Jensen Huang, Nvidia’s founder & CEO, concludes “The age of AI is in full steam”. He unveiled another set of sparkling results. Nvidia is the captain, the rallying point for AI technologies and investors, but a victim of its success, the law of big numbers and muted guidance. Muted guidance is catching - it is a sector-wide Q3 affair – and investors hoping for optimistic waypoints are mostly disappointed. Sector sentiment, like some many times over the past 1000 days, is fragile and dominated by geopolitics. Missiles heighten investors’ nerves (and create opportunities). In addition, the UK economy posted ‘worse than expected’ data points, pushing the UK 10-year rate higher, leading to a return of ‘higher for longer’ thinking, and with it ‘lower (valuation) for longer’. The ‘trough’ extends.

The pleasing aside is that as the tide ebbs on Q3 reporting, tech companies, not just Nvidia, continue to show positive results. Muted company guidance telegraphs an industry with reservations about the strength of demand. This is despite successful rounds of price increases and an NRR rate, while down Y/Y (113% vs 113.2% Y/Y), increased sequentially (112.2% in Q2/24). Jensen leads, the chasing pack are not Full Steam ahead and Slack informs us that some of the passengers are growing weary. Are we nearly there yet? Nope.

Our latest roll call: Eagle Eye, GB Group, Intuit, Made Tech, Monday.com, Nvidia, Palo Alto, Redcentric, Sage, Snowflake, Softcat, Tracsis, Xero. Read on. Data insights inform our cohort dashboards and views of the global tech-economy.

Results Roll-call

Magnificent 7

Nvidia: The sight of Awesomeness

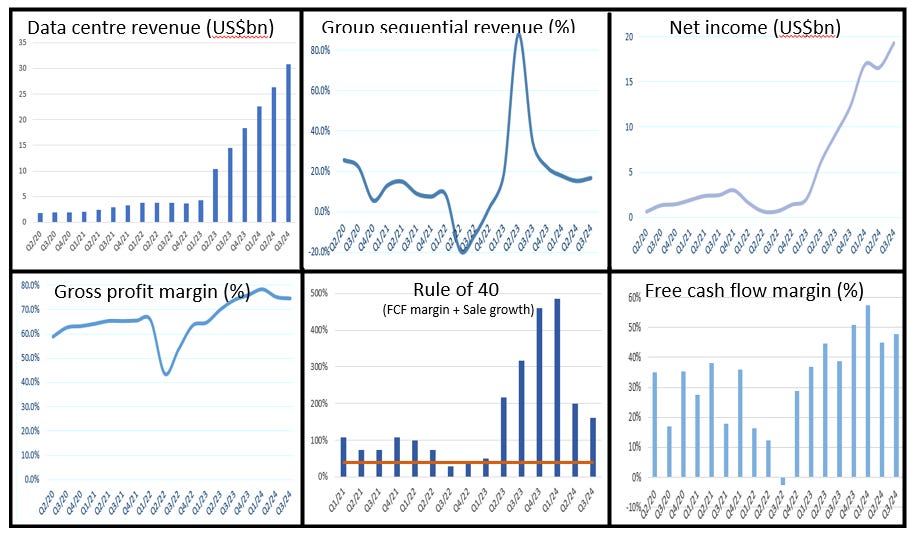

While the Y/Y compares started to suffer a few quarters ago, the hockey stick of numbers remain impressive. Q3 Group revenue, US$35.08bn +94% Y/Y, and Net income, US$19.31bn more than doubling from US$9.24bn a year ago. The Q3 print was a beat (revenue consensus was US$33.2bn with Adj FD EPS US81cents vs consensus US75cents). Guidance was muted but Nvidia raised Q4 revenue guidance to US$37.5bn ahead of consensus US$37.09bn. Jensen Huang, Nvidia’s founder & CEO: “The age of AI is in full steam, propelling a global shift to Nvidia computing”.

Our primary interest is in the data center division where revenue surged 112% Y/Y to US$30.8bn where Hopper supports large language models, generative AI, and recommendation engines and where demand for the next-generation Blackwell AI chips outstrips supply. CFO Colette Kress stated that Blackwell production begins in Q4 with the ramp up into FY2026 - more big numbers await.

Nvidia: The slide of Awesomeness

Source: Company data, Technology Investment Services

Magnificent 7 Valuation Overview

Note: Priced 22/11/24 Source: Company data, Yahoo Finance, Technology Investment Services

IT Professional Services

Made Tech: AGM

A pleasing AGM headlining with the news that trading is ahead of expectations. Chair Joanne Lake commented that “the business achieved YTD Sales Bookings of £37.5m and so is already ahead of the £36.0m bookings achieved for the whole of the prior year”. Hence Group revenue for FY25 will be ahead of market expectations with Adj EBITDA to increase as margins are maintained. Also the Group continues to be on track to generate positive free cash flow in FY25. "The commitment to digital transformation that the UK Government signalled in the recent Budget is expected to unlock a number of further public sector digital transformation programmes in early 2025, and in particular following the UK Government Spending Review in Spring 2025.” This is good across the board and we look forward to learning more at Interim results (6 months to 30/11) which are planned for early February 2025.

Meanwhile UK Government issues new spending curbs on Consultants

Why wait until February for good news? The Cabinet Office has announced new controls on the use of consultancies across government, aimed at saving £1.2bn by 2026. The news is a positive for the UK listed suppliers. The Government is aiming to reducing reliance on larger companies, supporting SMEs and increasing diversity, innovation and social value. Ministerial sign-off will be required for any consultancy spend over £600,000 or for contracts lasting more than nine months. Any spend over £100,000, or for contracts exceeding three months, requires sign-off by a permanent secretary.

In addition, there is an invitation to companies to bid for places on a new procurement framework to streamline the use of consultants. This will provide a centralised list of suppliers that have gone through a competitive tendering process and reduce the time departments have to spend on procurement – although the new guidelines will naturally extend the decision making time. The new process will be managed by the Crown Commercial and its total value has been set at £1.7bn over two years, compared with an earlier provision for £5.7bn over four years.

POV: This is as expected, the focus on SMEs is a positive, the spend limits mean a delayed timescales in procurement and social value imposes extra costs, however on balance this is a positive for the cohort.

Infrastructure IT Services

Softcat: Q1 2025 Trading Update

Like Sage, Softcat is also an SME supplier. This week we had a positive Q1 Trading Update as Softcat signalled that it was trading in line for the FY outturn (i.e. double-digit gross profit growth together with high single-digit operating profit growth). “The Group performed well during the Period, delivering further growth in gross profit and operating profit.” Customer demand remains resilient. Two bits to CEO Graham Charlton market commentary which caught our eye, as follows (i) “. . . our wealth of expertise, is proving invaluable to customers in an increasingly complex IT landscape” this is somewhat of a classic reseller with limited Professional Services – while we don’t see the business model changing – we agree with the SME focus means an amount of ‘handholding’ which in time could become ‘chargeable’ rather than pre-sales function. (ii) “I'm confident that our unique culture” (Softcat has long been a top tier Glassdoor performer.)

IT Infrastructure Services Valuation overview

Note: Priced 22/11/24 Source: Company data, Yahoo Finance, Technology Investment Services

Finance & Accounting

Xero: Bounce back

Some nice ‘bounce back’ numbers and KPIs coming through from Xero. The print featured 25% revenue growth, Adj EBITDA +52% Y/Y FCF margin 21% and 10% subscriber growth following 401,000 net additions. In the UK, Xero achieved 26% revenue growth with 49,500 net subscriber additions. Of note:

Churn was higher.

Xero removed 160,000 “long idle subscriptions” – this was a brave move but it positively impacted ARPU. On the analyst call there was commentary about challenges in driving payroll adoption in the UK (this is a mature market) and in New Zealand, both which require further effort to improve product market fit – for us these are sticky contracts and also need switching incentives beyond product features.

Company flagged that hiring domain experts was slower than expected, impacting the planned reinvestment in product development. This is interesting as in the industry unplanned staff attrition reflect the economic trough and is at a low point – but is a leading KPI for improving outlook (i.e. industry participants see better outcomes/salary opportunities elsewhere).

Xero KPIs over time

Source: Company data, Technology Investment Services

Intuit: Beat but no raise

Shares fell 6% after hours following a Q2 revenue forecast which came up shy of consensus expectations. This was despite posting a beat for Q1. Q1 revenue was up 10% to US$3.28bn, it was ahead of consensus of US$3.14bn. Adj EPS US$2.50 also bested the US$2.35 consensus.

Intuit guided Q2 revenue to a single-digit decline at its consumer segment because of promotional changes for the TurboTax desktop software in retail environments. Revenue from the Global Business Solutions Group was US$2.5bn in Q1, which was inline with estimates. This was the Small Business and Self-Employed segment and the product portfolio includes Mailchimp, QuickBooks, small business financing and merchant payment processing.

Note that earlier, Tuesday (19/11) Intuit shares crumbled -5% following The Washington Post article saying that US President-elect Donald Trump’s proposed Department of Government Efficiency had discussed developing a mobile app for federal income tax filing. This would impact Intuit, and other companies in this market (note: Sage does not have an offer). On the analyst call, Intuit CEO Sasan Goodarzi said he was personally communicating with leaders of the incoming presidential administration, adding “we will see an improved environment as we look ahead in 2025, particularly just with some of the things that I mentioned earlier around just interest rates, jobs, the regulatory environment. These things have a real burden on businesses. And we believe that a better future is to come.”

Turning to the Sage overlap part: Global Business Solutions Group revenue grew to US$2.5bn, up 9% Y/Y, and Online Ecosystem revenue increased to US$1.9bn, up 20% Y/Y. In the product groups: Online Services revenue grew 19% Y/Y, QuickBooks Online Accounting revenue grew 21%, International Online Ecosystem revenue grew 10%, Desktop Ecosystem revenue fell 17% following the changes made to its QuickBooks desktop offerings (in early FY24) to complete the transition to a recurring subscription model.

Sage Group: Finals in line- share price doing fine

Shares +17% on the day was the best ever day on the market. The FY financial results were in line and the highlights included: revenue +9% Y/Y to £2,332m, Adj operating profit +21% Y/Y to £529m which was a 220-basis point uptick to a 22.7% margin, EBITDA +16% Y/Y to £622m. EBIT+43% to £452m, FCF +30% to £524m, net debt to EBITDA 1.2x. On results day Sage launched a £400m Share buyback programme - these are crowd pleasers and usually are good for shareholder value.

From the operating KPIs: we noted ARR +11% Y/Y to £2,339m, with “growth across all regions balanced between new and existing customers”. Renewal rate by value was 101%, down from 102% Y/Y (note: there was a 5% price rise in the period). Sage Business Cloud revenue was up 16% Y/Y to £1,871m (FY23: £1,619m). This include 23% cloud native product revenue growth to £732m. The outlook commentary was more muted with Sage guiding “organic total revenue growth in FY25 to be 9% or above” (i.e. flat Y/Y), and operating margins “expected to trend upwards in FY25 and beyond”.

As we look into results, the point of note is that (once again) Intacct is the leading product revenue growth driver in North America (responsible for >40% of US revenue), the product grew by 24% to £385m and in UKIA Intacct is “a significant contribution” with <1,200 customers. For FY24, Intacct's ARR grew by almost a quarter in the US and by 60% outside the US. However, in Europe (with its poorer 6% Y/Y revenue growth) featured growth spanning the product portfolio (accounting, payroll and HR) but no contribution from Intacct.

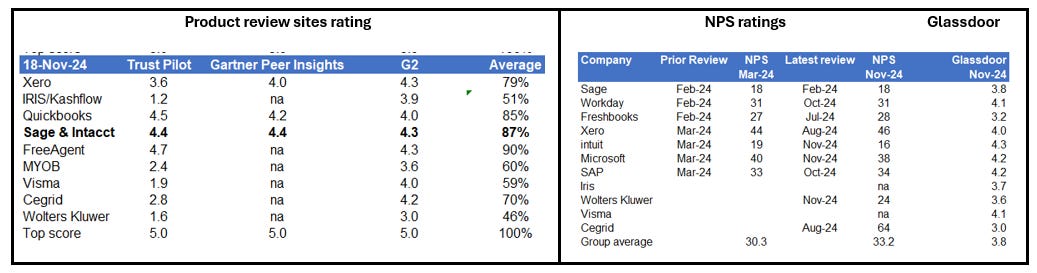

While pleasingly Sage cloud native revenue grew by 23% to £732m (and also positive was that this was via new customer acquisition) it only accounts for 31% of Group revenue. The reason for this is existing customers have preferred the cloud connected (i.e. Desktop offers with cloud services) rather than cloud native. This technology array means that Sage has to support multiple functionally overlapping products (below). While (say) Intuit, SAP and Visma have all managed a successful transition, Sage, like (say) Iris and Wolters Kluwer have a different approach – clearly the overlapping products are not disruptive for customers, but it means that Sage is burdened with extra costs, product development and support. We note from looking at Product reviews - existing customers are happy (and so they should be) while the NPS rates where customers recommend possibly suggest that Sage customers would rather be shunted to cloud native!

The numbers we track

Source: Company data, Technology Investment Services

Mirror, mirror on the wall - reviewing the reviews

Source: Trustpilot, Gartner Peer Insights, G2, Comparably, Glassdoor, Technology Investment Services

Sage (overlapping) product portfolio

Source: Company data

Updated Finance & Accounting dashboard

Our updated dashboard shows that the cohort is generally on an improving trend. Cohort revenue has settled to ‘mid-teens’ and is slightly shy of the ARR rate. NRR is traditionally lower than the Data & Analytics companies. The Rule of 40 (calculated revenue growth + FCF margin) is trending for the better.

Finance & Accounting Dashboard

Source: Company data, Technology Investment Services

Finance & Accounting Valuation overview

Note: Priced 22/11/24 Source: Company data, Yahoo Finance, Technology Investment Services

IoT

Tracsis: Final Results

The print was in line with the earlier warning (13/6) with little further deterioration. Of the highlights: Revenue down 1% Y/Y to £81.0m, Adj EBITDA -20% to £12.8m, (positively) cash was £19.8m up from £15.3m Y/Y. Statutory Operating profit was £1.0m down from £7.3m Y/Y, and basic EPS was 1.6p, from 22.8p Y/Y. Undeterred the Final dividend/share, 1.3p, was up from 1.2p Y/Y, bringing the Total dividend/share to 2.4p from 2.2p Y/Y.

From the operational narrative there were new UK rail technology contracts awarded across smart ticketing & delay repay, safety & risk management, and operations & planning solutions and the “pipeline of software opportunities increased by 200% across UK and North American markets”.

The key messages in the Outlook commentary were mixed:

activity levels increasing following the UK General Election, though some near-term variability in customer activity in the UK through H1.

Network Rail Control Period 7 funding pressures impacting UK Remote Condition Monitoring hardware activity

Increases in UK national insurance and minimum wage will add cost from April 2025 and beyond; expected to impact FY25 EBITDA directly by c.£0.5m

Chris Barnes, CEO flags two cautions in his commentary:" (i) Some short-term headwinds remain across the UK Rail supply chain related to Control Period 7 funding restrictions from Network Rail, which is impacting our Remote Condition Monitoring hardware activity. (ii) The changes to national insurance and minimum wage legislation announced in the October Budget will bring additional cost into our business.”

Data & Analytics

Snowflake: Best ever day

Like Sage, Snowflake shares (+32% on the print) also had their best ever day following Q3 which beat consensus and highlights included RPO US$5.7bn, +55% Y/Y, product revenue, US$900.3m, was 29% Y/Y growth, NRR, 127% (a best-in-class rate), was unchanged sequentially. Sridhar Ramaswamy, CEO: “Our obsessive drive to produce product cohesion and ease of use has built Snowflake into the easiest and most cost-effective enterprise data platform”.

Adj EPS was US$20cents vs. US$15cents consensus, as revenue, US$942m crushed the US$897m consensus. The guidance raise saw product revenue (c96% of total sales) guided to US$3.43bn for FY25, 29% Y/Y growth which was raised from the US$3.36bn forecast at Q2 results. In addition the guidance for Adjusted operating margin was lifted to 5%, prior 3%.

The numbers we track

Source: Company data, Technology Investment Services

Data & Analytics Valuation overview

Note: Priced 22/11/24 Source: Company data, Yahoo Finance, Technology Investment Services

IaaS

Redcentric: H1 results

Redcentric plc (UK IT managed services) reported 5.8% revenue growth to £86.8m, Recurring revenue was 90.2%, 91.2% Y/Y, Adj EBITDA grew by 25% to £18.2m (margin to 21%, from 17.7 % Y/Y). Net debt has decreased to £66.6m from £72.4m (31/3/24). CEO Peter Brotherton commented that H1/25 marked the first reporting period “to fully reflect the benefits of the investments made in FY22 and FY23”. The key performance indicators illustrated progress with the cost efficiencies removing an additional £2.6m from the cost base on an annualised basis. The company also announced a plan to separate reporting and implementation of growth initiatives to the core two businesses: Data Centres (DC) and the Managed Service Provider (MSP) business.

Signalling a pending step change in the business, by the end of FY26, the Group will have fully modernised the former Sungard data centres, with future capital investments focused on meeting customer needs rather than on maintenance. The improvements made throughout FY24, FY25, and FY26 will strategically position Redcentric to effectively support the growing demands of enterprise and AI customers. Actions taken during the course of H1 FY25 should alleviate some of these cost pressures and drive further increases in profitability in H2 FY25 and beyond.

IaaS Valuation overview

Note: Priced 22/11/24 Source: Company data, Yahoo Finance, Technology Investment Services

UK extended company list

Eagle Eye: AGM

Eagle Eye (SaaS for loyalty and personalised, real-time marketing in retail, travel and hospitality) announced that FY25 “has commenced well”. There are several new wins and deepening relationships with existing customers, including:

a five-year contract win with Waterstones Booksellers Limited in the UK,

a five-year contract win with a “leading retailer in the UK”,

contract with Côte to support their new employee loyalty and discount programme,

expansion with Loblaw in Canada for the deployment of the "message at till" solution, and

“increased engagement” with Morrisons, extending Eagle Eye's loyalty services to all 960+ Morrisons Daily convenience stores (formally McColl's).

Eagle Eye tellls us that it has a “considerable sales pipeline across all geographies”. Also agreed a new and increased three-year £10m revolving credit facility with HSBC Innovation Bank, replacing the previous £5m revolving loan facility with HSBC. The new facility includes an additional £10m accordion – POV: Eagle Eye is likely thinking a potential acquisition.

GB Group: Interim results

GB Group (identity fraud and location software) has been under a cloud (not that one) for years but Interim results suggest an improving trend but also a coherency from a company which was built from an M&A dream. Results were in in line with the 17 October Trading update.

The headlines included: revenue, £136.9m, was +3.4% Y/Y and the Operating profit £9.4m reversed last years £52.6m loss – admittedly that was mostly a £54.7 non-cash goodwill impairment charge. Net debt, £71.9m was an improvement on the £104.8m debt last year. From the operational highlights we note that NRR improved to 100.2% 30/9 vs 94.9% Y/Y.

The Agent of change

CEO Dev Dhiman said that he was pleased to report on a first half where “we have made positive progress against my initial focus areas; removing complexity, being globally aligned, driving a performance culture and differentiating through innovation”. Mr Dhiman reiterated the FY25 outlook (mid-single-digit revenue growth c/c and high single-digit growth in Adj operating profit). Note: Mr Dhiman was appointed CEO this January. He joined GBG in 2020 as Managing Director of Asia Pacific, where he led significant growth in the region. Before that, he worked at Experian for 12 years in senior positions across EMEA and APAC.

The Segments

Identity (59% of the Group's revenues) – Revenue, £80.3m, +6.0% Y/Y with growth due to Y/Y improvement in EMEA and America as as a result of improving NRR. EMEA has a healthy pipeline: (i) Retail and e-commerce, age-verification cross-sell opportunities from Location resulted in the Identity team securing some of Asia's largest online marketplaces. (ii) Financial services: new wins and expanded our relationship (Remitly and Capital.com). (iii) Gaming: expansion into emerging markets within LATAM (Brazil and Peru) with Rush Street Interactive and SuperBet. In the Americas, the expanded account management team has “helped to improve NRR”.

Location (29%): Revenue +8.6% Y/Y to £39.5m. There was a brace of new customer logos (SharkNinja and Warner Music) coupled with expanded existing relationships (Primark and FootLocker) and GTM partners (Smartystreets and Oracle).

Fraud (12%): Revenue (fraud prevention, detection and investigation solutions) -9.2% Y/Y to £17.1m. This was due to timing of customer software licence renewals across this segment's core Southeast Asia and EMEA markets. The pipeline “remains attractive” and guidance was for a return to growth in H2.

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.