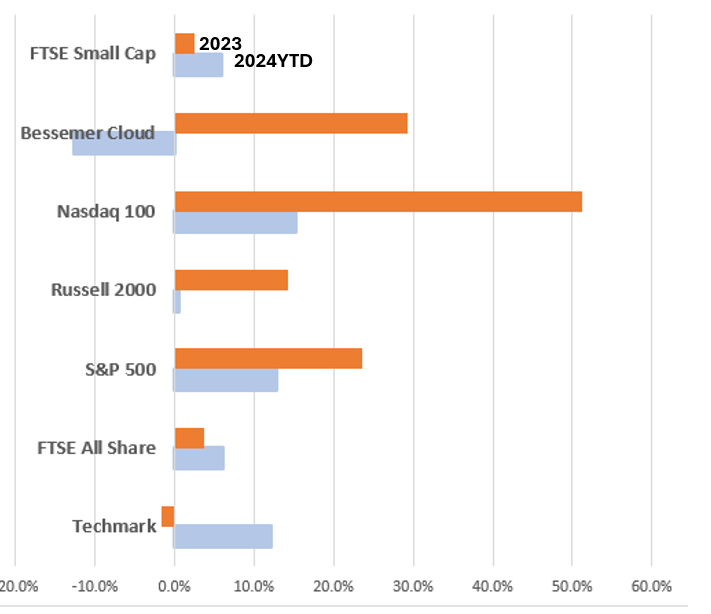

With economic concerns abating and rate cuts looming, UK smaller companies are due a bounce. London is overrun by smaller companies this week: nanny to London Tech Week, the annual back-slapping jamboree of organised chaos for UK “soonicorns” and, the city hosts the ‘Small Cap Awards’, the annual festival for <£350m plcs. We are prompted to revisit the smaller company segment and assess the data. Smaller companies are generally acknowledged as the growth engine of the economy but not the growth engine of Capital Markets where they have serially disappointed. Memories of Sage and Aveva who started as c£35m IPOs before ascending to c£10bn market cap have faded - someone has lost the ‘on-the-market’ growth playbook. That said, as evidenced by the FTSE Small Cap index, +6%YTD, vs +2.5% in 2023 (see below), smaller companies have turned. Furthermore, given that smaller companies out-perform in a falling interest rate environment those positive zephors should strengthen. Read on as we review smaller company valuation, TSR, Glassdoor (why not?) and shine a light on those outperforming company allstars Made Tech, AdvanceAdvT, Keywords Studios and Beeks Financial Cloud.

The YTD story

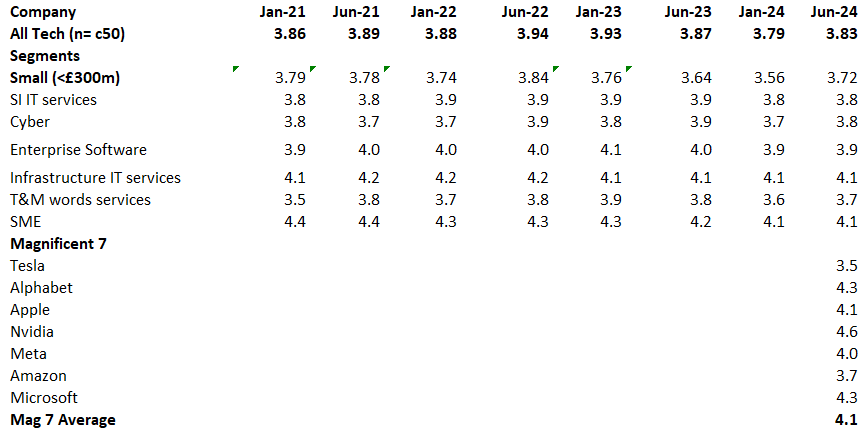

Performance in the smaller company segment suffers from wide variations. While investors can gain exposure to themes like automation, IoT, EV, digitisation and GenAI, share price drivers are usually stock specific (demanding bottom-up analysis) rather than top-down /thematic. Smaller companies can be tiresome. The smaller segment currently offers strong TSR (+11.4% YTD) and despite the rally they remain valued at a c30% discount to their larger brethren (EBITDA basis - see below). That said, large and small companies are cheap relative to history. We also review employee grudge site Glassdoor to assess if small companies suffer from their size . . . they do (rating 3.72 vs wider tech sector 3.83x - see below). Larger companies have the happiest staff, after-all they can afford to pay more, so attrition will be a worry. But in truth this also holds true for the Magnificent 7 (see below) where staff are the happiest and whatever concerns investors might have, Mag 7 staff are unlikely to “rotate out of overbought US growth stocks”. Interestingly, the LSE star-turn YTD2024 (to 10 June) across all segments is Made Tech with TSR +85.1% vs sector +11.1%. Made Tech is a small (mkt cap: £23m) IT professional services company to the UK public sector. Smalls are on the march.

Mind the macro

Smaller companies have higher correlation to the UK economy, like Made Tech, so gain from lower rates as the cost of capital reduces and the associated economic boost means that their customers have more cash. We see this as a more likely scenario as UK interest rates fall, rather than any rate reduction being symptomatic of a deepening recessionary environment. So, while the rate reduction acts as an immediate catalyst for shares, in time the lower interest rate environment boasts earnings due to better demand-side conditions. Hence, expect a ‘double whammy’ of continued share out-performance. In our view, investors are unlikely to ignore the disconnect between valuation and the growth potential.

The top sector performer: Made Tech + 85.1% YTD 2024, Market Cap £23.7m

This is an IT Professional Services firm operating in the UK public sector (central & local government, healthcare) and so operationally it looks like Kainos and TPXimpact (both incidentally also having a good run this year with TSR being +21.2% and +17.5% respectively – see below).

Made Tech was founded in 2008, and has c430 employees spanning London, Manchester, Bristol and Swansea, with an offering spanning digital transformational services. At interim results (26/2), despite revenue ticking down 7% Y/Y to £19.1m, Adj EBITDA was +180% Y/Y to £1.4m (H1 FY23: £0.5m), cash was £7.9m from £8.3m at the FY. Current Trading commentary saw the company guide say that it was “on track to meet FY24 profit expectations, with revenue slightly down on prior year”, despite the “challenging market and uncertainty created by the forthcoming general election”. CEO Rory MacDonald commented that Made Tech was focused on ensuring that the company was “fit and ready to capitalise on the structural growth opportunities that we see in the UK public services market” with a right-sized cost base, experienced senior management, and an achievable strategic growth plan.

More recently (22 April) Made Tech announced that it was awarded a new contract with The Department for Levelling Up, Housing & Communities, DLUHC, worth up to £19.5 over 24 months with a 12-month extension option. Made Tech won its first contract with DLUHC in 2019 and the latest contract sees Made Tech work on the design and development of new digital tools and services with the first being the Privately Rented Property Portal - a national private rented sector database. CEO Rory MacDonald reminded investors that the award helped underpin FY25 revenue expectations.

Looking into the cohort - General Election timing welcomed by TPXimpact

Given the general end market similarities, plus the confirmed date of the UK election we had a catch-up with TPXimpact (6 June). TPXimpact is itself ‘glowing up’ as it is nominated for a brace of awards at the forthcoming Small Cap Awards.

The company (30/5) confirmed the FY24 outturn and guidance for FY25 and FY26. For FY24 (ended 31 March) the results, to be released in July, were ‘in line’ with 20%+ revenue growth, c£84m, Adj EBITDA margins “in the middle of the guidance range of 5-6%” and Net debt (excluding lease liabilities) “just over” £7m, ensuring Net debt/Adj EBITDA comfortable <1.6x. Even though FY25 was “subject to a degree of disruption resulting from the General Election” TPXimpact reiterate prior FY25 targets of: (i) like-for-like revenue growth of 10-15%, (ii) margin improvement of 2-3% on top of that achieved in FY24, which “we expect to be weighted to H2” – for us acknowledging the temporal election effect. For current trading, FY25 pipeline opportunities and committed backlog revenue, £67m, is c70% of target FY revenue. Looking into FY26, TPXimpact guided for 10-15% like-for-like revenue growth, with Adj EBITDA margin 10-12%. CEO Bjorn Conway stated that the announcement of a General Election in July removed the uncertainty and while they were working through the implications of the snap election announcement it “sees no reason to change our FY25 targets”.

Note: Following our update we updated our IT Professional Services dashboard (below).

Buy the company & get the trend for free

While this week sees the political parties reveal their election manifestos, at this juncture we see no big changes (as per the ERG from the Conservative/Liberals from 2010) or any wider policy shift in favour of in-house delivery. Despite the expected pause on new IT spend during the Election purdah period the structural drivers favouring digitisation are well-ingrained as is the levelling-up agenda and UK administration remains short of technical skills, so freeing up staff for public services can only imply: (i) further Public service digitisation, (ii) increased automation in service processing and, (iii) continued use of third party suppliers.

The drivers should ensure that Made Tech, TPXimpact and indeed Kainos (Public Sector is 36% of revenue) should deliver in line. In the short term, shares should continue re-rating on removing election timing uncertainty, while in the medium-term the expectation of improved earnings as an incoming administration (of whatever hue), looks to make good on early promises. That said, as we look into the wider the UK strategic suppliers, we note that Computacenter and Capita have been ignored in any election-date bounce.

Second placed top-performer: AdvancedAdvT +79.1% YTD, Market cap £195m

Joining AIM on 10 January, AdvancedAdvT is a ‘buy and build’ from experienced buy and builder Vin Murria who is the Executive Chair. Ms Murria’s strategy is “centred around backing sectors characterised by long term AI, digital transformation, data analytics and business intelligence trends, that are in early stages of adoption and set to transform the workplace for professionals over the next few decades”. Of interest AdvancedAdvT acquired five software businesses from Capita for £33m in July last. The Group's divisions are IBSS (financial management software), CHKS (AI based healthcare intelligence compliance and accreditation software), Retain (global resource planning and talent management software) and WFM (workforce management software provider).

On 7 May, AdvancedAdvT announced the acquisition of Celaton and posted a year-end trading update (eight months to 29 February 2024). For the FY update there was a comment of “good progress against key financial metrics” with revenue and Adj EBITDA deemed to be ahead of pre-acquisition trading and recurring revenue c77% of continuing revenues. PBT would benefit from the gain on the sale of Synaptic Limited, c£2.6m, an increase in fair value of investment in M&C Saatchi plc of £2.5m and Interest income, c£2.2m. Net cash and investments (29 February) was £102.9m with net cash at a very healthy £82.1m.

As to the acquisition, Celaton acquired for £5.0m has spent the past two years, and £2.3m, developing an intelligent document processing platform, inSTREAM. This is a machine-learning intelligent process automation document processing platform which features automatic data recognition, classification and validation. The last two years development saw the addition of AI capabilities, web user interface and multi-language support. Customers are multi-national enterprises such as Talk Talk, Currys and Capgemini. For the 12 months ended 30 June 2023, revenue was £3.3m, (80% recurring subscription/transactional) with EBITDA before those development costs was £1.2m, net assets £1.5m.

Ms Murria commented that "Celaton will be immediately beneficial to the wider AdvT client base, with its e-invoicing, AI, document processing IP centric product”. Of note this was a related party transaction as Ms Murria and BGF Investment Management (substantial shareholder of AdvT), each own c45% of Celaton.

Third placed company: Keywords Studios +75.4% YTD, Market Cap £1.7bn

Keywords is a video games services company. It is not a small cap anymore as the share price rallied from 18 May when it announced a possible cash bid by EQT. Should it occur (and the share price has settled below the mooted bid) this would be at a 75% premium to the undisturbed share price. The Keywords management team had re-buffed four previous unsolicited proposals from EQT and the latest “represented a significant increase from the initial proposal”. Kudos to the team for their concerns on shareholder value. The ‘put up or shut up’ date is 5pm on 15 June.

Fourth placed company: Beeks Financial Cloud +71.7% YTD, Market Cap £115m

Shares have performed well based on the solid foundations of strong trading, earnings upgrades and a secular driver on cloud migration. On 5 March, Beeks posted interim results which sparkled with: (i) 25% Y/Y growth in Annualised Committed Monthly Recurring Revenue, (ii) PBT +121% Y/Y, and (iii) operating cash flow +27% Y/Y, marking a decisive turn in cash generation. The strength of the business is reflected in 87% recurring revenue (H1 FY23: 93%), the low 0.5% attrition rate (H1 FY23: 0.8%), and improving operational leverage (underlying EBITDA 35.6% margin, +110bps Y/Y). The print was “significantly ahead of prior expectations” and Exchange Cloud is a “transformational opportunity” (via IaaS sales to exchanges, which in turn sell to clients). In our view, the risk to estimates remains on the upside for this structural growth compounder as Beeks is optimised for low-latency private cloud compute, connectivity and analytics. Customers use Beeks to connect to exchanges, trading venues and public cloud for hybrid cloud. By productising its vision (Build. Connect. Analyse), Beeks now offers an end-to-end service where exchanges are clients (three on the roster). TAM is a portion of the global US$192bn IaaS market, with 21k banks and hundreds of global exchanges all migrating on-prem infrastructure to the cloud as they reconcile cloud’s cost and agility advantages with improved security with regulatory and data sovereignty concerns being addressed. Beeks is a client of Progressive Equity Research.

The data

Indices - A YTD snapshot: A UK small cap bounce

Source: Company data, Yahoo Finance, Technology Investment Services

Small companies recover in falling interest rate environment - data

Source: Marlborough Investment Management

TSR performance since 2020 - and the YTD winners are

Note n=80 only showing companies ahead of the sector average Source: Company data, Yahoo Finance, Technology Investment Services

Valuation Heatmap: Illustrates strong TSR & undemanding valuation

Note UK company n=100 Source: Company data, Yahoo Finance, Factset, Technology Investment Services

Glassdoor - Who has the happiest staff (i.e. worry less about attrition bouncing as things only get better)

Note Company specific data available on request. Source: Glassdoor, Technology Investment Services

IT Professional Services dashboard

Source: Company data, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.