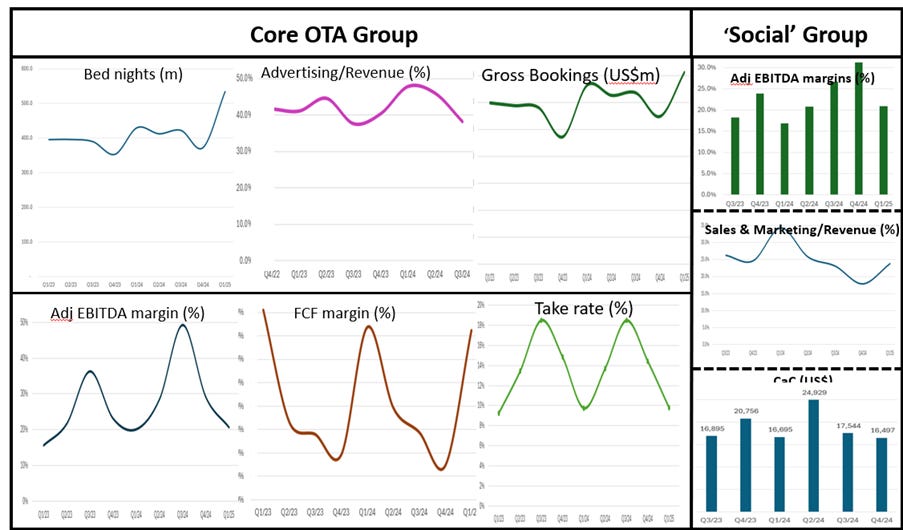

Travel-tech cohort: KPI Dashboard

Source: Company data, Technology Investment Services

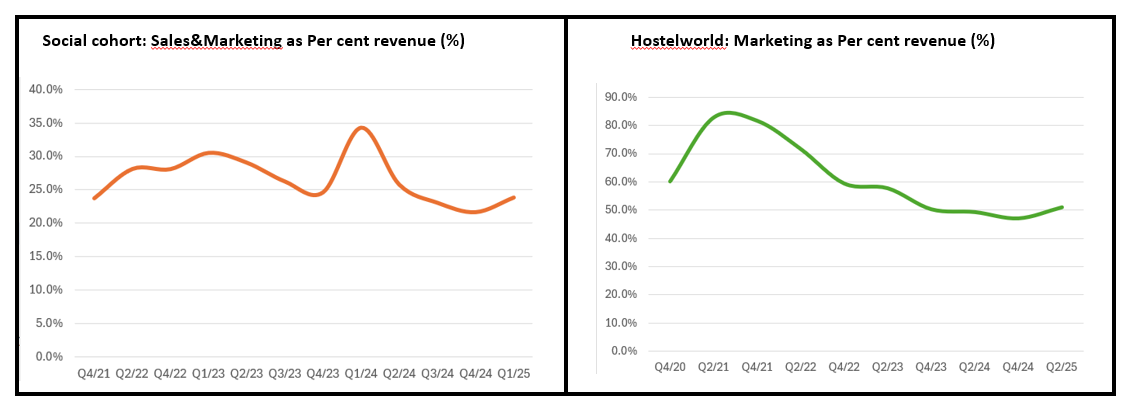

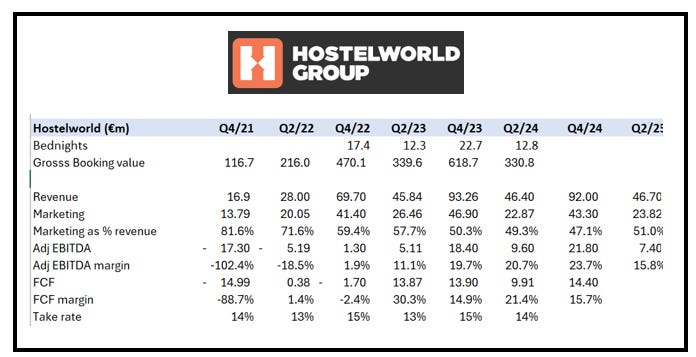

Hostelworld. An H1 trading update ahead of results (30 July) was a curate’s egg. While the company reiterated FY/25 guidance, it admits that trading is mixed and the numbers disappoint: net revenue, €46.7m, flat Y/Y, ditto for net bookings and ABV-1% Y/Y. Direct marketing as a percentage of revenue increased to 51%, 45% Y/Y, due to “cost inflation in the first few months which since moderated”. We are minded to give the company a break - our pathfinding Social cohort had a similar outturn for Q1. Their Sales & Marketing/Revenue increased sequentially to 23.8%, from 21.7% (Q4/24), but still down substantially Y/Y from 34.3% (Q1/24) (Aside: before you ask, social posted 16.7% Y/Y revenue growth in Q1!)

H1/25 adjusted EBITDA €7.4m, down from €9.6m last year. Cash €11.0m and a net cash €6.1m. We are encouraged: Asia continues to grow at record levels and there was good progress with the strategic product initiatives which are leading to improved unit economics, notably:

Bookings via mobile Apps +11% Y/Y. The rollout of Elevate (marketplace monetisation tool) delivered “encouraging early results” with base commissions rising to 15.8% H1/25, 15.2% Y/Y.

Trip Plans (pre-booking feature on the social network) helped to increase the proportion of bookings from Social Members to 85%, 80% Y/Y.

While it “continues to evaluate acquisition opportunities”, Hostelworld reminds of its £5m share buyback programme and pending interim dividend, expected H2/25. Gary Morrison, CEO: “Despite a continuation of the trend for low-cost destinations in H1, we are seeing an improving geographic mix, supported by a pickup in European demand.”

Marketing spend has trended upwards

Source: Company data, Technology Investment Services

The numbers we track: Hostelworld

Source: Company data, Technology Investment Services

Dear reader,

Well done for making it to the end. Don’t forget to subscribe if you haven’t already!

Join me again soon.

Best wishes

George

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.