The long and the short of IT

"Better to stand and fight. If you run, you will only die tired."

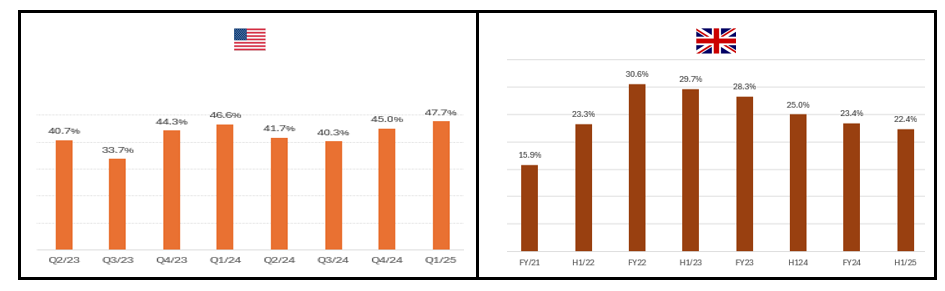

Harald Gormsson was King of Denmark c. 958 – c. 986. A famous builder. He brought Christianity to Denmark. But it was his nickname, Bluetooth, which endures. That technology unites devices as Harald Bluetooth united the tribes. Today Danes, and everyone else, obsess with the macro. It is a worry. Yet quarterly results tell a tale of resilient performance across our 24 technology cohorts. There is no shortage of debate points, line of sight on multiple ‘S’ curves. But why be a hostage to fortune? Why stay and fight? Companies do not need to be outliers and so they couch guidance, as they unveil strong results. To wit: US data analytics reported Rule of 40 is now 47.7%. The companies expect 19% revenue growth in Q2, down from 21% a fortnight ago, as they just reported 21.2% Y/Y growth, the compare is the 20.2% Y/Y growth this time last year. This cannot endure. At some stage the market will wake up to the apparent contradiction. Bear with.

Latest Tech Universe results span Data & Analytics (Crowdstrike, Docusign, Elastic, Guidewire, MongoDB, Nutanix, ServiceTitan, Uipath, Zscaler); IoT/Smart (Samsara, Terranet); Games (tinyBuild); UK Software (Eleco; FD Technologies); MSP (Maintel); Accounting & Finance (TeamSystem); Internet Services (S4Capital); UK Hardware (Gooch & Housego); Travel-Tech (Weibo); Defence-tech (Cohort). We had an IPO (Sundae Bar). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

The tech drivers and Points to Ponder

1. Reporting rules – when Less is less

Dear fellow investors, it is important to get into the detail of our companies. UK listing rules were last changed (29 July 2024) with the aim of simplifying the listing process. Now (3 June) the Financial Reporting Council published the ‘UK Stewardship Code 2026’. Effective 1 January 2026, this aims to “foster long-term sustainable value creation and improve engagement quality between market participants”. We appreciate that reporting can often discriminate against smaller companies. Simply put, larger companies are better resourced to fill out paperwork. However less information can mean less transparency for investors and so be off-putting. We hope that regulators appreciate that markets are two-sided affairs (buyers and sellers) and be good to both constituencies.

Key features include:

Enhanced Definition of Stewardship: Focuses on creating long-term sustainable value for clients and beneficiaries.

Reduced Reporting Burden: Streamlined principles and reporting prompts aim to reduce reporting volume by 20-30%, eliminating ‘box-ticking’ approaches.

Flexible Reporting Structure: Signatories can submit separate Policy and Context Disclosures, and Activities and Outcomes Reports or combine them into a single document. The Policy and Context Disclosure will only need to be submitted once every four years (as opposed to annually as originally proposed in the consultation).

Targeted Principles: Dedicated principles for asset owners, asset managers, and for the first time, specific principles for proxy advisors, investment consultants, and engagement service providers.

New Guidance: Optional guidance offers tips and examples for effective implementation. This is especially for non-equity asset classes.

The transition year, 2026, sees current signatories adapt to the new Code without the risk of removal from the signatory list.

2. US exceptionalism - a different lens

There is much debate about dwindling US exceptionalism . . . Below we show Rule of 40 US and UK. Readers can form their own views. The data speaks for itself.

US and Them: Rule of 40* performance over time

*Revenue growth and FCF margin: Source: Company data, technology Investment Services

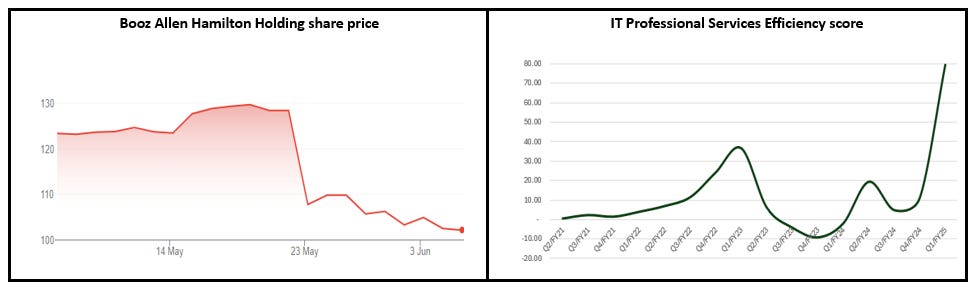

3. T&M from Booze Allen

Amongst the debate points that punctuated this week was the falling Booz Allen Hamilton share price. Shares are spooked by sell-side commentary about the underlying business model (T&M, has been so for eons, I didn’t know it was a secret). Sell-side analysts see challenges with the people-based business models (i.e. Time and Materials) in the AI age. We were more interested in the topic as we heard a comment by Sir Martin Sorrell (S4 Capital – below) at his AGM. Sir Martin said that S4 Capital was on the move from “purely, time-based approach to one more based on outputs - i.e. use of assets”.

This (outcome-based pricing) has been somewhat of a holy grail for the (Time & Materials) industry. The rub is that buyers are reluctant (have been for eons) to move pricing models as they appreciate that the ruse would see them pay more. Given poor rates of delivery on fixed time/fixed price contracts, in truth, some in the industry also appreciate the challenges. Yet this is a story that will ‘run and run’.

The data tells us that while headcount is linked to revenue, the efficiency model is currently working in the industry’s favour (see below) and is at a multi-year high. In addition, with industry utilisation and attrition moving positively for the suppliers, there is scope for further profit improvements in the IT Professional Services in the quarters ahead. Improving numbers will cauterise the debate, for now.

A boozy Efficiency score in IT Professional Services

Source: Yahoo Finance, Company data, Technology Investment Services

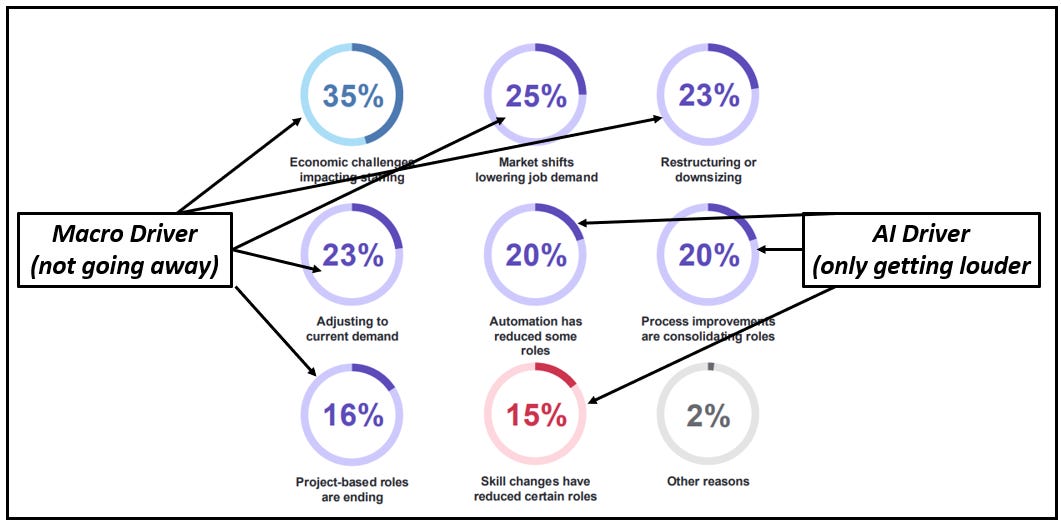

4. Hiring still a mixed backdrop

Re-visiting the latest Manpower Employment Survey we note that the drivers on hiring seem to split into two groups: macro and AI. Macro is an on-going concern still pregnant through reporting season, and AI is addressing efficiency.

Disappointingly, as we look into the next period of Recruiter cohort reporting, there is little here to suggest that guidance improves.

Reasons for delaying hiring

Source: Manpower Employment Survey, Technology Investment Services

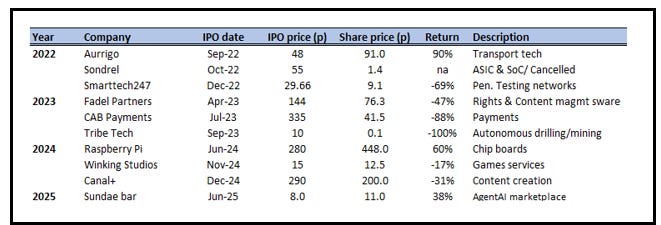

5. A London IPO

Rare as hen’s teeth. . . A two-sided marketplace for software developers and buyers of AI Agents, Sundae Bar Plc IPO’d on AIM this week (SBAR, Mkt Cap c£33m). The company was formed from two Aquis companies; Kondor AI who bought Ora Technology PLC in an all share offer. Ora developed the infrastructure to support secure transactions, compliance and AI agents management as Kondor developed the sundae bar platform, an AI marketplace. As part of its move to AIM, Sundae Bar raised £2.0m.

IPO share price - When the bell stops pealing

Priced Pre-open 6 May. Source: Company data, Yahoo Finance, Technology Investment Services

6. UK Government Spending review - how about some light reading?

We pass the time awaiting the findings of the forthcoming UK Government Spending Review by flicking through the ‘State of digital government review’ published by the Secretary of State for Science, Innovation and Technology.

This tells us that the UK public sector spends over £26bn annually on digital technology, employs a workforce of nearly 100,000 digital and data professionals, and delivers “millions of online transactions” every day. Millions of people across the country rely on digital services from their local authority, their hospital, their school and all parts of the public sector to help them in their daily lives. But “successes are too often achieved despite the system rather than because of it”.

The blame for this, concludes the Secretary, is “experts are doing their best with limited resources, navigating processes which were not designed for a digital age, and implementing policies which were not designed to be digital first”. He argues for a “realistic and unflinching view of how much more we have to do to create a modern digital government and reform public services”.

While we still remember the Efficiency Reform Group, the coming Review can only be a positive for the suppliers.

Latest Results review

MSP

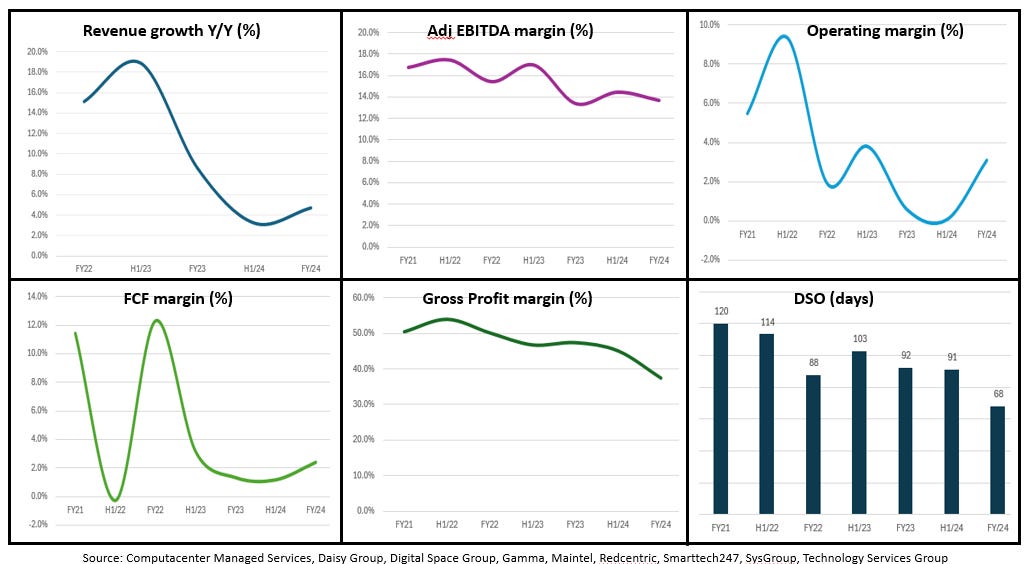

MSP KPI Dashboard

Source: Company data, Technology Investment Services

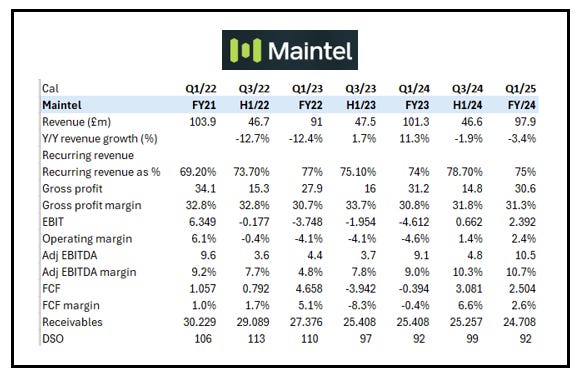

Maintel. This is a provider of cloud and managed communications services currently pivoting from a generalist to a specialist managed service provider, MSP. With strategic progress in H1, the next phase of its transformation leverages internal process and system efficiency, spend optimisation and operational gearing.

The AGM statement was positive with news of growing revenue after an initial slower than expected start to the year. There are new contracts with existing and new customers across the focus technology pillars: Security and Connectivity, Customer Experience, and Unified Comms and Collaboration. H1 included a significant central government managed service contract through a large global service provider. However, as elsewhere, buying trends are mixed with client-led variation in the delivery of sales bookings, long contracting cycles, and some projects experiencing longer than anticipated delivery lead times. Maintel has implemented mitigation measures against macroeconomic headwinds and increased employer-related costs aimed at boosting profitability, with the initial benefit expected in H2.

Of the new operational news:

The new AuditTrack App will shortly be launched on the Maintel Application Platform. This provides a unique way to track historical configuration changes made within the Genesys platform and meeting the demand of some of the Company's larger customers.

A new strategic partnership with Zoom Communications combines Zoom's AI embedded meeting, collaboration and hybrid working platform, with Maintel's pedigree in managed services, voice and network delivery.

The C-suite is strengthened with the appointment of a new Chief Operating Officer who joins in the summer.

Guidance. The combination of H1, some slower booking conversion coupled with “solid progress on pipeline growth” in H2, means a H2 weighting. Nonetheless the Board remains cautiously optimistic about meeting current FY market expectations.

The numbers we track: Maintel

Source: Company data, Technology Investment Services

UK Hardware

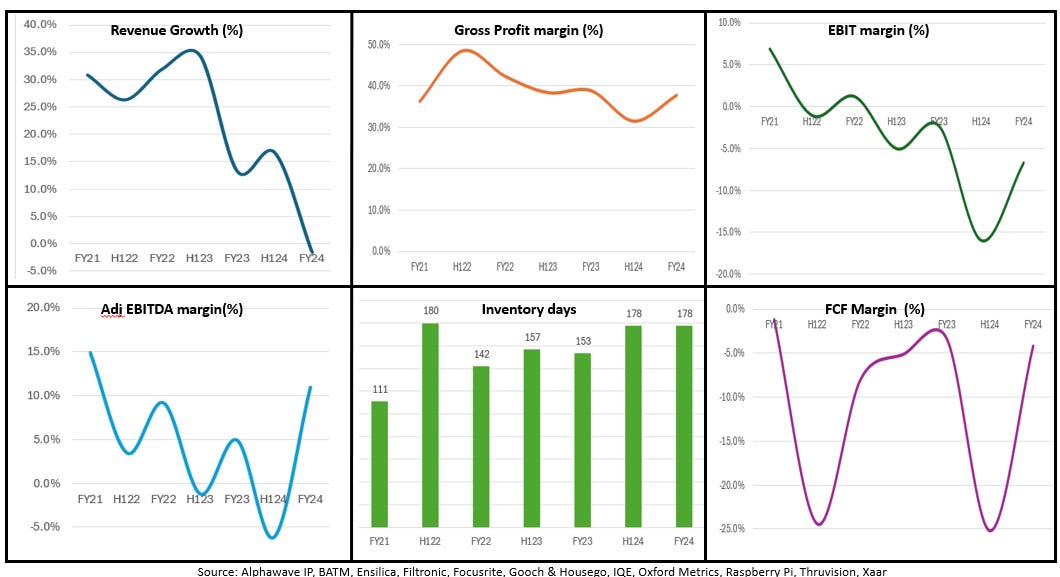

UK Hardware: KPI dashboard

Source: Company data, Technology Investment Services

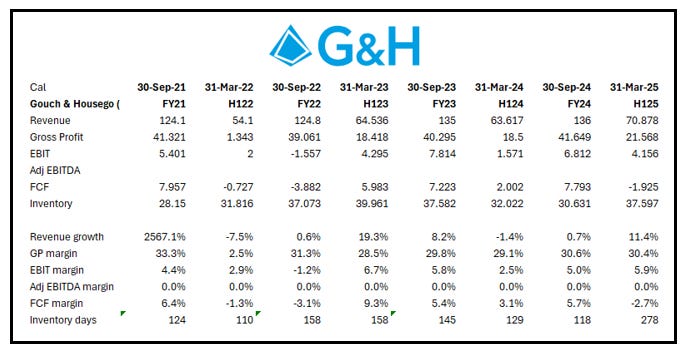

Gooch & Housego. The H1 results contained some positives with revenue growing by 11.4%, 7.5% organic, Adj EBIT +60.5% Y/Y, the Order book, £121.5m, up from £104.5m last year (note: Phoenix Optical contribution accounted for c£7m of the uptick), Leverage comfortable at 1.3x. Guidance was unchanged with YTD >95% order cover, although the company flagged the “increased execution risks due to increased global uncertainty”. The May 2025 agreement to acquire Global Photonics should extend G&H's A&D capability and offering into the US market. CEO Charlie Peppiatt commented: "With our growing order book, strengthening market positions and differentiated photonics expertise aligned to structural growth drivers from megatrends, we remain confident in our ability to deliver further progress on our journey to mid-teens returns by 2028 and generate value for all our stakeholders."

Tariff talk: “Following the implementation of changing global trading policies from the new US administration and the consequent retaliatory measures from China and other nations we are seeing near-term uncertainty increase, especially in our Industrial, semiconductor and Life Sciences markets. This has resulted in reduced demand levels from our industrial market persisting longer than we expected and delays with infrastructure, semiconductor and Life Sciences projects, including increased regulatory approved lead times However, we are well positioned to benefit from recovering demand levels in these markets.

In our A&D business we are seeing strong demand, especially for our optical systems, advanced coatings, ring laser gyros, armour vehicle periscope and our imaging solutions for air, sea and land equipment. The company is repositioning the division to capture new business opportunities as a full optical systems solutions provider for prime defence contractors in the US, Europe and RoW.”

The numbers we track: Gooch & Housego

Source: Company data, Technology Investment Services

IoT/Smart

IoT/Smart: KPI dashboard

Source: Company data, Technology Investment Services

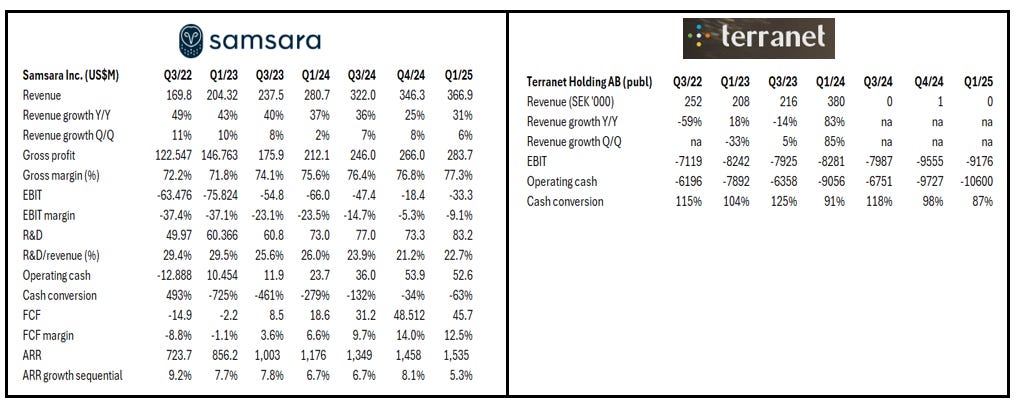

Samsara. An impressive start to the year with 31% Y/Y revenue growth to US$366.9m and ending ARR, US$1.535bn, +31% Y/Y as the customer count soared +35% Y/Y to 2,638. Recap: Subscription revenue mix is c.98% of total revenue. Co-Founder and CEO Sanjit Biswas reminded of the uncertain macro but the product ROI was enabling customers to “get more out of their labor, resources, and assets” as the AI-powered platform improves the safety, efficiency, and sustainability of operations. Use cases in:

Increased safety for frontline workers, reduce accident payouts, and lower insurance premiums.

Preventative maintenance to extend the life of their equipment and reduce capital expenditures.

Improving asset utilization to run smarter and more efficient operations.

Terranet. A positive in helping the company on the road to commercialisation with news of a successful validation of Proof of Concept with a MobilityXlab partner. Following the installation of BlincVision in the partner’s vehicle and test environment, work continues on the defined requirements. Terranet intends to involve that partner in upcoming evaluations of the MVP, planned for Q3. There will be a few selected partners for the MVP, one of which is an industrial player in the mining sector, with whom a collaboration agreement has already been signed. On April 16, the company announced two directed share issues of SEK25m and a SEK 15m rights issue (for those shareholders who could not participate in the directed issue).

The numbers we track: Samsara, Terranet

Source: Company data, Technology Investment Services

Data & Analytics

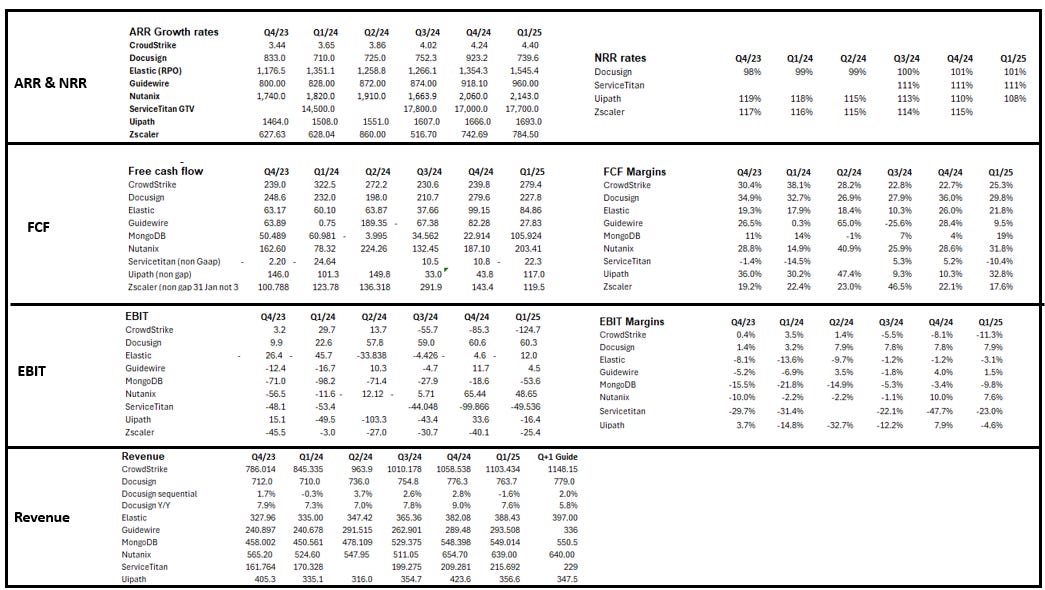

Crowdstrike. Shares weakened on disappointing guidance (Q2 revenue range US$1.14 - $1.15bn shy of consensus US$1.23bn) yet with ARR +225 Y/Y, US$4.4bn, the company continues to recover from its Microsoft disaster of July last year. Revenue was US$1.10bn, +20% Y/Y and the print also featured record operating cash, US$384m although Free cash flow, US$279.4m was down from US$322.5m last year. There was a new share repurchase of up to US$1bn. CFO Burt Podbere commented that the “conviction in net new ARR re-acceleration and margin expansion in the second half of fiscal year 2026 is reinforced by Falcon Flex deal momentum and early Falcon Flex expansions, strong competitive win rates and robust pipeline for the second half of FY 2026.”

Docusign. In Q1 Docusign surpassed 10,000 Intelligent Agreement Management (“from eSignature to Agreement Process”) customers as revenue, US$763.7m, was + 8% Y/Y, matched by subscription revenue, US$746.2m, growth as billings, US$739.6m, edged up 4% Y/Y. Despite a good set of results shares sank, 17%, as the company lowered its full-year billings outlook to a range US$3.285 - $3.339bn from prior US$3.3 - $3.354bn.

Elastic. Although Q4 was a ‘beat’ there was concern about weak performance in the federal sector, FY26 guidance was weaker and concerns about further macro headwinds all combined to send the share lower. That said, there is very good sales traction; Total customer count with Annual Contract Value >US$100,000 was 1,510+ vs 1,330+ in Q4 FY24. There are 21,500 subscription customers vs 21,000 in Q4 FY24. Q4 revenue, US$388m, +16% Y/Y with Elastic Cloud Revenue, US$182m, +23% Y/Y. CEO Ash Kulkarni flagged “leadership in Search AI as customers continue to build Generative AI applications and consolidate onto our platform.” From the operational news the company integrated the Elasticsearch vector database (see the performance on DB-Engines) as a native RAG option for Google Cloud’s Vertex AI Platform. This is billed as allowing joint customers to build RAG applications in a single workflow.

Guidewire. Q3 was shy of revenue expectations (nonetheless 22% Y/Y revenue growth), but earnings beat and FY guidance was raised which resulted in the shares rallying, +16%, post the print. CEO Mike Rosenbaum called it an exceptional third-quarter highlighted by “record Q3 sales activity and 17 cloud deals” - subscription revenue was +32% Y/Y and ARR, US$960m, compared to US$864m (31 July 2024).

MongoDB. "MongoDB is off to a strong start in fiscal 2026 with 26% Atlas revenue growth, meaningful margin outperformance, and the highest total net customer additions in six years," said Dev Ittycheria, President and CEO. "Enterprises and startups are choosing MongoDB as their platform of choice for both modernizing existing and building new applications." Revenue US$549.0m +22% Y/Y, matched by subscription revenue growth. The Gross Profit margin was 71%, down from 73% last year, the EBIT loss, US$53.6m was reduced from the US$98.2m a year ago, also on the positives MongoDB generated US$109.9m operating cash up from US$63.6m a year ago. MongoDB added 2,600 new customers in the period bringing the total customer count to 57,100 and this was the highest net additions in over six years.

The company authorised up to an additional US$800m share buyback. Of the negatives:

Softness in Atlas consumption in April due to macroeconomic volatility, although it rebounded in May.

The non-Atlas business is expected to decline in the high single digits for the year, with a US$50m headwind from multiyear license revenue anticipated in H2.

Slower than planned headcount additions.

Nutanix. A strong print which beat the Guided metrics headlining with 18% Y/Y ARR growth. “We delivered solid third quarter results, above the high end of our guided ranges, driven by the strength of the Nutanix Cloud Platform and demand from businesses looking for a trusted long-term partner,” said Rajiv Ramaswami, President and CEO. He flagged the recent announcements around support for external storage, modern applications, and generative AI coupled with broadening GTM partnerships.

ServiceTitan. Ara Mahdessian, Co-Founder and CEO. “We're building a series of stacking S-curves (Note: later defined as ‘enterprise, commercial, pro, and roofing’ on the subsequent analyst call) to put ourselves in a position to deliver transformative customer outcomes, and each of our four primary areas of focus this year are off to a strong start.” Despite the strong execution in the period, the QandA was dominated by ‘macro’ concerns. The shares traded sideways.

Uipath. A stronger than expected print and a guidance raise due to steady renewal rates (NRR 108%) and resilient performance in its Federal business even as macroeconomic uncertainty lingers. ARR, US$1.693bn, +12% Y/Y. Daniel Dines, Founder and CEO commented on a “milestone quarter” marked by the launch of the agentic automation platform, which has encouraging early responses. Revenue, US$357m +6% Y/Y and so one of the poorest growth rates among the cohort.

Zscaler. A strong quarter (shares reacted in kind being +10% on the news) with billings +25% Y/Y to US$784.5m, revenue +23% Y/Y, US$678.0m and deferred revenue +26% Y/Y to US$1,985.0m. Jay Chaudhry, Chairman and CEO commented that the proliferation of AI “in all aspects of business” is increasing demand. EBIT loss expanded to US$25.4m from US$3.0m Y/Y. FCF, US$119.5m, 18% margin, compared to US$123.1m (22% margin) last year. Commenting on the relative strength of Zscaler versus the wider cyber group, CEO Jay Chaudhry stated: “And even in cyber, the two areas that are high priority for our customers are Zero Trust Architecture and securing the use of AI. If your project involves one of these two security offerings, and you can actually do some cost savings, the deal can get done. We are able to do all these things together. That’s why it has been a good quarter for us.”

The numbers we track: Crowdstrike, Docusign, Elastic, Guideware, MongoDB, Nutanix, ServiceTitan, Uipath, Zscaler

Source: Company data, Technology Investment Services

UK Software

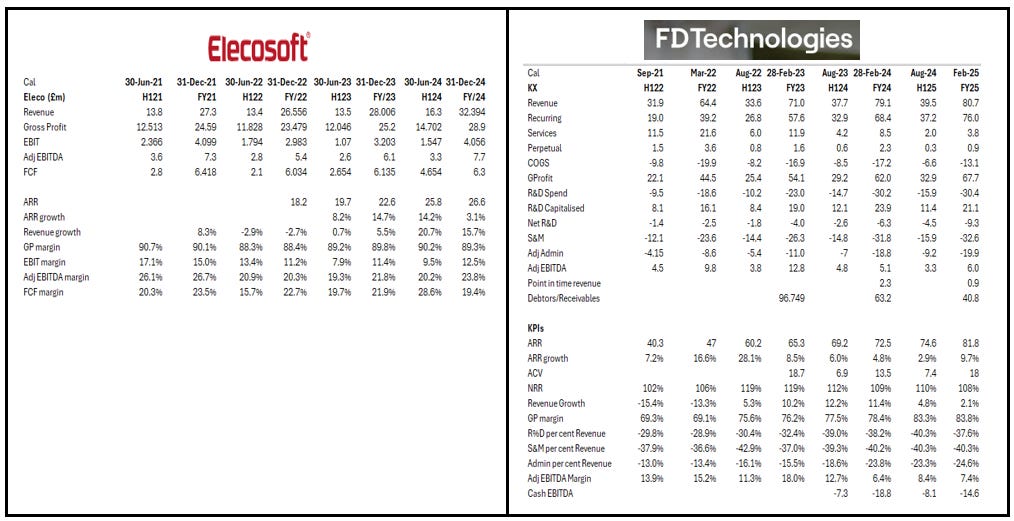

Eleco. AGM Statement and Trading Update. A positive AGM statement and the company re-iterated FY guidance. "We are pleased with Eleco's progress in the first four months of 2025, particularly given the backdrop of ongoing political and market uncertainty. Underlying demand for Eleco's products remains resilient, driven by the construction industry's continued shift toward sustainability, digitisation of the built environment, and productivity enhancements."

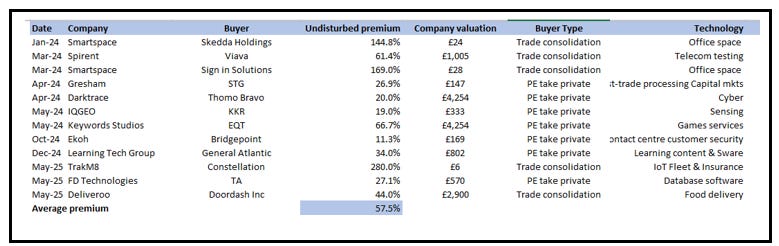

FD Technologies/KX Software. A superb print and delightful execution ahead of its (disappointing) take-over. KX continues to execute well with FY bookings growth at the top end of the guidance range and ahead of consensus as ACV grew 33% Y/Y with ARR +13% Y/Y. Cash EBITDA was ahead of previous guidance and above the top end of consensus expectations with a loss of £14.6 m, from -£18.8m Y/Y. Bookings growth was a function of:

expansion deals with existing financial services customers, expanded market share in high-tech semiconductor manufacturing, and

new business among tier 2 hedge funds and investment banks, as well as in the aerospace and defence sector.

On 8 May 2025, the Board unanimously recommended TA's cash offer for the business (under Kairos Bidco), which valued FD Technologies at £24.50/share or £570m.

Outlook. In FY26, ARR growth of at least 20% and continue to target positive Cash EBITDA in FY27.

Seamus Keating, Group CEO commented: "With accelerating ARR growth and better-than-expected operating leverage, KX delivered a strong performance based on good ongoing execution. Meanwhile, our strategic repositioning of the Group during the period has unlocked significant shareholder value.”

The numbers we track: Eleco, FD Technologies/KX Software

Source: Company data, Technology Investment Services

The M&A undisturbed premium

Source: Company data, Technology Investment Services

Gaming

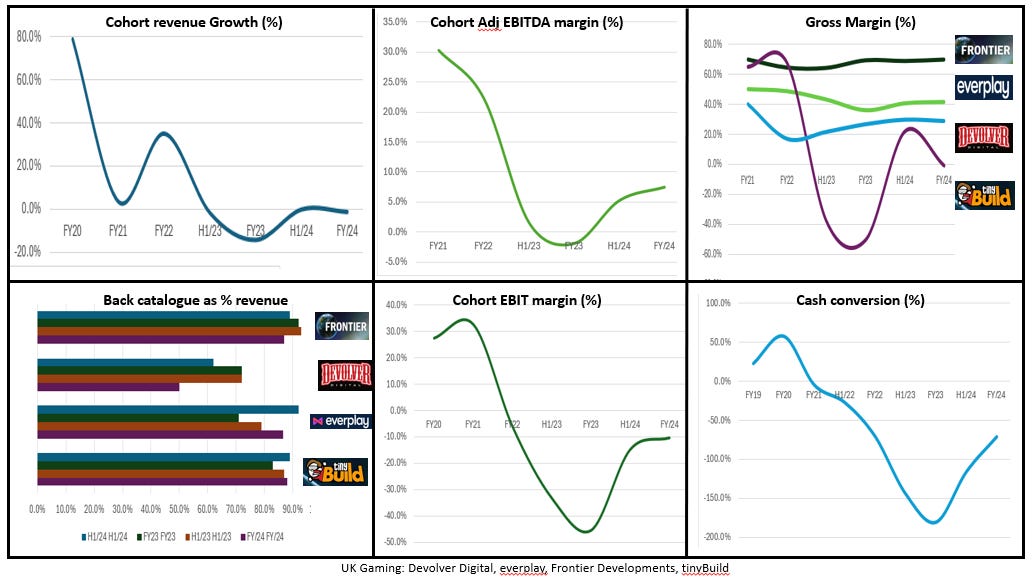

Gaming KPI Dashboard

Source: Company data, Technology Investment Services

tinyBuild. tinyBuild’s AGM trading update is positive. Revenue is “slightly ahead of expectations”, the cash burn is down (again) and the cash trough (summer 2025) should improve post the launch of “high-potential new games”. The pipeline is “strong” and, despite the economic backdrop and Ukraine conflict, tinyBuild anticipates results in line with expectations. For us, tinyBuild’s continued recovery is predicated on working the valuable back-catalogue and game releases that are already proving hugely popular. Kingmakers, SAND and Streets of Rogue 2 are #13, #41 and #61, respectively, on Steam, and have the potential to be new global franchises. From Steam we note new clarity on release timing (H2-weighted), which is illustrative of the new ‘sleeves rolled-up’ dynamism. We make no changes to our estimates for now, but the risk is evidently on the upside. Greater certainty from these new titles and monetising the back-catalogue means investor attention can now comfortably pivot to tinyBuild’s strong valuation support (EV/Sales 0.8x vs sector 3.1x). This gives plenty of re-rating potential.

Read our coverage on Progressive Equity Research

The news coincides with the biggest pre-order of the Ninetendo Switch 2 – the first big console release for five years.

Internet Services

S4Capital. A workman-like AGM statement. While the macro is worse and performance at the two divisions is uneven, S4C is better able to execute and is more efficient. There is a new dividend (1p/share on 10 July 2025) and, despite a greater H2 weighting, FY guidance is reiterated. In addition the focus (digital only; data driven; faster, better, cheaper and more; and unitary) plays well to buyers with “significant opportunities for new business, particularly driven by our AI tools and capability” and the company winning “multiple exploratory assignments, as clients experiment and explore AI applications and develop AI use cases”. Of note: S4C is changing its revenue model from a “purely, time-based approach to one more based on outputs - i.e. use of assets” – this is somewhat of a holy grail for vendors, but historically buyers have been more reluctant as contracts cost more – but a decisive moment in terms of defining moment for pricing power for S4C.

AGM key guidance points: Like-for-like net revenue expected to be “down by low single digits” overall, with Marketing Services (formerly Content and Data&Digital Media) only “slightly down” and Technology Services net revenue more following a reduction by a major client. Like-for-like operational EBITDA remains unchanged (“broadly similar to 2024”), with a higher H2 weighting than last year. This reflects timing of revenue from “significant new business wins”, particularly with General Motors, Amazon and T-Mobile. Month-end average net debt in the first five months of the year down almost 30% from £199m to £144m underpinning the Board's confidence to recommend a first time final dividend of 1p/share.

The demand-side backdrop: Performance impacted by “challenging global macroeconomic conditions, continued high interest rates and some underperformance, when compared to our addressable markets”. Technology clients continued to prioritise capital expenditure over operating expenditure. Clients are likely to remain cautious, however once the levels of tariffs are negotiated and the impacts assessed, we believe clients will become much more selective about the geographies in which they operate in order to find growth. They will focus on implementing technologies, such as, but not only AI, to drive efficiency in a slower growth, higher inflation and higher interest rate environment. This may be the time when AI-adoption accelerates at scale.

Guidance reaffirmed: Net revenue down by low single digits, operational EBITDA to be broadly similar to 2024. Net debt £100 - £140m. Medium term financial leverage at the lower end of the previous range of c1.5x operational EBITDA. Longer term growth to outperform our markets and operational EBITDA margins to return to historic levels of around 20%.

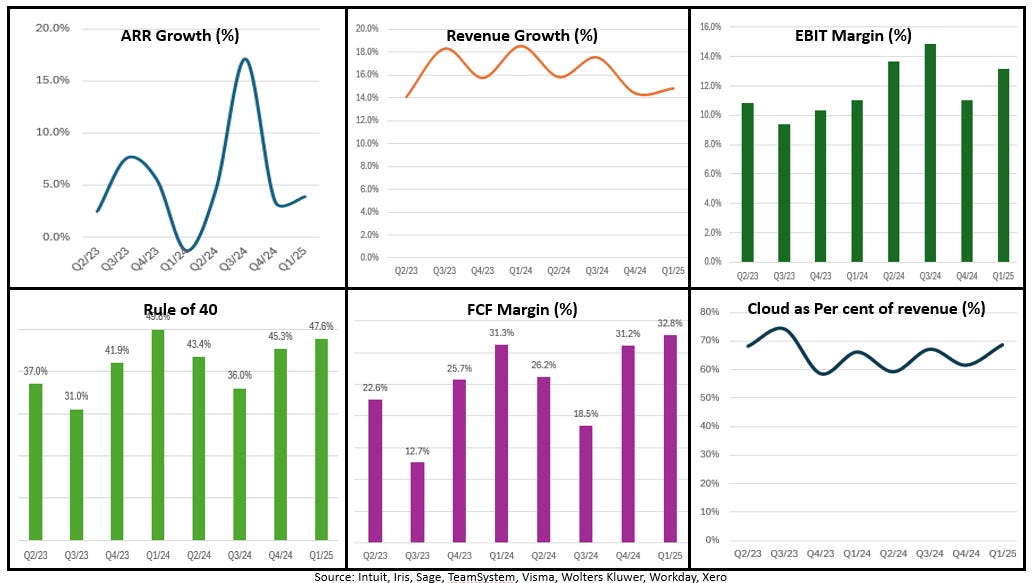

Accounting & Finance

Accounting & Finance: KPI dashboard

Source: Company data, Technology Investment Services

TeamSystem. Another good period from the Italian Sage-look-alike (TeamSystems has slightly more ‘S’ in the revenue mix than at Sage). Revenue growth (+12.8% Y/Y, with recurring revenue +15.1% Y/Y with ARR growth (“exceeded” €870m), growing +14.3% Y/Y due to a mix of cross-selling (up by >50% Y/Y), stable churn (no disclosed data) and price increases (in fairness this practice is common across the cohort). The acquisitions in the period, €97.2k spend, was for the cash-out payments for Golden Soft, Multifatture, Horizon, Muscope Cybersecurity and Alpha Team. Note: Interest payments on the loan Notes (€ 33.9k) account for the majority of the €46.3k finance costs – to put it in context: Group Employee costs are €82k.

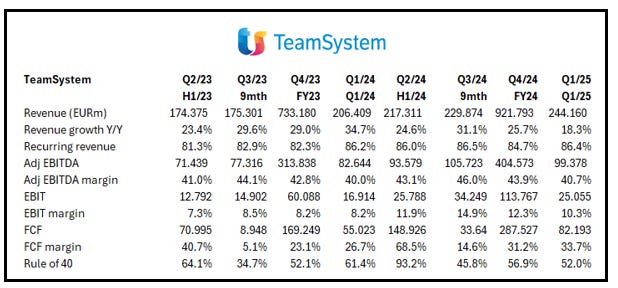

The numbers we track: TeamSystems

Source: Company data, Technology Investment Services

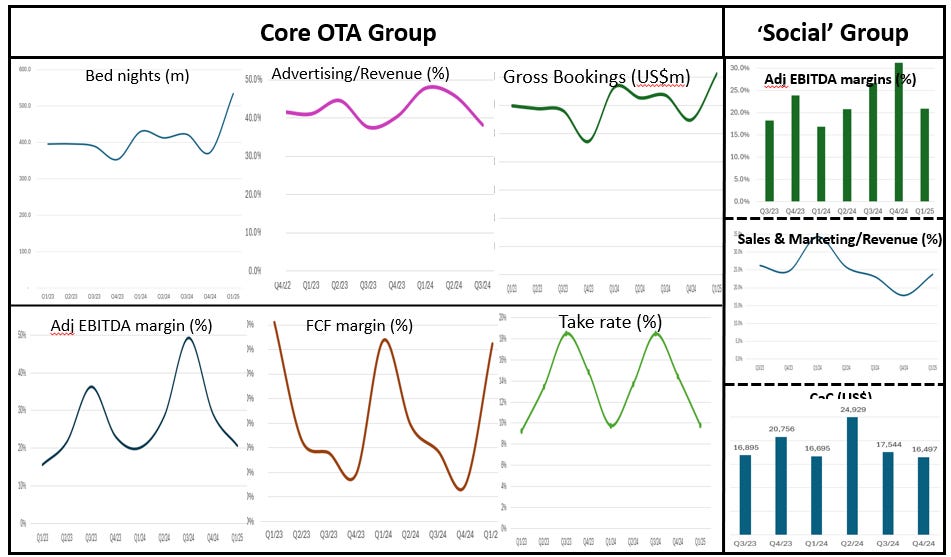

Travel-Tech

Travel-Tech KPI dashboard

Source: Company data, Technology Investment Services

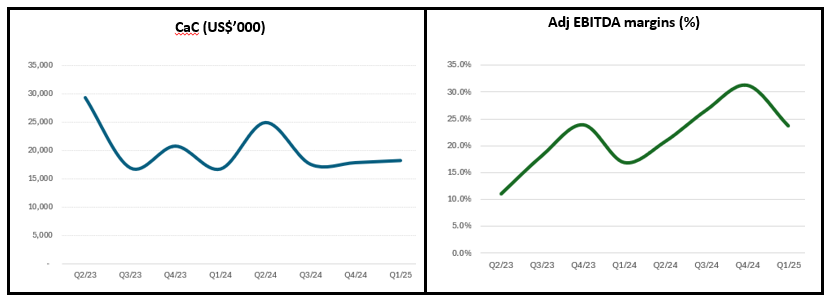

Lessons from the Social Group: The evolution of CaC and Adj EBITDA margins

Source: Company data, Technology Investment Services

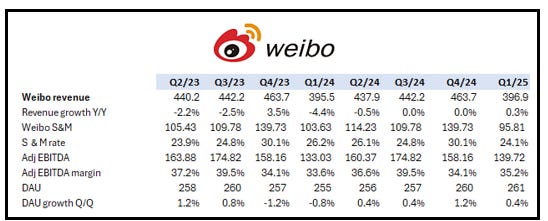

Weibo. We review Weibo apart of the Social cohort which is increasingly informing our thoughts as OTAs operationally begin to resemble social companies. Weibo Q1 (21 May – tut-tut, #analystfail) featured, as expected, notes on how the company is incorporating AI (Weible Intelligent Search), integrating Weibo's social features and upgrading the recommendation system in order to deepened user engagement. Revenue, US$396.9m was flat Y/Y with Advertising and marketing revenue, US$339.1m, also flat Y/Y. Average daily active users, DAUs were 261m also flattish.

The numbers we track: Weibo

Source: Company data, Technology Investment Services

Defence-Tech

Cohort. Continuing the drum-beat of positive noise from the Defence-tech sector, an FY Trading Update from Cohort says that the year (ended 30 April) concluded in line with market expectations (Revenue: £245m, Profit: £27.6m, Adj EPS: 46.1p). of the highlights: Net funds, £5+m, significantly ahead of expectations. Order intake, c.£285m (excluding c.£80m order book acquired with EM Solutions) compared with £387m a year ago. As 2024 included an exceptionally large Royal Navy order, £135m, the like for like is +12% Y/Y. The closing order book, c.£615m, marks a new record for the Group, £518.7m last year.

Outlook for FY26. Cohort continues to see good demand for products and services from both domestic and export customers. The drivers for investment in defence remain strong, with the ongoing conflict in Eastern Europe and continuing tensions in the Indo-Pacific region leading to increased global defence spending. The company awaits the findings from the UK's Strategic Defence Review, but expects this to maintain a focus on technologies and capabilities aligned with what the Group provides.

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.