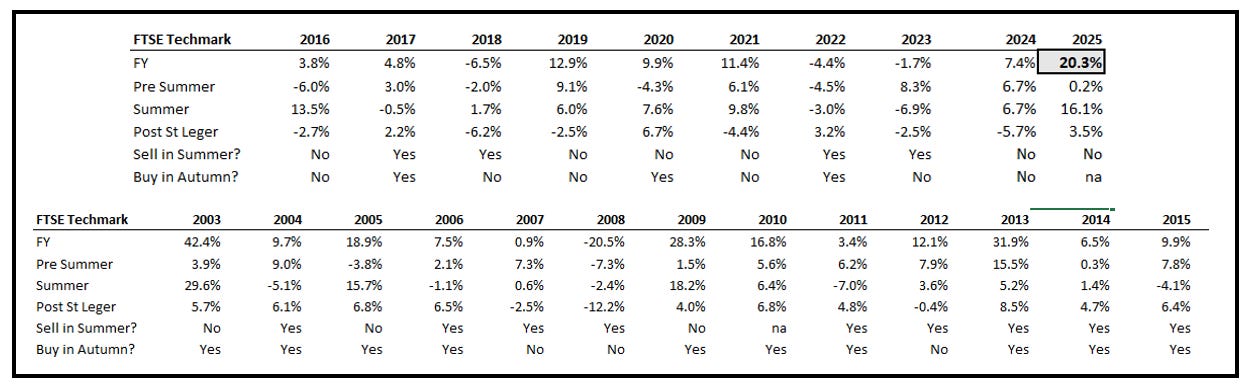

Good news abounds. We have IPOs in over-drive (here, here and here), valuations are cheap (below), US valuation jaws are opened, and Techmark Index returns (+20% YTD) are the best in many years (12, actually). There is very wide performance diversity ensuring that ‘active’ (rather than passive) management is critical, and to underscore that, the esteemed Ms Katie Potts was honoured with the Brian Winterflood Memorial Award at the glittering AIM Awards this week. We are thru September. Now Q4 offers the opportunity to lock in gains and think about 2026 portfolio selection from a position of strength. The cohort KPIs tell us that tech business models are generally on an improving trend, despite the macro headwinds and brewing concerns about state actors. Yes, nothing moves in a straight line, except sentiment. In this edition we cover the AIM awards, tech sector valuation in Q4, TSR, key performers and IPOs.

Tech Universe results and updates from the past week span UK Hardware (Alphawave IP, Xaar); Gaming (Devolver Digital); Fintech (Boku, Monzo, Revolut); UK Software (Advanced AdvT); Consumer-tech (Beauty Tech); IoT/Smart (Aurrigo); IaaS (Fermi). Read on. Data insights (not navel gazing or ‘vibes’) inform our evolving views on the tech-economy.

Tech drivers and Points to Ponder

1. AIM awards: Celebrating 30 years

AIM topped off its 30 year birthday celebrations with the AIM Awards held on Wednesday evening. As always, superbly managed by the Ford Sinclair team (hat tip: Ian, Jo, Julie and Izzy). BDO, the stalwart of the sector, was lead sponsor, and so deserves everyones’ business (hat tip: Jo, Matthew and Chris). As always, there was a healthy constituency of tech companies on the podium and on the short list.

Marcus Stuttard, Head of AIM & UK Primary Markets, London Stock Exchange Group, commented that AIM is the most active European growth market and there are many reasons to be optimistic for the future. Mr Stuttard called out the UK reform agenda which includes measures to unlock greater flows of capital into growth companies. Continuing the head rush of good news, this morning (3 October) sees the debut of Beauty Tech (below), a Cheshire-based company, which makes and sells at-home beauty devices using lights and lasers.

‘Lights and lasers’ a suitable reminder of the AIM Awards.

AIM Awards 2025: The winning Cohort

Source: Company data, Technology Investment Services

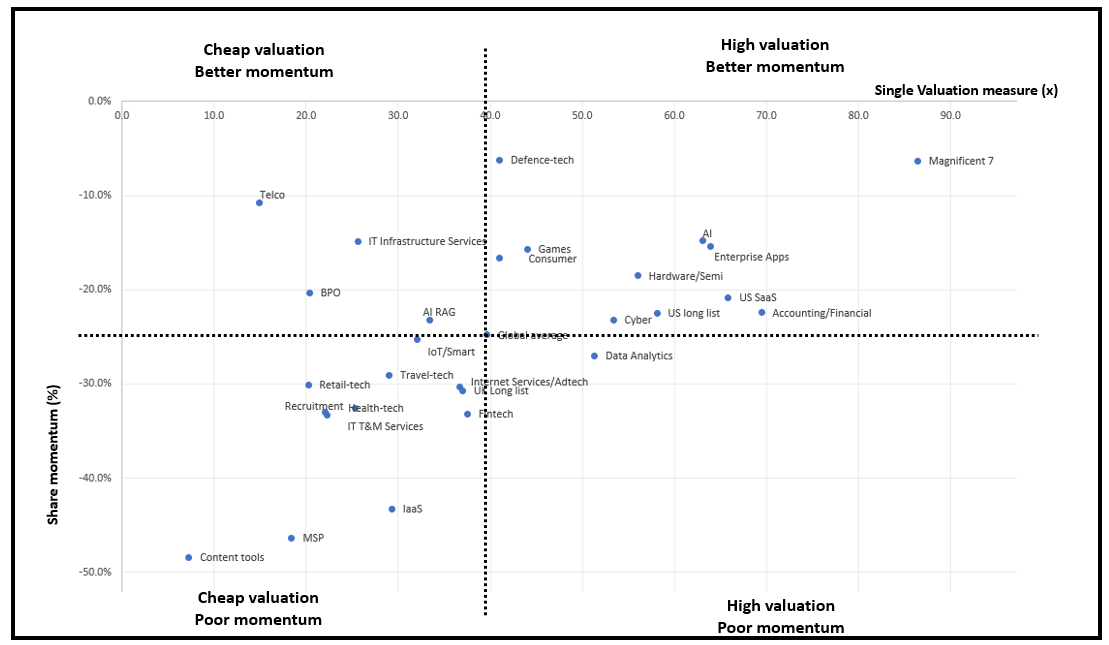

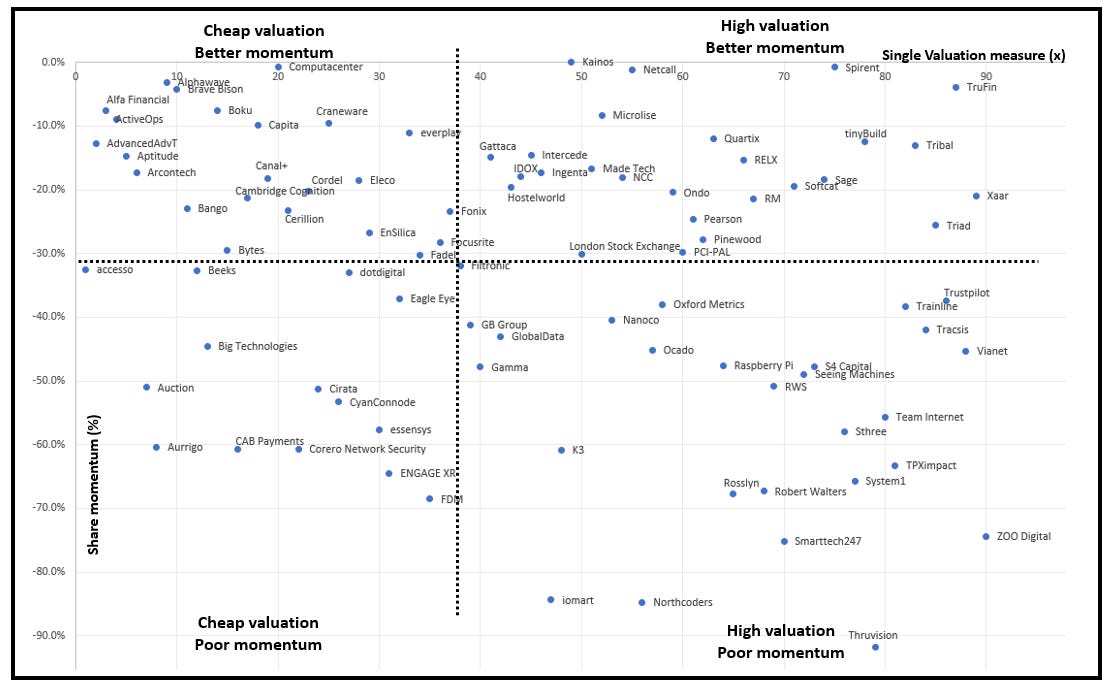

2. Into the final quarter: What’s in and out of favour

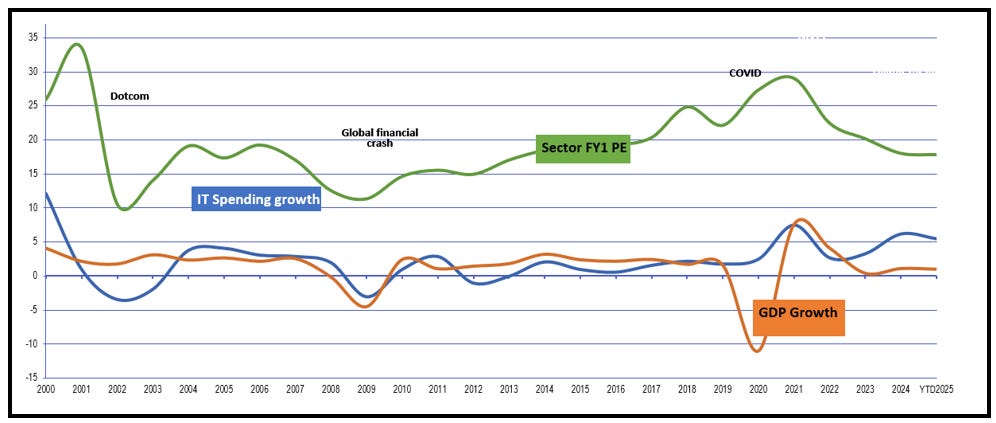

The clock has turned into calQ4. We review the runners and riders and call out the best, and not so best, performers. The Techmark Index YTD gains are truly impressive (i.e. +20.3% YTD), and now investors will be keen to ‘lock in’ the out-performance, and prepare for 2026 portfolio selection (i.e. sell into the strength). At the same time, the valuation tables inform that valuation remains pedestrian, and with the US valuation jaws opening again, the UK looks ‘cheap’ both for overseas investors (looking to diversify) and local buyers. In addition the KPI dashboards indicate that tech underlying business models are on an improving trend - yes there are ‘up and down’ cohorts - as identified below.

Techmark Index: A seasonal view since 2003. A banner year in the making

Priced 2 October after market. Source: Yahoo Finance, Technology Investment Services

Tech cohorts ‘in and out’ of favour

Priced 30 Sept after market n= 550. Source: Company data, Yahoo Finance, Technology Investment Services

UK shares ‘in and out’ of favour'

Priced 30 Sept after market n= 90. Source: Company data, Yahoo Finance, Technology Investment Services

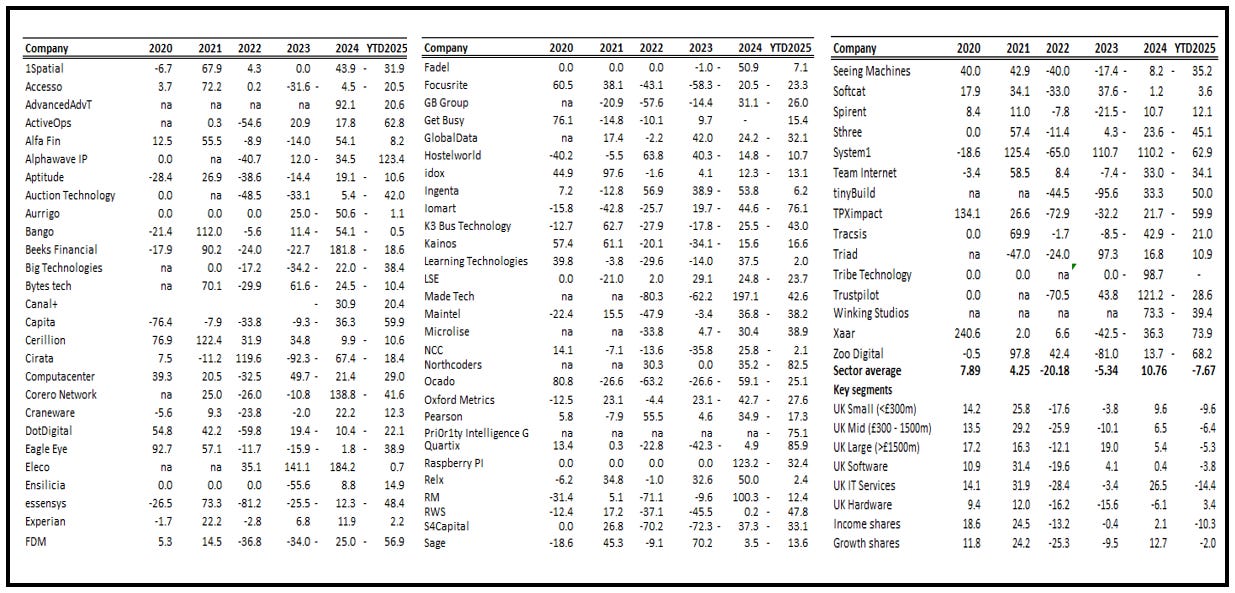

LSE Tech share TSR 2020 - 2025YTD (%)

Priced 2 October after market. Source: Company data, Yahoo Finance, Technology Investment Services

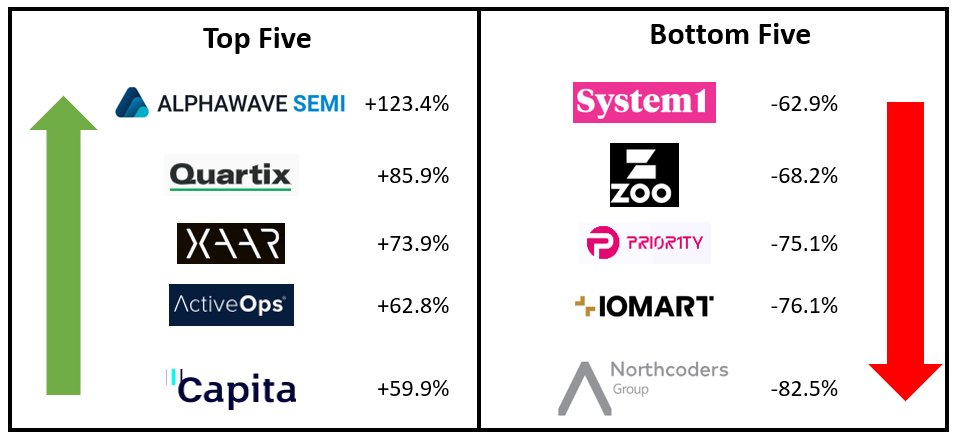

2025YTD TSR Top Five, and bottom Five, performers (%)

Priced 2 October after market. Source: Company data, Yahoo Finance, Technology Investment Services

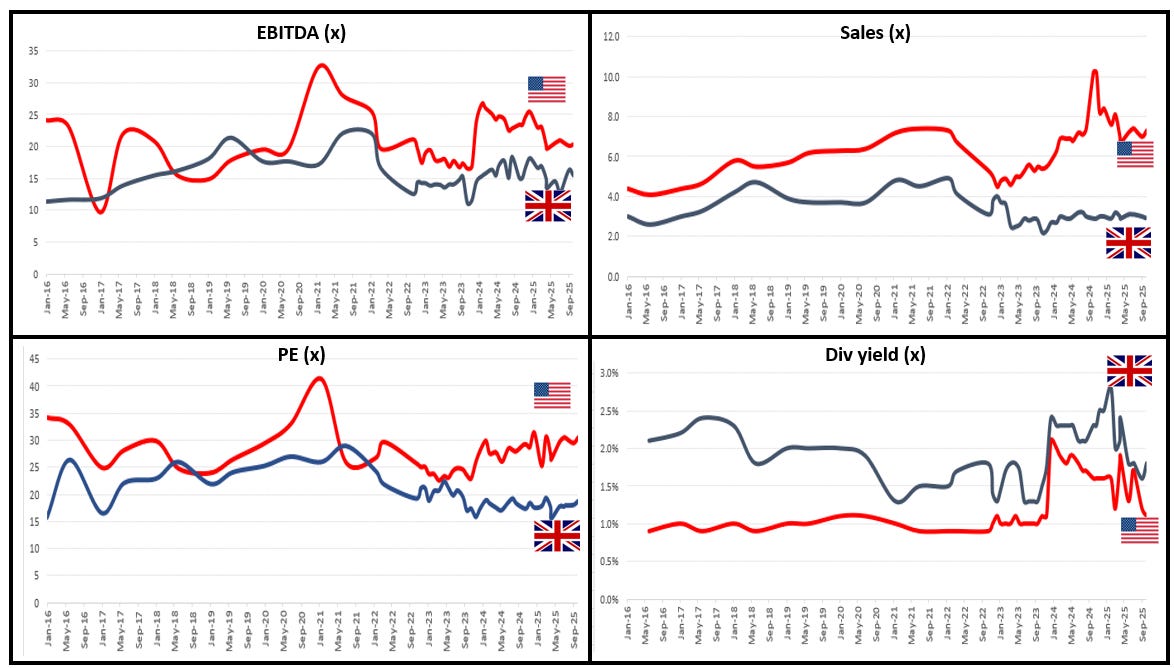

US and Them: Valuation gap Jaws open wide illustrating that the UK is cheap, cheap

Priced 30 Sept after market n= 550. Source: Company data, Yahoo Finance, Technology Investment Services

UK Valuation cheap over the long-term view

Priced 30 Sept after market. Source: Company data, Yahoo Finance, Technology Investment Services

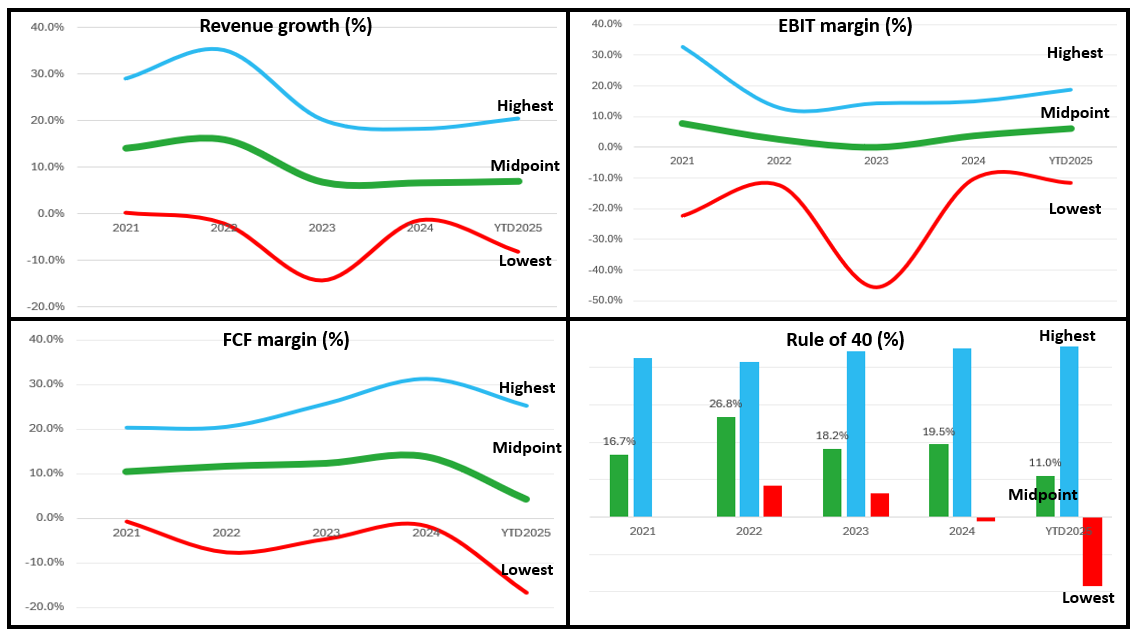

Cohort KPI dashboard overview shows the tech sector KPIs are broadly on an improving trend

Priced 30 Sept after market n= 550. Source: Company data, Yahoo Finance, Technology Investment Services

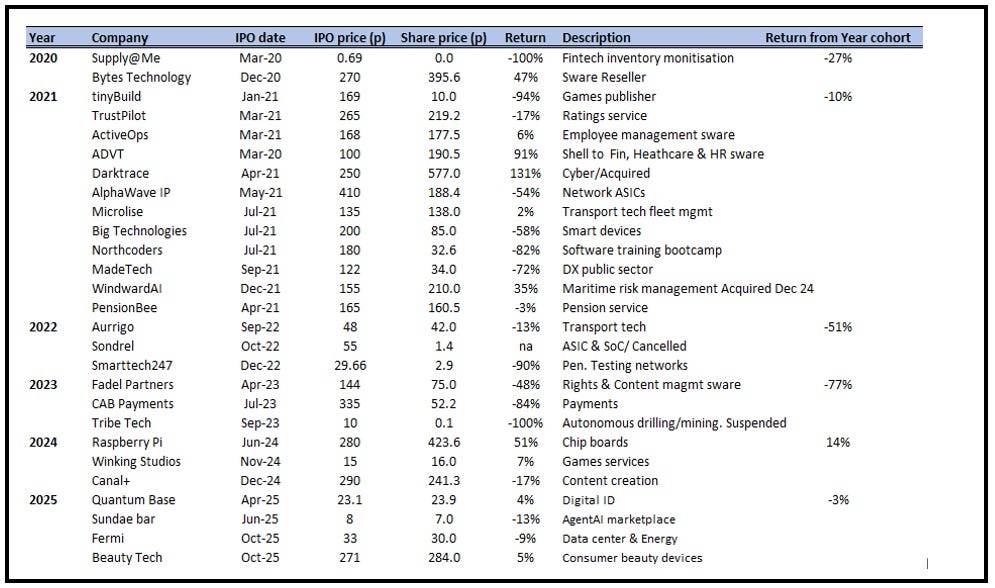

3. IPOs and share prices: For when the bell tolls

Last edition I wrote about the brewing IPO pipeline for London. This week there was a whopper with the Fermi dual listing (see below). This morning brings Beauty Tech, a Cheshire-based company which makes and sells at-home beauty devices using lights and lasers. Although it is not a tech company, there is news of another pending IPO this morning. While the sums raised in the UK are tiny, nonetheless these give London something to showboat. In addition, with Fermi in particular we have a pre-revenue company nesting on a US$19bn valuation. This can only help sentiment amongst those pre-IPO companies who are dithering between a London or US listing. The message from Fermi: ‘do both’.

IPO share prices: After the bell

Priced 3 October pre-market, Beauty Tech 10:00 GMT. Source: Company data, Yahoo Finance, Technology Investment Services

4. More on PISCES - first GTM partner

Further to my previous commentary on PISCES this week, Crowdcube became a Registered Auction Agent (RAA) for the Private Securities Market. Now, Crowdcube investors will be able to invest in late stage, private secondary tender offers on PISCES. Crowdcube can act as a conduit for eligible investors, sophisticated investors, and employees of the investee companies, providing them with access to ownership in businesses that previously would not have been available until after an IPO.

For their part, companies can use Crowdcube’s technology to manage liquidity events for employees in share option schemes. Crowdcube portfolio companies could use it to provide liquidity to their retail investor bases as well as their employees and other early shareholders. PISCES is open to EU companies.

Latest results/Company Updates

UK Hardware

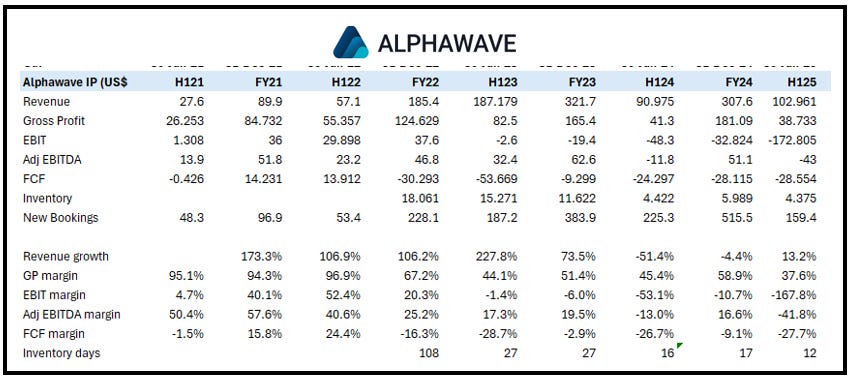

Alphawave IP. The company is in offer period so little disclosure - fortunate as the KPIs are all over the place. H1 results saw revenue grow +12% Y/Y to US$103m (royalties fell 0.5% to US$25.7m, reminding us that the mainstay of revenue remains ‘non-recurring’). The company says the results reflect global economic uncertainty, imposed tariff regimes, and “certain customers deferring or revising their purchase decisions due to the uncertainty arising from the announcement in early April 2025 of the recommended acquisition of the Group by Qualcomm”. Adj EBITDA -US$43.0m vs -US$11.8m last year due to “certain customer projects taking longer to complete than expected”, higher headcount, impairment of a purchased intangible asset and an additional US$4.5m commission payment due to a customer. Cash outflow from pre-tax operating activities in H1/25 was US$15.3m (H1 2024 cash inflow: US$50.4m), reflective of lower revenues in H1/25, and the continued investment in leading connectivity technology products.

Bookings, US$159.4m, were -29% Y/Y, and the current backlog excluding royalties was US$327.7m also down on H1 2024 when it was US$486.4m. Cash and cash equivalents held by the Group US$118.7m with net debt of US$231.4m. President and CEO Tony Pialis commented that the company continues to support Qualcomm in obtaining the approvals required to complete the transaction and received clearance from the UK government in respect of the notification made under the National Security and Investment Act 2021.

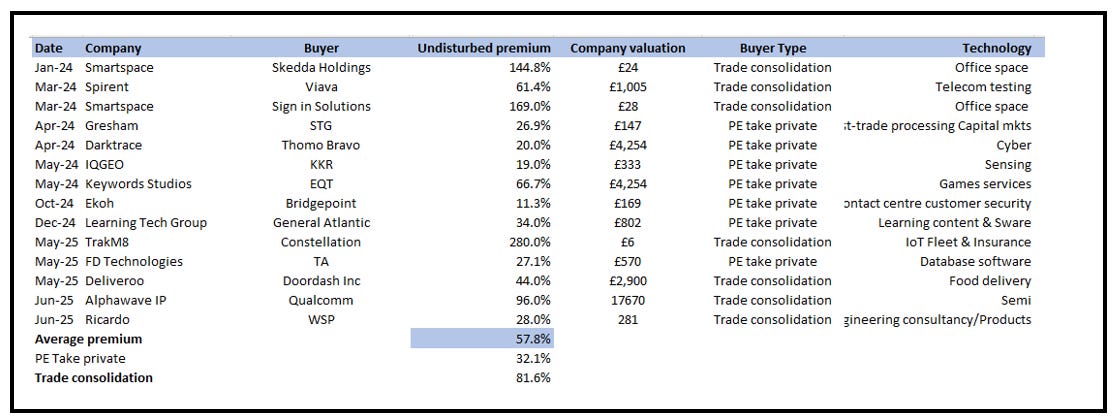

Exploring the undisturbed premium in LSE M&A

Source: Company data, Technology Investment Services

The data we track: Alphawave

Source: Company data, Technology Investment Services

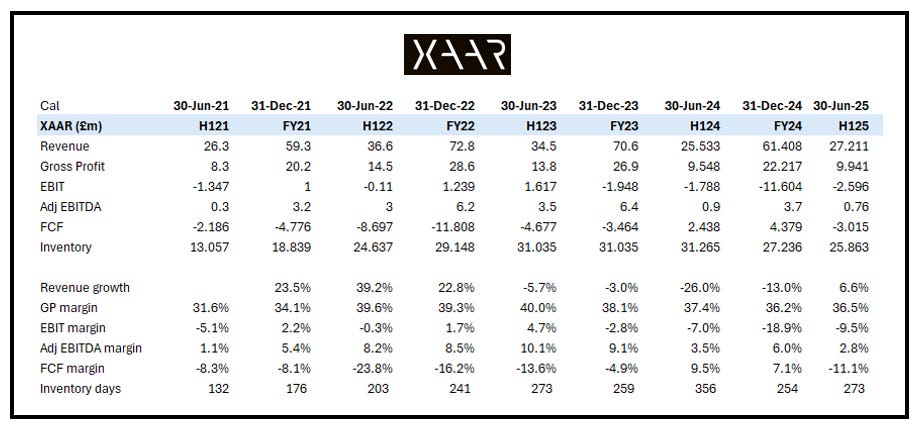

Xaar: In-line, doing fine. Xaar has confirmed that trading is in line with guidance, and reiterated FY25 expectations (to 31 December). This follows the maturing of recent product launches and the timing of new ones. Xaar announced that all new market initiatives are progressing as anticipated. With these, Xaar is able to brush off some of its prior caution. Pleasingly, part of the growth is due to new orders from a major customer for the launch of its desktop 3D printer. This new segment has the potential to develop revenues in a way similar to wax jetting earlier in 2025 – a revenue stream that soared from £0.6m to £3.3m. While there is an irksome new tax liability (£3-4m) to be paid over the next two years, the taxes can be comfortably paid as they fall due. We are delighted that Xaar is now sure-footed about its H2 prospects. Shares are racing (+73% YTD) but remain on a pedestrian rating.

See my views on Progressive Equity Research

The data we track: Xaar

Source: Company data, Technology Investment Services

Gaming

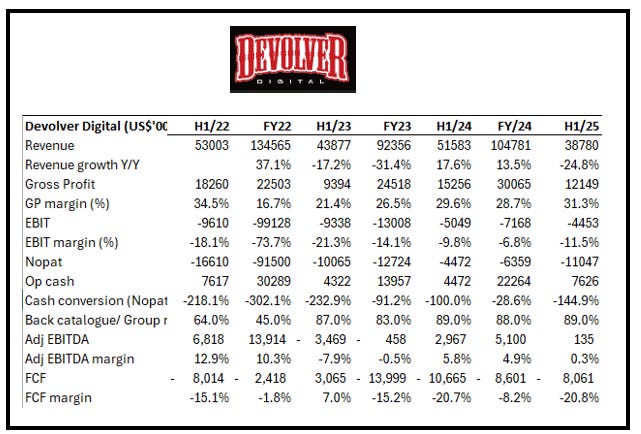

Devolver Digital. A poor H1 (suffering from comps) but a very optimistic view on H2 - and so another proof point of the recovery in the gaming sector. H1 revenue -24.8% Y/Y to US$38.8m with a net loss US$11.0m, Adj EBITDA US$0.1m. Cash US$34.7m (30 June) vs US$41.6m (31/12/24). The company reiterates FY guidance. CEO Harry Miller said that the company has “good visibility” on H2 supported by signed platform deals, Steam publisher and seasonal sales, a healthy release schedule and strong current trading. Current trading and outlook

At least 15 new titles expected for full year 2025, with 8 or more releases in 2H.

On track to meet guidance, a.k.a. revenues over US$100m and Adj EBITDA in the high-single digit US$m.

Healthy pipeline >30 new titles due for release in the future 3-year cycle to mid-27.

The data we track: Devolver

Source: Company data, Technology Investment Services

IoT/Smart

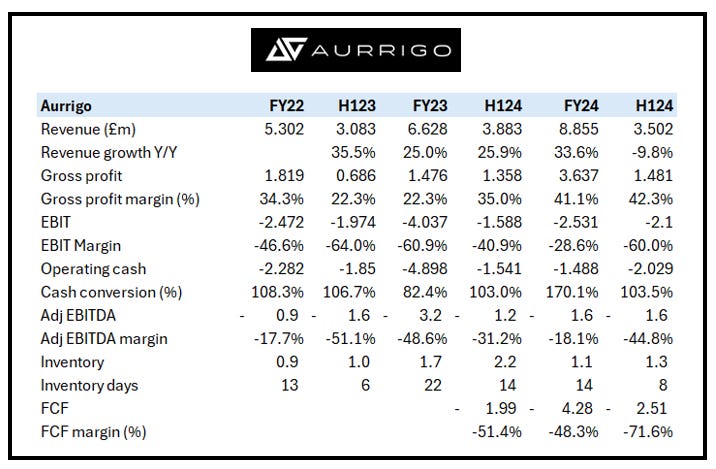

Aurrigo. Shares remain on the ‘wait and see’ step, but there are a few encouraging signs visible in the KPIs (see below). H1 revenue, £3.5m down from £3.9m last year, although the Autonomous division saw a 41% revenue increase to £1.1m as Automotive revenue, £2.36m, slipped from £3.1m last year. Adj EBITDA was -£1.6m, reversing the £1.2m profit in H1/24. Net cash was unchanged £1.8m, and ahead of a £14.1m fundraise. Operational positives include:

Auto Cargo, the Group’s largest autonomous aviation vehicle to date, and developed in collaboration with UPS, was launched.

A three-year partnership signed with Swissport International AG to deploy Auto-Sim at Zurich Airport and trial an Auto-DollyTug, which is “due for delivery soon”.

Following successful trials at Amsterdam Schiphol, Aviation Solutions B.V. formally approved Auto-DollyTug and Auto-Sim for recommendation across a network >60 airports.

The company reiterated the (downward) revised FY expectations. CEO David Keene commented on the “encouraging momentum” with new customer and partner engagements despite the macroeconomic headwinds which “contributed to delays in the timing of certain tenders”.

The data we track: Aurrigo

Source: Company data, Technology Investment Services

IaaS

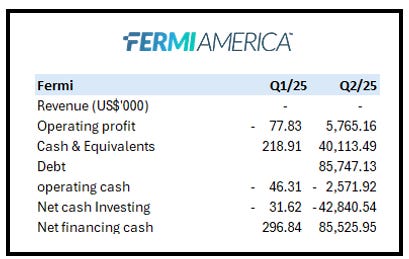

Fermi Inc. On Thursday (2 October), Fermi made its London debut with a secondary listing on the Main Market, following its US$14.8bn, US$682.5m raise, US IPO on Wednesday on Nasdaq’s Global Select Market (Prospectus). This is the first concurrent US/UK dual listing IPO since Arm in 1998. Fermi, based in Amarillo, (Texas) is a pre-revenue real estate investment trust focused on building the world’s largest energy and data complex, powered by nuclear, natural gas and solar. Fermi is less than a year old.

Project Matador, Fermi’s flagship project, is a 5,236-acre site expected to deliver 1.1GW of power by 2026 end and up to 11 GW at scale. (For context: The UK’s data center capacity is 1.6 to 1.7 gigawatts (GW) with planned expansion to 4GW.) The project, initially announced in June, is still in its very early stages of development and according to the company, has commenced with geotechnical work and “expects” to deliver 1GW by the end of 2026. When built, it will house one of the largest nuclear power complexes in America, with combined-cycle natural gas, utility grid power, solar power, and battery energy storage. Last month, Fermi entered a non-binding letter of intent with its first tenant for a 20-year agreement. Still, it does not expect tenant revenue to commence until 2027.

Gas is expected to be the primary source of power in the short to medium term. Fermi has signed several agreements with nuclear energy companies to supply the campus with nuclear power for its long-term operations. This week, Fermi signed a Letter of Intent with Siemens for up to 1.1GW of gas turbine capacity to power the site. This followed a deal in July that saw the company purchase more than 600MW of natural gas generation capacity through two separate transactions. The acquired assets included nine natural gas turbines, which the company stated will support its goal of delivering 1GW of AI power at the site by 2026.

Fermi was co-founded by Toby Neugebauer (CEO) and Rick Perry (Director).

Mr Neugebauer is an investor and entrepreneur in energy infrastructure, with a career spanning private equity, investment banking, and strategic development. He co-founded and served as co-managing partner of Quantum Energy Partners, one of the largest dedicated US energy PE firms with c.US$28bn capital deployed (or to be deployed). His prior company was acquired by Macquarie who secured Fermi’s US$250m senior loan facility.

Mr Perry is a former Texas state governor and former US Secretary of Energy (2017 to 2019), where he oversaw the DOE’s US$30bn annual budget and led major policy initiatives to modernise the US nuclear energy sector. Mr Perry brings connections with the current US administration.

Fermi intends to use the IPO proceeds, in addition to its existing assets, to support business growth, enhance its workforce, and increase financial flexibility in support of its planned data center project. Last month, it secured US$100m Series and a US$250m senior loan facility with US$100m drawn at close.

The data we track: Fermi

Source: Company data, Technology Investment Services

FinTech

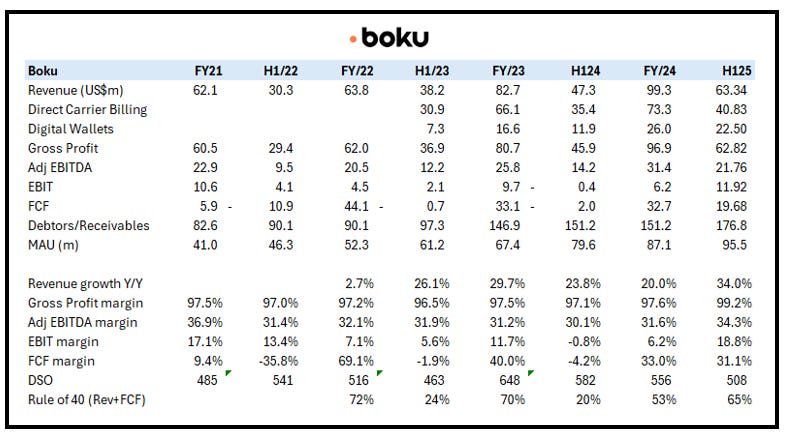

Boku Inc. ‘Company of the Year’ at the AIM Awards this week, Boku is now firmly on an established high-growth curve as reflected in the latest 34% Y/Y revenue growth to US$63.3m. As to segments: Direct Carrier Billing revenue was +15% Y/Y, with Digital Wallets and Account-to-Account 89% Y/Y revenue growth. Adj EBITDA +53% to US$21.8m (34.3% margin). Cash, US$192m, +8% Y/Y, with Boku’s own cash +9% to US$87.3m, which was after 5.8m shares repurchased costing US$12.3m. MAU +20% to 95.5m. Commented that it is trading in line with consensus (i.e. revenue US$126.7m/Adj EBITDA US$39.3m). CEO Stuart said that the H1/25 momentum is a function of the trust built with the world’s largest tech giants and the scale of the global network - driven by consistent execution, resilient infrastructure, and a seamless localised payments experience. As merchants expand across both mature and emerging markets, “the rapid rise of Digital Wallets and Account-to-Account schemes underscores the accelerating shift beyond traditional card networks toward more flexible, mobile native local payment methods”.

The data we track: Boku

Source: Company data, Technology Investment Services

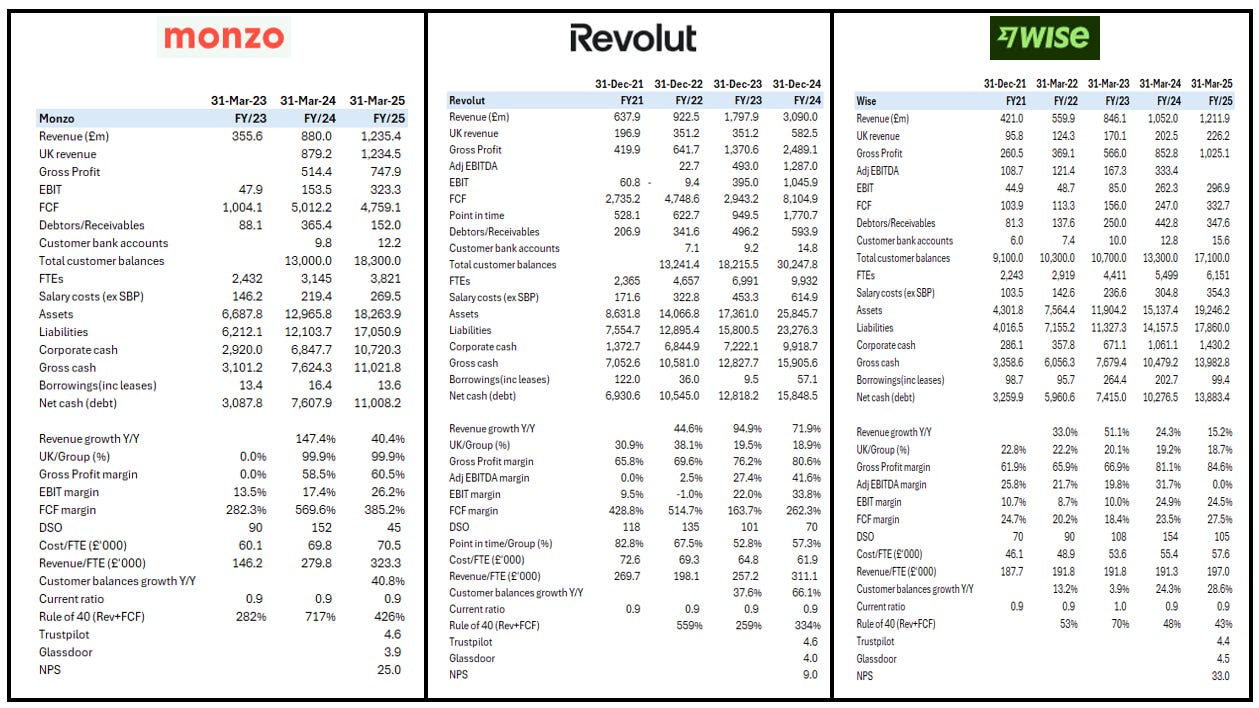

Monzo & Revolut. I commented on IPO candidates Monzo and Revolut last edition but forgot to include the data file (#analystfail). Apologies, it is below. As recompense I have included a side-by-side with Wise so you can compare and contrast as you begin to form your valuation views. The latest valuation is currently c.US$65bn for Revolut, c.£4.5bn for Monzo, while listed Wise is £10.3bn.

The data we track: Monzo, Revolut, Wise

Source: Company data, Technology Investment Services

UK Software

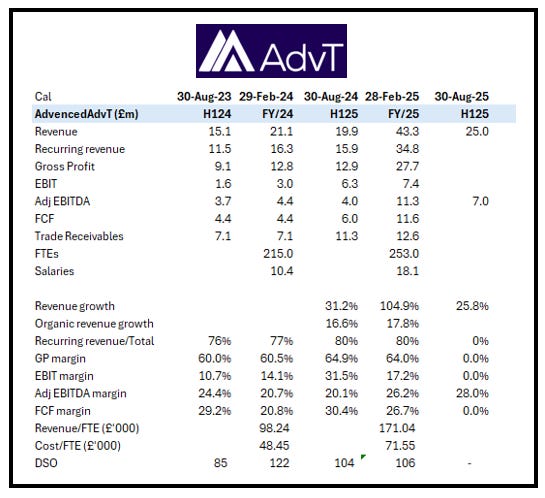

AdvancedAdvT. A positive H1 Trading update (to 31 August). Revenue is expected to be not less than £25m with “sustained momentum across all operating units” and Adj EBITDA is expected to be not less than £7m – the drivers being operational efficiencies, customer growth, and successful contract renewals. Net cash is £116.1m (£96.9m net cash plus £19.2m investment in M&C Saatchi plc). The completed “two strategic acquisitions, GOSS and HFX”. While there is a macro caution (“tariff uncertainty and local government devolution”) Trading is in line with expectations with more details at H1 results “later in October 2025”. Exec Chair Vin Murria commented that the results “reflect the mission-critical nature of our solutions and the continued progress we’re making in operational performance and improvement”. Adds that in addition to organic growth in AI, automation and SaaS, she is committed to “exploring acquisition opportunities”.

Everyone moans that UK tech shares are cheap (in fairness the grumbles are supported by data); Ms Murria is one of the few domestic players to actually test the water – Go for it Vin!

The data we track: Advanced AdvT

Source: Company data, Technology Investment Services

Dear investor,

Thank you for reading to the end.

This is the 97th edition. Hopefully, as one of the 44,500 readers, you have seen value in ‘The long and the short of IT’. From the 100th edition the plan is to move to a part-paid subscription model. ‘Paid’ is actionable- it addresses ‘what it means, and what to do next’. To date, I have been setting the framework and reviewing the ‘as is’ status. From 100, I will share a deeper analysis, build on my proprietary frameworks, annotate the financials and add context with my KPI industry comparisons.

I hope that you will join me.

Best wishes

George

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.