95 million FTEs need re-training because all business strategies lead to GenAI. The tech industry is firing 4.5 workers for every 1 hired as it supposedly gears up for the AI boom. JPMorgan Chase CEO Jamie Dimon comments that AI is “the biggest issue” his bank is grappling with as AI could “augment virtually every job” but it “may reduce certain job categories or roles”. Recruiter Adecco (5/4) is in grim mood concluding that “thousands of jobs will be affected by AI”. Meanwhile a report (4/4) by outplacement firm Challenger, Grey & Christmas confides that the AI revolution has yet to happen. To wit: AI was responsible for 383 US job cuts in Q1/2024, out of 257,254 total. Research by industry analysts ETR and The Cube Research suggest that many AI projects have yet to go into production. Customers are tyre-kicking. So far the ‘boom’ has not reversed the IT Services sector productivity dip (see below). Here, let’s neglect the doomsterism, ignore the boosterism and ask: What does the data say about AIs impact on jobs?

It all started with

An IMF report has found that 40% of jobs globally will likely be impacted by AI technology with the figure rising to 60% in the advanced economies. The analysis concluded that “in most scenarios, AI will likely worsen overall inequality”.

Adecco Group with Oxford Economics

A report (5/4) by Adecco Group, in collaboration with Oxford Economics, concludes that AI will reduce the number of workers at “thousands of companies over the next five years”. The evidence was a poll of 2,000 executives, spanning 18 industries in nine countries, with white-collar and blue-collar jobs. Of the findings:

41% expect to employ fewer people because of AI.

61% believe AI is a game changer for their industry, with 82% in the tech sector.

57% "lack confidence in their leadership team's AI skills and knowledge".

46% will redeploy employees internally if their jobs were impacted by AI, two-thirds will recruit AI skills externally, a one-third will re-train existing workforce.

Challenger, Grey & Christmas: The revolution has yet to happen

A report by outplacement firm Challenger, Gray & Christmas (4/4) concludes that US-based employers announced 90,309 cuts in March, +7% sequentially. At +0.7% Y/Y this marked the highest monthly total since the 102,943 cuts in January 2023. The Q1 tally, 257,254 job cuts, was down 5% Y/Y but was +120% on Q4/2023.

The technology sector leads all industries in job cuts this year with 42,442, admittedly down 59% from 102,391 Y/Y. The results mirror those of the latest review by the Layoffs.fyi.

Why Are companies reducing headcount?

The leading reason for job cuts in Q1/2024 (see below) was “Cost-Cutting,” being 66,302 of the reductions. Next up was “Restructuring,” with 48,352 cuts, with 38,619 due to “Business, unit, or store closures”, “Market Conditions” were responsible for 23,329 cuts, and 7,591 were linked to “Bankruptcy”. From a tech perspective “Technological Update (not AI)” was noted in 15,225 job cuts with “AI” named in 383 out of the 257,254 Q1 total (see below).

Another view: Company ‘growth plans’

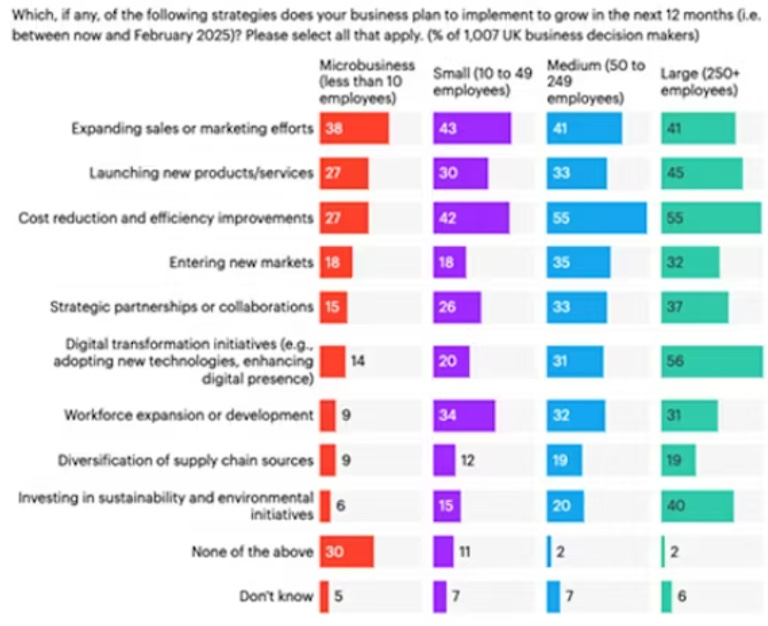

According to the UK data from YouGov 41% of decision-makers in large businesses say they are investing for growth this year. Digital transformation is the most common strategy pursued by large businesses for growth (56%). However next placed, 55%, was “efficiency and cost reduction measures”.

Hiring Plans

US employers announced plans to add 36,795 positions in Q1, a 48% decrease from the 70,638 hiring plans announced Y/Y. This is the lowest number of announced hiring plans since 2016. The Energy sector led all industries with plans to hire 5,800 workers, followed by the Technology sector, which plans to add 2,237 positions. The hiring intent was also reflected in the latest Manpower Employment Survey (see below).

The tech economy is supposed to grow in 2024 . . .

IT industry analysts Gartner have trimmed their IT spending forecasts (below) but still predict that European IT spend will reach US$1.1tn in 2024, a 9.3% Y/Y rise. The growth is due to cloud computing, particularly IaaS, with AI and GenAI with AI-related security risks prompting higher cyber spend.

John-David Lovelock, Distinguished VP Analyst at Gartner, says: “Despite a conflated economic situation, IT spending in Europe continues to be recession-proof. CIOs in Europe who pursued the ‘growth at all costs’ strategy for over a decade are now shifting the emphasis of ongoing IT projects toward cost control, efficiencies and automation, while curtailing IT initiatives with longer ROIs. . . AI has also added a new level of concern around security ensuring that their systems are wrapped before hackers get near their sensitive data.”

Helped by staffing pay trends

New staff are cheaper as UK tech salaries continue to drift lower (see below), a move which helps sector profitability. Also, as we review UK data, we note that AI skills are priced at a premium, on average c31% above average UK full-time IT salary.

A hiring spree in a small pond has 1 effect . . . Microsoft’s new AI hub

Who remembers the London tech salary surge in 2019 & 20 when a new SI vendor rushed to hire in London following a series of Public sector and Covid-related contract wins? In the rush they created a salary bubble. This positively boosted the tech economy in the UK regions as other competitors looked outside London for FTEs. We are looking for a similar effect with the latest news from Microsoft.

As it cuts staff at Linkedin, Activision and its Gaming division, Microsoft has promised a hiring spree in London. This news came in blog (8/4) by Mustafa Suleyman, EVP and CEO of Microsoft AI who announced the opening of a new AI hub in London. The aim is to drive “pioneering work to advance state-of-the-art language models and their supporting infrastructure, and to create world-class tooling for foundation models, collaborating closely with our AI teams across Microsoft and with our partners, including OpenAI”. Mr Suleyman sees an “enormous pool of AI talent and expertise in the UK, and Microsoft AI plans to make a significant, long-term investment in the region”. Apply for a vacancy if you are “driven by impact at scale, are a passionate innovator eager to contribute to a team culture where continuous learning is the norm”.

The decision to open this hub follows Mr Suleymans “close work with thought leaders in the UK government, business community and academia so that he appreciates that the UK is committed to advancing AI responsibly and with a safety-first commitment to drive investment, innovation and economic growth”. This builds on Microsoft’s announced £2.5bn investment to up-skill the UK workforce “for the AI era and to build the infrastructure to power the AI economy”.

The TTC and the AI-Enabled ICT Workforce Consortium

We noted (4/4) the AI-Enabled ICT Workforce Consortium, an industry lobby led by Cisco (with Accenture, Eightfold, Google, IBM, Indeed, Intel, Microsoft and SAP) which aims to assess AI's impact on technology jobs and identify skills development for the roles most likely to be affected by AI.

The Consortium is evaluating the impact of AI on 56 ICT job roles and will provide training recommendations for those impacted jobs. These job roles include 80% of the top 45 ICT job titles garnering the highest volume of job postings from February 2023-2024 in the US and five of the largest European countries by ICT workforce numbers (France, Germany, Italy, Spain, and the Netherlands – no sign of the UK). Collectively, these countries account for c10m ICT workers.

Consortium member goals = Massive retraining

Consortium members have established goals with skills development and training programs to positively impact over 95m individuals over the next 10 years. Note:

Cisco to train 25m people with cybersecurity and digital skills by 2032.

IBM to skill 30m by 2030 in digital skills, including 2m in AI.

Intel to train 30m+ people with AI skills for current and future jobs by 2030.

Microsoft to train and certify 10m people from under-served communities with in-demand digital skills for jobs and livelihood opportunities in the digital economy by 2025.

SAP to upskill 2m people worldwide by 2025.

Google has recently announced EUR25m funding to support AI training and skills for people across Europe.

The Consortium follows the work of the US-EU Trade and Technology Council Talent for Growth Task Force, TTC. The TTC was established (June 2021) by US President Joe Biden, European Commission President Ursula von der Leyen, and European Council President Charles Michel to promote US and EU competitiveness and prosperity through cooperation and democratic approaches to trade, technology, and security. It explores AI’s impact on ICT job roles with the aim of enabling workers to find and access relevant training programs and connect businesses to skilled workers. It is not a UK initiative.

If not now . . . When do we see AI ‘in the data’?

Speaking to the NY Times Vanguard Global Chief Economist Joseph Davis opined that AI could be “transformative” to the US economy in the second half of the 2020s. He added that the technology could save workers “meaningful time — perhaps 20% — in about 80% of occupations”. Mr Davis admits that “we’re not seeing it in the data yet”. He also believes that the recent productivity gains were due to a snapback from a steep drop-off dating back to the pandemic. “The good news is that there’s another wave coming”.

There is a similar view emanating from Jerome Powell, Chair at the Fed who suggests that AI “may” have the potential to increase productivity growth “but probably not in the short run”. John Williams, President of the New York Fed has publicly made similar remarks and cites economist Robert Gordon.

Mr. Gordon argues that new technologies in recent years have probably not been transformative enough to give a lasting productivity boost. Other economists are more optimistic. Erik Brynjolfsson, Stanford University, has bet Mr. Gordon US$400 that productivity will “take off” this decade. His optimism is based partly on an AI experiment he ran at a large call center, April 2023.

End note: The (much) Bigger Picture

JPMorgan has identified more than 400 use cases for AI across marketing, fraud and risk, and has only begun exploring GenAI. Experts struggle to create an accurate picture of just how many jobs are being eliminated as AI advances. Understandably, companies are slow to give data as they are afraid of the consequent bad press. Since last May, there have been more than 4,600 job cuts to free up resources to hire people with AI experience or because the technology replaced tasks, according to Challenger, Gray & Christmas.

Sometimes we can get too wrapped up in the data. Let’s reflect at the comments made by Gina Raimondo, US Secretary of Commerce at a recent Consortium event:

“This work is helping us build a strong and competitive economy, propelled by a talented workforce that’s enabling workers to get into the good quality, high-paying, family-sustaining jobs of the future. We recognize that economic security and national security are inextricably linked.”

The data

IT Services Sector Productivity Index

Source: Company data, Analyst

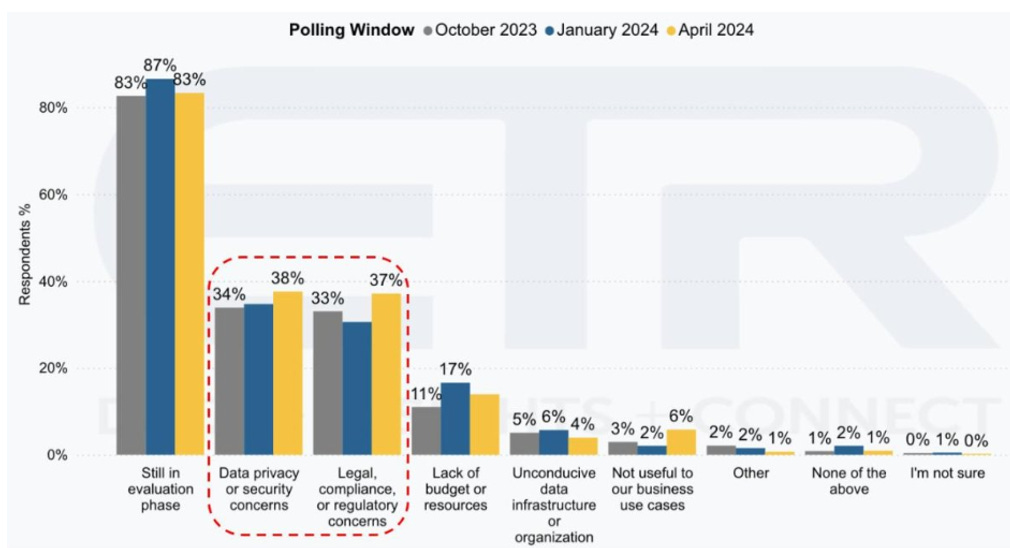

Q: Why has your organisation’s usage of GenAI for business use cases not resulted in production environment?

Source: ETR, The Cube Research (n=431)

UK Business priorities for the coming year

Source: YouGov survey 26 February - 4 March

US Job cuts by reason, Q1/2024

Source: Challenger, Gray & Christmas

UK IT salary trends since 2011 (£)

Source: ITJobswatch.co.uk, Analyst

Gartner Group Global IT spend forecasts (US$bn)

Source: Gartner Group

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.