We bid adieu to the London Tech week caravan. The event was not about technology. The event was about people: PM Keir Starmer, Jensen Huang, Eric Schmidt, Adolfo Hernandez, Gary Turner, Steve Vamos, 30,000 attendees from 125 countries. Amongst them possibly some of those 7.5m future programmers that the PM wants. We are reminded of Witch Cakes and wonder: in trying to find our witch (i.e. economic growth) are we just feeding the dogs? Note: UK available jobs fell by 63k since March, the unemployment rate is 4.6%, 4.5% sequentially; the number of available jobs is 736,000, but firms are delaying hiring – a move echoed in the Q3 Manpower Global Employment Survey (see below). There is another story. To wit: ‘Digital skills shortage’ is considered the biggest challenge to AI adoption, hence the PM’s intent. But Jensen Huang argues that programming is no longer a vital skill. As coding is taken over by AI, humans should focus on “more valuable expertise like biology, education, manufacturing, or farming”. The UK risks copying Salem, our witch is different: economic growth, our solution is the same: feeding dogs. The power of an AI nation is not just about creating programmers, but (like Mr Jensen) it is about creating Electrical Engineers, Sales & Marketing and Accounting professionals, and crucially Entrepreneurs and Tech investors - this remains a two-sided marketplace.

Latest Tech Universe results span Data & Analytics (Adobe, GitLab); Games (Frontier Development); UK Software (GB Group, Idox); AI-RAG (Capita); Internet Services (Intuitive Investments, Team Internet); UK Hardware (Alphawave IP, Filtronic, Xaar); IaaS (Oracle). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

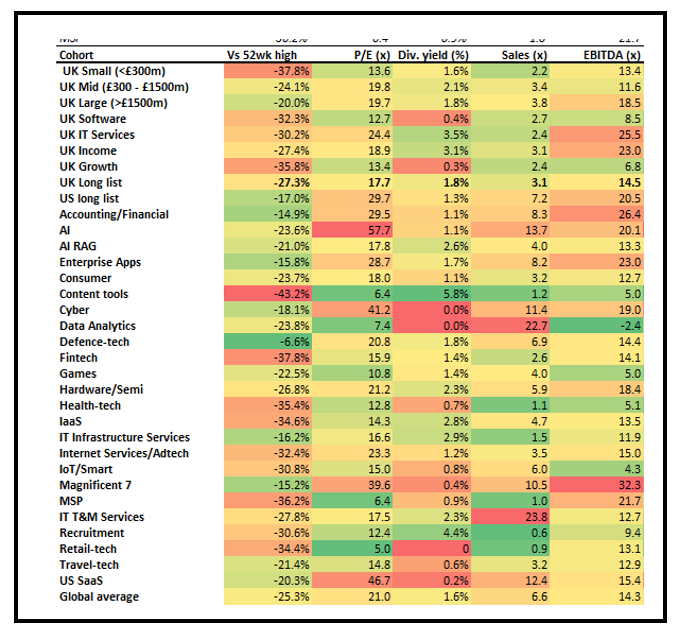

Tech universe: Valuation heatmap

N= 535. Source: Company data, Yahoo Finance, Technology Investment Services

The tech drivers and Points to Ponder

1. London Tech Week – “Perfect for take-off”

London tech week was not about technology it was about people: armies of people. PM Keir Starmer announced AI training for 7.5m people by 2030 (c.20% of the workforce), £1bn for the national computer infrastructure (c.20x current capacity), and £86bn committed to science, innovation and tech. Mr Jensen (playing to the galleries) highlighted the UK’s strengths in research, talent and innovation, depth of our AI ecosystem and signalled interest in investing here.

A report from Tech Nation concluded that the UK tech industry is worth US$1.2tn, and UK startups raised US$7bn+ in H1/2025. More backslapping please. Mr Huang concluded that UK AI ecosystem is “perfect for take-off, it’s just missing one thing”, which he says is having its own AI infrastructure - that would be Nvidia hardware. The announcement package included:

The UK government signed an MoU with NVIDIA to support its ambition to upskill the UK workforce in AI skills over the next 5 years.

A new £187m “TechFirst” programme to help embed AI through the UK education system.

The Spärck AI scholarship programme,

A new government-industry partnership to train those 7.5m UK workers in essential skills to use AI by 2030. This was supported by Google, Microsoft, IBM, SAS, Accenture, Sage, Barclays, BT, Amazon, Intuit, and Salesforce.

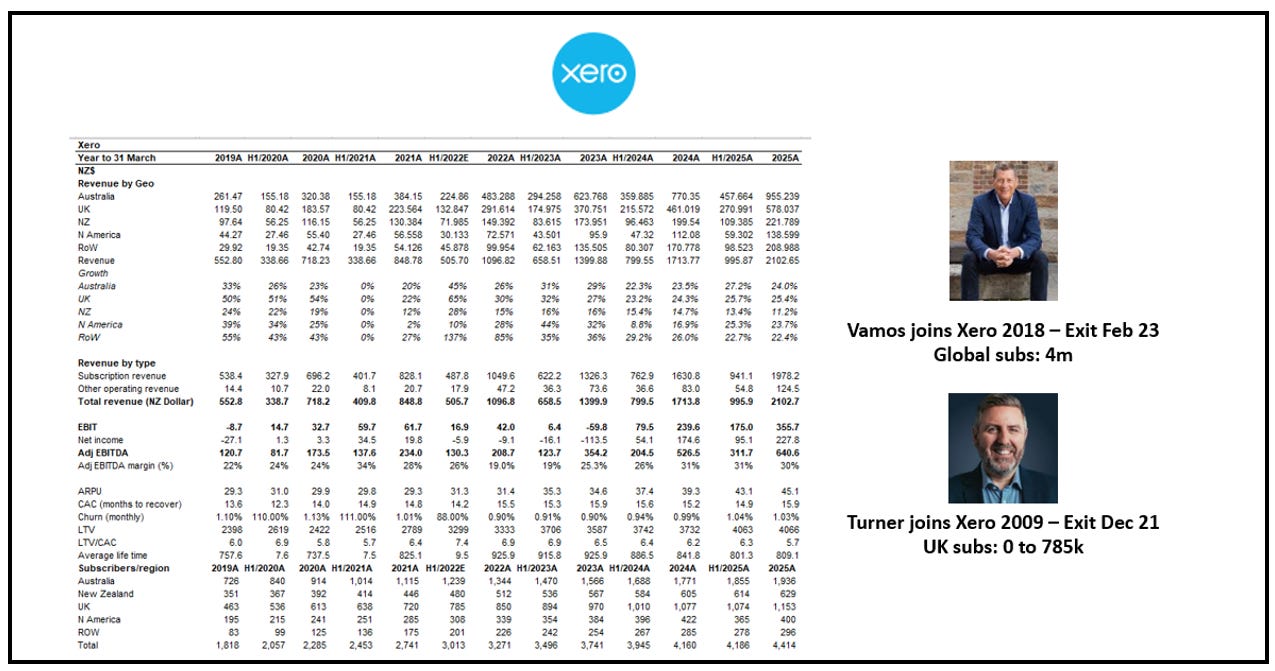

Our pick of the events was Gary Turner in conversation with Steve Vamos. This pair led a halcyon period as Xero became a global tech business out of Wellington, New Zealand (pop: c.200k). Xero is a disruptive cloud accounting platform for business owners. Since launch, the UK (which is where Mr Turner enters the story) has been crucial to a very impressive international growth story. Today, Xero has 4.4m subscribers, 1.2m in the UK. Since IPO in 2007, Xero has grown from a start-up on the public capital markets.

We wanted to know what the secret sauce was. This pair navigated the answer to the vision and clarity of purpose of the founder, Rod Drury. Also mentioned was the ecosystem in NZ and Australia around accounting reporting standards and that customers were willing to move to the cloud. Mr Turner highlighted the right product/right time in the UK with the development of cloud, and that incumbents were slow to innovate.

Frankly, the gentlemen were gracious in their praise of the founder, but we don’t buy the argument. Very, very few people have created a global technology success from startup, and a startup in the other side of the world. With an IPO in 2007, fewer still have done it year in/year out on a consistent basis. Worse, as Xero results gapped when the pair left, history has only served to enshrine their amazing reputations. At the very least, investors in Xero (and across our Accounting & Financials cohort) would do well to read Steve Vamos’ book – maybe it will give more insights: ‘Through Shifts and Shocks’. In addition, the continually busy Mr Turner keeps a substack.

Standing room only (You had to be in the room when it happened)

Source: me

The numbers we track: Xero

Source: Company data, Technology Investment Services

2. Manpower Employment Survey

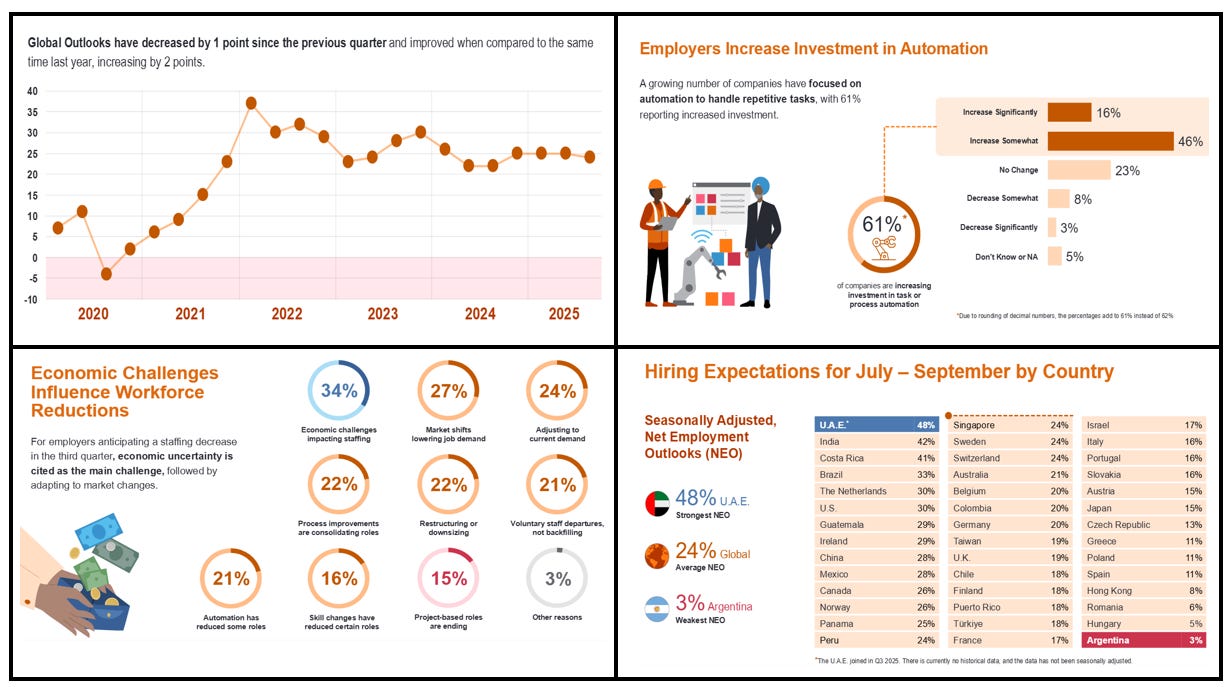

The week saw the latest Manpower Employment survey. The Q3 Net Employment Outlook was 24% down from 25% sequentially (up two points Y/Y). Employers who anticipate a staffing decrease in Q3 cite ‘economic uncertainty’ as the main challenge. Second placed was ‘adapting to market changes’. Employers in the Asia Pacific (29%) region have the strongest hiring intentions, followed by the Americas (27%), and Europe and the Middle East (19%). That said, the North, Central, and South America hiring intention weakened by 7 points sequentially. Note also:

With an Outlook score of 36%, IT companies reported the brightest outlook, remaining relatively stable (+1p) when compared to the previous quarter and improving since the same time last year (+7p).

Does the macro matter? Yes, because global trade uncertainty is shaping hiring decisions for 90% of companies, with Communication Services & IT employers most concerned. In addition, with a growing number of companies focusing on automation to handle repetitive tasks (61% reporting increased investment,) it is hardly a surprise to learn that 76% of employers expect automation to bring the biggest changes to IT and data-focused roles over the next five years.

21% say that Automation (i.e. AI) has reduced some roles.

Manpower Q3 Employment Survey: Pick of the slides

Source: Manpower, Technology Investment Services

3. The UK Government Spending Review 2025

For some reason this was long awaited, but the conclusions were as expected – a broad positive for suppliers. The review set out departmental budgets for day‑to‑day spending until 2028‑29 and for capital investment until 2029‑30. Departmental spending soaks up £648bn in 2025/26 and reaches £717bn in 2028/29. Departmental budgets will grow by 2.3% in real terms as capital funding increases by 1.2%. in real terms.

The winners are health, defence and Digital Transformation. The losers are transport and official development assistance. Shares of the impacted were largely unmoved on the day – however UK cost of capital remains high – reminding us that higher (cost of capital) for longer means lower (valuation) for longer.

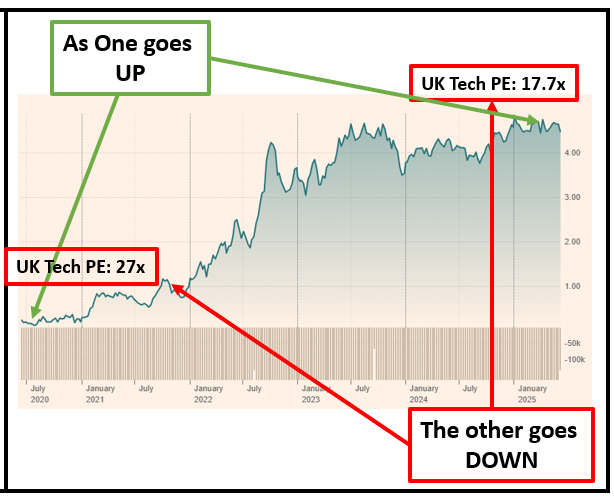

Trade-off: UK 10-year gilts vs tech sector valuation

Source: Hat Tip FT, Technology Investment Services

4. AIM is 30

AIM is celebrating this week. It has its 30th birthday. AIM has been an amazing success over the years and this week was topped with Rosebank Industries Plc completing the largest ever AIM placing. It raised £1.14bn to fund its acquisition of US-based Electrical Components International (ECI). We understand that the ‘Books’ were formally covered in under four hours (POV: books would likely have covered in advance).

With the celebrations this week, in the background there is the on-going saga of de-equitisation:

Qualcomm and Alphawave IP announced a recommended acquisition. Under the terms each Alphawave shareholder gets US$2.48 cash (183p)/share, a 96% premium to the undisturbed price.

WSP Global, WSP UK and Ricardo plc announced a recommended final cash acquisition. Ricardo shareholders get 430p cash in a deal where the acquisition price is a 28% premium to the undisturbed price.

GB Group announced that it intends to move from AIM to the Main Market. The Board believes this proposed move will further enhance GBG's reputation with larger and more global customers in-line with its strategy to move into new geographies. It will increase GBG's access to a broader pool of capital from domestic and overseas investors.

That said, GlobalData announced that ICG Europe Fund IX GP S.a.r.l. confirmed that it does not intend to make an offer for GlobalData. In the wake of the news, shares were off 12% as the market tried to re-price back to the undisturbed price.

Latest Results review

AI-RAG

AI-RAG cohort: KPI Dashboard

Source: Company data: Technology Investment Services

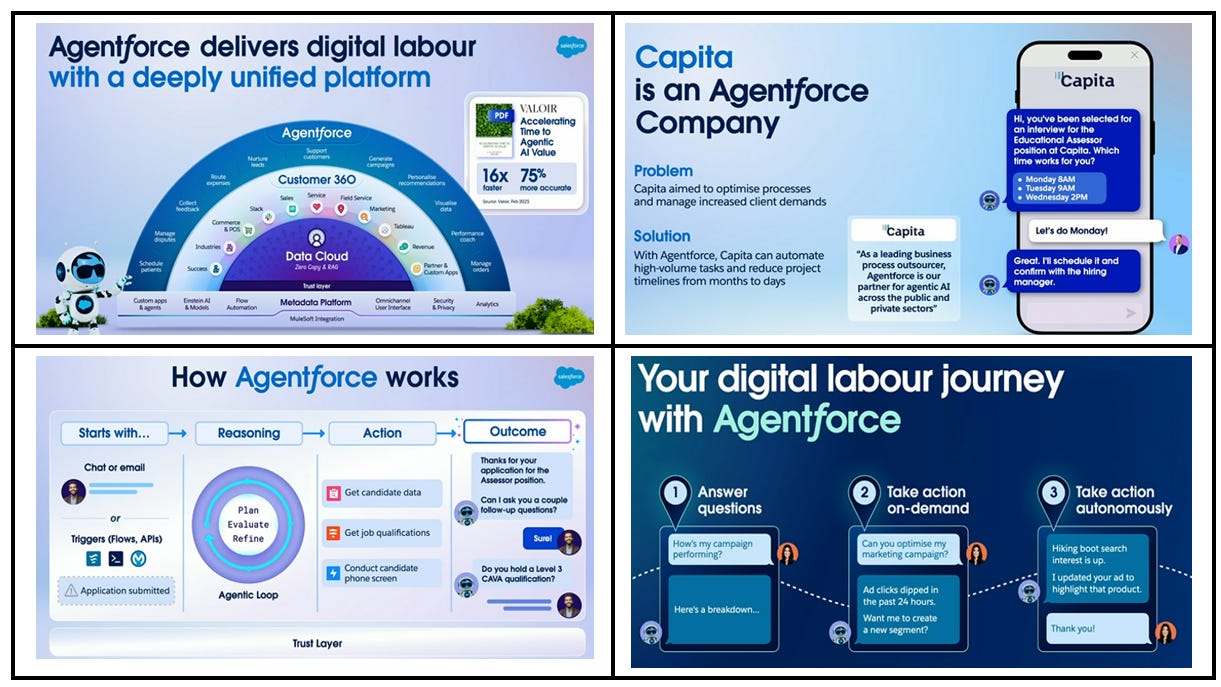

Capita. Salesforce UK/IRL CEO Zahra Bahrololoumi CBE hosted the Salesforce Agentforce live event coinciding with London Tech Week. The event was all about becoming an Agentforce company. Agentforce is the Salesforce agenticAI platform that enables users to build, customise, and deploy autonomous AI agents. It has the potential to revolutionise customer service as the agenticAI agents plan and automate complex tasks, make informed decisions, and integrate with existing workflows. Less than a year old, we learned that 19k organisations use Agentforce with some very impressive ROI data – such as a US$50m saving on 850k customer conversations with 85% resolved with Agentforce. Salesforce has 200 Agentforce industry use cases (for context: Adobe’s AI platform has an agentic layer with 10 agents) and these are already unlocking digital labour and so freeing workers from the repetitive drudgery to concentrate on more fulfilling complex tasks. Ms Bahrololoumi live demo’d some Capita use cases showing a very efficient processing, use of intelligent agents and all in, a great customer experience. These were around hiring use cases. However the big reveal was that she then welcomed Capita CEO Adolfo Hernandez to the podium.

Mr Hernandez talked about the Agentforce deployment at Capita. Culturally, Mr Hernandez explained there was a fear of using AI agents in Capita, but staff now understand the notion of the ‘human in the loop’. The organisation better appreciates that humans are better at variety, complexity, better at escalation and have better ethical considerations. Mr Hernandez urges all to “grab the AI opportunity with both hands”. As Capita customers are Government and regulated industries, establishing ‘trust’ has been fundamental to success and AI roll-out has been helped because “Agentforce is grounded by data and this is the guardrails”.

Capita sees the potential for improved Citizen services and with it better productivity. In this, Mr Hernandez echoed the aims of the UK PM earlier in the week. Capita is in lockstep with Salesforce, but more crucially with the UK Government as well. Mr Hernandez concluded the “gloom is overdone” – if only the message could penetrate the investor community.

Pick from decks at Agentforce

Source: Salesforce: Technology Investment Services

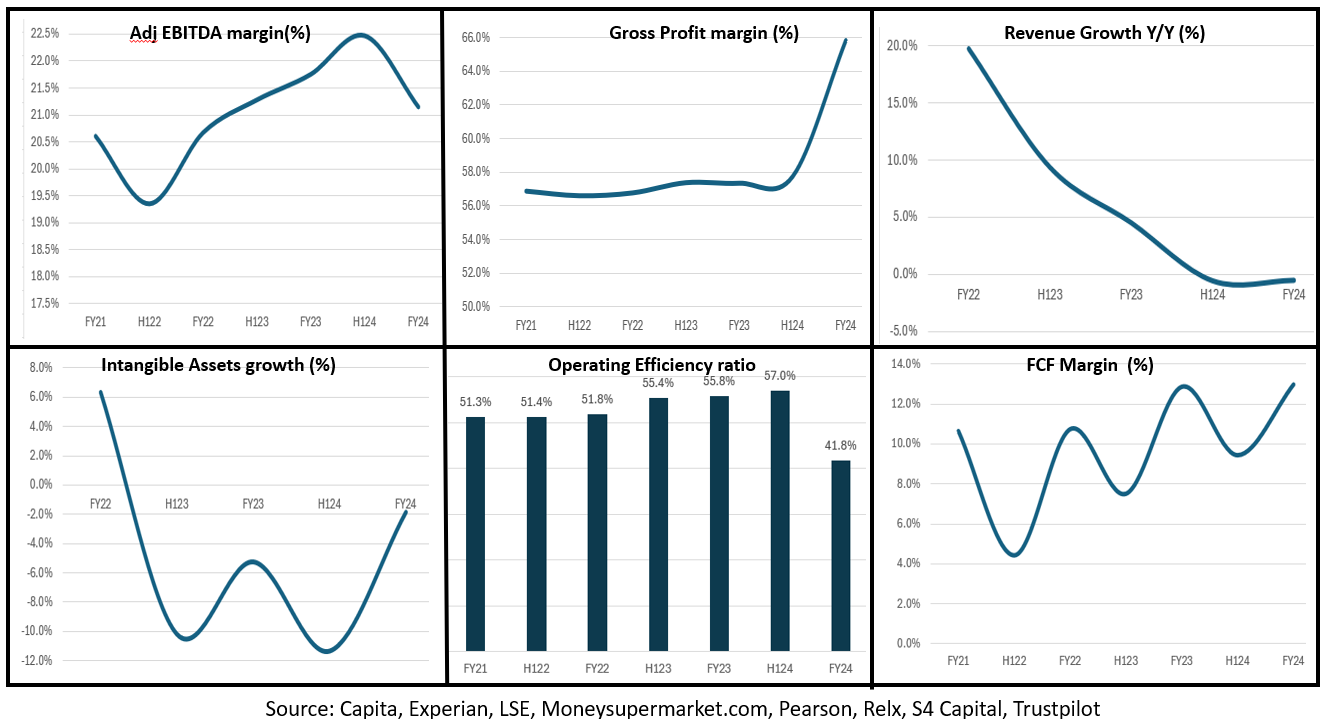

Backstory: Capita

Our AI-RAG companies are defined by having deep domain expertise, hard to get data, and are seeing in GenAI a tool to deliver superior outcomes (for customers, shareholders and their financial models). Like Capita, the other AI-RAG companies (say Relx or Trustpilot) are tech adjacencies. Capita is to pivot from BPO to BPS and in that he must change the company architecture. While acknowledging that Capita is not a technology company, the tools to change Capita have a strong technology bias. Mr Hernandez believes in the ‘human in the loop’ theory which tells us that he is opting for the AI co-pilot/side-kick more than AI as human replacement.

There is much people-change with exits/new entrants and training with data academies, AI apprenticeship and collaborative use case sharing. This is “not optional” and Mr Hernandez admits that staff have moved from initial denial through curiosity and now wider use. NPS has grown strongly during his tenure.

The current UK Government Labour party reforms present a large upside opportunity for Capita both in terms of the shape of government services, supplier bias and the importance that the UK administration ascribes to the role of AI in delivering Government Services. We concur with Mr Hernandez that Capita needs to “get smaller and get fitter to grow, and also get clearer”. ‘Restructuring’ always takes longer than expected, and does not necessarily end up at the first expected destination. But properly crafted and executed it should give shareholders a double whammy of better-than-expected earnings stream and a re-rating.

Aside: Nerd-corner. Capita is pivoting to Business Process Services (BPS) from its heritage in Business Process Outsourcing (BPO). These are not the same thing: BPS extends the ‘classic’ outsourcing service to include process improvement, technology implementation and managing business functions. The move will see Capita being more involved with ongoing management and process redesign (automation) and so will have a stronger ‘tech’ imprint. The migration sees Capita over time competing more with Accenture, Capgemini and Genpact rather than (BPO) vendor Serco and ADP.

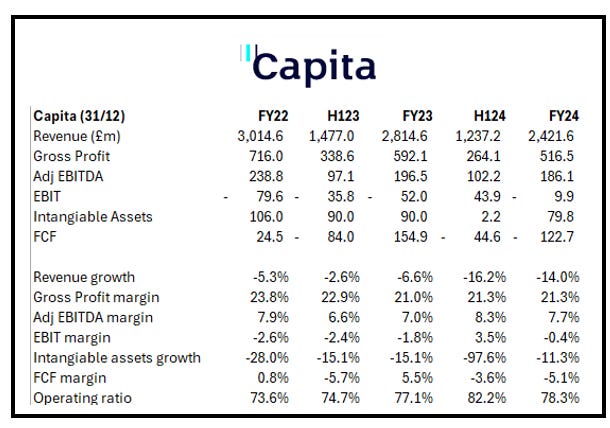

The numbers we track: Capita

Source: Company data, Technology Investment Services

UK Hardware

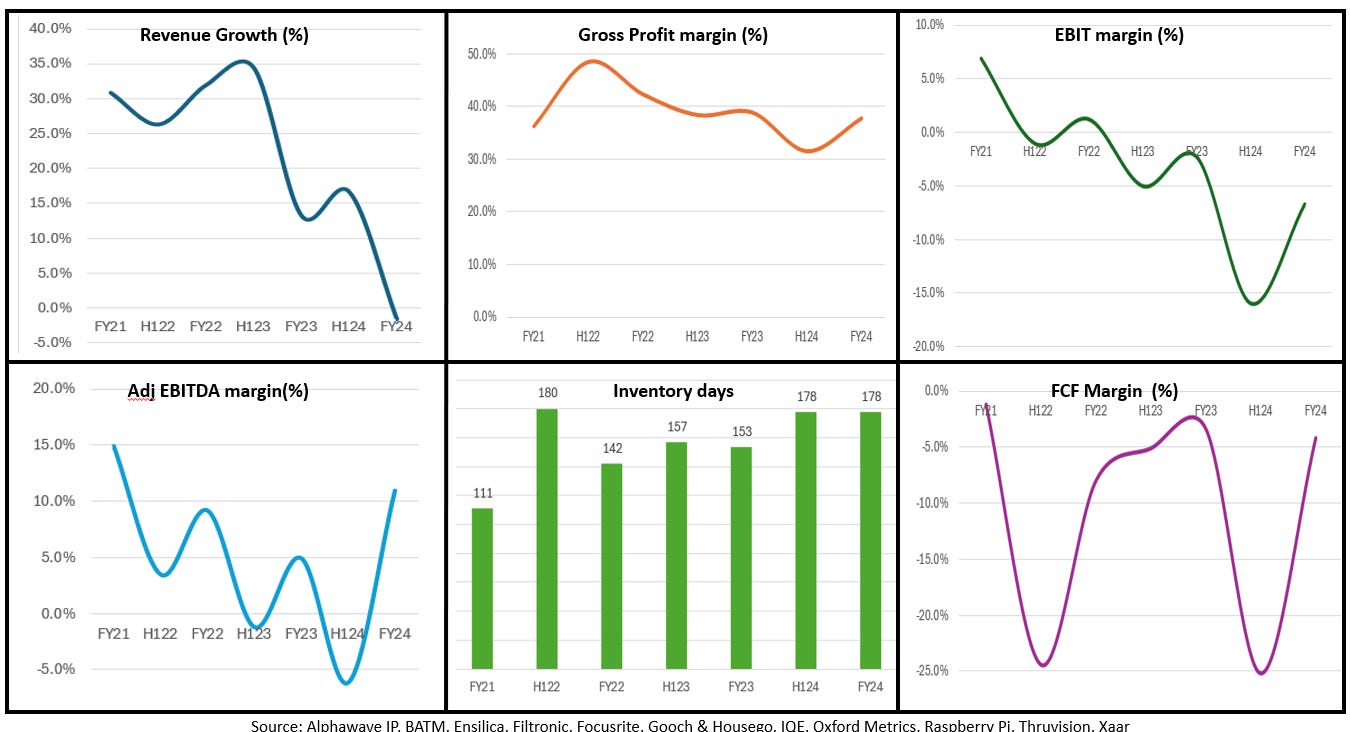

UK Hardware cohort: KPI Dashboard

Source: Company data: Technology Investment Services

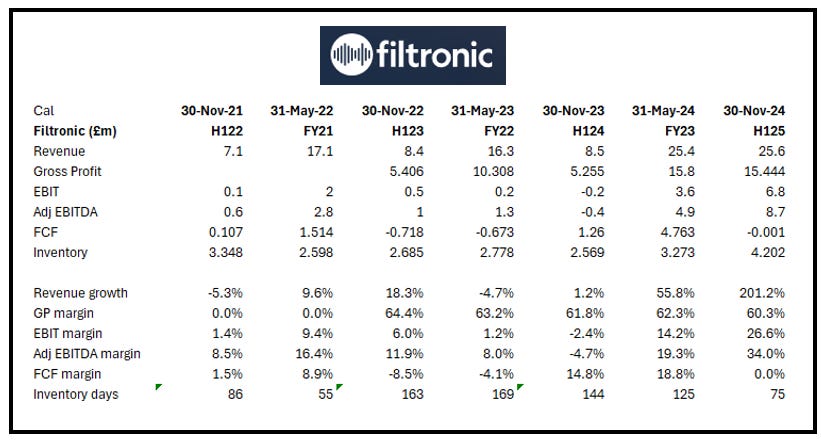

Filtronic – it just gets better. Filtronic announced its largest contract award to date with SpaceX. This was a follow-on order for its E-band Cerus 32 Solid State Power Amplifier (‘SSPA’). This is the largest in value to date, worth US$32.5m (£24.0m), and is expected “to be materially fulfilled” in FY2026. This contract pretty much matches revenue in FY24. Unsurprisingly, the Board signalled that it will exceed current revenue expectations for FY2026. CEO Nat Edington: "We are delighted to have secured our largest order to date with SpaceX, reinforcing Filtronic's growing reputation for delivering high-performance RF solutions to the high-growth space market."

The numbers we track: Filtronic

Source: Company data, Technology Investment Services

Xaar. Xaar shares, +71.1% YTD, are the top performing share among our UK tech selection (n = 72) which is -3.6% YTD. Xaar is the best illustration of the revival in UK smaller company shares which has been happening since April. Don’t worry, you have not missed the boat - the share remain on a pedestrian valuation (a discount to the sector). Investor enthusiasm is due to the company moat, strengthening GTM and execution on global TAM - all despite the ongoing policy ‘flip flops’ which have heightened uncertainty. Xaar’s latest partnership with Sokan New Materials strengthens its position in the EV battery coatings market in a deal which marks; (i) a further endorsement of Xaar’s printhead technology, and (ii) is another sign of the structural shift from traditional film coating methods. Xaar’s precision inkjet technology uses high viscosity inks, which are thicker and permeate less into surfaces, consequently OEMs see improved print consistency, uniformity and lower cost while using fewer precious environmental resources. Xaar has contracts with an array of OEMs and partners are starting to debut new products. While some of the KPIs urge caution for the immediate term, there are positive signs that this market is braced to ‘unclog’. Shares, currently trade on just 1.4x EV/Sales, vs Sector 3.1x. The re-rating is long overdue.

Read our coverage in Progressive Equity Research

UK Software

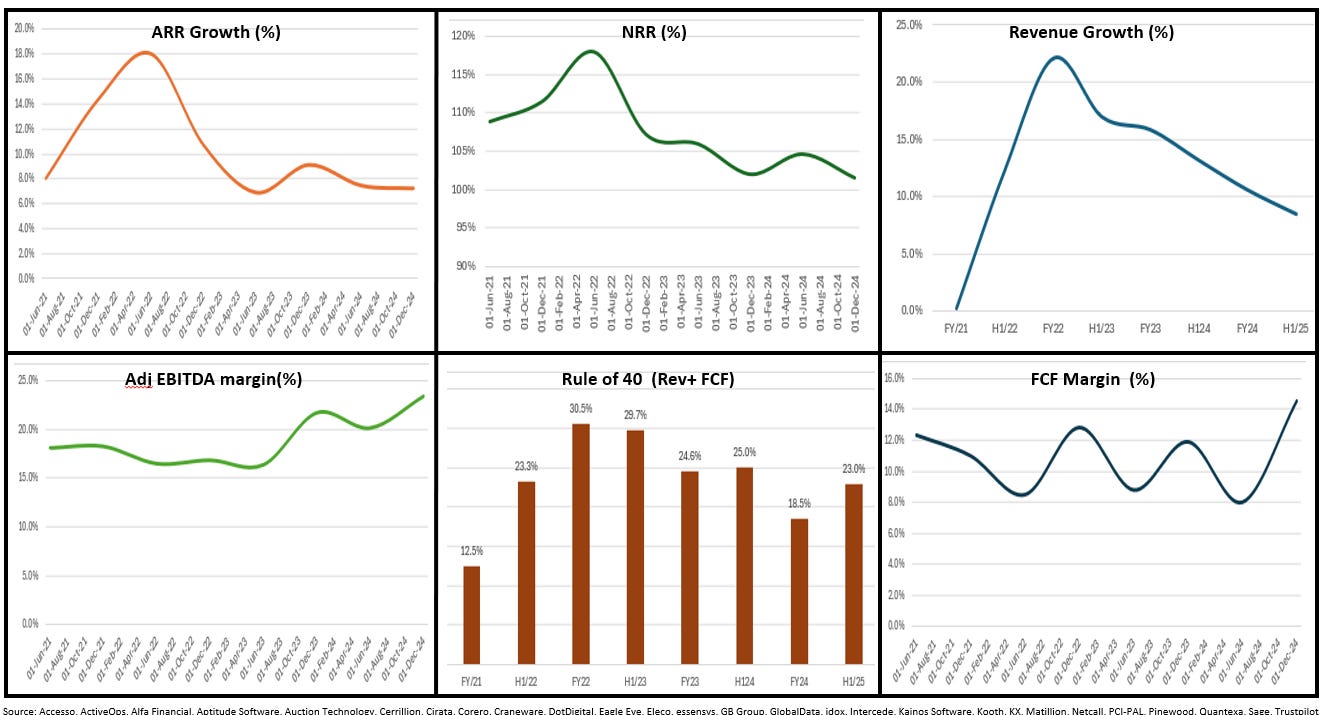

UIK Software cohort: KPI Dashboard

Source: Company data: Technology Investment Services

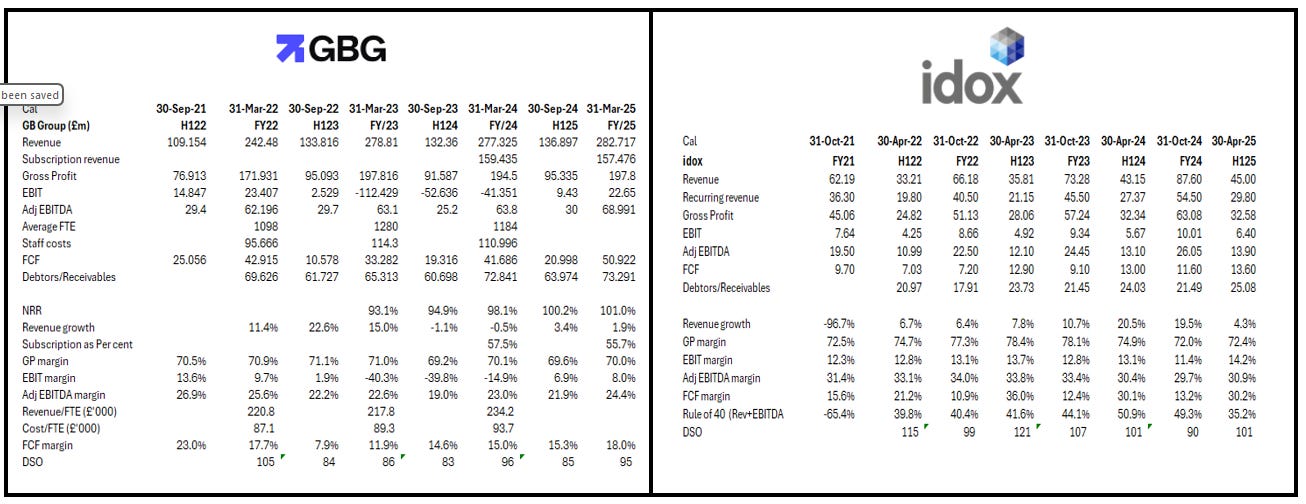

GB Group. We like this sure-footed new CEO, Dev Dhiman, who is working hard to clarify the prior messy business. CFO David Ward earned his stripes at Aveva. For the first time in years GB Group has a C-suite who know global growth. Importantly Mr Dhiman has, with GBG Go (unifies the identity capabilities onto a single platform) finally harnessed the three disparate divisions into a coherent whole. This has long felt right. Yet turnarounds are pockmarked by the ‘stuff’ that doesn’t always move in a straight (upwards) line. So it was with finals. The data file (below) shows the twin irks;

H2 revenue growth and

the NRR, where weakness became more important than an in-line print and the reiteration of FY26 guidance.

The share price was hit hard, being -9% on the day. Longer term investors have a nice buying opportunity.

Finals were in line with the trading update published on 24 April 2025, in fairness estimates were trimmed then. Commenting, Dev Dhiman, CEO, stated: "In today's rapidly evolving digital world, where billions of online interactions happen every day, trust and security have never been more critical. It was an important year in GBG's evolution, aligning our global organisation behind a new purpose, enabling safe and rewarding digital lives for genuine people, everywhere. A mission that is fundamental to the future of commerce and human connection in an increasingly interconnected world”.

FY revenue £282.7m +1.9% Y/Y (not enough given the compare), Operating profit £22.7m reversed the £41.4m loss last year, so too Net debt at £48.5m down from £80.9m last year. Revenue growth driven by Identity, up 3.1%, and Location, up 6.2%.

The operating segments

Identity (56% of Group's revenues). Revenue £159.0m +3.1% Y/Y. Growth drivers in EMEA and APAC as a result of improved levels of NRR, driven by cross-sell and up-sell to existing customers of capabilities such as international data and multi-bureau solution with Americas performance “broadly flat” where the company is building out account management teams to improve retention (NRR improved by 670bps to 98.2%).

Location (30% of Group's revenues) - Revenue £85.6m +6.2% Y/Y. Growth drivers include strengthening NRR. Partner channel momentum continued with GTM strengthened with partner agreements with Microsoft, Dell, and FedEx choosing to transform their location intelligence capabilities with GBG.

Fraud (14% of Group's revenues) - Revenue £38.1m -4.0% Y/Y. The company called out timing differences in software licence renewals in Southeast Asia and EMEA inH1 with “modest growth” in H2. However new logo and related professional services activity was “relatively slower reflecting extended sales cycles”. Annualised recurring revenue (ARR) was up 5.0%, benefitting from strong retention and expansion of our largely financial services customer base, which this year included institutions such as Grupo Galicia, ING Group, Maybank Indonesia, Bank Danamon and the Bank of Queensland.

New standalone segment: Global Fraud Solutions. The fraud prevention software business will be a separate segment from FY26. Global Fraud Solutions is 8% of Group revenue. This mostly operates in emerging markets. There are value creation options which includes expansion of its target addressable market and the opportunity to simplify the product and technology stack. The UK-focused Identity investigation solutions will be reported within the Identity segment.

Idox. A typically positive H1 punctuated by a record H1 order intake, £58.7m, +9% Y/Y. There are now 100+ FTEs in Pune with “further ongoing recruitment to support growth ambition”. As he re-iterated FY guidance, CEO David Meaden commented that following the acquisition of Plianz (strengthened existing Health and Social Care offer) the “M&A pipeline remains healthy, and we remain confident of adding to our existing portfolio of specialist software and geospatial data solutions to deliver further profitable growth”.

Numbers featured: 4% Y/Y revenue growth, 6% Adj EBITDA growth, operating cash £19.6m, and net cash £0.2m. operationally the company sees “strong demand” from existing customers and sees opportunities that “extend our product and service footprint with our customers”.

Follow the commentary from colleague Ian Robertson at Progressive Equity Research

The numbers we track: GB Group, idox

Source: Company data, Technology Investment Services

Gaming

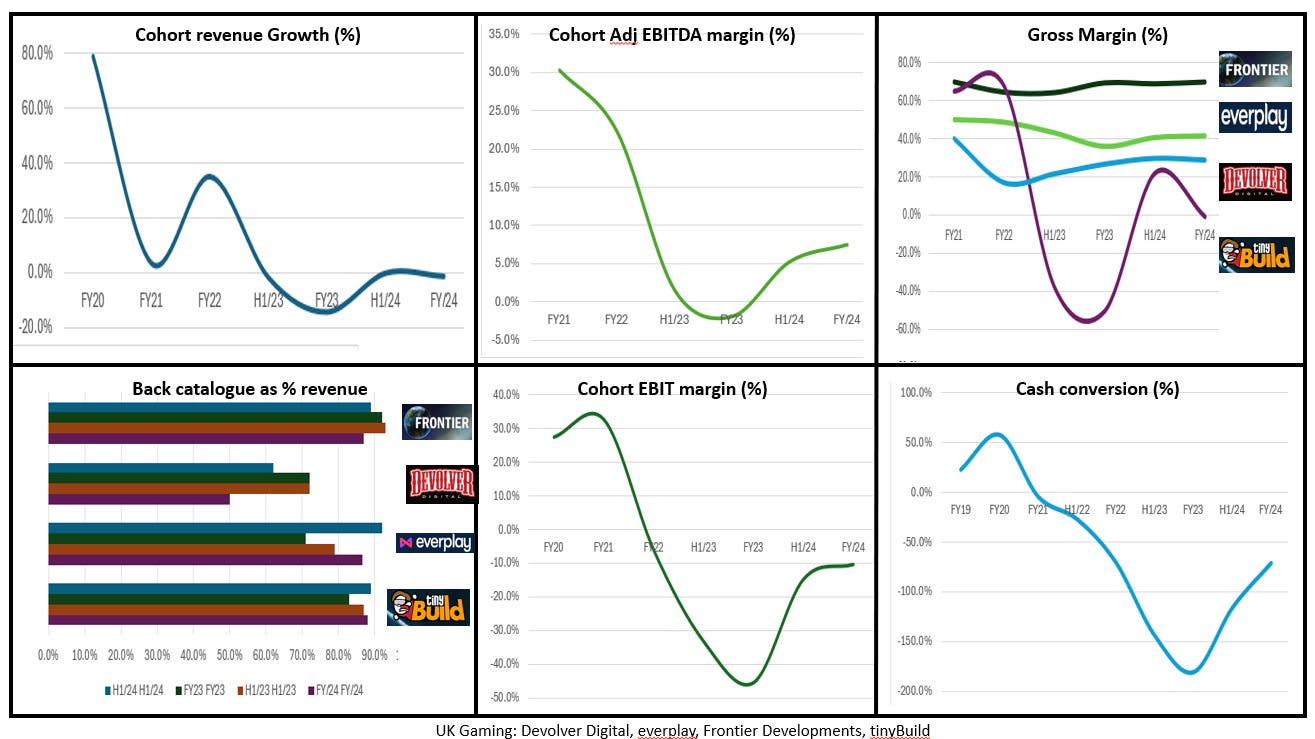

UK Gaming cohort: KPI Dashboard

Source: Company data: Technology Investment Services

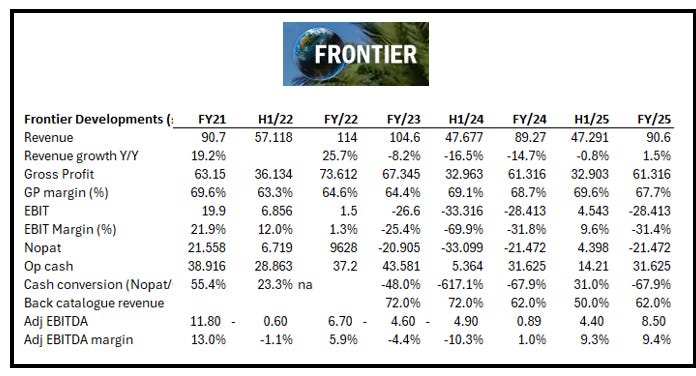

Frontier Developments. Although still patchy (i.e. Sony's first-party Bend Studio has undergone a round of layoffs following the cancellation of ‘a live service concept’) the operating results in the gaming sector continue to budge positively. Frontier Developments trading Update (FY ended 31 May) featured news that revenue increased to £90.6m, £89.3m last year. Revenue from Frontier's Creative Management Simulation games growing 25% year-on-year. Profitability grew significantly, with Adj EBITDA expected to be in the range of £8 - £9m from £0.9m last year. Cash grew by £13.0m to £42.5m (£29.5m last year). It announced a share buyback of up to £10m.

Jonny Watts, Frontier's CEO, said that the new financial year begins with “renewed confidence, a portfolio of games that continues to deliver, and an exciting roadmap of future games and content. Our next big release will be Jurassic World Evolution 3, where we intend to delight players with brand new creative tools and highly sought-after breeding and juvenile dinosaurs."

The numbers we track: Frontier Developments

Source: Company data, Technology Investment Services

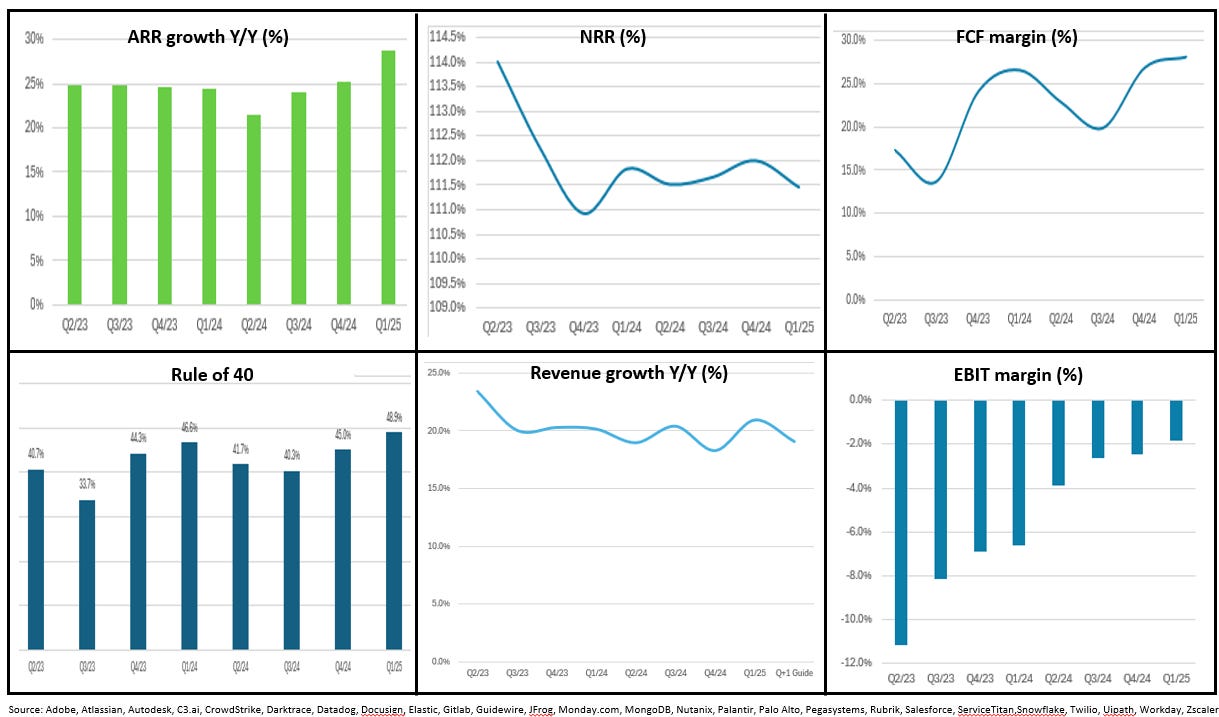

Data & Analytics

Data Analytics cohort: KPI dashboard

Source: Company data: Technology Investment Services

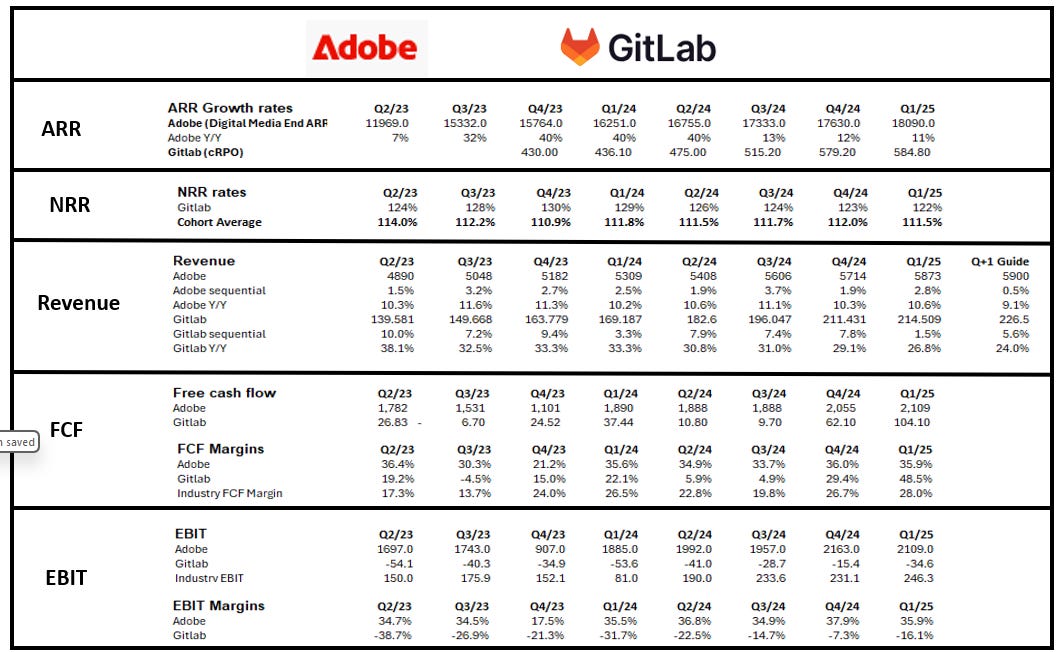

Adobe. A ‘beat and raise’ quarter with record revenue and raises FY25 revenue and EPS Targets. Chair and CEO Shantanu Narayen commented that “Adobe’s AI innovation is transforming industries enabling individuals and enterprises to achieve unprecedented levels of creativity.” Q2 revenue, US$5.87bn, +11% Y/Y, GAAP operating income US$2.11bn, and RPO exiting the quarter was US$19.69bn, +10% Y/Y with cRPO (67% of total) also growing 10% Y/Y. Operating cash flow was a Q2 record at US$2.19bn. From the segments Digital Media segment revenue +11% Y/Y to US$4.35bn, as ARR exiting Q2 was US$18.09bn +12.1% Y/Y. Digital Experience revenue was US$1.46bn +10% Y/Y.

GitLab. ‘Tech stack’ decisions for the AI world are being chosen now across the enterprise software world. These will have long term implications, hence the product insertion rate becomes important at this juncture of the cycle. GitLab has not disappointed with the debut of GitLab 18 its AI-native DevSecOps platform. Q1 revenue, US$214.5m was +27% Y/Y. In the mix Subscriptions, self-managed and SaaS (91% of total revenue) revenue was +28.6% Y/Y to US$194.5m. Development costs pushed (GAAP) operating margin to - 16% with the (non-GAAP) -this disappointed as it was lower-than-expected. Operating cash US$106.3m reversed the US$63.2m outflow from the previous quarter driving FCF to US$104.1m from US$62.1m. NRR 122% and RPO was +40% Y/Y to US$955.1m with current RPO +34% Y/Y to US$584.8m. CEO Bill Staples, “As AI transforms development practices, our unified platform enables organizations to integrate these capabilities within a framework that helps maintain enterprise controls and deliver the required scalability and security.” Shares were down due to a combination of the ongoing macro backdrop, competitive sphere and guidance (FY guidance, US$936 - $942m, matched the lower end of consensus, US$936.51m).

The numbers we track: Adobe, GitLab

Source: Company data, Technology Investment Services

Internet Services

Team Internet Group. A sparkling contract with Team Internet-led JV winning a 10-year contract to operate Colombia's .co domain. With more than 3m active registrations, .co is one of the world's most prominent and trusted country-code domain extensions as the domain of choice for startups, creators, and enterprises seeking a short, brandable, and credible online identity.

Colombia's Ministry of Information and Communications Technology awarded Team Internet, in partnership with Colombian domain registrar CCI REG, a 10-year contract to manage and operate Colombia's country code top-level domain, .co. This will be executed by Equipo PuntoCo, a newly formed JV between Team Internet and CCI REG where Equipo PuntoCo retains 8% of gross revenues from .co domain registrations and renewals for its registry services.

CEO Michael Riedl commented that winning the .co mandate was “a milestone moment for Team Internet strengthening the company position as a global leader in domain infrastructure”.

Intuitive Investments. IIG’s interims, as expected, focus on the continued development of its most significant and 100%-owned investment, Hui10. Chair Sir Nigel Rudd comments that Hui10 has ‘a proven model and technology, national-scale partnerships and milestones that support the rollout’ in H2 and beyond. The update recaps that the well-regarded Giles Willits is now CEO (from March 2025) and overseeing the next phase of IIG’s development. Former deputy chairman of the London Stock Exchange, Richard Kilsby, has also joined as NED. The Hui10 opportunity is substantial: a TAM of 1.1bn Chinese adults gives Hui10 a dramatic scale-up opportunity to grow revenue, earnings and cash very quickly through digitising the Chinese lottery user experience. With this, IIG shareholders have a substantial opportunity from the asset-light, cash-generative Hui10 business. We see a significant valuation opportunity, with an intrinsic value for Hui10 of 969p

Read our coverage in Progressive Equity Research

IaaS

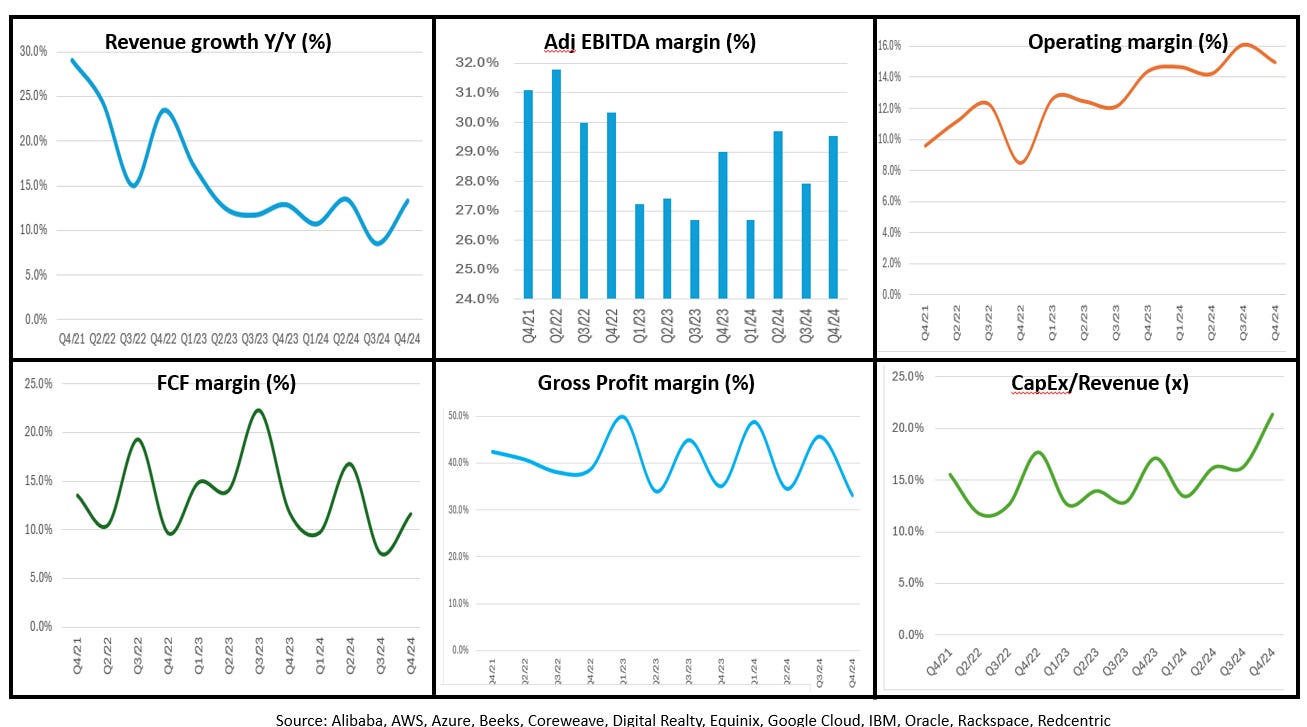

IaaS Cohort: KPI Dashboard

Source: Company data: Technology Investment Services

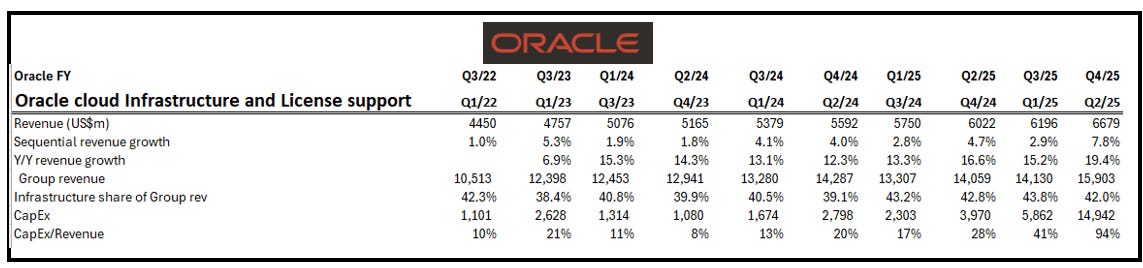

Oracle. Capex remains the big debate in the IaaS cohort. Q4 revenues +11% Y/Y to US$15.9bn with Cloud services and license support revenues +14% Y/Y to US$11.7bn, Cloud license and on-premise license revenues +9% Y/Y to US$2.0bn. CEO, Safra Catz comment that total cloud growth (applications and infrastructure) “will increase from 24% in FY25 to over 40% in FY26” with Cloud Infrastructure growth to “increase from 50% in FY25 to over 70% in FY26”. “MultiCloud database revenue from Amazon, Google and Azure grew 115% from Q3 to Q4,” said Chair and CTO, Larry Ellison. “We currently have 23 MultiCloud datacenters live with 47 more being built over the next 12 months. We expect triple-digit MultiCloud revenue growth to continue in FY26”. Note from the data file (below) that capex is soaring to reflect the company’s growth ambition. Reflecting the bullish guidance, shares surged c.8% in premarket.

The numbers we track: Oracle

Source: Company data, Technology Investment Services

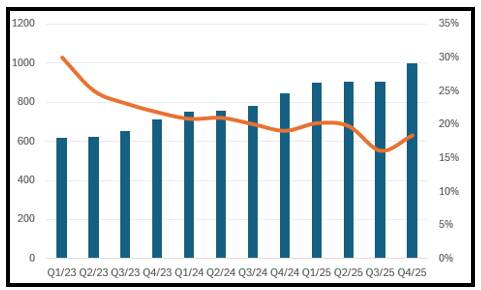

Note: Oracle - more precisely Netsuite is also a member of the Accounting & Financial cohort. Results continued its impressive growth run.

Oracle Netsuite revenue (US$m) and Y/Y growth (%)

Source: Company data, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.