Who are you carrying a torch for? As Netflix signalled the start of earnings season (team FAANG), week 2 had results from Alphabet and Tesla (team Mag7). Both disappointed. More broadly the week saw updates from: IT Professional Service (Capgemini, Tieto, IBM, SopraSteria, Coforge, Tech Mahindra), IT Infrastructure Services (Econocom, Computacenter), Mag 7 (Alphabet, Tesla), Health-tech (Cambridge Cognition, Kooth), IaaS (Alphabet, SAP, Beeks), Recruitment (SThree), Security (Checkpoint, Corero), Internet Services & Adtech (Alphabet, Audioboom) and Data & Analytics (SAP, Servicenow). Breathless? We are. The general emergent themes include: (i) continued demand for large-scale digital transformation projects, (ii) companies have pipeline, but decision-making cycles are stretched in a “soft” environment, (iii) there is limited discretionary IT spend but GenAI is a growing opportunity, (iv) the UK is navigating through political instability from the ‘wait-and-see’ of the elections (commentary from Sopra, Capgemini, Kainos and Kooth). (v) There is no wider contagion as Mag7 eases, but there are consequential moves; GenAI exposure includes IT Prof. Services (finally); there is tech rotation from large to mid/small (Russell 2000, UK small/mid) and from tech income to tech growth. With continued expectations of falling interest rates the sector is relatively more attractive creating a ‘rising all boats’ effect which started at the Bessemer index. This is somewhat contradictory given a ‘risk-off’ environment.

That contradiction was also captured in the sobering comments by Andrew Joy. Mr Joy is Chair at tech specialists Herald Investment Trust. In his H1 report (24/7), Mr Joy states: (i) investors are realising capital gains for fear of an increase in the tax rate, while inflows are from overseas corporates, PE and direct investing from US investors. Overseas investors own the majority of the value in the UK market, and so any change of sentiment would be damaging. This explains “the Manager's progressive reduction in weighting in spite of the relatively attractive UK valuations”. (ii) In the UK the trust's historic co-investors have “either disappeared or are cash constrained by redemptions”. (iii) Herald sees innovation “continues at an extraordinary pace” - Agreed. Read on Olympians as we race through the themes and highlights.

IT Professional Services - No razzmatazz, No gold medals

The news flow continues to edge positive, but there are negatives. There are new contracts in GenAI (IBM has >US$2bn bookings and has GenAI use cases in revenue growth, cost reduction and doing new things, i.e. transformation, and was happy to name check a UK central government department on the analyst call, Capgemini has >2,000 GenAI pipeline deals. We feared last week that the cohort was burning through Bookings rather than replenishing but the week saw bookings recover. Also, the smattering of hiring continues. Attrition, a cause of concern, has started to return to more normal rates telling us that staff can see fresh opportunities, rather than exiting the market. This in turn helped utilisation, profitability and cash. That said, fortunes are mixed. To wit: positives at IBM and Coforge clash with negatives at Capgemini, Tieto (note: “Macroeconomic uncertainty has resulted in continued weak market demand with efficiency measures were initiated to address the current market environment”) and Sopra Steria warned last week.

Capgemini downgraded FY guidance in a set of results (26/7) that showed quarterly sequential progress. The market is “soft” which continues through Q3 but it did not see discretionary spend falling further as demand is “slowly starting to improve”. The evidence was in the sequential trends: Q2 revenues -1.9% Y/Y, H1 revenue, €11,138m, was -2.5% Y/Y. The book-to-bill was 1.02 Q1, 1.09 Q2.

CEO Aiman Ezzat said that the recovery “is particularly visible in North America”. But the outlook in the automotive and aerospace sectors was worse, with a slower recovery in financial services, indeed the theme through the analyst call was recovery slower than expected. Revised FY revenue guidance was growth rate of -0.5% to -1.5%, prior 0% to 3%, with operating margin guidance unchanged (13.3% to 13.6%).

Operationally: (i) Capgemini has 350+ new GanAI projects with >2,000 deals in the pipeline, and it trained 120k employees on GenAI tools. (ii) UK/Ireland revenue (12% of Group) was -2.8% Y/Y, driven by Financial Services and Consumer Goods & Retail sectors with strong growth in the operating margin at 20.5% from 18.4% prior. (iii) Public Sector (15% of group) grew +3.0% Y/Y, of which +2.4% in Q1, with +3.6% in Q2. (iv) Like elsewhere, there was a strong FCF recovery, FCF + €216 to €163m. (iv) from the skills portfolio the best growth rates was in Strategy & Transformation - usually a harbinger of larger transformation deals.

SopraSteria reported UK (17% of Group) revenue €487.3m, 3.1% Y/Y even after “declining slightly in Q2, notably as a result of the electoral context” while the operating margin, 11.6%, is +0.2 points Y/Y. At Tieto there is a new restructuring initiative which impacts 110 FTE in the Tech Service division. Revenue was -4% Y/Y as the segment was impacted by “continued market softness and volatility in hardware and software reselling” but cloud platform revenue and security services +17% Y/Y. The Q2 Book-to-bill was healthy, and with improved profitability (i.e. the effect of the downsizing) Tieto guided that Q3 Adj EBIT margin would be “at or above” Q3/FY23.

Being concerned about the aftermath of UK public sector tech spend we chatted to Kainos CEO Russell Sloan who reminded us that the new administration is still in the honeymoon period. “The pace of early activity and the focus on delivery is encouraging, and it needs to follow through into actual delivery. Tech is not mentioned explicitly in Labour’s five missions but it will be vital in enabling growth (the first mission) and in providing the transformed services that achieve the other four missions on energy, health, justice and education. Safely harnessing the potential of AI is key.

This administration has made only one Ministry of Government change, but it’s one that we expect will have a big impact. The bringing together of CDDO, GDS and i.AI under one roof and into the Department for Science, Innovation and Technology (DSIT) gives DSIT an exciting role to play in the future of public sector tech in the UK.

The Spending Review to decide public sector budgets from April 2025 onwards is now underway, with a likely Autumn budget to come, and the impact of the changes in DSIT still to work through. After that we’ll know a lot more, and I’m enthusiastic about the future for tech in Government under this administration.”

Caution: Influencing drivers on utilisation in the cohort – hiring & training

As the hyperscalers come under scrutiny for their Capex spending, remember that IT Professional services companies must build their GenAI capacity: hiring and training (note: Sopra trained 4k consultants in the period, Capgeminin 120k). Large scale hiring and training will dent utilisation and profitability. Similar to the hyperscalers, for us, this is a case of ‘damned if you do, dammed if you don’t’. We would rather companies engaged with investors, took the financial hit and so remained relevant to changing buying patterns.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

The week 2 IT Professional Services vendors - what the numbers tell us

Source: Company data, Technology Investment Services

Recruitment - the thread of disappointment continues to unravel

Sthree H1 results

In the wake of downbeat commentaries from Robert Walters, Manpower and Hays, Sthree’s disappointing market prognosis didn’t disappoint. For Sthree the market remains challenging “for longer than anticipated”. H1 net fees -7% Y/Y, but operating profit, £37.7m, was + 3% Y/Y as Sthree stated that market sentiment “remains largely unchanged” characterised by new project expenditure taking longer resulting and a continued subdued new business activity. Business mix: Contract business -4% like-for-like and is 84% of Group net fees, Permanent net fees -18% Y/Y. As to skills: Engineering (29% of Group net fees) +8% Y/Y “across most regions”; Clean energy/renewables +15% Y/Y; Technology (48% of net fees) -9% Y/Y; Life Sciences (17% of net fees) -16% Y/Y. Note: UK net fees -9% Y/Y, with growth in Engineering +18% Y/Y, with Life Sciences -26% Y/Y and Technology -5% Y/Y.

Tech recruitment companies are at the front end of the tech economy as hiring drives growth. For their part tech recruiters pay decent dividends, are ‘cheap’ on valuation yardsticks, yet the cohort remains a ‘point of the cycle’ play. Given our cautious stance on a recovery this year (2024 is a muddling along affair) there are better returns elsewhere. But the recruitment cohort is bought in any market recovery.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

Analytics and cloud - A tale of two contenders

SAP remains of interest as it informs us about the demand for cloud migration in the enterprise market, where it is a bellwether. SAP Q2 Group revenue was +10% Y/Y to €8.29bn, of which cloud revenue +25% to €4.15bn. The switch from on-prem is clear as we noted that software licenses revenue -28% at €0.2bn. While it is making progress, the restructuring continues and is increased with SAP upping the FTE downsizing numbers from c8k to between 9k and 10k. Positively, the majority should be voluntary leavers plus internal re-skilling. SAP guides that it should exit 2024 with a flat Y/Y headcount. SAP reiterated FY guidance.

Meanwhile ServiceNow is on a tear. Its Q2 exceeded guidance across the board. It raised FY2024 subscription revenues and operating margin guidance. In the hall of fame: Subscription revenue+23% Y/Y, Group revenue, US$2,627m +22% Y/Y, Current remaining performance obligations, US$8.78bn +22% Y/Y with total RPO +31% to US$18.6bn. ServiceNow bills itself as the “AI platform for business transformation” – a moniker that a few companies could claim. ServiceNow Chairman and CEO Bill McDermott (yes, him from SAP) said that CEOs are looking for “new vectors of growth, simplification, and digitization. ServiceNow intends to reinvent every workflow, in every company, in every industry with GenAI at the core.”

Selected cohort KPIs

Source: Company data, Technology Investment Services

IaaS - beyond the hyperscalers medal hopefuls

Given that cloud native apps need a cloud we maintain our IaaS interest.

Our reward was the Q2 from Alphabet where Cloud (GCP) revenue was US$10.35bn, marking the first time that it exceeded US$10bn in quarterly revenue. Also, the scale effect is unlocking better operational leverage with US$1bn in operating profit.

It may look as though the IaaS market is the sole property of the hyper scalers but that is not the case. To be sure at SAP IaaS revenue continues to drift downwards, but the wider cloud migration continues.

This was brought home by Beeks Financial Cloud which posted an FY trading update. Their headline was 27% Y/Y revenue growth, which percolated to a beat to FCF, a beat to net cash (£6.58m vs £4.41m in FY23) and a beat to profitability – all illustrative of improving unit economics. CEO Gordon McArthur commented that the record results were a testament to Beeks’ growing reputation. For us, the fact that Beeks did not suffer outage, or break SLAs, on the 19 July CrowdStrike outage will only copper bottom that reputation. Beeks received ISO 22301 certification, all about resilience and continuity, only a few weeks ago that will further strengthen Beeks’ reputation.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

The profit surge at Google Cloud

Source: Company data, Technology Investment Services

Health-tech - No shortage of potential in the GenAI Age

Cambridge Cognition, Trading Update & Board Change

Cambridge Cognition develops and markets digital solutions to assess brain health, trading update. Downsizing the development and operational costs continue as the company looks to build profitability. Interim period revenue, £5.6m, was down from £6.0m last year, Adj EBIT loss £0.1m reduced from -£2.1m Y/Y. Cash, £3.4m, vs £3.2m in December but it followed a £2.2m placing. Revenue was mostly from existing customers but there was a contract with a new top ten pharmaceutical client. The contracted order book (30/6) was £14.6m, £17.2m (31/12). Matthew Stork, CEO said that the Company has a “healthy forward pipeline of opportunities including multi-contract opportunities with three large customers”. As announced in May, Stephen Symonds steps down as CFO at the end of July 2024 and recruitment of a new CFO “is progressing well”.

Kooth Trading Update 25 July

Trading is in line with expectations, though Kooth cautioned on H2 currency headwinds. Operationally it is making progress in the US (70% of the Group revenue) where since ‘go live’ in California (1/24) it has contracts “in every one of California's 58 counties”. The company is “nearing the launch” of its partnership with Aetna Better Health to pilot its services in Illinois, continuing to deliver services in Pennsylvania, and is engaging in contract extension negotiations. There is a strong pipeline of new US business and anticipates new contracts being signed in late 2024.In the UK, Kooth is NHS England's largest single access provider for mental health support for under 18s. We note the comment “Following the election of a Labour Government, which made plain its focus on mental health in both its manifesto and the recent King's Speech, Kooth believes that renewed focus will be placed on this important area”. The Company continues to prepare for the launch of Soluna in the UK which it anticipates for Q2 2025. Net cash (30/6) £14.9m, £11.0m Y/Y.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

Internet Services & Adtech – improving trends, but not off the advertising blocks yet

From Alphabet Q2 results we were also pleased with the return of the Google advertising where revenue rose to US$64.6bn, US$58.1bn last year and bested consensus (US$64.51bn) from Reuters. A fourth straight quarter of revenue growth, telegraphing an uptick in the advertising market and given that on Monday Google ended plans to remove user-tracking cookies from its Chrome browser,we wonder if the Adtech Winter may be coming to an end. Valuations across this cohort continue to say ‘wrap up warm’. Here too we are looking for evidence of a wider improvement. In this there was some supportive tones in the Audioboom Group plc H1 results.

Audioboom is the biggest independent podcast company and the fifth largest podcast network in the US. H1 results featured revenue, US$34.1m +7% Y/Y, Adj EBITDA US$0.3m flat Y/Y but Q2 was the third successive quarter of positive Adj EBITDA. Note (i) Record average quarterly eCPM (revenue/1,000 downloads) in Q2 of US$60.09, +38%, (ii) Average Q2 brand advertiser count was 8,062 (from 8,042 Q2 Y/Y). This was despite the average Q2 global monthly downloads 94.8m down from 125.9m Advertising demand strongest for the past two years. We were encouraged by the advertising related KPIs but we confess to being disappointingly when CEO Stuart Last commented the Board was working to understand the benefits and requirements of listing Audioboom in the US. We appreciate that Mr Last is US-based, much of the revenue lives there, but at c£37m market cap Audioboom would get lost in the US.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

Cyber Security - still winning as CrowdStrike fell at the hurdles

Corero Network Security Half Year Trading Update

While the larger cyber software companies tell us that the segment is consolidating on a range of suites, for us this remains a point product market. And the CrowdStrike outage will only ensure that it remains point as end users appreciate that no one product /Suite addresses all vulnerabilities and as no product is perfect buyers will have seemingly overlapping products. This gives continued momentum and opportunity for smaller companies. This was evidenced in the new momentum at Corero (distributed denial of service). Trading highlights included 16% revenue growth to US$12.2m, ARR +12% Y/Y to US$17.2m, EBITDA US$0.7m, ‘record’ cash US$7.9m. Of note (i) New deals secured in eight countries across four continents, (ii) added ten new direct customer wins.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

UK group

Eleco Plc H1 Trading Update, 25 July

Eleco (software for the built environment) is more interesting post the UK election given the new UK administration pledge of a wider building program. H1 trading is in line with FY market expectations. The update features news of record ARR growth (30/6 i.e. ahead of the election period) +31% Y/Y to c£25.8m, with Group revenue +21% Y/Y to c£16.3m, organic +12% Y/Y. Cash £12.0m, £9.4m Y/Y. Jonathan Hunter, CEO reminds of the recent launch of AstaGPT where customers use GenAI to find tailored support from the knowledge bank of documentation. “Eleco is well positioned in an attractive market that is increasingly utilising technology to meet the demands of the built environment.” More at the September interim results.

Hardware/Semi - Beyond Nvidia

Alphawave IP, Q2 2024 Trading and Business Update, 24 July

The third consecutive quarter of bookings above US$100m, at US$107m, +27% Y/Y. The period featured a record design win quarter with 14 new design wins, due to industry adoption of chiplet architectures. Alphawave IP makes ultra-high-speed data connectivity for AI, compute and networks. The results show real momentum with Licence and NRE (non-recurring engineering) being +98% Y/Y, but Royalties and Silicon Orders were -65% Y/Y. Tony Pialis, President and CEO said: "Once again, we are pleased to demonstrate our leadership this quarter with new IP, Custom Silicon & chiplet design wins in advanced nodes and a new design win with a hyperscaler leveraging our 112G and UCIe-based solutions. In addition, we are seeing strong interest from the industry for our portfolio of scalable, interchangeable and customisable connectivity and compute chiplets, including our Arm-based compute chiplets."

Nanoco Board and Management Change, 25 July

Nanoco (development and manufacture of cadmium-free quantum dots) announces that CEO Brian Tenner has advised the Board of his intention to leave the Company to pursue new opportunities. Mr Tenner stays until a successor has been appointed and provides a handover and consultation. A CEO search is underway. Chairman Chris Richards, after his nine-year tenure was s to step down at the next AGM, has agreed to stay until a new CEO is in place. Mr Tenner has been at Nanoco for six years, as COO, CFO and CEO. The main event for the past few years was the settlement of the Samsung litigation (great job) this leaves a new CEO with cash to re-build the commercial business.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

IT Infrastructure Services

Econocom H1 revenue, €1,335m, + 3% Y/Y, +2.6% in Q1, with growth across the businesses and is in line with 2024 guidance. EBIT €38.3m was impacted by the “significant investments” in sales, IT and security. Trends in continuing operations. Econocom reiterated 2024 guidance i.e. revenue growth between 3% and 5%. No sign of the deteriorate in working capital in this inventory re-build phase of the cycle.

In an unscheduled Trading update (26/7), Computacenter stated that hardware demand has been weaker than expected, with greater caution by purchasers. Whilst the committed product order backlog has “grown significantly” since the start of the year, the company guides that H1/2024 Adj PBT will be c£87m, £121.8m last year. H1 was impacted by the timing of fulfilment of certain North American large orders which have since budged into H2, and the phasing of strategic initiatives investments accounts for an additional c.£6m (H1/23 £0). The FY expectation investment is unchanged, £28m to £30m.

Computacenter expects stronger H2 momentum because of the size of the committed product order backlog and pipeline. While mindful of the continuing geopolitical and macro uncertainty it maintains prior guidance (to make progress in FY 2024) qualifies that while this refers to constant currency, it expects a negative c£7m translation impact on FY Adj PBT. Learn more at H1 results, 9 September.

Computacenter announced (26/7) a share buyback programme to repurchase up to 11,414,110 shares, 10% of market cap, spending up to £200m. The programme ends on or before 30 June 2025. We confess to having mixed feeling about buybacks as they make illiquid shares more illiquid, but they are an effective bulwark against a declining share price (recap: Q2s from CDW and Insight on 31/7 and 1/8 respectively). On a more provincial basis lowering the denominator improves the EPS, thereby (hey presto) drawing that record of 20 years of unbroken EPS growth one step closer.

The cohort constituents

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

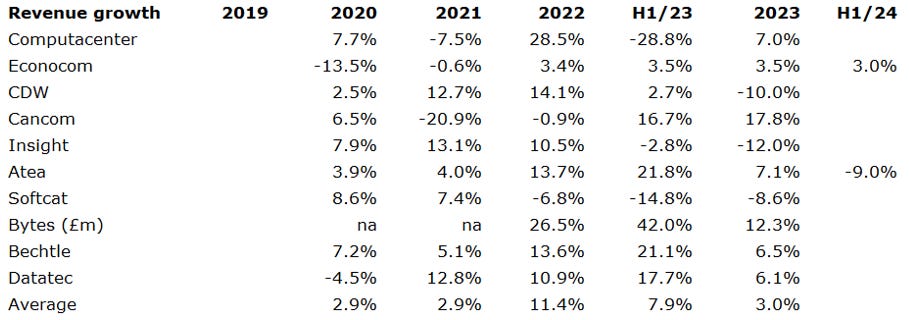

Week 2 revenue growth rates for the cohort

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

The data

The index story

Valuation heatmap

Note: Priced 25 July. Source: Company data, Yahoo Finance, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.