The long and the short of IT

Q2: How is it for you? Pull up a chair

UK unemployment is rising (4.7% in the three months to May), the +5% Y/Y increase in pay (excluding bonuses) marks a near three-year low, and the number of payrolled employees was down by 41,000 (0.1%) in June as vacancies fell by 56,000 April to June –the 36th quarterly drop. Employers are cautious (as they have been for the past two years) and the UK economy is marked by disappointing GDP, inflation and employment data. As a positive there is enough gloom, and evidence of deterioration, that the Bank of England can comfortably lower interest rates (25bps in August) with a further before year-end. Lowering the cost of capital will help UK tech valuation, but the price is a poorer operating environment. To wit: early days Q2/H1 reporting/Trading Updates is giving ample evidence for the doomsayers: UK software cohort is poor, it is a little better at global IT Professional Services and Recruitment. Positively; thematic tech is better with AI-RAG, Consumer-Tech, IoT/Smart, Defence-Tech and Fin-Tech are all doing marginally better. Secular winner Filtronic continues to fly the good news flag, on its own. US Tech starts next week with numbers from Alphabet, IBM and ServiceNow amongst many others, but after hours Netflix last night (17 July) started the show – time for the popcorn and a comfy seat.

Tech Universe results and updates span UK Software (Cirata, Corero Network Security, Craneware, Eagle Eye, FD Technologies, Globaldata); AI-RAG (Experian, Trustpilot); IT Professional Services (HCLTech, LTIMindtree, Tech Mahindra, Wipro); IoT/Smart (Seco); UK Hardware (Filtronic); IaaS (Beeks); Consumer-Tech (Netflix); Defense-Tech (Cohort, Qinetiq); Fintech (Wise); Recruitment (Manpower, Robert Walters). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

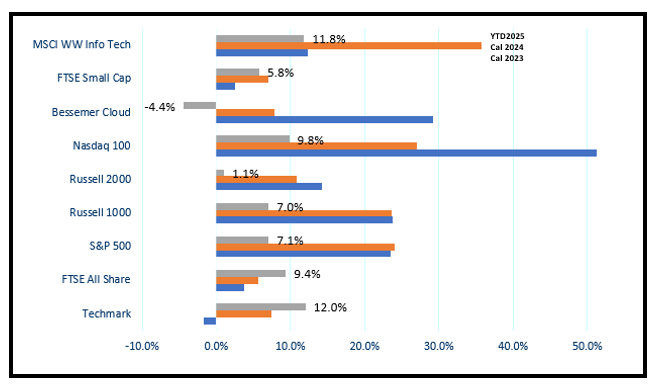

Markets continue to make strides pulling in momentum, but operating results are mixed

Source: Company data, Yahoo Finance, Technology Investment Services

Consumer-Tech

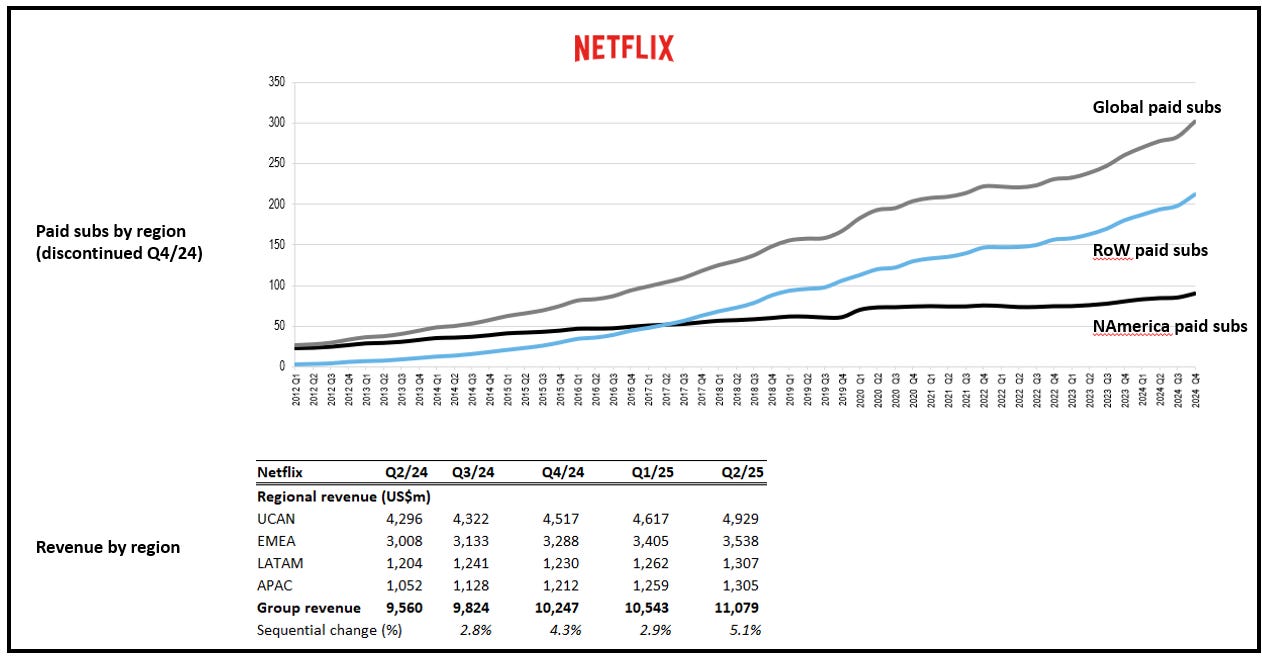

Netflix. Netflix did a beat and raise, yet shares drifted downwards (c.1%) due to the high valuation and some justifiable profit taking on the news (shares are +40% YTD). Q2 revenue grew 16% Y/Y, the 34% operating margin was +7bps Y/Y, both exceeding guidance - but this was due primarily to F/X, net of hedging, and the timing of expenses. Also Netflix increased 2025 revenue guidance to a range of US$44.8-$45.2bn, up from US$43.5-$44.5bn prior with a 29.5% operating margin vs. 29% previously.

The Q2 slate ended with Squid Game S3 (122m views), which becomes the sixth biggest season of any series in the company’s history.

We are reminded that alongside the series finale of Squid Game, Netflix made updates to Squid Game: Unleashed, introducing new games, characters and Play Along rewards based on season 3. Squid Game: Unleashed was released with season two of the show, racked up 42m plays by the end of 2024 and was the “#1 Free Action Game in 57 countries.” Yet this stands out in a confused gaming ‘play’. While Netflix says that it continues to invest in immersive, narrative games based on its own IP, this week (14 July) over 20 mobile games, including popular titles like Hades and Rainbow Six: SMOL, all departed Netflix reminding us that Netflix's gaming struggles continue since the closure of its AAA gaming studio last year.

But Gaming is harder and legislation is getting ‘more’. Note that the UK Online Safety Act has its latest deadline, 24 July. By then companies have to comply with Children's Safety Duties.

To recap: The OSA aims to ensure online services used by people in the UK are safe by design, with a higher standard of protection for children, while promoting transparency and accountability for all users. Video games and related digital platforms are caught by the legislation which seeks to increase the accountability of platforms and game publishers, requiring them to assess risks, prevent illegal and harmful content, and establish stronger controls. Companies must use “highly effective age verification systems” to restrict access to content and features based on the user’s age, ensuring children are not exposed to inappropriate material. Non-compliance can result in heavy fines (up to 10% of global turnover, or £18m, whichever is greater).

The numbers we track: Netflix

Source: Company data, Technology Investment Services

UK Software

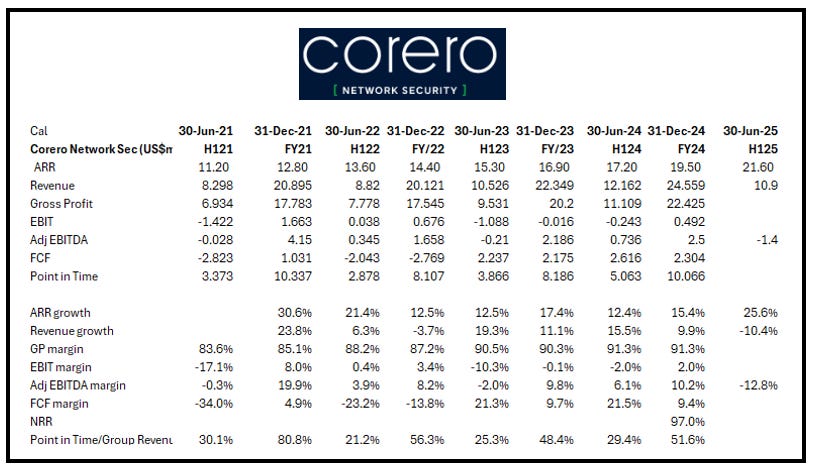

Corero Network Security. Profit warnings typically flush out momentum investors and give longer term investors the opportunity to take stock and revisit the investment case. So it is with Corero H1 Trading. Much of the disappointment is the rev/rec impact which was foreseeable and so disappointing it had not been baked-in advance, operationally we like the underlying operational momentum of customers migrating to better products. Shares are -56% YTD.

H1 Trading Update sees 25% ARR growth with the revenue mix shifting to a higher DDPaaS proportion of sales. However H1/25 revenue will be “below the prior period as a result of the weaker macroeconomic environment and lower upfront capex license sales”. The H1/25 order intake was US$12.5m down from US$14.2m last year. The reduction was below expectations due to Alliance Partner’s performance, weaker macro-economic environment, and US tariff uncertainty. These combined to delay customer decision making. That said there is some consolation as Q2/25 order intake grew 13% Y/Y to US$7.8m. Customers are shifting to DDPaaS subscription rather than licenses which defers revenue recognition, and so H1 revenue is expected to be US$10.9m down from US$12.2m last year with EBITDA a loss of US$1.4m from a profit of US$0.7m last year. As a consequence of the shift in buying patterns (a move predicated on the best of intentions, i.e. a repurposed product set and subscription sales), FY revenue guidance is between US$24.0 and $25.5m and EBITDA between a US$1.5m loss and US$0m – a year ago this was US$2.5m – which the company tells us is “below market expectations”.

Cash (30 June) was US$3.1m, down from US$7.9m last year, and the Group “is in advanced discussions” with its banking partner to put in place an overdraft facility to manage the increased working capital requirements due to the revenue mix shift. This is disappointing as the rev/rec effect of moving to SaaS is well known.

The numbers we track: Corero Network

Source: Company data, Technology Investment Services

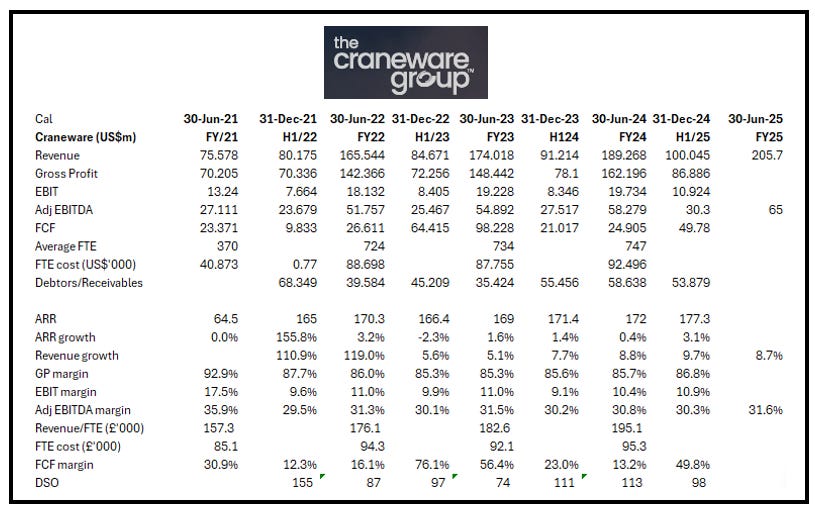

Craneware. Health-tech remains strong as does selling into the US, although there are concerns given the widespread intended and unintended effects of DOGE. Craneware’s FY25 Trading Update featured headlines of strong revenue growth and profitability ahead of expectations with accelerating EBITDA, ARR and NRR. The Group has experienced positive trading throughout the fiscal year, delivering continued strong growth, and profitability ahead of consensus market expectations. Of note: NRR increased to 107%, 98% a year ago.

As to the outlook, Craneware guides that the ongoing drive within US healthcare to improve efficiency and deliver value in healthcare “will continue to provide a positive market environment for Craneware's offerings”. Keith Neilson, CEO commented that the “extensive data sets and the powerful insights we can provide via our Trisus platform give our customers the means they need to improve their operational and financial performance”.

The numbers we track: Craneware

Source: Company data, Technology Investment Services

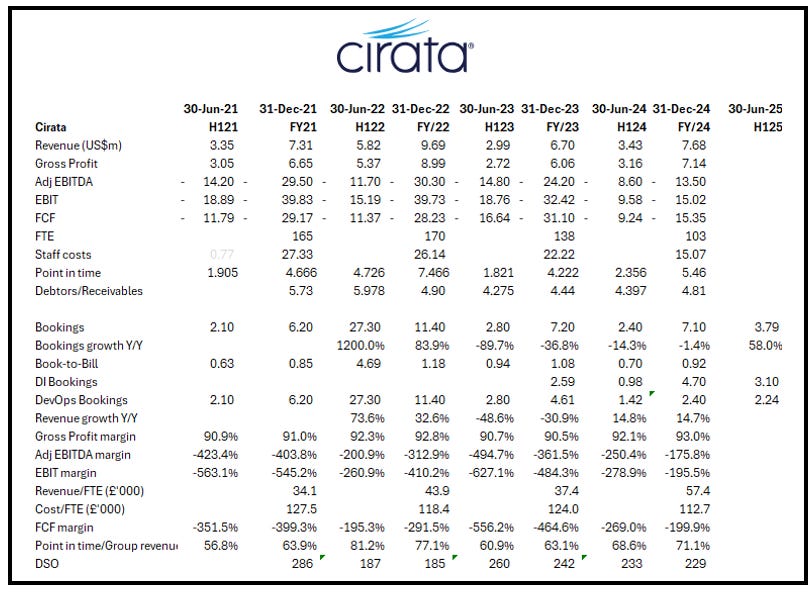

Cirata. Q2 bookings, US$0.8m, -53% Y/Y, and Data Integration bookings, US$0.7m were up cUS$100k Y/Y. The Q2 cash burn was US$2.2m, down from US$4.2m Y/Y, but cash (30 June) was US$6.1m with short-term trade receivables US$1.3m – giving a very short run way. So the DevOps division is being sold, netting US$2.5m cash end August and up to US$1.0m in December 2025. North American sales is the latest problem child (“disappointing relative to plan”) and so there is a new Chief Revenue Officer, Dominic Arcari, from 1 July. Operating costs are being reduced from a US$16-17m run-rate (exit Q1FY25) to an annualised US$12-13m exiting Q3FY25.

There were some pleasing headlines: 58% Y/Y H1FY25 bookings growth, with DI H1FY25 Bookings +244% Y/Y. There were 6 contracts signed (31 last year), while only two were DI which accounted for 95% of total bookings value.

The plan. Cirata aims to broaden the use cases for its Live Data Migrator product offering, using Apache Iceberg open table formats to offer interoperability for unstructured data across the (on-prem) enterprise to the cloud. Strategic relationships will provide an environment for collaboration on future Cirata data orchestration platform functionality. Data orchestration is Cirata's vision for addressing the challenges of data modernisation within the enterprise, evolving the product beyond Hadoop migration. It has been stuck in Hadoop migration for c12 years since the initial AltoStor acquisition, but it has also been trying to migrate beyond the Hadoop to a business case predicated on multiple use cases for large-scale data modernisation.

The plan still has opportunity, but so much of the software engineering world has changed over that 12 years (see below from ChatGPT - only partly tongue in cheek). As of 2025, the on-prem Hadoop deployment segment is expected to account for 63.6% of the Hadoop market, driven by user preference for retaining direct control over business-critical infrastructure. Sectors such as healthcare, finance, and government have kept Hadoop clusters in their own data centers for compliance and security reasons. . . which may undermine their supposed interest in cloud migration.

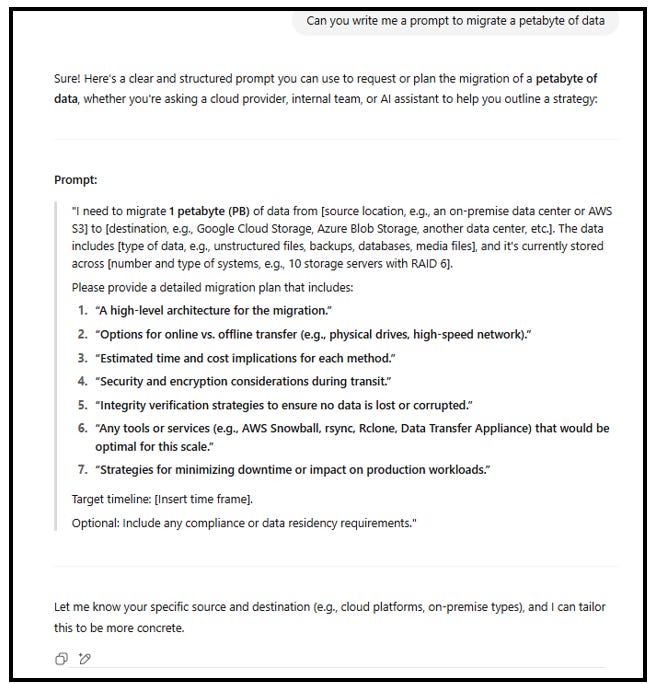

Hi GPT, can you write me a prompt to move a petabyte of data?

Source: ChatGPT, Technology Investment Services

The numbers we track: Cirata

Source: Company data, Technology Investment Services

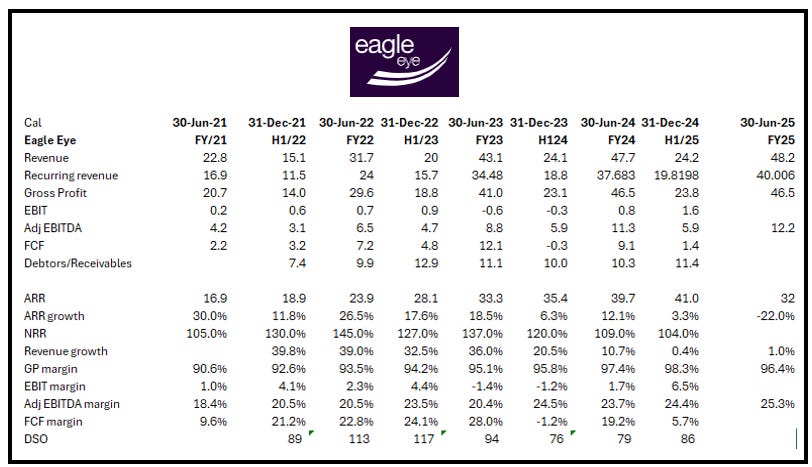

Eagle Eye. An FY25 Trading Update features news that FY25 revenue was +1% Y/Y to £48.2m as ARR shrank to £32.0m (£39.7m last year), following a contract loss. Adj EBITDA, £12.2m, was +9% Y/Y (margin 25%). Net cash is £12.3m, up from £10.4m last year. Positively there were six new blue-chip customer wins in H2. That well flagged “transformational OEM agreement with one of the world's largest enterprise software vendors” is progressing well and the first customer contracts are anticipated for H1/FY26 with “substantial revenue generation expected from FY27”. 83% of revenue from the current top 10 customers is under contract to at least FY27. Of note:

Announced a share buyback, up to £1m to be executed over the next seven months.

As a result of the loss of the NRS-related contract and the Group's move towards a System Integrator model of implementation “appropriate head-count reductions commenced in FY25, with further under way”.

The Board anticipates maintaining a double digit adjusted EBITDA margin for FY26 as a whole, and to be on a materially improving trajectory by the end of FY26, supporting a 20% adjusted EBITDA margin in FY27, alongside double digit revenue growth.

The numbers we track: Eagle Eye

Source: Company data, Technology Investment Services

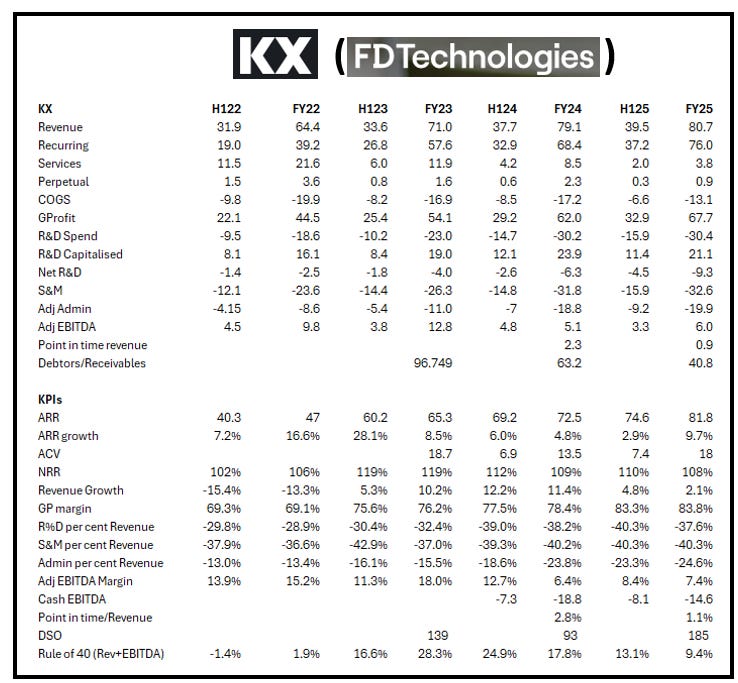

FD Technologies. One of our favourites is leaving. The Scheme will become effective on 21 July. Shares suspensions on AIM and Euronext (Dublin) expected to take effect by 07:30 21 July with the last day of dealings 18 July 2025. Cancellation expected 07:00 22 July 2025.

Superb job in generating Shareholder value Seamus, Ryan and Derek and the cast of many, many others at FD Technologies. Come back to Capital Markets as soon as (I will keep a chair warm).

The numbers we track: KX Software (from FD Technologies)

Source: Company data, Technology Investment Services

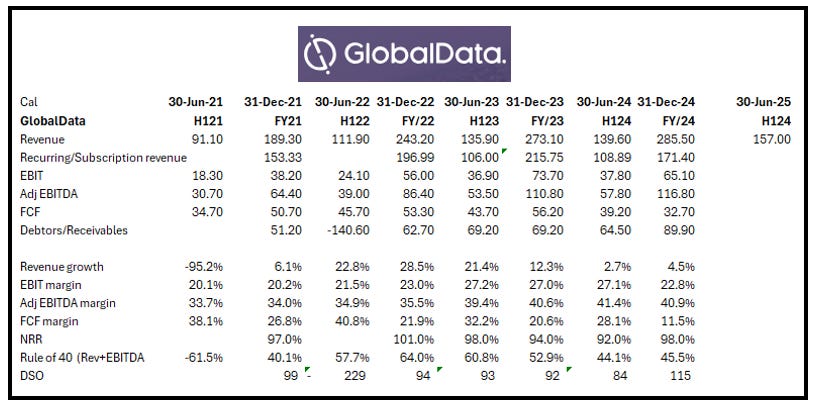

GlobalData. A Trading Update gives some comfort as Q2 improved following “a slow start to FY25”. Revenue of c.£157m, £140m last year but underlying organic revenue was flat, renewal rates were “consistent”, USD weakness reduced revenue by c£10m - c.50% of Group revenues is derived in USDollars. Mike Danson, CEO, talked about “a tough and uncertain macro- environment”. Of note:

The company is transitioning to a “more solutions-based selling and strategic account management approach” which means a “significant change” to the sales organization . . . This often leads to sales disruption. . .

From the product set we note the debut of "Sam". This is GlobalData’s first digital worker which uses agentic AI to deliver personalised insights, automate workflows, and increase productivity for sales professionals.

On 6 February 2025, the company announced a £50m share buyback. It was suspended (2 May) following the announcement of the possible offer proposals. By then £39m was spent. The offer talks were since terminated, and now the Group will look to return surplus capital to shareholders by way of a tender offer of shares.

The numbers we track: GlobalData

Source: Company data, Technology Investment Services

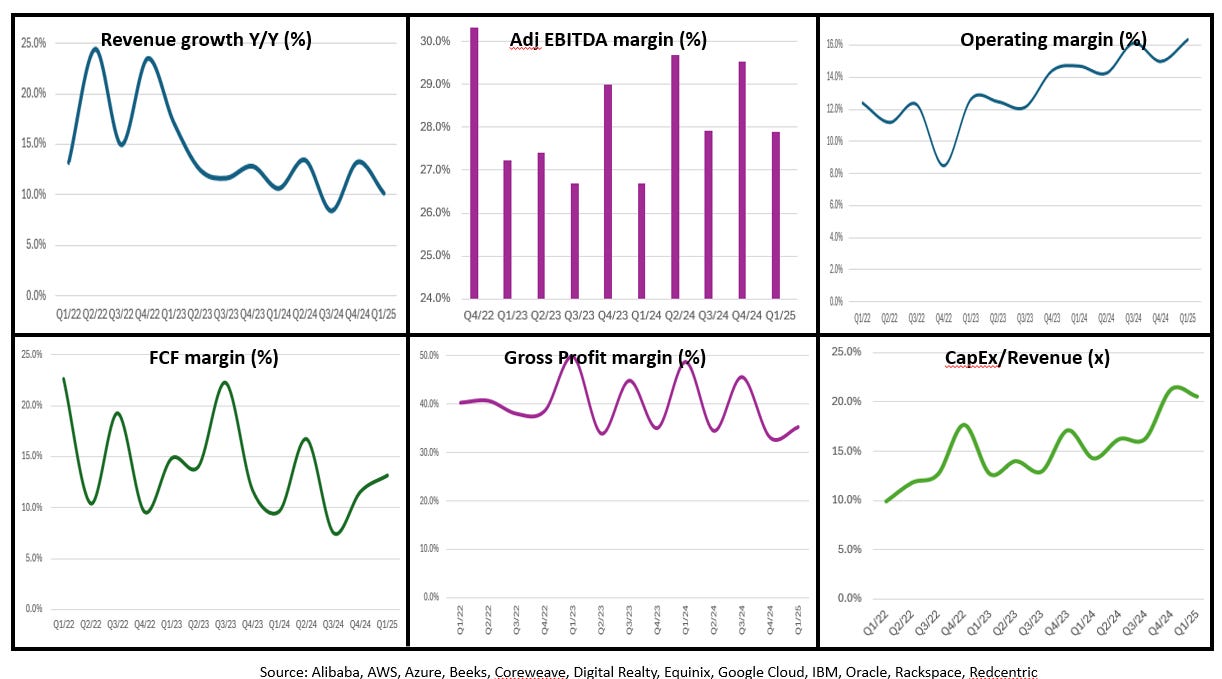

IaaS

Beeks. Ends FY25 with a record month, inking US$10m Proximity Cloud contracts in June. The year saw revenue soar by 25% Y/Y to £35.5m, underlying EBITDA +29% Y/Y (industry-leading EBITDA margin, 38.9%), with net cash of £6.96m vs £6.58m last year. The results were impacted by currency headwinds and the new deferred revenue contracts; however, as this simply delays revenue recognition it ensures that FY26 is off to a flying start. CEO Gordon McArthur signals that Beeks enters FY26 with “ongoing confidence in our ability to convert the strong pipeline of opportunities across our offerings”. No change to our view: Beeks is gaining from industry tailwinds (cloud adoption, compliance, data sovereignty, cybersecurity, sustainability, analytics, payment modernisation, AI in risk management), which have enabled it to carve out a moat as market leader in cloud infrastructure for financial markets and payments. A long-term secular growth investment play, with a ‘best of breed’ financial model.

IaaS cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Read our research at Progressive Equity Research

IT Professional Services

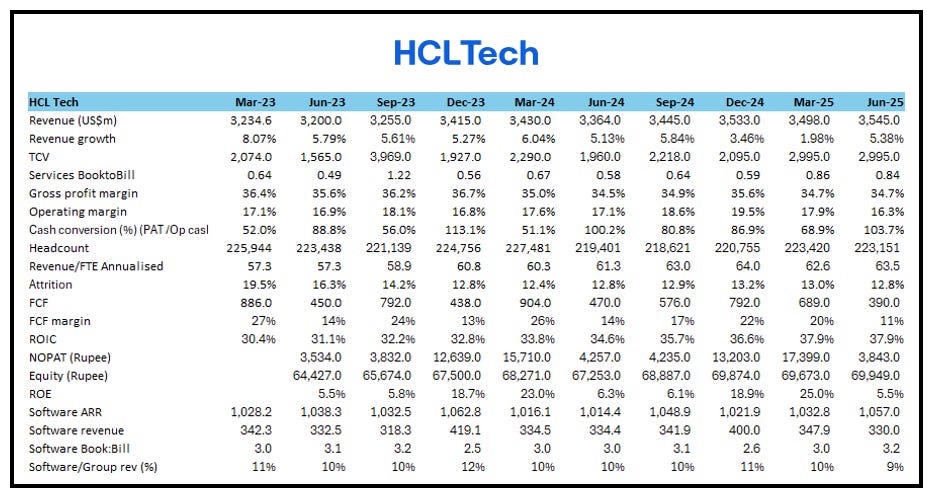

HCL Tech. Shares mimicked TCS and fell 4% on the day as net profit slipped 9.7% Y/Y for Q1, as the operating margin was shy of guidance at 16.3%, impacted by lower utilization, higher expenses (+9.2% Y/Y), a one-time impact of a client bankruptcy and additional Gen AI and GTM investments. Like TCS, HCL Techraised the lower end of FY revenue growth outlook. HCLTech CEO and MD C. Vijayakumar announced a restructuring programme aimed at achieving structural agility to better address market demand in the AI era to involve optimising un-utilised facilities, mostly outside India, and staff reduction in geographies outside India. Given that this will entail additional cost, guidance was reduced. Positively, revenue grew 3.7% Y/Y, but declined 0.8% sequentially, with growth driven by Technology, Telecom, Retail, and Financial Services sectors.

Note:

AI: AI Force platform is now deployed across 35 clients and 70 plus deployments and is the key solution enabler for several of our new wins.

Guidance: The company increased FY26 revenue guidance to 3% to 5% in constant currency, based on better Q1 performance, and adjusting EBIT guidance to 17% to 18%. Margins should normalize back to the aspirational 19–20% range by FY27 as these issues moderate.

Deal shift: Some large deals shifted from Q1 to Q2 due to procedural reasons, not demand weaknesses. Management remains confident about deal pipeline and revenue growth outlook.

Talent Strategy: Fresh hiring is now more specialised with higher compensation to attract talent with desired skills. Company is proactively managing upskilling and redeployment to adjust to productivity gains and evolving service needs.

Productivity Benefits & Pricing: The company is transparent with clients about AI-driven productivity improvements, willing to share cost savings with clients which may reduce revenue but increases wallet share. This has helped secure renewals with increased overall client revenue.

The numbers we track: HCLTech

Source: Company data, Technology Investment Services

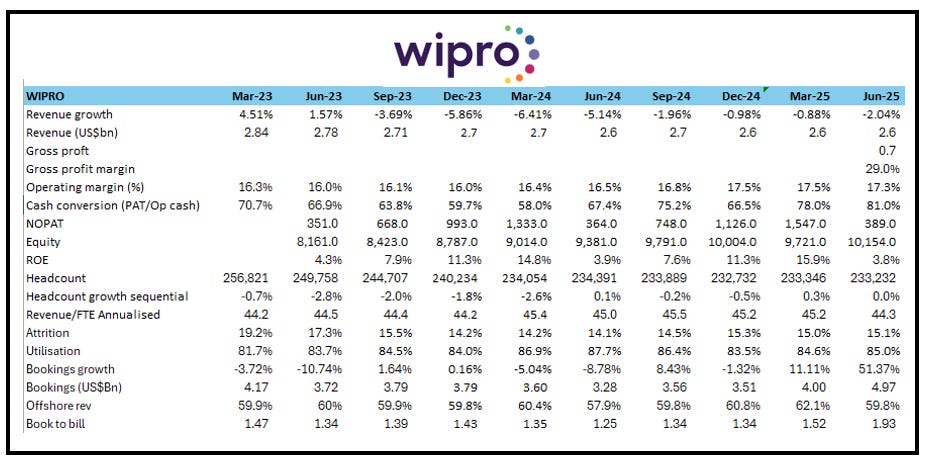

Wipro. A 9.8% increase in consolidated net profit buoyed by strong deal wins with revenue edging up slightly, although here too there was a sequential story as profit and revenue declined by 7% and 1.6% sequentially. Bookings US$4,971m with Large deal bookings, US$2,666m, +130.8% Y/Y. Wipro CEO and MD Srini Pallia commented that while the company started the quarter facing “significant macro uncertainty, which kept overall demand muted”, clients prioritised initiatives with immediate impact, focusing on cost optimisation and vendor consolidation as they “accelerated their AI, data and modernisation programmes”. (Comment from the call: “Clients are modernizing their IT landscape with a sharp focus on AI-led efficiency and transformation”.) However, he cautioned that discretionary spend is “not uniform and is coming back in certain pockets”. Of note:

Quarterly revenue guidance growth was raised to 0%.

The employee count reduced by 114 sequentially in Q1 FY26, bringing the total to 233,232.

The numbers we track: Wipro

Source: Company data, Technology Investment Services

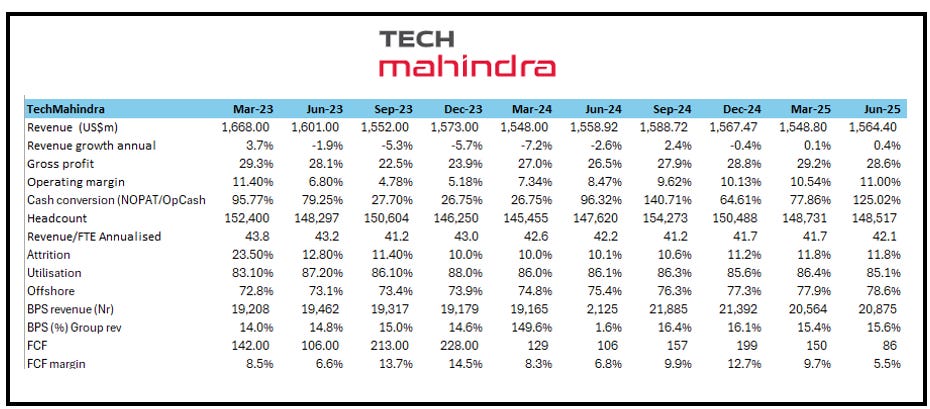

Tech Mahindra. Q1 US$ revenue, 1,564m +1.0% sequentially +0.4% Y/Y with EBIT, US$172m a 11.1% margin +50 bps sequentially. Yet, despite a workmanlike print shares dipped on the news (-c2%) as investors concentrated on the continued weakness in discretionary spend. Mohit Joshi, CEO/MD said “Our performance is steadily strengthening, reflecting disciplined execution and a focused strategy. Deal wins have increased by 44% on a last twelve months (LTM) basis, supported by broad-based momentum across verticals and geographies.” Of note:

Portfolio of 200+ enterprise-grade AI agents across industry segments, of which “several” are in use at scale with clients. Tech Mahindra and mimik launched the Agentic AI Production Center — a physical, production-first hub to build, scale, and certify agentic-native AI workflows on real-world infrastructure.

A strong outturn from Europe (26.0% of Group) which grew 3.6% sequentially, 11.7% Y/Y.

The numbers we track: Tech Mahindra

Source: Company data, Technology Investment Services

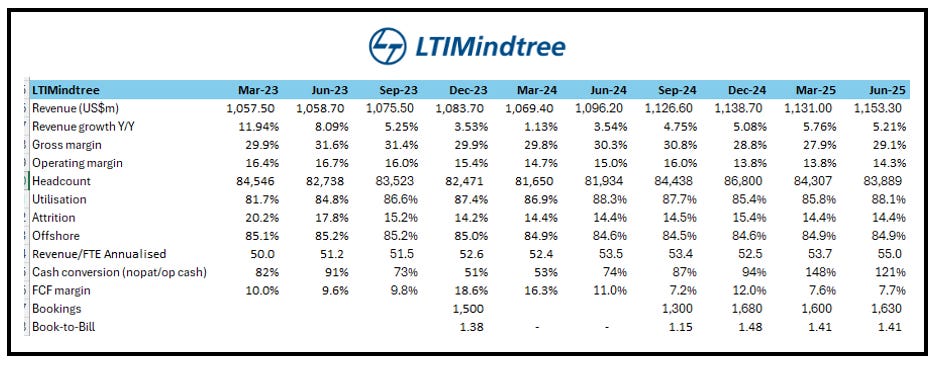

LTIMindtree. Shares dipped following the print. However the print was in line with expectations and featured Q1 revenue, US$1,153.3m, +2.0% sequentially and +5.2% Y/Y with EBIT margin +550bps Y/Y to 14.3%. Venu Lambu, CEO/MD commented that despite the “promising start to the year” (which included the largest-ever TCV win, broad-based vertical performance and Order inflow +16.43% Y/Y to US$1.63bn) the macroeconomic environment “remains challenging”.

The numbers we track: LTIMindtree

Source: Company data, Technology Investment Services

AI-RAG

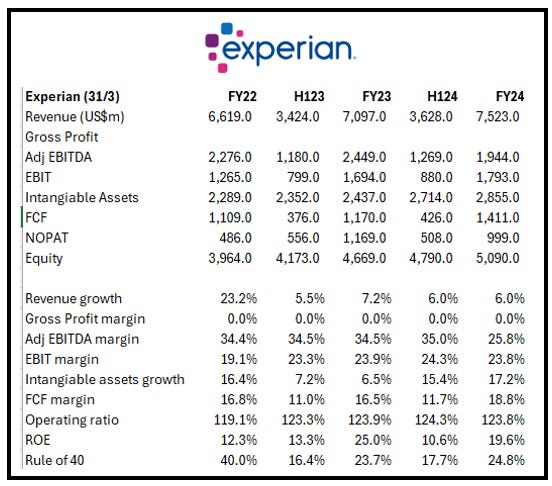

Experian. For the AI-RAG companies we want to see increased ‘technology usage’ and a migration from people-based to automated processes. Pleasingly, at Experian this is echoed in the top line company description. Experian bills itself as a “global data and technology company” helping to redefine lending practices, uncover and prevent fraud, simplify healthcare, deliver digital marketing solutions, and gain deeper insights into the automotive market “using our unique combination of data, analytics and software.” We would like more evidence-based KPIs, but the Trading Statement read well and we are relaxed with the company’s inclusion in our RAG cohort.

For Q1 the Trading Update, Experian reiterated FY guidance. Of the highlights:

North America (67% of Group): 9% Y/Y organic revenue growth. Total revenue growth was 10% including contributions from the NeuroID and Audigent acquisitions completed in the prior year. B2B organic revenue growth was 12%.

Latin America (14% of Group): 5% Y/Y organic revenue growth, with B2B organic revenue flat Y/Y with Brazil’s ongoing macroeconomic volatility and persistently high interest rates holding back B2B growth. However, Consumer Services organic revenue growth was 24%.

UK and Ireland (12% of Group): 1% Y/Y organic revenue growth as B2B organic revenue fell 2% Y/Y and Financial Services was flat. Consumer Services was +11% Y/Y organic growth.

EMEA and Asia Pacific (7% of Group): 7% organic revenue growth with 36% total revenue growth following the illion acquisition, completed on 30 September 2024, and is “progressing well”.

The numbers we track: Experian

Source: Company data, Technology Investment Services

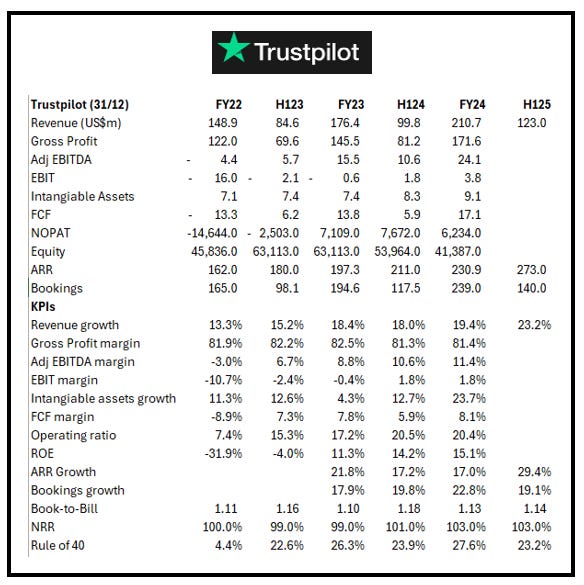

Trustpilot. A pleasingly strong H1 sees FY margin upgrades. H1 Bookings (US$140m) grew 19% Y/Y, ARR (US$273m) +29% Y/Y, Revenue (US$123m) +23%. The bookings growth was evenly balanced across the geographies with UK +15% Y/Y, Europe & ROW +19% Y/Y and North America +18% Y/Y. The NRR is 103%, flat since December 2024. The period also saw net cash US$67m, from US$69m (FY24) after US$23m share buybacks. The company upgraded FY2025 Adj EBITDA margin guidance to 14% as CEO Adrian Blair commented that the company “continues to annualise the package migration which benefited last year's bookings."

The numbers we track: Trustpilot

Source: Company data, Technology Investment Services

Recruitment

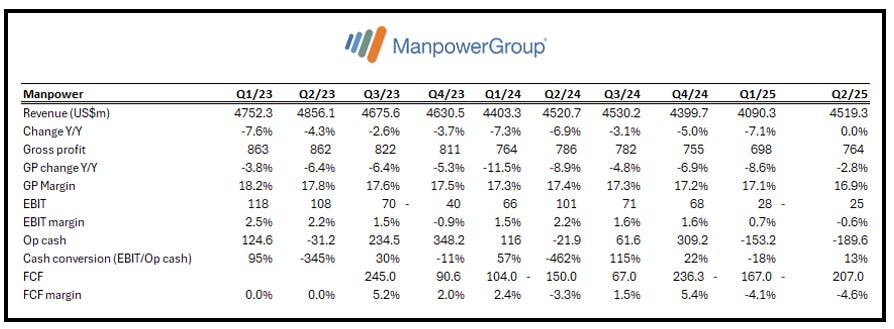

ManpowerGroup. Q2 were ahead of expectations with revenue, US$4.5bn (flat Y/Y) with Latin America and Asia Pacific showing “good demand” while demand in Europe and North America saw stabilizing trends. Q2 included a non-cash goodwill and intangible asset impairment charge, restructuring costs, and net losses from the sale of businesses, which will operate as franchises going forward. These reduced EPS by US$2.22. Jonas Prising, Chair & CEO, said that demand remains mixed across global markets as employers adapt to economic and geopolitical volatility, but the company is beginning to see positive signs of stabilisation in the US and parts of Europe. This differs somewhat from Q1 results (April) when organisations were choosing to pause or slow hiring plans as they waited for greater clarity. Since then many employers are absorbing what “might once have been seen as ‘Black Swan’ moments”. Note:

European employers continue to be more cautious, particularly Northern Europe, reflecting its greater exposure to economic and geopolitical headwinds.

On Gen AI: Most organizations are focused on driving adoption and exploring possibilities, and outside of some specific areas, Manpower is not seeing any structural impact to labour markets, but cautioned that the lag from exploration to impact has the potential to be shorter than any tech advancement in history. Manpower research concludes that 58% of employers are investing in AI—but only 26% believe their workforce is ready to use it.

The numbers we track: Manpower

Source: Company data, Technology Investment Services

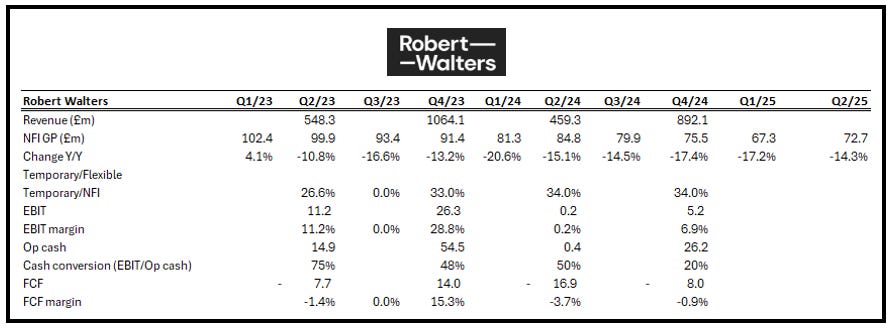

Robert Walters. Still no improvement, but the company (like others in the cohort) is better able to achieve profit and cash guidance (i.e. management layers removed, loss-making teams closed or merged) as Q2 Group net fee income fell -13% Y/Y. There was a pronounced positive sequential trend (+8% this year vs +4.3% a year ago) but macroeconomic uncertainty “became more pronounced, with forward indicators (new job flow and interviews) slightly weaker compared to the end of the first quarter”. The Group exited H1 with a monthly operating cost base of £24.5m, down from c.£25m at the end of 2024 as Fee earner headcount (1,815) down by 4% quarter-on-quarter (down 17% year-on-year) and the non-fee earner headcount (1,310) was flat quarter-on-quarter (down 10% year-on-year). We learn that there are further cost reductions planned for H2. Toby Fowlston, CEO, commented that geographically the most challenging conditions are in Europe (a refrain echoed elsewhere), with a more resilient performance in the UK and stable trends in Asia-Pacific. Of note:

Asia-Pacific: net fee income -9% Y/Y with Japan -3%, Australia -9%, New Zealand -31%, mainland China (flat due to Tariff uncertainty, Taiwan +15%. South-East Asia (-9%, but it improved sequentially, with Singapore +11% and Indonesia +16%.

Europe: net fee income -22% Y/Y with the Netherlands -30%, France -15%, Belgium -24%, Spain -19% but it grew quarter-on-quarter as the turnaround continued, Germany -27%.

UK: net fee income -8%: London (-3%) outperform the Regions -27%.

Rest of World: net fee income -2%: Middle East +1% Y/Y, USA -29%.

The numbers we track: Robert Walters

Source: Company data, Technology Investment Services

IOT/Smart

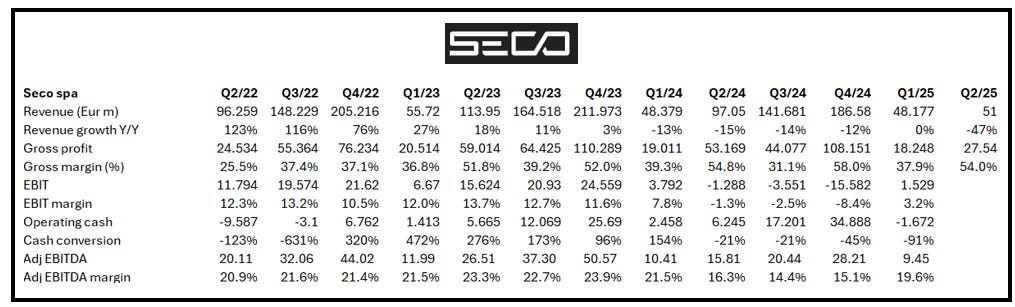

Seco spa. The preliminary look on Q2/H1 results is a positive as Q2 beat revenue expectations (€50m) and Gross margin ( >50%) as sales rose to c. €51m in 2Q25, +8% Y/Y Gross margin 54%. CEO Massimo Mauri commented that the company saw a “healthy shift in market conditions, with encouraging signs from key indicators such as order intake and book-to-bill ratio, as well as client feedback”. Note:

SECO products exported to the US fall under the exemption list defined by the Presidential Action “Clarification of Exceptions Under Executive Order 14257 of April 2, 2025, as Amended,” issued on April 11, 2025. As a result, SECO products exported to the US are currently not subject to the reciprocal tariffs in force, including the 10% baseline tariff.

The numbers we track: Seco

Source: Company data, Technology Investment Services

Defence-Tech

Cohort. Cohort is knocking out records with “record revenue, adjusted operating profit, and closing order book” as Adj EPS and net funds “exceeded market expectations”. The “record order book” is £616.4m with deliveries extending out to mid-2030's. Nick Prest CBE, Chair: "We are optimistic that the Group will continue to advance in the coming 2025/26 year as demand for our products and services continue to grow, and accordingly our adjusted EPS is now likely to be ahead of our previous expectations."

Against this background, the Group delivered another year of strong order intake, winning £284.7m of orders (2024: £392.1m), representing 1.1x full year revenue (2024: 1.9x) and has resulted in a record closing order book of £616.4m (2024: £518.7m). The 2023/24 order intake benefited from the large Royal Navy order of £135m. The closing order book included £80m secured with the acquisition of EM Solutions.

QinetiQ. A Q1 Trading Update sees the company Trading in line with expectations. Expectations were set prudently and foresaw a slow conversion of ‘positive tailwinds’ to orders being signed. That may have allowed the share price to get ahead of itself, but those macro drivers will deliver improving and better-than-expected in time. CEO Steve Wadey commented that “the ambition to accelerate warfighting readiness set out in the UK's Strategic Defence Review and the recent NATO summit clearly underpin the ongoing relevance of our mission essential capabilities, supporting our confidence in the long-term growth prospects for the Group”. Qinetiq closed Q1 with a record order backlog of c.£5bn, providing a strong foundation for long-term sustainable growth.

Guidance: c.46-48% of revenue in H1, c.10% margin and good cashflow. FY expectations (unchanged) are c.3% organic revenue growth, margin of c.11%, EPS growth in the range of 15-20% and good cash conversion. Of note, for us was the news that “revenue continues to be driven by good programme execution across our existing contracts” hinting that there has not been any contract jamboree.

Fin-Tech

Wise. Q1 Trading headlines with 24% Y/Y quarterly cross-border volume as Wise customer holdings grew by +31% to £22.9bn. The company had 9.8m active customers in Q1, +17% Y/Y. Underlying income, £362.0m, +11% Y/Y reported.

The strategic plan is unchanged: “to become 'the' network for the world's money’” while investing to target an underlying profit before tax margin of 13-16% in the medium term, with FY26 expected to be around the top of this range.

"Last month we also announced our proposal to dual list our shares in the US and the UK, with the strategic and capital market benefits positively received by Owners”.

UK Hardware

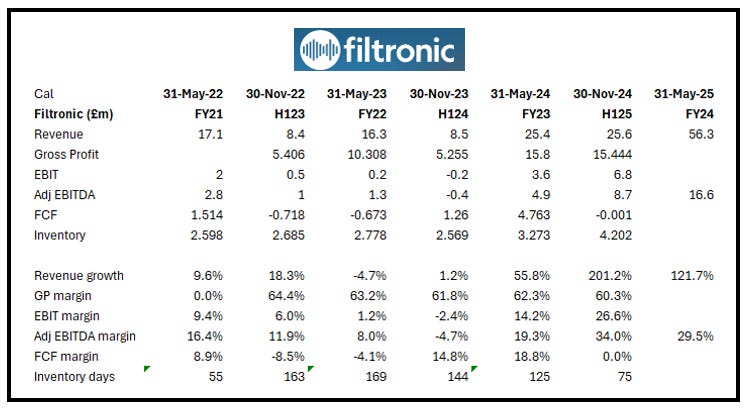

Filtronic. It goes on and on. A new contract award to supply high-performance modules for an electronic sensor system for £13.4m. Delivery is expected to commence in the middle of calendar year 2026, with the modules being built and tested at Filtronic's new hybrid microelectronics facility in Sedgefield (Durham). CEO Nat Edington commented that “Aerospace and defence remains a key sector in our growth strategy, and this latest order reflects Filtronic's proven track record of successful project delivery, collaborative partnerships, and manufacturing excellence."

The numbers we track: Filtronic

Source: Company data, Technology Investment Services

Dear reader,

Well done for making it to the end. Don’t forget to subscribe if you haven’t already!

Join me again soon.

Best wishes

George

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.