The uncertainty caused by ‘Liberation Day’ and subsequent policy flip-flopping means that companies will be reluctant to embark on large scale IT projects. All we are certain of now is the promise of continual uncertainty throughout the Trump Presidency. Reporting companies have started to insert tariff-effect commentary - it is negative. IT industry analysts are re-visiting their IT spend estimates - similarly negative moves expected. Tech spending concerns echo those about a broader economic slowdown. Into ‘Liberation Day’ the US economy seemed to be well placed being characterised by growth momentum, low unemployment and good job creation in March. It is difficult to ascertain how much of that is now unpicked. We note commentary from PageGroup Q1 update "Given the recent introduction of tariffs and the resultant market uncertainty, we are not providing forward-looking guidance on business performance."

Latest Tech Universe results span IoT/Smart (Ondo InsurTech, Quartix) Recruitment (Staffline, PageGroup); IT Professional Services (Made Tech); UK Software (Cirata), UK Hardware (Gooch & Housego). Read on. Data insights inform our evolving views on the tech-economy.

Tech in a changing world

We map the long term relationship between IT Spend, GDP, and valuation (FY1 PE is our valuation proxy) in our ‘try-hard’ slide. Over the long term the variables share a general direction, but any numerical relationship breaks down quickly on closer scrutiny. As we think about the relationship we are reminded of the Mark Twain quote; “History doesn't repeat itself but it often rhymes”. On that basis the message in the data is that lower GDP will result in lower IT spend, and lower IT spend means slower sector earnings and with it lower sector valuation.

There is a spoiler. Tech has a countervailing force - the growing demand for AI and related technologies. We are in the midst of a shift of computing architectures to one where AI-based systems have the potential to take action with or without human intervention. As in other tech waves, consumers are early adopters which percolates up to enterprise adoption. However, the current macroeconomic climate coupled with concerns around privacy and regulation may result in a dip in consumer confidence, but so far there is no likely change in enterprise adoption. The read thru to the sector is that macro does not suggest any longer term spring back for valuation, beyond the relief rally and in fairness, the times we are living in may well just encourage investors to look first for the ‘safe haven’ sectors.

History rhymes: IT spend, UK GDP, IT Valuation

Source: World Bank, OECD, IDC, Gartner, Technology Investment Services

UK IT Staff rates: Days increase Y/Y, but this masks sequential decline

Source: ITJobswatch.co.uk, Technology Investment Services

Latest results round-up

IoT/Smart

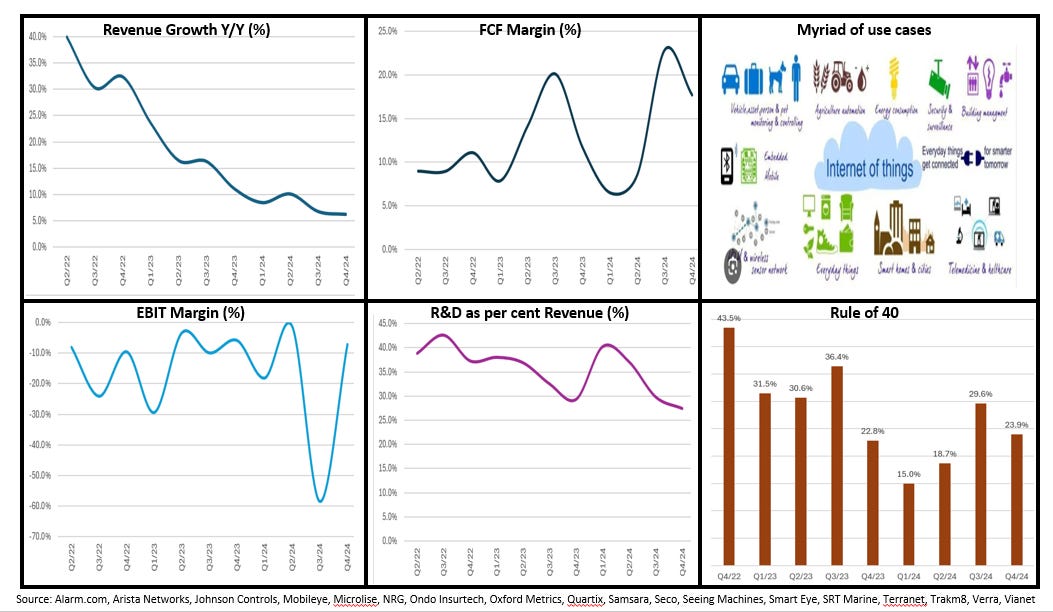

Cohort scenario. The Internet of Things (IoT) industry is substantial and growing rapidly across a number of industries, as use cases expand. The IoT market is projected to grow from US$945.6bn in 2024 to US$1,377.8bn by 2029 as the installed base of IoT connections reaches 20bn this year and 31.5bn by 2030. Central to the development are technologies such as Wi-Fi, Bluetooth, 5G, and Low Power Wide Area (LPWA) networks, and end markets in healthcare, automotive, smart homes, security, and industrial applications. However, the (investor) attention caravan has moved to GenAI and so ignores the many opportunities in this cohort. The companies are at the development stage (so R&D/Revenue is a monitored KPI) as we try to understand the Life Cycle positioning (a typical S-curve for a product based business). While this sacrifices profitability to establish product and customer moats, pleasingly, FCF margins have recovered from the H1/24 decline (see below). The challenge now is to recognise the eventual leaders from the mere market participants. There is lots of shareholder value, and value traps, in the cohort.

Ondo InsurTech. An FY Update (ended 31 March) brings encouraging operational news and an improved cash model, however ambitious revenue aims were missed due to a delayed roll-out in Sweden. The highlights included 59% Y/Y increase in registered customers to c.151k, ARR £5.9m and FY revenue “not less than £3.8m” or +40% Y/Y. Performance was impacted by continuing delays in Sweden. The company is “Trading EBITDA positively on a run rate basis remains on track to be delivered by the year ending 31 March 2026”. Also, the business model has been improved as the company now has a prepaid contract model with upfront cash deposits from customers. This eliminates working capital outflow on new business. That said, cash is £4.0m before the £1.3m loan note repayments due to HomeServe in April 2025 - the outstanding balance is £5.5m. Positively, the US operation is “successfully scaling” and has 34k US customers (+435% Y/Y) with State expansion being driven by LeakBot activations in 23 states, supported by Nationwide's program extension and recent expansions with key U.S. insurance partners, including Mutual of Enumclaw, PURE Insurance, and Selective Insurance. Note the good Customer feedback with NPS+80, with a customer satisfaction rating of 4.93/5.

Craig Foster, CEO: "Despite slower-than-expected contract momentum, we have exceeded our expectations in securing new insurer partnerships over the past twelve months. In the United States of America, we are now contracted with 7 insurers including 3 of the Top Twenty US home insurance companies, giving us access to 5.8m households across 23 states."

Quartix. A trading statement (Q1 cal/25) featured news of a “very good start to the year, with new subscriptions, customer acquisition and growth in ARR showing very strong progress”. Quartix expressed confidence in achieving FY consensus expectations. From the data: ARR +£2.0m during Q1 to £34.2m, +21% Y/Y, with just over £0.9m was derived from new business. NRR increased slightly, but sits shy of 100% at 96.3% in Q1. New customer acquisition was +18% Y/Y to 2,206 new customers. On a TTM basis, the customer base increased 10% Y/Y to 31,040. Andy Walters, Executive Chair: “Notwithstanding any unexpected impact of a potential trade war, we are confident of meeting market expectations for 2025 and look forward to the rest of the year and the future with confidence."

Tariffs. Quartix trades in the USA from an incorporated local subsidiary, Quartix Inc., which imports tracking systems used for new installations from Quartix Ltd in the UK. This hardware supply represents a small element of the Company's business, so tariff costs are expected to be modest at this stage, but further detailed review of this is underway.

The numbers we track: Ondo InsurTech, Quartix

Source: Company data, Technology Investment Services

IoT KPI dashboard

Source: Company data, Technology Investment Services

IT Professional Services

Cohort scenario. The Q3 margin uptick has reversed, but bookings have recovered and revenue growth c5-6% is achievable. The IT Professional Services cohort is slowly emerging from the aftermath of the Covid and immediate post-Covid environment which saw the industry over-hire. Since then, staff attrition dried up impacting profitability. However, more recently attrition has been shuffling upwards, the industry has some pricing power (i.e. inflation clauses) and so revenue growth has been rekindled. In addition, GenAI has given the industry a new secular growth driver and a new twist to Digital Transformation programs. From the KPI dashboard the industry is slowly starting to rehire and re-train existing staff which in the short-term dents utilisation. Shares in the cohort are cheap reflecting the past two difficult years, rather than the dashboard which is starting to telegraph a recovery.

Made Tech. A reassuring trading update from Made Tech. Sales bookings YTD £68.2m are +£26.2m sequentially (H1 FY25: £42.0m) and +89% on FY24, £36.0m. H2 contract wins include the Department for Business and Trade and the Ministry of Justice. Trading “remains strong”, the company is “in line” with FY market expectations and will be free cash flow positive for the year. Not just a story of sales execution but also the right offer. Made Tech was one of LSE-AIM top performing shares in 2024 but has weakened this year in the general market pull back. Rory MacDonald, CEO: " These (Department for Business and Trade and the Ministry of Justice) wins expand our relationships across multiple service lines, demonstrating the Government's confidence in our ability to deliver critical digital solutions and reinforcing our reputation in the market." Following the trading update, investors will see the news that the UK Cabinet Office is to shed 1,200 civil servants, with a further 900 to be transferred, as a positive read for Made Tech. The UK government is seeking to cut more than £110m a year costs by 2028 and sees restructuring, closing down non-essential programmes, better use of AI and technology as the key to delivering public services at reduced cost. We would hope that the UK administration would lean into local suppliers, and the ‘Social Value’ requirement would disadvantage companies (like Accenture) who were quick to roll back on DEI initiatives, but also against companies (Barclays) trying to ‘play both horses’.

Note: 14 April for Kainos FY update

IT Professional Services KPI dashboard

Source: Company data, Technology Investment Services

UK Software

Cohort scenario: These companies are typically smaller than their US counterparts, but all sell and compete globally. In addition to being smaller they typically have poorer KPIs (notably cash-based, ARR, NRR) but have better profitability. The comparative KPI mix may on its own account for the lower valuation and support the view that ‘venue’ has little to do with the valuation. The group is cheaper and pays a dividend/income in addition to share buybacks.

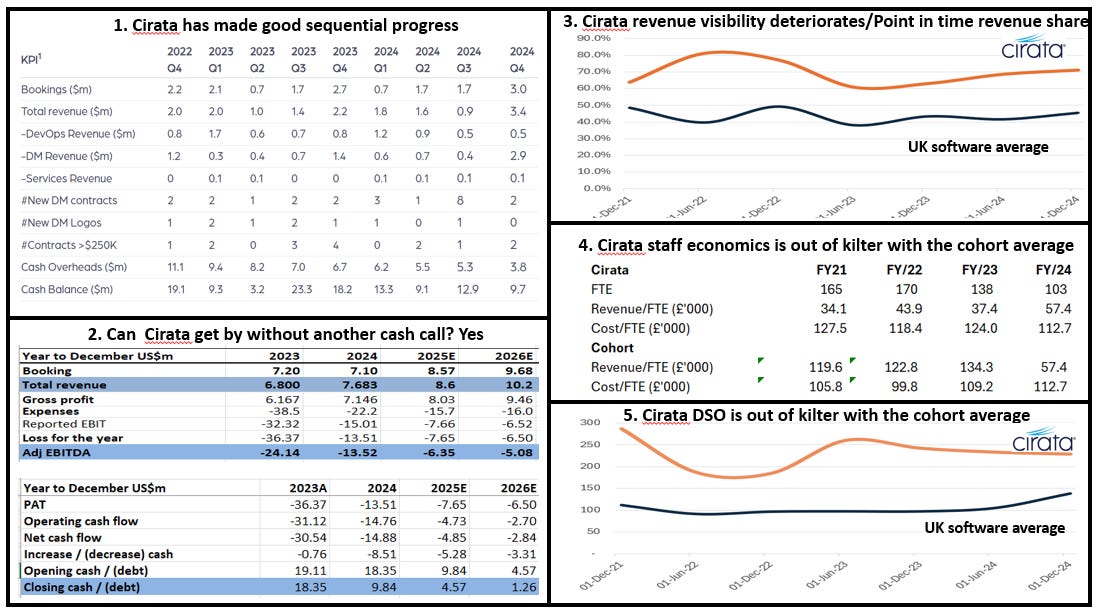

Cirata. Cirata posted the Reports & Accounts in a timely manner and so we could complete the Points to Ponder slide and the data slides (as below). The missing element was the staff economics, other data points are unchanged. Note that the new data points mark a big step in the right direction (i.e. cost/FTE) and we anticipate revenue/FTE moving up again in 2025.

Recap from final results when Cirata guided that momentum in DI would continue in FY25, with Q1 “broadly in line” with management expectations. Cirata will release a Q1 trading update in mid-April.

Cirata: 5 Points to Ponder

Source: Company data, Technology Investment Services

The numbers we track: Cirata

Source: Company data, Technology Investment Services

UK software KPI dashboard

Source: Company data, Technology Investment Services

Recruitment

Cohort Scenario: The KPIs have yet to record any improvement. Recruitment (i.e. Staff, i.e People), as much as technology, is the front-end of the tech economy. From our latest results rollcall the strategic messages from the Recruitment cohort remain downbeat and recovery talk is deferred - but this is not a universal truth - there are pockets of growth and service innovation. In addition, the companies spent 2023 and 2024 downsizing and re-shaping their offer. Now they are better able to meet expectations (given their reduced cost bases and doing more contractor sales). As a positive, all agree that there is a digital skills gap which is a barrier to economic growth. Companies also flag the shortage in tech talent, but slow hiring and slow willingness to move employer has created a bottleneck. While a volatile market, the industry is telegraphing that C-suite turnover is consistent with historical levels. We remind that the impact of AI is contributing to the malaise (i.e. more acceptance of blended environments – so for IT development “organizations won’t just have more developers, they’ll have more production ready code generated by AI and more applications built and deployed by agents”). Our message to investors: Look East, and this week specifically to HRnetGroup. Recruitment remains one of the cheapest cohorts. It usually is at this point of the economic cycle. The lesson from the past is that the pricing here can ‘turn on a penny’ following any economic/MSI data.

Staffline. This was a positive FY print with revenue +14% Y/Y to £992.9m, gross profit +10.3% Y/Y to £70.8m and Adj EBITDA +26% Y/Y to £12.6m. Of note:

Revenue growth was a function of market share gains and the increase in the National Living Wage.

Permanent fees increased 4.7% in Recruitment GB and 38.2% in Recruitment Ireland in contrast to the declining recruitment market.

Net cash significantly ahead of expectations at £9.6m (2023: £3.8m) due to debtor day reduction and tight control of working capital following peak trading during Q4.

Increased volumes came from key food retailers; Tesco, Sainsbury's, Morrisons and Marks & Spencer, combined with increased market share from the logistics sector.

There is a caution on current Trading with the company calling out that the headwinds caused by the proposed increases in employers national insurance rates have reduced business confidence, which has made us cautious about prospects for the year. Contributing to this caution around trading are interest rate levels, which remain higher than originally anticipated. However, the company guides that trading to remain in line with current management expectations for FY 2025. Albert Ellis, CEO, commented: “There is no question that the recruitment market remains challenging”.

PageGroup. The tone at PageGroup was more cautious stating that "given the recent introduction of tariffs and the resultant market uncertainty, we are not providing forward-looking guidance on business performance." Despite this, Q1 performance was judged as ‘in line’ with expectations. Page has instigated a cost reduction programme geared to carving out c£1.5m annual savings. The data points kept up the Y/Y declines with gross profit, £194.2m, -9.2% vs. Q1 2024 (Q4 2024: -13.0%) in c/c due to “continued subdued levels of client and candidate confidence impacted decision making”.

CEO Nicholas Kirk commented that the slower end to Q4 2024 “continued into Q1 2025”, and the “conversion of interviews to accepted offers remained the most significant challenge, as ongoing macro-economic uncertainty continued to impact confidence, which extended time-to-hire”. Also reflecting the uncertain macro-economic conditions, temporary recruitment (-7%) continued to outperform permanent (-10%), as clients sought more flexible options. There were some geographic bright spots in India, an improvement in customer confidence in Germany and improved trading in the US. Note:

America’s gross profit of £37.0m, +3.3% Y/Y. In the US, +7% Y/Y an improvement on the growth of 3% in Q4 2024, with a particularly strong performance in Engineering and Manufacturing. In Latin America, excluding Argentina, gross profit grew 1%. Mexico, the largest country in the region, was flat, an improvement on the 4% decline in Q4. Brazil was up 10%, with strong growth, particularly in temporary recruitment.

UK Q1 gross profit -12.7% Y/Y, in line with Q4 2024. The conversion of interviews to accepted offers remained a significant area of challenge, with ongoing subdued levels of client and candidate confidence impacting decision making and increasing time-to-hire. Temporary recruitment, -11%, outperformed permanent, -14% Y/Y, reflective of market conditions.

Gross profit from permanent recruitment decreased 12.4% reported, 9.9% in constant currencies to £140.4m (Q1 2024: £160.3m). Gross profit from temporary recruitment decreased 10.0% reported rates, 7.1% in constant currencies to £53.8m (Q1 2024: £59.7m). This resulted in the ratio of permanent to temporary recruitment gross profit of 72:28 (Q1 2024: 73:27).

Staffline does well, Page doesn’t. Is this telling us about the People Pyramid and/or the slowdown in the knowledge economy?

Source: Technology Investment Services

The data we track: PageGroup, Staffline

Source: Company data, Technology Investment Services

Recruitment KPI Dashboard

Source: Company data, Technology Investment Services

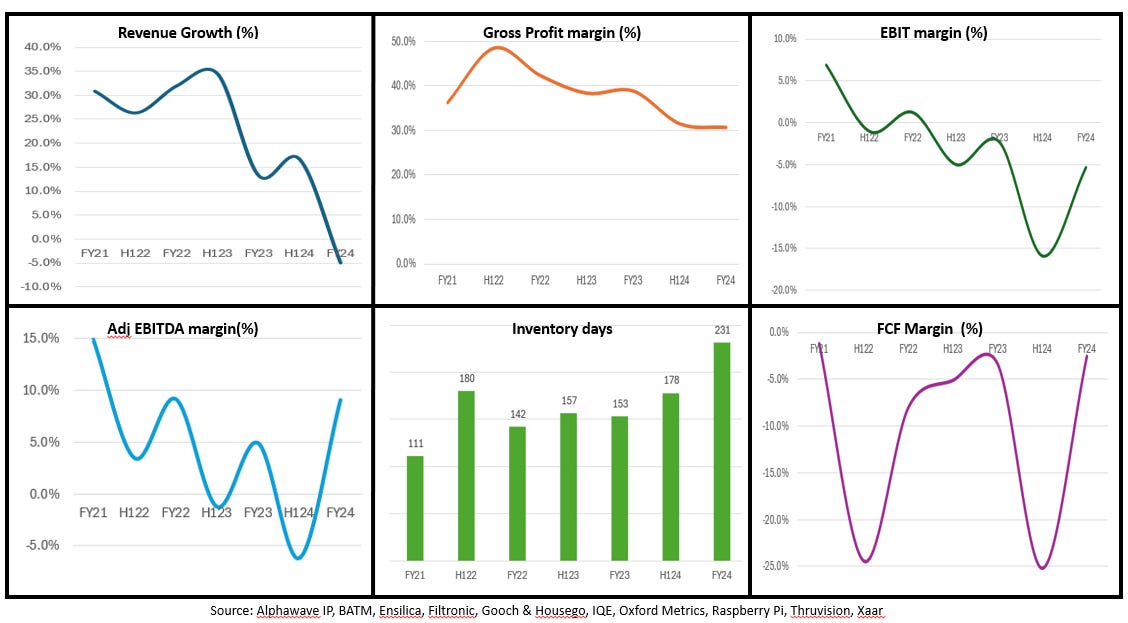

UK Hardware

Gooch & Housego A mixed update (six months ended 31 March) was of the ‘in line’ variety with revenue, £70.8m, was +7.5% Y/Y. This followed “strong” demand from Aerospace & Defence and Life Sciences markets. However, activity levels in the Group's industrial laser and semiconductor markets “remains subdued”.

Tariffs commentary.

Negative but too soon to quantify. The Group is seeking to navigate the rapidly evolving tariff arrangements being implemented by the US administration together with the consequent actual or potential retaliatory actions of other nations. It is too early to be definitive on the net impact to the Group. The Group's direct exposure to those countries that have been subjected to the most significant tariff increases on imports to the US is limited, but it remains vigilant to the more general inflationary impacts of increasing global tariffs and possible indirect effects.

Re-sourcing inputs. H&G is actively re-sourcing supply of certain raw materials required in production processes where availability has been restricted by some nations retaliating against the newly imposed tariffs.

Pass the price on. Intend to pass on cost base increases arising from these developments through higher pricing. Given the Group's considerable US-based manufacturing presence the new tariffs could over time be a benefit to some parts of the business against non-US competitors.

The numbers we track: Gooch & Housego

Source: Company data, Technology Investment Services

UK Hardware KPI Dashboard

Source: Company data, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.