Spring is here. We are in the last gasps of FY24 reporting, but some companies (Accenture, SThree and Bytes) are now reporting on 2025 Spring conditions. For those hoping that a new season would spark new commentary, be disappointed. The belly-aching about “challenging end markets” persists. The most recent news suggests that we are still at ‘trough’ and Accenture flagged new downbeat concerns. But the week belonged to Nvidia GTC which has a spring in its step as it looks to open-source AI (Deepseek inspired?), quantum computing, humanoid home robots to personal AI supercomputers and a new AI chip architecture. Nvidia is looking to democratising access to AI tools (i.e. lower the entry price). On the early evidence, Spring valuations look set to flatline, but in the meantime the UK Techmark is a great place to hide.

Latest Tech Universe results span IT Professional Services (Accenture); IT Infrastructure Services (Bytes, Bechtle, Computacenter, Softcat); Recruitment (SThree, HRnetGroup); UK Software (Eagle Eye); IaaS (Beeks); Travel-Tech (Hostelworld); Defence-tech (QinetiQ); Internet Services (Trustpilot). Read on. Data insights inform our evolving views on the tech-economy.

Recruitment

Cohort Scenario: The KPIs have yet to record any improvement. Recruitment (i.e. Staff, i.e People), as much as technology, is the front-end of the tech economy. From our latest results roll-call, the strategic messages from the Recruitment cohort remain downbeat and recovery talk is deferred - but this is not a universal truth - there are pockets of growth and service innovation. In addition, the companies spent 2023 and 2024 downsizing and re-shaping their offer. Now they are better able to meet expectations (given their reduced cost bases and doing more contractor sales). As a positive, all agree that there is a digital skills gap which is a barrier to economic growth. Companies also flag the shortage in tech talent, but slow hiring and slow willingness to move employer has created a bottleneck. While a volatile market, the industry is telegraphing that C-suite turnover is consistent with historical levels. We remind that the impact of AI is contributing to the malaise (i.e. more acceptance of blended environments – so for IT development “organizations won’t just have more developers, they’ll have more production ready code generated by AI and more applications built and deployed by agents”). Our message to investors: Look East, and this week specifically to HRnetGroup. Recruitment remains one of the cheapest cohorts. It usually is at this point of the economic cycle. The lesson from the past is that the pricing here can ‘turn on a penny’ following any economic/MSI data.

SThree. Q1 Trading Update (1/12 – 28/2/25) Group net fees -16% Y/Y reported a slight improvement on the c18% fall in Q4 which was “against the backdrop of the ongoing challenging market conditions”, also on the slightly better KPI is that Contract (84% of net fees) -15% Y/Y, whilst Permanent was - 13% Y/Y (note in tough markets employers opt for temps rather than perms so this is not a bad sign and also SThree commented that Permanent saw a sequential improvement, particularly in the US). The contractor order book was £168m, -7% Y/Y, and a reduced rate of decline versus FY24 year-end. And finally, no downward guidance with the comment that “Performance for FY25 expected to be in line with previously announced £25m PBT guidance”. CEO Timo Lehne talked about “anticipated challenging market conditions driven by the ongoing global political and economic conditions. New business continues to be soft, however extensions remain robust across our core STEM Contract service offering”.

HRnetGroup. HRnetGroup concludes that “the groundwork for recovery is well underway”. FY revenue -2.0% Y/Y to S$567.0m, gross profit -12.1% to S$122.2m and NPAT declined 29.9% to S$46.3m in what was described as a “challenging business environment”. HRnetGroup has two business segments, Flexible Staffing (FS) and Professional Recruitment (PR).

FS revenue was unchanged at S$508.0m, but the gross profit margin was 12.6%, from 13.7% last year due to margin pressures. Contractor volume -3.7% and Gross Profit/ Contractor -4.9% Y/Y. Consequently, GP declined 8.4% to S$64.0m.

PR revenue declined 16.2% to S$54.9m, with the gross profit margin 99.9% (2023: 99.8%). There was a 6.3% increase in Gross Profit/Placement was offset by 21.1% Y/Y decline in Placement Volume at 4,558, down from 5,774 last year.

From the geographies we note that across the Group’s 17 operating cities, Hong Kong S.A.R., Jakarta, Taipei and Shanghai registered FS growth. GP contracted in Singapore and Mainland China. For guidance HRnetGroup commented that market conditions are expected to remain unpredictable but argues that it’s “entrepreneurial DNA, strong cash reserves and resilient business model will enable it navigate the uncertainties”. In this the company is:

Moving up the Recruitment Pyramid by pivoting PR higher up the value chain to serve the increased talent needs and pipeline building in senior and strategic roles. While FS migrates to recurring mega contracts especially for governments.

Structural Cost Management as it de-layer management which should make savings of c.S$1.0m with additional space consolidation and hot-desking making rental cost savings of S$1.6m.

Fresh S(igmoid) Curves. HRnetGroup has created new growth waves with new co-owners coupled with fresh branding with new business units in Shanghai, Singapore and Vietnam.

The numbers we track: SThree, HRnetGroup

Source: Company data, Technology Investment Services

Recruitment KPI Dashboard - highlighting HRnetGroup

Source: Company data, Technology Investment Services

Beyond the KPIs - we also see

Source: Manpower Employment Survey, HRnetGroup, Technology Investment Services

IT Professional Services

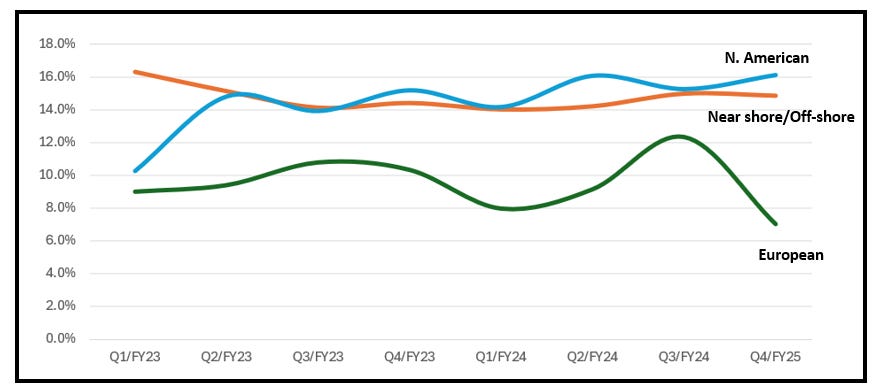

Cohort scenario. The Q3 margin uptick has reversed, but bookings have recovered and revenue growth c5-6% is achievable. The IT Professional Services cohort is slowly emerging from the aftermath of the Covid and immediate post-Covid environment which saw the industry over-hire. Since then, staff attrition dried up impacting profitability. However, more recently attrition has been shuffling upwards, the industry has some pricing power (i.e. inflation clauses) and so revenue growth has been rekindled. In addition, GenAi has given the industry a new secular growth driver and is a new twist to Digital Transformation programs, but from the KPI dashboard the industry is slowly starting to rehire and re-train existing staff which in the short-term dents utilisation. Shares in the cohort are cheap reflecting the past two difficult years, rather than the dashboard which telegraphs a recovery.

Accenture. A Q2 modest beat, but some of the KPIs disappointed and so the shares were down (c6.5%). New bookings US$20.9bn, -3% Y/Y, while GenAI new bookings were US$1.4bn up from US$1.2bn sequentially and GenAI contributed US$600m to revenue. Revenue US$16.7bn +5% Y/Y and EBIT margin 13.5%, +50bps Y/Y. Staff was over 800k, +6.9% Y/Y, with the data and AI workforce now at 72k. While Accenture raised the lower end of FY guidance, there are new cautions, for example;

It is too soon to understand if the company’s now negative DEI stance impacts business or staff (unplanned staff attrition was up to 13%, from 12% and the Glassdoor rating is unchanged, 3.8x).

Uncertainty in the US Federal business following the US General Service Administration instructed all federal agencies to review their contracts with the top 10 highest paid consulting firms contracting with the US Government (Accenture Federal Services is on the list). The GSA’s guidance was to terminate contracts that are not deemed mission critical.

In recent weeks, Accenture is seeing an “elevated level of what was already significant uncertainty in the global economic and geopolitical environment, marking a shift from our first quarter FY twenty five earnings report in December”.

The numbers we track: Accenture

Source: Company data, Technology Investment Services

IT Professional Services KPI Dashboard

Source: Company data, Technology Investment Services

European IT Professional Services companies have an EBIT margin problem

Source: Company data, Technology Investment Services

UK Software

Cohort scenario: The Cohort Adj EBITDA margin has recovered but otherwise the KPIs telegraph a continued period of difficult trading. These companies are typically smaller than their US counterparts, but all sell and compete globally. In addition to being smaller they typically have poorer KPIs (notably cash-based, ARR, NRR, but have better profitability. The comparative KPI mix may on its own account for the lower valuation and support the view that the venue has little to do with the valuation). The group is cheap from a valuation perspective and capital allocation will usually include dividends and share buybacks.

Eagle Eye. H1 period revenue and Adj EBITDA were flat Y/Y. There was some good operating news with an OEM agreement with “one of the world's largest enterprise software vendors” (un-named). The deal is that elements of the Eagle Eye AIR platform will be directly integrated into the vendor's offerings, which should take Eagle Eye into new markets and sectors. The formal launch is currently scheduled for May 2025 with customers expected to be live from FY26 and “material revenue generation from FY27”. CEO Tim Mason commented: “Whilst the H1 performance was lower than we had hoped, we have reset the business and are ready to scale, with multiple avenues for growth. We have started the second half of the year with renewed momentum, energised by the progress already achieved”.

Trustpilot. The turnaround continues with a very pleasing set of FY results (which were ahead of the Pre-closed update) as Trustpilot looks to develop as a high margin SaaS business. Bookings grew 21% Y/Y to US$239m. Revenue grew +18% Y/Y to US$211m, Adj EBITDA +55% Y/Y to US$24m. Also a positive is NRR at 103% (2023: 99%). Reviews were +23% Y/Y to 301m with 140bn annual TrustBox impressions.The company is guiding to “high teens 2025 revenue growth c/c with Adj EBITDA slightly ahead of market expectations” and a 2ppt improvement in adjusted EBITDA margin.

The numbers we track: Eagle Eye, Trustpilot

Source: Company data, Technology Investment Services

UK Software KPI Dashboard

Source: Company data, Technology Investment Services

IaaS

Cohort scenario. We are in the midst of a large ‘cloud’ shift which favours the IaaS cohort. While the hyperscalers seem the obvious ‘winners,’ the IaaS segment has an array of companies who will gain from vertical market focus, but also in the wider cloud migration, as well as the more ‘classic’ RAS (reliable, available, Secure) corporate requirements. In addition, most modern applications were designed to run on cloud, rather than on-prem systems. While the newsflow tells us that CapEx is on the increase, there is less attention to improving Adj EBITDA margins and recovering FCF margins which feature in the KPI dashboard.

Beeks Financial Cloud. H1 results are in line with the 19 February trading update. Illustrating continuing strong, double-digit sales growth, there is a raft of client wins and Beeks enters the crypto exchange market. CEO Gordon McArthur gives an upbeat assessment of the pipeline opportunities while the current ACMRR ‘take rate’ underpins the positive view. The wider ‘cloud’ industry (Oracle’s print, pending CoreWeave IPO) offers ample evidence of strong cloud demand, as does the increase in trading volumes, due to heightened volatility. While customers span UK, US and EMEA, contracts at JSE and BMV illustrate the potential in Asia-Pacific and the wider developing world. Our view is unchanged: Beeks is gaining from secular tailwinds (cloud adoption, compliance, data sovereignty, cybersecurity, sustainability, analytics, payment modernisation, AI in risk management), which have enabled it to carve out a moat as market leader in cloud infrastructure for financial markets and payments. Investors buy Beeks for long-term secular growth and its ‘best of breed’ financial model giving resilience in difficult times. See our write up on the Progressive Equity Research platform.

Defence-Tech

Qinetiq. A Trading Update became a profit warning coupled with a bigger share buyback programme (up to £200m over 2 years) and so tells us that any blind approach to Defence-Tech is not a good option. Qinetiq called out “tough near-term trading conditions” which continue to affect short cycle work in the UK Intelligence and US Sectors resulting in “further delays to a number of contract awards”. Add in the geopolitical uncertainty which has impacted Q4 weighting to higher margin product sales from the US. The company needs to show evidence that it can win available contract work.

Travel-tech

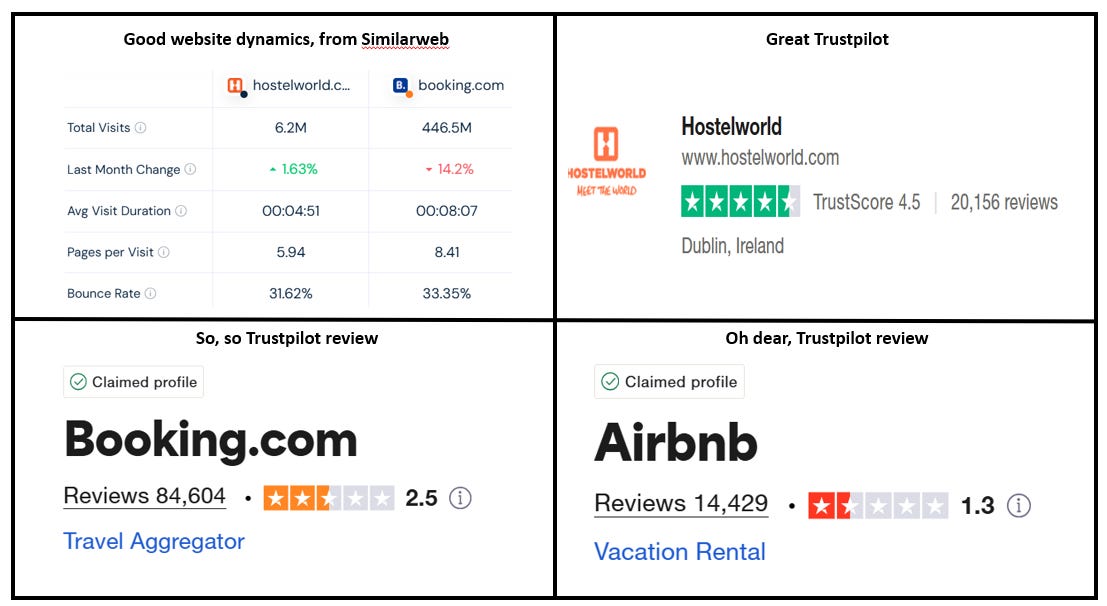

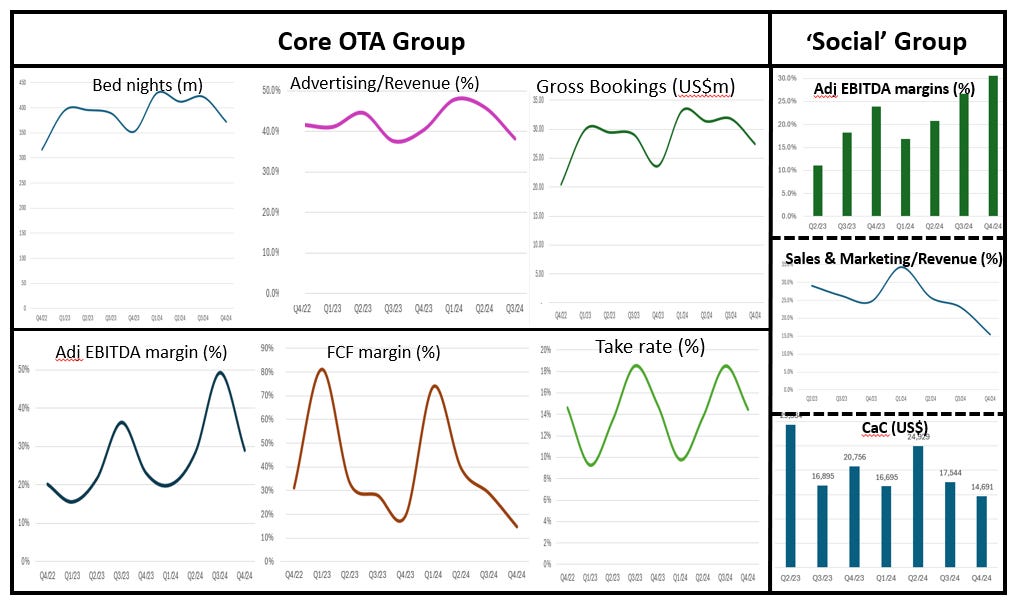

Cohort Scenario. Core OTA KPIs continue to trend downwards. We have lapped pre-Covid, but in the recovery period travel patterns have changed: it is farther away to cheaper destinations, it is also wider in scope, and closer European breaks tend to be shorter/more frequent, while maintaining spend. The OTA industry is using GenAI and social media to better engage with customers before, during and after their stay. We factor this dynamic into our cohort modelling by looking to Social company KPIs to understand how CaC drives lower Advertising spend and in turn shapes higher margins. The viral effect of App usage, creates a network effect from the App and with it the opportunity to create expansion products. If we travel in part to ‘hang out’ with new people and friends – why shouldn’t the financial models resemble social media companies? From the KPI dashboard we note in the Social group higher Adj margins with reducing CaC and a faster cash cycle. This is being echoed by the travel-tech group with falling Advertising/Revenue rates.

Hostelworld. We increasingly view Hostelworld as a Social app and less of an OTA, but for now it is an OTA, the mission is to “Meet your People” (Aside: this is what my daughter says when she comes back from yoga class). Hostelworld now has 2m+ social members, 80% of bookings are made by social members (+13%) and these fueled the 16% App booking growth. We continue to nudge investors to look at our Social Group KPIs to see how increased ‘virality’ reduces marketing and increases EBITDA while lowering CaC and thereby breaks the classic OTA marketing spend cycle. FY net bookings 6.9m (2023: 6.5m), with a record performance in Asia and Central America. Net ABV of €13.21, a decrease of 8% year on year (2023: €14.36), driven by shift in consumer demand towards lower cost destinations (i.e. Asia and Central America). Revenue €92.0m, -1% Y/Y. Adj EBITDA €21.8m +19% Y/Y – this is driven by the social strategy which reduces marketing expenses. Cash (31/12/24) €8.2m (2023: €7.5m) with net cash €2.0m (2023: €12.3m net debt). CEO Gary Morrison commented that the increase in adjusted EBITDA, coupled with robust cash conversion, enabled early debt repayment and return to a net cash position in the third quarter.”

Sidebar. The Hostelworld app uses customer booking data to create chat rooms and private messaging channels (iOS and Android) connecting customers with overlapping stay dates in hostels and cities. These chat rooms are hostel-based and city-based. Hostel-based chat rooms connect customers staying in the same hostel on the same dates, while city-based chat rooms connect customers staying in any hostel within the same city on the same dates. City-based chatrooms are further organised by themes, such as drinks and dancing, walking tours and food, allowing customers to easily find other travellers with similar interests, visiting the same city at the same time. Members make approximately twice as many bookings and being three times more likely to use the app within the first 91 days of joining compared to non-members. App usage has reduced marketing expenses as a percentage of generated revenue, from 50% in 2023 to 46% in 2024.

The numbers we track: Hostelworld

Source: Company data, Technology Investment Services

Hostelworld’s App-enomics

Source: Company data

Hostelworld the mission now is to use ‘app virality’ and great referencability to widen reach

Note: Data from 21/3, Source Similarweb, Trustpilot

Travel-Tech KPI dashboard

Source: Company data, Technology Investment Services

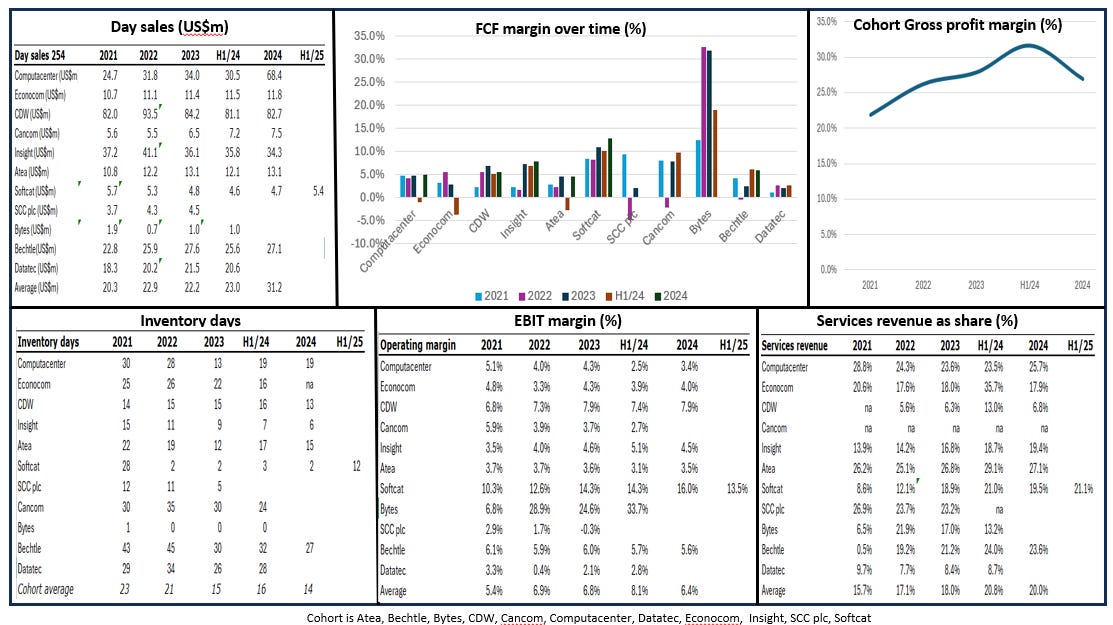

IT Infrastructure Services

Cohort Scenario: Day Sales are recovering, but margins (gross and operating) remain under pressure. Positively the cohort is doing more higher margin services revenue, although it will suffer from the utilisation issues common to the IT Professional Services cohort. There are multiple demand-side drivers for this cohort. The most immediate one is Windows 10 end-of-life. However, soundings from the latest batch of analyst conference calls suggests that this effect could drift into 2026. Generally, the cohort KPIs are emerging from a cyclical downturn. As a caution we note that as spend returns, there will be pressure on inventory days which in turn will soak up working capital – and a feature of the latest results is that inventors are increasing.

Computacenter. The disappointment of missing 20 years of unbroken EPS growth was partly erased by an ‘inline’ print and a confident outlook. In the aftermath the shares recovered some of the recent lost ground. Gross profit +1.2% Y/Y but Adj operating profit -6.8% Y/Y but this was after a record H2 Adj operating profit, +11.2% Y/Y. Adj net funds £482.2m, up £23.2m (operating cash of £417.1m, up from £410.6m last year) and this was after a £200m share buyback programme (clearly the buyback should have been larger to ‘work’ the EPS calculation, manage tax exceptions, but Computacenter has yet to appoint a new CFO). The star turn was the US with 8% revenue growth with a 2.4% Adj Operating margin, unchanged Y/Y and illustrating that there is still much to do to bring it closer to Group margins. The region is now 43% of revenue at £2971.4m, from £773.2m in 2019 and 0 in 2018. We see lots of potential in the Asian business where Computacenter has been steadily building its footprint. We note:

Podium customers were 192, 179 Y/Y,

Professional Services revenue growth 11.9% Y/Y, and

Product order backlog (31/12/24) +116% Y/Y and +35% since 30/6/4.

Mike Norris, CEO "Computacenter delivered a solid performance in 2024 as a whole in the context of a tough first half comparative and a more challenging IT market. Encouragingly, the second half was the most profitable in our history and was derived from our highest number of major customers”. Looking to 2025, “we remain mindful of the uncertain macroeconomic and political environment . . . We have started the year positively and overall, we expect to make progress in FY 2025, with earnings per share benefiting further from the impact of the share buyback”.

Softcat. A positive H1/25 (period to 31 January) which headlined with 12.1% growth in gross profit and 19.3% in gross invoiced income. Also there was 10.4% operating profit growth in what was described as “another record first half profit” even as headcount was +6.0%. Closing cash of £141.0m, from £112.5m last year (note the big inventory build-up – see KPIs). CEO Graham Charlton commented that the H1/25 performance was “slightly above our initial expectations and an upgrade to full year guidance, despite the persistent backdrop of generally more challenging trading conditions”.

Bechtle. Q4 revenue of €1.8bn -4% Y/Y but in line with expectations (€1.83bn). Fukk year Bechtle’s EBIT €351.3m above the €351.1m consensus midpoint with FY revenue, €6.31bn, in line with consensus (€6.33bn). Bechtle commented on the “exceptionally challenging year” (note the two most important markets are Germany and France) but in addition it had a soft SME sector and “uncertainty among our public sector customers due to the unresolved budget issues”, “some drastic changes at our manufacturing partners, political upheaval at national and global level, terrible wars”. Bechtle has two reporting segments: IT System House & Managed Services reveue was -5.3% Y/Y, while the IT E-Commerce segment was +4.4% Y/Y

Bytes Technology Group. No numbers but an upbeat FY Trading Update (ended 28/2) with news of double-digit growth in its key financial metrics, gross invoiced income, gross profit and operating profit where GII exceeded £2bn for the first time. Wait till May for any actual detail.

IT infrastructure Service KPI dashboard

Source: Company data, Technology Investment Services

The UK market -Remains a safe place to hide (better than a duvet)

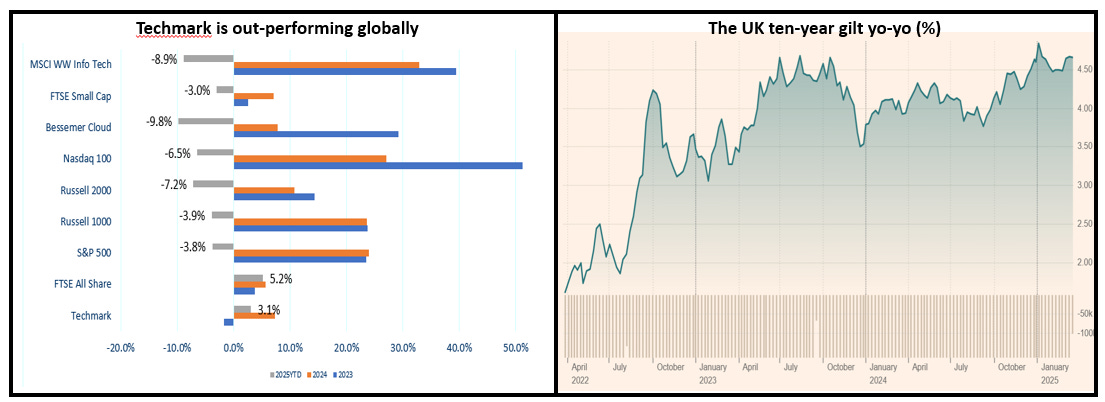

Message: Good news - while all indices have retreated, the UK Techmark remains a safe ‘place to hide’ in this market. As the dust clears we would expect more international investors to come to the UK to reduce US market risk on their way to Asian growth seams. Note: As an inducement, the UK remains attractively priced and has a stable political backdrop. As always ‘bottom fishers’ look for extreme over-sold situations - but in truth - that is a long list.

Techmark out-performs globally but the 10-year tells us the valuation may be stuck for now

Note: Priced pre-open 21/3 Source: Yahoo Finance, Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.