The long and the short of IT

"I want to be rich," says Dick, "So I'm going to London!"

The Lord Mayor’s ‘Growth Unleashed’ and the final of Britain’s Got Startups - this week was all about London. As I spoke to The Rt Hon. Lord Mayor of London Alastair King (#696) my thoughts drifted to Dick Wittington (Lord Mayor: #126, #127, #136, #149). He came to London thinking the streets were paved with gold. Mr King’s London is paved with Tech Entrepreneurs, and cats. We offer thoughts on ‘Growth Unleashed’. The Britain’s Got StartUps made it to London after a journey which started in Edinburgh in a cold January. A superb cohort of StartUps and ScaleUps were marshalled by the indomitable Chris Lowe and the indefatigable Jensen Brooke for the London final. The winner was Sophia Jarvis of Mia Wealth: London has a new queen.

In this edition, we also explore the gating factors on UK public sector Digital Transformation and uncover the secret behind our UK software cohort’s recent surge in profitability. Meanwhile, the week’s Tech Universe results and updates span UK Software (ActiveOps and here too, AdvancedAdvT, Cirata, Eagle Eye); IT Infrastructure Services (Bytes); IoT/Smart (Quartix, Seeing Machines). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

1. Growth Unleashed at the Mansion House

I attended ‘Growth Unleashed’ hosted by The Rt Hon. Lord Mayor of London Alastair King where the ‘heavy lifting’ was carried out by the Worshipful Company of Information Technologists (WCIT). The afternoon saw 21 UK tech Startups and ScaleUps. Each had a 10-minute slot (a big elevator) to pitch to 250 blue-blooded institutional investors, banks and VCs. Chatting to the Lord Mayor, he told me that his aim is to ensure that the City is the place where Innovation meets Capital – interesting compare with New York where its message is about ‘tradition meeting innovation’. The Lord Mayor is an unabashed supporter of UK growth and the many initiatives to get these companies to scale, not just in the UK but to create Global Champions. In a former life, Mr Lyons was a VC (BTW: Dick Whittington was a mercer), so he knows, and is a rallying supporter, for the UK tech sector. “Be bolder” he challenges. Unlike Dick, Mr Lyons only has a year in post, but is making a big impression.

The companies on the podium, in the order that I met them:

Meshed: Mark Costello. Every technology shift has led to a new entrant in the insurance industry taking a significant share from the incumbents: think Direct Line (mobile phones), Compare the Market (search browsers) and Moneysupermarket (price comparison), as examples. Meshed could be the AI play. Today Meshed is targeting its AI Agents at eliminating waste on admin costs and losses due to underinsurance. This software product is built from lots of Subject Matter Expertise with an AI Voice agent, and an engine which qualifies risk, and gathers and assesses any pre-existing documentation (so that you don’t spend forever going over your details) for the information that they need. Then, the final quote uses the ‘human in the loop’. The ROI is the quoting process which is reduced from 1 hour to 9mins – in fairness the ‘feel good’ in customer experience should be many times greater. The company is initially targeting Landlords and Accountancy partnerships where they see a fast track route to £10m revenue. The MVP was shipped at the end of January. In time, the aim is to create their own insurance products, and it is already speaking to two insurers.

ICON: John O’Connell. This was our favourite B2B enterprise software company. This is a simulation software company operating in Digital Engineering. This was originally founded as a Consultancy (1992) which then productised the IP (initially on-prem, but then cloud native). Now the revenue split is 80/20 favouring software. The company has revenue traction (ARR £3.1m), is growing (50% CAGR) and is profitable (EBITDA £0.23m). We noted strong customer traction (c.50 customers, primarily in motor engineering) and it has already internationalised (US 18% of Group revenue, Japan 36% and Korea 14%) but moaned about the size of the revenue. The company just raised £4.5m VCT funds and is currently conducting a secondary for c£3m in order to accelerate GTM, and add AI and ML to the platform and so accelerate simulation workflows. Note: This was the John O’Connell, chair of ScaleUp Group, on the podium- not some doppelganger or deep fake- presenting for the company.

Lupovis: Ribbie Binnie. A Cyber Security company focused on ransomware. It developed a picture of how ransomware attacks occur and uses that pattern/template to map and stop future attacks. The data mapping of prior ransomware attacks was sourced from:

public data breeches,

their own analysis engine and,

customers where they have installed networks sensors.

They noted the legislative driver with Digital Operational Resilience Act, DORA, which makes companies document their penetration testing. Lupovis is to conduct a Series A round shortly. While we appreciate the strength in the suite approach in the cyber industry, for us, cyber has been a point product market, and importantly one where customers overlap functionality knowing that there is no silver bullet, every product has gaps hence buyers usually overlap functionality, and thereby giving space for new innovative solutions. Admittedly this resembles a spaghetti junction, but the downside of ‘getting it wrong’ impacts careers (technical and board-level).

Capably: Rafa Pulido. The vision is to “supercharge your company with AI”. This 18 months old company already has 30 customers in Retail and FMCG. The offer is AI agents who tackle routine work and it has already developed an Automation engine which looks at a company’s existing processes/workflow and then automates where it can. So far, it is claimed to be able to automate from 20% to 30% of ‘work’ for their clients. While starting with the routine (think the current BPO or RPA market) the aim is to automate more complex tasks (i.e. killing off BPO and RPA vendors). However, we note a recent study by Apple researchers which concluded the AI models offer the “illusion of thinking” and fail to solve complex tasks – we agree with this view. We confess that while the Capably goal might seem too lofty, as others are also targeting the space, why not be super ambitious? The company has traction (Q1/25 ARR of US$300k, which by Q2 was US$480k) but for us this is more illustrative of the amount of eyeball interest in this area.

Note: A leaked Microsoft email: “AI is now a fundamental part of how we work. Just like collaboration, data-driven thinking, and effective communication, using AI is no longer optional — it's core to every role and every level.” Microsoft managers have reportedly been asked to consider the extent of AI use in the staff appraisal process.

Quantum Base: Robert Young. This is a listed company, since 4 April, which is trying to create a new global standard for securing physical objects. It uses Quantum ink, packaged like a QR code, to establish identity. The use case is anti-counterfeiting in areas like tax stamps (found on cigarette packets - apparently still a thing) and in the pharma industry. While QR codes are easy to fake, quantum ink tags are not as the “particles decide if they want to scatter and so are impossible to replicate”. The company was originally a spin-out from Lancaster University and has been 12 years in the making. It has 30 granted patents, another 10 being granted and a further 19 pending. To date, it has two customers, an unnamed secure printing company (doing the tax stamps on cigarette packets) and it has a framework agreement with Signe for, amongst other things, sports garments. This referenceability has opened up a larger pipeline.

Pikl: Louise Birreteri. This is an insurance product for flexible cancellations for the global vacation market focused on infrequent destinations (say AirBnB). The customers are professional property managers looking to offer “flexible cancellations” policies. The company is getting traction: £3m ARR which it hopes to grow to £10m by 2026. While the CEO confesses that the company needs to “professionalise how we operate” in addition to the revenue growth we also noted that it has been successful achieving a 32.5% commission –the company is not comprised of amateurs.

Raffolux: Gerry Lianos. With a lovely purpose, to “make winning accessible to all”, this is a gaming company with a strong charitable component. While operating in a large but competitive market (c.£2.4bn) the company has good traction to date with FY revenue £8.1m +40% Y/Y, from 30,000 active players. The secret sauce appears to be:

create lots of winners – c.20,000 winners each week and,

targeting female gamers; 53% of Raffolux players are women.

The stats tell us that female gaming is on the rise and currently has a c.60% female participation rate with 46% of women gaming in the last four weeks. For investors (like so many attracted to the gaming companies) the unit economics are a delight: CaC <£15 and LTV is £250. The company is raising money, looking for a £5m investment as it aspires to grow revenue to £180m in 2029.

Caristo Diagnostics: Prof Keith Channon. Heart attack deaths number 371.5k/year. Caristo Diagnostics aims to transform cardiovascular care using patented AI/ML algorithms to detect inflammation around the heart, which traditional scans do not capture. It claims that the symptons of most people who die would not have shown up using current tests whereas CaRi-Heart can detect and quantify inflammation. This in turn enables personalised risk predictions and treatment. In tests using CaRi-Heart more than half of patients have changed their cardio treatment. Targeting the US$8bn market of unmet clinical need, Caristo is now ready to go to market here and in the US, following 15 years of research and having received FDA approval.

Security Gen: Dimitry Kurbatov Co-Founder. The company, three years old, targets Teleco cyber security and is already successful with 53 customers across 39 countries. It is growing by 50% and is profitable. There are three aspects to the solution:

identify and fix weak spots,

prevention measures and,

constant security surveillance.

The Telco focus narrows a very wider cyber industry to a few specialists in addition to itself, ENEA and Mobileum. From the deck there is a very impressive team. The company is currently raising £4m to accelerate growth with 60% earmarked for expansion sales marketing and partnerships.

Dexory: Oana Jinga. This is a robotics and AI company selling into warehouses where it automates data collection for warehouse operations. Founded in 2015 the company is present in nine markets, four counteries and has 160 FTEs. The client reference names are very impressive. The solution is a physical autonomous robots which moves through the warehouse lanes collecting data which it uses to create a digital twin which are of two types:

targeted at improved inventory management giving the ‘as is’ state of the warehouse and,

optimisation digital twin which will streamline operations and recommend areas to improve scale and productivity.

This was a very impressive case study.

Greywolf Therapeutics: Peter Joyce. Using a pill rather than an injection, Greywolf hopes to be a paradigm shift in disease targeting for immunology testing. The company has developed a new approach to detection and via its code stimulation can create new responses. There is in the future the opportunity to enter the Virology market. To date, the company has raised US$28m Series A and US$99m in Series B, which has funded the company through to the end of 2026.

CoBa: Carl Hasty. This is a second time successful founder. CoBa (a.k.a Connected Banking) is gaining traction at tier 2 banks who are‘missing out’ as the smart new fintechs ‘win’ the highly profitable customer transactions delegating (classic) banks with the mundane and less profitable. CoBa is live at Lloyds Bank (for the past six months) where it has achieved a demonstrable ROI of 20%, 100% straight thru processing, Zero client side errors and 15,000 people hours saved. As banks are a (gold)mine of old, fragmented, silo data, CoBa also has a service where it offers actionable insights based on interrogating those historical transactions. It is also working with Lloyds Bank to co-develop an interbank system. In the next 12 months CoBa hopes to increase ARR from £1.8m to £3m+ as it begins to close in on its current 30+ sales opportunities.

NanoMation: Teja Potocnik Founder. This Cambridge spin-out, is a software application with the initial use cases targeting the Semiconductor industry (but there are applications including Sensing, photonics, neuromphorice computing and quantum). This addresses the problem that nano materials are hard to scale. This accelerates nano adoption, reduces manufacturing time and so should unlock new applications. The company is targeting foundries, semiconductor foundaries, consumables and OEMs. The company is raising money £1.5m for two years of run rate for widening the team and IP development. Ms Potocnik has an identifiable end market and a pronounced ‘need’.

Ocula technologies. CTO Tom stepped in to present as his Co-founder Greg Fletcher welcomed a new baby at the weekend. The company developed an AI Copywriter for ecommerce that creates brand-aligned SEO-optimised product copy. The problem is that AI search engines (think of Perplexity) are great at search but do not have any e-commerce capabilities. Also, in this environment Product pages have become the new homepages (i.e. where the buying happens, rather than just the product definition), and Copywriter gives more contextual information accelerating the customer journey. The product ROI is impressive: customers report 15% increase in traffic, revenue and savings between three and five equivalent FTEs. Unsurprisingly at this early stage, given the impressive traction of AI search engines who we all acknowledge have the potential to ‘kill-off’ social search, this is a company getting lots of client interest.

Companies that unfortunately I could not meet:

enAcuity: Keyhole surgery cameras

Meatly: Cultivated meat

Certino: Cloud-based expatriate payroll calculation.

Microplate DX: antibiotic susceptibility testing diagnostics

Kooth: Digital Mental Health (listed company and part of our UK Software cohort).

Space Solar: Developing space-based solar power – affordable energy from space to Earth

Stroll: B2B digital therapeutics startup that deploys clinically validated rehabilitation software on AR glasses. Disappointed that I did not see this one.

Hat tip to the sponsors, as it could not happen without YOU: WCIT (who marshalled a big team for the event led by Rob Wirszycz, Mark Bridger, Mike Day, Gary Moore), Cavendish, Founders Forum, Goodwin, HSBC Innovation Bank, Insurtech UK, Lloyds Banking Group, Oxford Investment Consultants, ScaleUp Group, Think&Grow, University of Strathclyde, Venturepath.

BTW: For the companies reading this post - here is a popular pitch deck template

Lord Mayor grafting at Growth Unleashed

Source: WCIT

2. Britain’s Got StartUps: FINALE

The word ‘movement’ cropped up several times at the Britain’s Got Startups presentations. But the word best applies to the 230-strong community who have been inspired by founders Chris Lowe and Jenson Brook - who say ‘pah’ to Mr Johnson. Mr Brook’s passion is to:

Increase investment into regional businesses,

Encourage the UK sub-regions to collaborate and,

Educate and build an ecosystem around UK regional fundraising.

The data (source: Beauhurst) informs us that London has cornered the UK market. In 2023, the capital was home to 35% of growth companies and garnered 50% of equity raised. By 2024, London sat on 32% of those companies and they raised 61.2% of the available growth equity. Plus 79.2% of early stage investors have a London postcode.

The final yesterday was the culmination of 398 applications, who funneled to 45 at the regional finales, and narrowed again to ten finalists.

Note: Despite a continuing uncertain world there was a groundswell of optimism (that ‘fed up of being fed up’ feeling). Conversation with Pierce Polak of Fiel Ventures, Valerie Aelbrecht of AlbionVC, Ross Goodwin of Salica and Steve Lemon from Volution all agreed that there is more optimism in the air. Mr Lowe even talked about more enthusiasm for IPOs. That said all exits discussed were trade sales. . . .

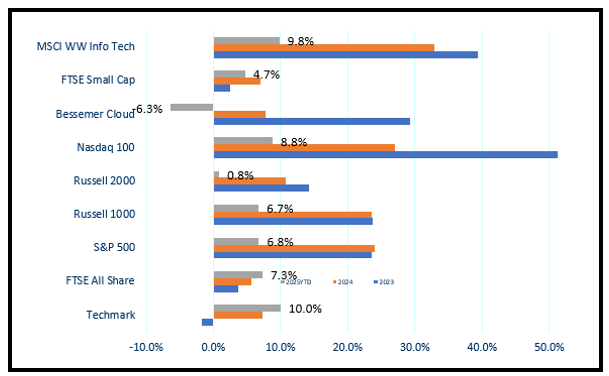

Aside: There are reasons to be cheerful (but beware untold messages in Bessemer) Index YTD performance

Note: Priced pre-market 4 July Source: Yahoo Finance, Technology Investment Services

The companies on the podium, in the order I met them:

Adora Digital Health: Ed Smith Founder/CTO. Adora aims to transform health for aging women and has developed (is already scaling), a conversational AI tool which addresses education in pre-menopause, perimenopause and post menopause women’s health. The chatbot is a large subject matter database, with a ‘human in the loop’ – usually a medical professional (nurse or specialist practitioner). A Class 1 medical device (i.e. considered a low-risk, designed and tested to be safe and effective), this has the potential to have a major impact on the life of the c.80% of women who have significant symptoms. This addresses a very large societal and health issue as 10% of those affected quit work, 28% reduce hours or responsibilities and leads to c.£10bn loss for the UK economy.

The company is already getting traction with public (Scottish Government) and private sector (10 enterprise deals, namechecks for Cargill and Allianz, as well as occupational health providers) contracts. The current renewal cycle has a 100% strike rate. We noted very strong NPS rates (80). Mr Smith is very inspiring and his deck says that he is supported by a strong team. The company is currently raising £1.5m. No stranger to London, the company was the Winner of the 2025 AI Pitch in Parliament. Aside: Rummaging thru bounce rate data between womens and mens health apps showed me that women are better better digital consumers than men, with better staying power and engagement, hence the Adora approach looks, to me, a strong contender in this market.

Staxy: Will Line CEO/Founder. Fans travelling to and from games make up c.50% of their club’s total carbon footprint. This forms part of Scope 3 emissions reporting under the Greenhouse Gas Protocol and clubs are expected to estimate these emissions based on attendance, distance travelled, and mode of transport. Also, the UN Sports for Climate Action Framework and Premier League’s Environmental Sustainability Commitment encourages clubs to account for all significant emissions, including fan travel. But so far there is no universal legal requirement forcing football clubs to report fan travel emissions, even though some (Manchester City and Tottenham Hotspur - common the blues and whites) are including fan travel in their Scope 3 reporting.

Transport is #1 source of emissions and in the UK there are currently c.50k organisations that track travel (either to meet regulations, measure carbon, sustainability initiatives, or improve customer satisfaction). These organisations are responsible for c.3.5bn journeys and their measurement methods are 86% manual surveys which has a 40% error rate. Staxy throws tech at the problem and has developed an “end-to-end mobility and data solution” - tackling this un-met need.

With Staxy, the data is collected using geospatial AI, the data is on your phone (not just football fans have phones). The phone also provides GPS motion tracking. This is linked with a multi-modal mobility platform which brings in train, coach, carpooling, public transport etc. This creates another revenue stream (B2C based on ticket sales, in addition to the B2B to the clubs, institutions etc who pay an annual license). For us a large new revenue opportunity for clubs, a very large improvement in travel experience for fans as club can deliver better services to their supporters (on yer ‘ead). So far Aston Villa gets it, so too does the University of Manchester - the first two Staxy customers.

Mia Wealth: Sophia Jarvis, CEO/Founder. Mia is a saving app targeting the female-led meaningful gifts for children. Ms Jarvis aims to replace some of the 8.5m toys and £3.2bn spent on children with financial products (tax free investment account) for children and so transform gifting for children. The app targets mothers who are concerned about their children’s future (unsurprisingly a very large proportion) and more surprisingly is the large TAM (c£10bn in house purchase help from the bank of mum and dad, alone). Ms. Jarvis has a prior background in wealth management.

Having just received FCA approval, on the development path is the launch of a Junior Pension next year This feels like a large niche, not entirely ignored by the large wealth managers (but as Ms Jarvis argues they typically target ‘men’ – who often do not make these decisions).

Ms. Jarvis (the app is still in early user testing) should enjoy success. Ms Jarvis is a winner and delightfully is currently raising money – form an orderly queue.

Circular 11: Founders Conor Winter and Ben Gibbons. The team met while working in Nepal and dreamt of turning global waste into next gen construction materials. Since returning to these shores, the pair discovered that there will be a shortage of construction timber by 2050. Coupled with this, plastic waste is a major health and environmental hazard and in many countries it is buried, burned or thrown into the landscape. We, dedicated recyclers, send 92% of household plastics to waste - adding to the 9.8m tonnes of plastic waste collected. Of this, only 0.8m tonnes is sold on. The rest cannot be recycled.

Conor and Ben decided to bring these forces together and have create a timber alternative from discarded plastics. This material is cheap (less than half the price of commercial lumber), long-lasting (3-5x timber), and is Carbon Negative as it mitigates 0.52 tonnes. Circular 11 is born.

The team sees immediate opportunities in the UK Fencing and Furniture materials market (a market happily spending £1.1bn a year). They have raised £1.1m pre-seed, but now their manufacturing needs to scale up (current capacity 30tonnes/month), but with two paid national pilots, two UK government and three council contracts, plus £2m demand from decking companies with a further £6m under discussion in national highways – expansion is a must do. The team is raising £2m equity to access £5m construction and wholesale contracts and has already secured £800k with its projection that they will have £2m revenue by February 2026 and be profitable.

CanCertain: Dr Himanshu Kataria CEO Founder. CanCertain delivers personalised cancer treatment. It has a live-cell based approach to analyse tumors and immune cells; it does not do genome testing. Patients get results in eight days. The IP was tested by 360 real-life cases (India, UK, UAE) and in the UK the trial response rate improved from 58% to 87%. With this the guesswork in treatments is eliminated, the results are all personalised, but more importantly they are actionable as the whole cell is tested. There are no regulatory hurdles in the UK, and in the USA they do not need FDA approval. The company is raising a £2m ‘final seed round’.

Phytofoam: Peter Loou CEO/Founder. Mr Loou wants to solve a pressing concern in the construction industry: Current Insulation foam is based on fossil fuels, it is a fire hazard, it does not biodegrade. There is now a green and safer alternative. While alternatives do exist they typically suffer from poor economics and/or poor distribution.

With an October launch, Phytofoam has developed a sustainable bio-based foam using plant-based agricultural waste. Phytofoam performs just like any other insulation foam but does not have the associated environmental and safety risks. Plus it will fully degrade at the end of its life. The company sees a US$65bn industry chugging along at 5.93% CAGR – this is a big prize but the company needs cash in order to scale its production because of buying interest from the construction, packaging and furniture sectors. The ask is £545k.

BLD BRO: Tariq Kazemi CEO. Tariq founded a skincare company (he prefers to call it a movement) – some of the unit economics says this has cult status.

The product is skincare for bald guys. The promise is self-acceptance, self-esteem and happiness. This is a global demographic as 85% of men experience hair-loss and baldness brings problems of shine, dryness, sunburn, sensitivity (tell me about it). The first product was launched in June 2023 (skin care cream for dryness, shine and sun protection). It went on to be sold out twice and the very strong revenue growth continues to £3.4m annualizing at the current revenue run rate. Beyond word of mouth there is no marketing.

The unit economics are very attractive with 8.9% online conversion (note: vs the industry average of 2.9%), there are 36% repeat purchase and the current LTV is £53 with the LTV/CaC being 10x. The team are working on collaborations, influencer marketing but they have not had marketing budget to date. The product is only now going on Amazon. To fuel the new sales initiatives and new product debuts the company is raising £1m, of which £550k is committed. We note the very positive 4.9 Trustpilot review.

Microneedle Solutions: Henry Dunne CEO. Needle-based drug delivery is expensive, painful, and while microneedles alternatives have been around for long time (c. 50 years) they have never achieved mass adoption. Microneedle Solutions has developed a needle free patch. This penetrates the skin. This dissolves in an interstitial fluid, has a two-year shelf life (people stocking in anticipation of future pandemics). Best of all it is painless. The product has already been validated on 70+ animal models. It is also getting strong commercial validation with four industry and academic paid collaborations in the pipeline.

Clearly this is a huge market measured in trillions (c.US$1.9tn). Microneedle believes that it can deliver far more drugs than its competitors and is currently looking to complete a £2m seed round, of which it already has £1m committed, which includes £300k from Innovate UK.

Everybody counts: Andy Ridgway CEO Co-Founder and Tom Beaven CDO. This is a SaaS-style (i.e. subscription) Digital Education product company, whose aim is to make everyone proficient in Maths. It targets education for 3 to 14 year olds around the world (currently students in the US, UK, Cambodia and Thailand). The company is established, is generating revenue (on track for £2.5m this year) and has already raised £700k.

The founding team have oodles of domain experience (former senior educators, teachers and tech people) who point out that maths standards are deteriorating globally. Also, poor maths proficiency carries a price – estimated to be a US$62.7bn cost to the USA economy alone due to poor numeracy. Mr Beaven believes that part of the problem is the status quo and the business model of text book publishers who have no incentive to develop new teaching methodologies. The company has 5k students in tests around the world and is targeting a US$6bn accessible market by 2029.

Whilst students gain, teachers gain more from lesson plans and the student data collected means that issues and challenges (phobias) can be captured early on. The content differs on a country-by-country basis as does pricing (i.e. US$2 to $15). We noted some very good referenceability. Also, the team alluded to additional learning areas (‘art’ was mentioned) as illustrative that the underlying technology platform is neutral to the content. “We have 12 – 24 months advantage now”.

Omnos: Ben Thomson CBE FRSE CEO/Founder. 26m people suffer from a chronic disease in the UK. Healthcare practitioners may have grown somewhat immune to the problem as individual care can be neglected. Mr Thomson developed in vitro diagnostic to help the 325,000 UK HCPs to access the widest range of functional tests (160 tests from 120 labs worldwide, across 16 areas of health). With their Omnos analysis practitioners are now able to integrate the test results (a competitive USP) and thereby make better diagnostics. The company is already successful with revenue run rate of £5.5m from this six times founder, but Mr Thomson is looking to raise £5m (at an £18m valuation) to improve the range of tests (adding Alzheimer’s) and to enhance platform test analysis, recommendation and the geographic footprint into the Middle East. This is Mr Thomson’s sixth startup.

Hat tip to the sponsors, as it could not happen without YOU: novus, Beauhurst, Abstract Group, British Business Bank, SECNewgate.

3. What’s holding up Public Sector Digital Transformation? Ssshhh the people

Could it be about the fear of losing one’s job to a robot? Public Sector enthusiasm for all things AI are being stymied by a lack of digital literacy and leadership and existing digital tools are not being used to maximum effect. These are amongst the conclusions from research, commissioned by Censuswide, into public Sector DX. The findings were gathered from public sector workers in central government, local government and the NHS and include:

25% of public sector respondents said digital literacy is a crucial skill to address. As a result, 30% also said that training and development will be important in the next three years.

Leadership and vision for AI and emerging technology is slowing adoption as the data suggests that both middle management (36%) and executive leadership (34%) are seen as key barriers.

Less than half of respondents (46%) reported that they are happy with their organisation’s current digital services in place.

Granicus’ Ian Roberts: “Although the data suggests the public sector views AI and data analytics as a priority for the future, the research reveals that the sector is not benefiting from existing investment in technology to enhance service delivery. Over half of respondents (58%) said they have the correct digital tools in place, but they could be utilised more effectively for stronger outcomes.”

4. Assessing profit growth among our UK software cohort

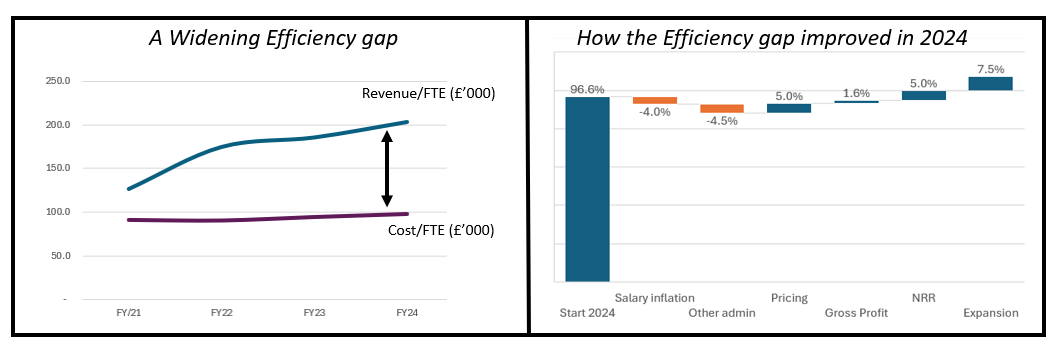

Software company profitability is improving. To wit: FY24 average Adj EBITDA improved to 20.1% from 16.7% Y/Y. In trying to understand the drivers behind the growth we note that the growth in revenue/FTE is far outstripped growth in Cost/FTE so the efficiency gap is widened. The difference improved to 107.2% in 2024, from 96% Y/Y. We let the numbers tell the story of how this was achieved (below).

Of more interest is how will this progress through 2025 as the price drivers diminish, but balancing this is the increased use of automation tools meaning fewer staff, and wage deflation should further help efficiency. However, in the current weak economic cycle, new customer CaC increases, CaC recovery extends and so companies will look to NRR, more than expansions and sell to existing more than new companies. While the evidence from our UK software cohort is currently too ‘spotty’ to draw any firm conclusions, the message from the US software (Data & Analytics) cohort from Q1 reporting season was that NRR shed 50bps sequentially in Q1 (down 20bps Y/Y) illustrating a tough buying cycle.

The FTE Efficiency gap (wider = better) amongst our software cohort

n=30 Source: Company data, Technology Investment Services

Company Results & Updates

UK Software

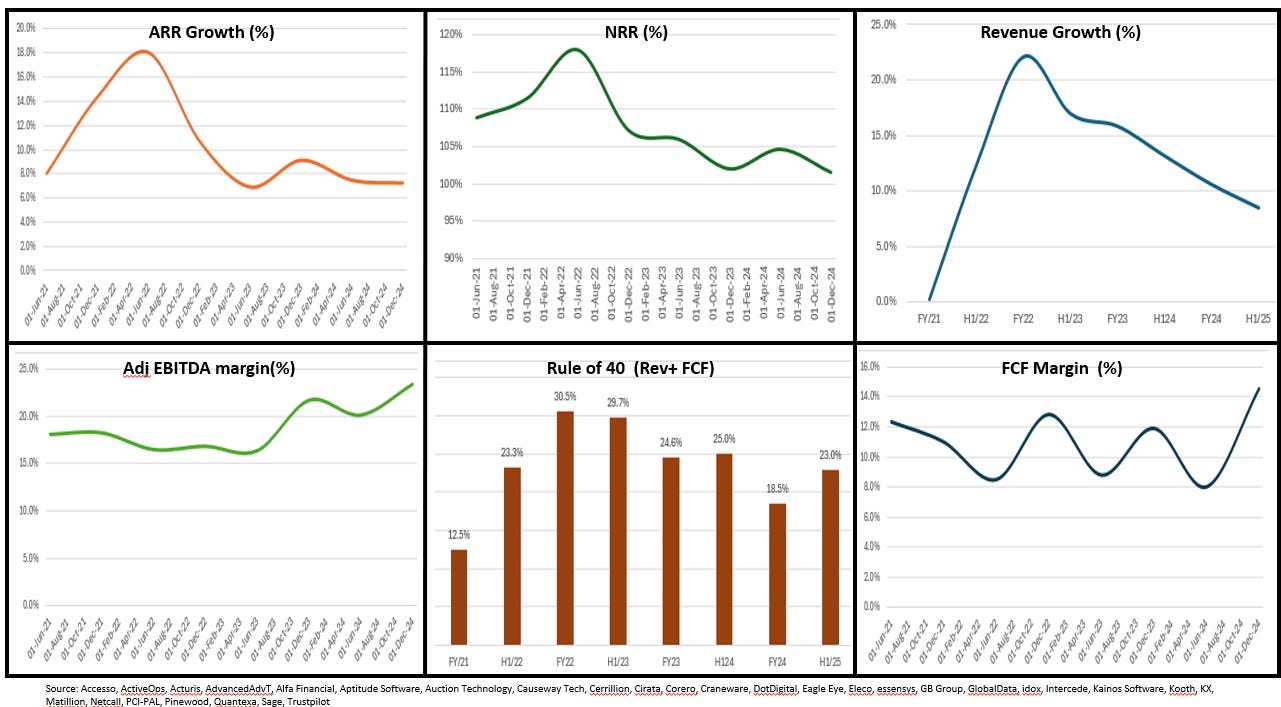

UK Software cohort: KPI dashboard

Source: Company data, Technology Investment Services

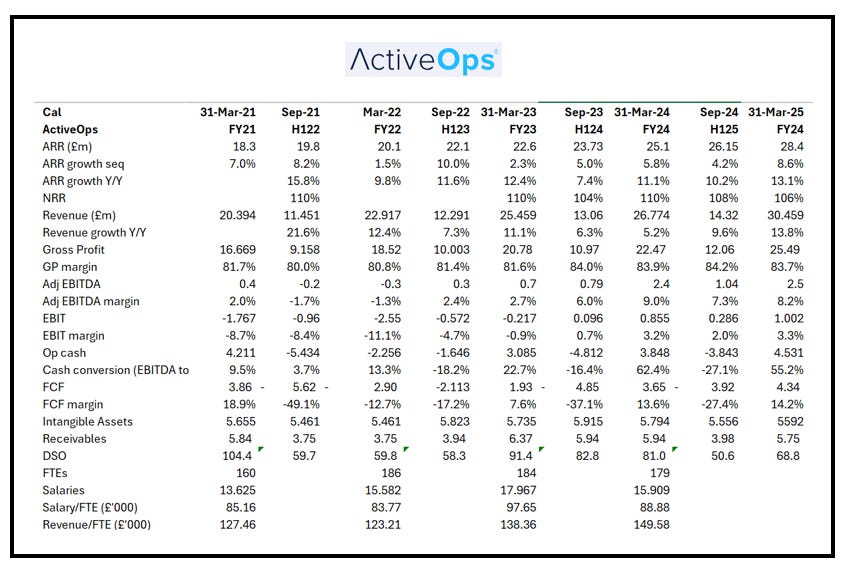

ActiveOps. A workmanlike set of final results headlining with a record number of new customer wins, 13% Y/Y ARR growth, 14% Y/Y revenue growth. Good progress in North America where revenue, £7.7m was +22% Y/Y following five new customer wins. Adj EBITDA +4% Y/Y to £2.5m. £20.6m cash from £17.6m last year. Sales and Marketing spend increased to £6.5m (2024: £4.9m), increased largely by five new sales staff hired .Of the operational highlights we noted NRR 106% (2024: 107%), 85% of customers increased or maintained ARR, Nine new customer wins – compared with three in 2024. From the product ControliQ Series 4 was launched in January 2025, with “further AI and Machine Learning features”. Trading in the first few months of FY26 has been in line with the Board's expectations with the commentary that despite enterprise spending impacted by the wider macroeconomic uncertainty, the company has seen “some shortening of sales cycles in select cases”.

Minority investment. On 26 November 2024, the Group made a minority investment in Contact Web Limited, acquiring 21% of the share capital for £400,000. Contact Web, a contact centre founded in 2023, provides both inbound and outbound customer support for the retail, healthcare and technology sectors.

Acquisition. Post the period end, 30 June, the Group announced the acquisition of a competitor, Enlighten Group Pty Ltd. Headquartered in Sydney, Enlighten is a software & professional services company in workforce optimisation, with 20 enterprise customers (financial services, insurance, healthcare) in North America and Asia/Pac. ActiveOps pays a total maximum consideration up to US$21.5m/£15.9m, payable in cash – just under 2x Enlighten's SaaS revenue run rate, c.US$11.0m/annum. The deal is expected to be earnings enhancing, anticipated EPS accretion of no less than 15% in its first full year of ownership (FY ended 31/3/27). The deal doubles ActiveOps' North American revenues and provides opportunity for cross-selling of CaseworkiQ and WorkiQ into Enlighten's customer base. From the product it expands ActiveOps' software capabilities in the area of organisational transformation and allows the combination of Enlighten's and ActiveOps' solutions over time. In time there will be “significant cost synergies” as the operations are merged (post the earnout period). Enlighten's co-founders and selling shareholders, Tony Tregurtha and Andrew Johansen, are assuming sales and customer relationship leadership roles in North America and Australia respectively.

Backstory. In the unaudited last 12 months (ended 31/5/25) Enlighten revenue was US$15.3m (£11.9m), Adj EBITDA loss US$1.0m (£0.8m) and net assets (31/5/25) US$3.9m (£2.9m). This is a blended software and professional services business - SaaS is US$11.0m. Ahead of the deal, Enlighten cut services staff.

The numbers we track: ActiveOps

Source: Company data, Technology Investment Services

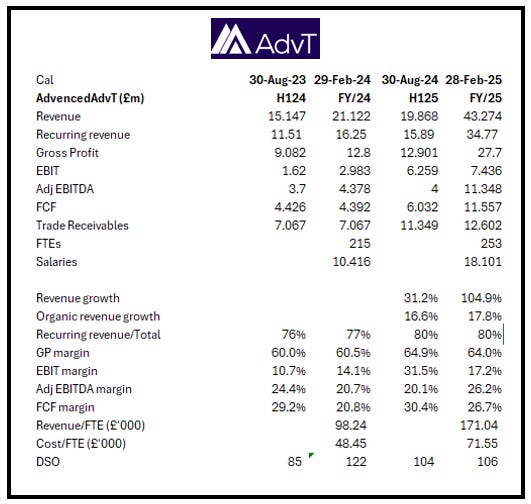

AdvancedAdvT Limited. The first 12 months trading at AdvancedAdvT (software for business solutions, compliance, and human capital management with the core being a carve-out of five businesses from Capita). While primarily an M&A proposition given the sizeable treasure chest, organic growth is also a key feature. Final results (12-months to 28/2/25, the comparative is 8 months to 29/2/24) showed revenue £43.3m (PE24 : £21.1m) with Proforma organic revenue growth 17.8% from the four originally acquired businesses on 31/7/23 and Celaton acquired 1/7/24. Recurring revenue is 80.3% of total. Adj EBITDA £11.3m vs £4.4m, PBT is £11.3m. Cash and Cash equivalent assets of £109.5m (PE24: £102.9m), made up of Cash of £88.5m and Cash equivalents of £21.0m investment stake in M&C Saatchi plc (PE24: £82.1m and £20.8m respectively).

Operational updates:

Growing momentum in the public sector digital transformation but the trend is “currently tempered by ongoing budgetary constraints”.

In the public sector, 60 organisations use the Centros Integra solution, built on Microsoft Azure. In the private sector, the Retain cloud product reported 96% Y/Y growth in SaaS revenue.

On 28 November 2024, the company created a new subsidiary, an Indian offshore development centre. It ended the year with 16 FTEs.

M&A: Acquired inSTREAM for £4.8m net of cash, 1 July 2024. This is an interesting machine-learning AI based intelligent process automation platform, offering intelligent document processing with data recognition, classification, validation and enrichment, continual process automation with machine-learning AI algorithms and analytics.

A brace of deals post the period end:

Acquired HFX Limited (workforce management SaaS platform) for £5.3m and,

acquired GOSS Technology Limited, a digital platform for public sector digital transformation for £7.1m.

Vin Murria, Executive Chair: “This performance is being driven by better operational focus, the expansion of multiyear contracts, and the positive momentum from customers embracing the benefits of digital transformation and choosing us to support their strategic delivery.” Note: It is early in the life of AdvancedAdvT but Ms Murria is well-regarded and has a track record of generating strong shareholder returns - Go Vin.

The numbers we track: AdvancedAdvT

Source: Company data, Technology Investment Services

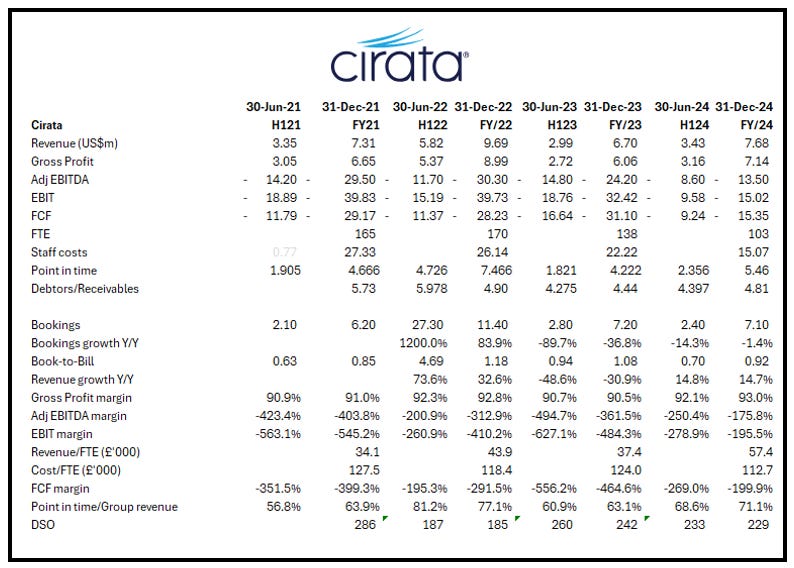

Cirata. With the period end Cirata starts to announce contracts: this week a US$0.7m two-year Data Integration renewal at an un-named “top five Canadian bank”. The contract has multiple use cases, including data migration, synchronisation, and disaster recovery.

The numbers we track: Cirata

Source: Company data, Technology Investment Services

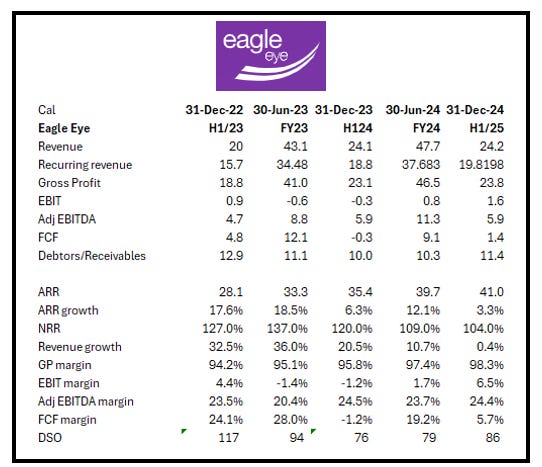

Eagle Eye. Acquires a complementary niche SaaS startup (founded 2014) company Promotional Payments Solutions Limited which brings customers and expands Eagle Eye's offering to include real-time CPG couponing. A cheap deal, the net consideration is €5.5m - the total, €7.5m, includes €2m of unrestricted cash on Promotional Payments Solutions' balance sheet. For the Year ended 31/12/24, Promotional revenue was €3.96m, of which SaaS revenue was €3.2m, EBITA €0.9m, net assets €5.2m. The core team joins Eagle Eye.

Backstory. Founded in 2014 and headquartered in Dublin (Ireland) with 20 FTEs, Promotional Payments Solutions developed a real-time digital marketing platform for managing and processing both retailer and CPG coupons. Clients include Musgrave Group, The Co-operative Group and Tesco UK.

Promotional Payments Solutions' PromoPay is a real time transaction engine similar to the Eagle Eye AIR platform. It supports promotions, loyalty, gifting, and PromoBase is a national database covering all national 99-code coupons issued and redeemed across the UK and Ireland, complete with qualifying product-level data. PromoBase helps retailers and manufacturers prevent mis-use and fraud.

Guidance update. The Acquisition is expected to be immediately accretive to EPS, with annual cost synergies at completion of €0.3m, and further cost synergies anticipated over time.

The numbers we track: Eagle Eye

Source: Company data, Technology Investment Services

IoT/Smart

IoT/Smart cohort: KPI Dashboard

Source: Company data, Technology Investment Services

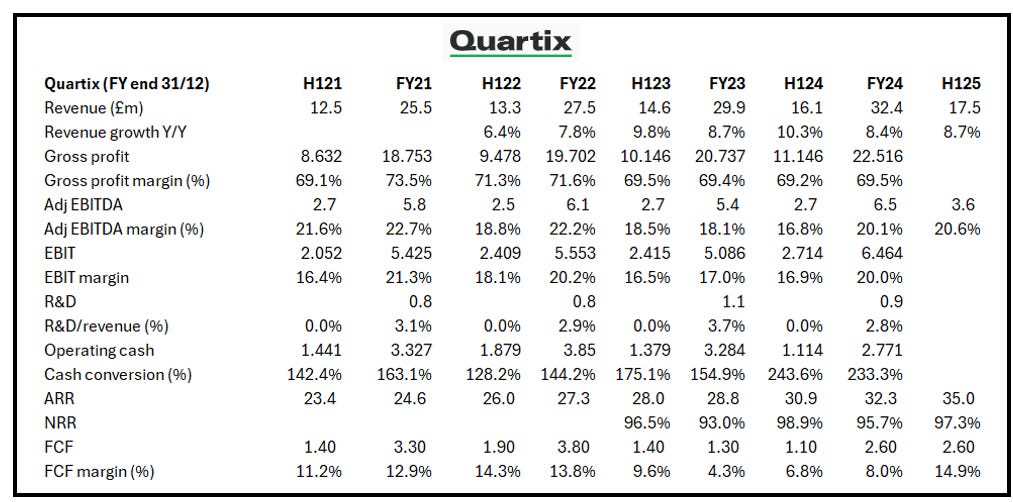

Quartix. A positive H1 trading update with decent progress on the disclosed KPIs, revenue £17.5m from £16.1m Y/Y and FCF £2.6m up from £1.1m last year. Closing cash balance of £4.1m. ARR +31% Y/Y to £35.0m and NRR from 95.7% to 97.3%. New customer acquisition in the Period increased by 13% to 3,962 new customers and new subscriptions increased by 7% to 40,698. The Company is confident of achieving market expectations for the year for revenue and EBITDA, and of being “slightly ahead” on free cashflow. There was news of a re-organisation which combined two principal software teams into one, and reducing overhead run-rate by £0.5m per annum from July 2025.

The numbers we track: Quartix

Source: Company data, Technology Investment Services

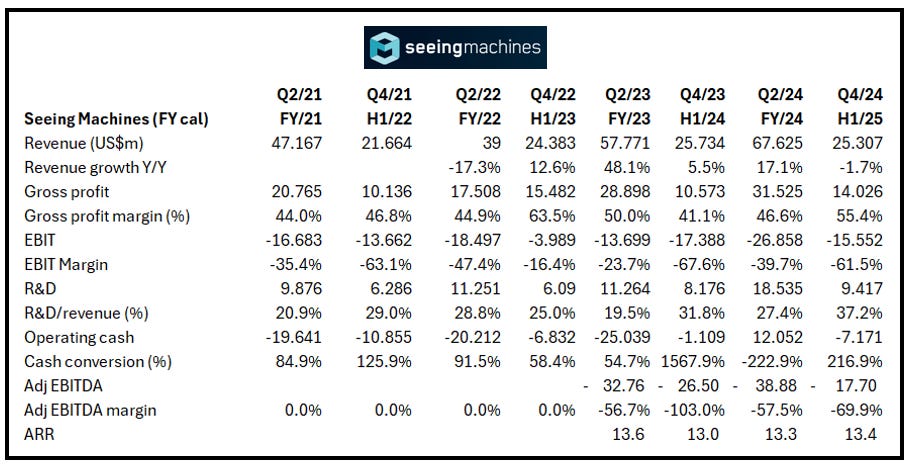

Seeing Machines. A brace of trade distribution news while the ‘commercials’ were not disclosed but positively they showed strengthening GTM. Details are:

Mitsubishi Electric Europe B.V agreement to enable greater driver safety, signed to coincide with automakers preparing to comply with the EU's Vehicle General Safety Regulations (GSR). This mandates the use of direct Driver Monitoring System technology to reduce the risks associated with distracted driving. The deal trails the collaboration with Mitsubishi Electric Automotive in America. Initially, Mitsubishi Electric Europe B.V will work with Seeing Machines to leverage Mitsubishi Electric's fleet connections including within logistics, distribution and maintenance to accelerate sales of Guardian Generation 3. The collaboration gives Seeing Machines some sight into Mitsubishi’s relationships with truck and bus OEMs and other sectors such as rail.

Seeing Machines renewed its distributor agreement with Connect Source, Australia's largest distributor of Guardian (failure to sign would have been a poor outcome). The deal supports new sales opportunities across Australia, including immediately with a large Australian utility company who will be installing Guardian Generation 3 across 550 vehicles within its fleet initially, with a view to full implementation over the coming 6 months. This marks the largest single order for Guardian Generation 3 to date.

The numbers we track: Seeing Machines

Source: Company data, Technology Investment Services

Infrastructure IT Services

IT Infrastructure cohort KPI Dashboard

Source: Company data, Technology Investment Services

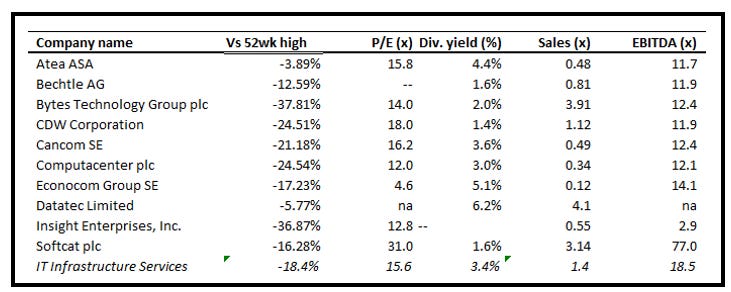

Cohort Scenario: This sector has been cautiously emerging from a cyclical downturn following demand volatility in the years following the end of the COVID pandemic. Since H2/24, demand for hardware has picked up across product categories, Day Sales are recovering, but margins (gross and operating) remain under pressure. Positively the cohort is doing more higher margin services revenue, although it will suffer from the utilisation issues common to the IT Professional Services cohort. There are multiple demand-side drivers for this cohort. The most immediate one is Windows 10 end-of-life, and IT security continuing as a top investment priority for organizations as threats of cyberattacks and data breaches continue to grow and from a regulation the EU Network and Information Systems 2 (NIS 2) Directive (a baseline of cybersecurity requirements for the public and private sector) was adopted into local law by EU countries in 2024. However, soundings from the latest batch of analyst conference calls suggests that this effect could drift into 2026. Generally, the cohort KPIs are emerging from a cyclical downturn. As a caution we note that as spend returns, there will be pressure on inventory days which in turn will soak up working capital – and a feature of the latest results is that inventors are increasing. The warning from Bytes serves to remind us that notwithstanding a fragile macro company actions determine outcomes.

Bytes. Warnings at AGM that H1 gross profit will be “similar” to last year with Operating Profit marginally lower, followed by “more normalised growth in both metrics” in H2.

Trading was impacted by a challenging macroeconomic environment (not a surprise) leading to some deferral of customer buying decisions (ditto), particularly in the corporate sector (ditto, ibid). But Bytes is also changing its corporate sales division (moving from a generalists to specialised, customer-segment-focused teams) and this is taking “longer than expected”. In addition, changes to Microsoft enterprise incentives are weighted to H1 due to high levels of renewals in March and April (public sector) and June (Microsoft year year). There was, for us, a mis-placed readacross with softening across the cohort, but Bytes has been on the cautionary step for a while and there was recent insider selling so the share suffered an outsized correction. Remains on the naughty step, and there is lots of better valuation cases elsewhere.

IT Infrastructure cohort: Valuation snapshot

Source: Company data, Yahoo Finance, technology Investment Services

Note. Latest data from ControlUp’s Windows 11 Readiness report says that half of all business-managed Windows devices have not yet made the switch, an improvement from last year (80% on Windows 10). From the verticals: 70% of Education and Tech systems upgraded; fewer than half of Healthcare and finance with healthcare devices needing PC swap-outs. Regionally Americas is 43% updated, 70% Europe. Also larger organisations are behind with their migration (companies managing 10,000+ Windows devices have completed 42% of migrations) as complex environments and aging infrastructure slow the progress. The customer and geographic profile suggests the long tail opportunity is with the likes of Computacenter, CDW, Insight rather than Bytes.

Recap: Windows 10 support ends 14 October, 2025. Microsoft is offering paid support through its Extended Security Updates program, open to individuals and companies. Third-party provider 0patch also plans to deliver security fixes for at least five years after Microsoft ends support.

Dear investor,

well done for making it to the end. You are a trooper and a super custodian of shareholders funds.

best wishes George

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.