The long and the short of IT

Glassdoor Review: Invest in ‘4’s not ‘2s’

Martina King CEO at Featurespace advised me: “Why work at a ‘2’ when you can work at a 4”. Ms King was referring to the Glassdoor company review system (1-5) where employees look before choosing an employer. Tech staff are hard to come by and retain. It is a seller’s market for the best candidates. Staff are c70% of the operating costs at a tech company, so as a cost, factor of production and success, their ‘state’ is of interest to the investing community. Not only does Ms King run a super company, but her Glassdoor score is usually a 25% premium to the chasing pack, currently at 4.3. As Ms King spoke, my thoughts drifted; “why should a buyer have a ‘2’ as a supplier” . . . “why invest in ‘2’, if you can invest in a ‘4”? For this reason (and being a nosey parker), I have looked at Glassdoor since 2014. As the latest Manpower Employment Survey shows improving hiring intentions, trueup spots an uptick in vacancies, and full-time salary rates increased in September (we are still below January 2024). Net/net there are indications that the tech job market may unclog. We present some of our aggregate Glassdoor findings. Spoiler Alert: There is a relationship between Glassdoor (our Happy Index), share valuation, and shareholder value. . . . this is not woke altruism.

In this episode, we also review the latest crop of company results and Trading Updates. These are courtesy of Adobe, Computacenter, Eleco, NCC, Oracle, Rubrik, TPXimpact, and Trustpilot. Let’s see how they dovetail with our performance dashboards and inform our happy/sad investment view.

Glassdoor: What do the reviews tell us?

All companies extol their cultures and internal staff NPS rates, Glassdoor puts transparency to this. To be sure, it can be gamed, but I have been following the site since Summer 2014. A decade on, there is meaningful data. While ‘n’ is 52, a challenge over the period has been that constituents change, some migrate from listed companies to private ones or became divisions of other entities, others have been dropped. Also, to better understand the context of UK listed companies, we look at companies listed on other venues (US and Europe) and UK private companies. We have anonymized company names but these are available ‘on demand’ (for other nosey parkers). In addition, we look at the scores through our ‘cohort’ lens to see if staff working in certain areas of the tech universe are ‘happier’, or more miserable, than others. Spoiler alert: They are.

General findings include:

Staff have been less happy since the pandemic ended (September 2022) and the Great Resignation took off.

The current top five Glassdoor plc company scores are: Beeks, Eagle Eye, Kainos, Sage and Softcat. Looking back to 2022 the top five over that period are Cirata, Eagle Eye, Kainos, Sage and Softcat. We also look at how these companies TSR has progressed since then.

Some poorly rated companies are well-regarded from a TSR perspective – any unclogging of the employment market makes their outlook more uncertain as, we expect, key staff to leave for happier employers.

Employees are happiest in private companies. The plc sector emphasis on transparency, governance and ESG does not translate to happier staff. An interesting aside is that when a plc is acquired typically the Glassdoor rating falls, a reflection, I feel, that acquisitions will usually by accompanied by a downsizing and ‘noisy’ exiting staff complaining. That said, companies are typically making exiting staff sign non-disclosure agreements.

Employees are happier in non-UK listed companies, relative to UK listed ones.

From the cohort lens: staff are happiest at the Mag7 companies (should we be surprised),

The current top five happiest companies are Beeks Financial, Eagle Eye, Kainos, Sage and Softcat. While this might indicate that unlike so much ESG scoring, ‘happy’ is not biased in favour of larger companies, however on average bigger company staff are happier than their counterparts at smaller firms.

Glassdoor ratings have been sliding consistently and this may be telling about salary levels. Our salary data has been showing a declining pattern (see below). Or it may reflect the many downsizing initiatives which are still on-going. Indeed, August was the busiest month since January 2024 for tech layoffs (see below).

Valuation patterns show a directional relationship with ‘Happy’. The cause relationship is uncertain, but directionally visible. Theoretically, we posit that engaged staff are ‘happier’, feel valued, work harder to achieve targets, which then a capable CFO translates to financial targets, themselves achieved leading to a better valuation etc. So much for the theory. Where this breaks down is that some sectors, for example Infrastructure Services have happier staff, who deliver their performance goals, yet the segment is lowly valued for a variety of other reasons.

Mindful of the challenges on the relationship with valuation we looked at TSR over the period. Drawing conclusions is mixed, despite the sector favouring share rewards as part of the overall compensation package.

Glassdoor measures, since 2014

Source: Glassdoor, Technology Investment Services

Could the tech labour market be about to ‘un-lock’?

Source: Manpower Employment Survey, trueup.io, Technology Investment Services

Persistent tech lay offs dent enthusiasm

Source: Layoff.fyi

UK tech salary rates - a slight uptick

Source: itjobswatch.co, Technology Investment Services

Top 5 UK plc Glassdoor performers and TSR - average since 2022

Source: Company data, Yahoo Finance, Technology Investment Services

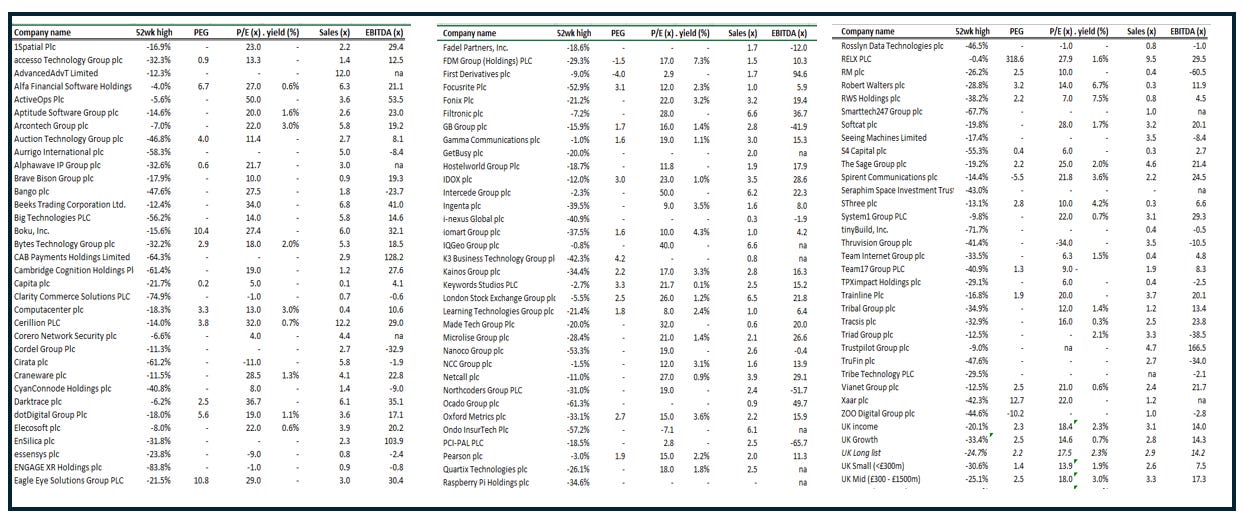

UK Long list valuation overview

Priced 12/9 Source: Company data, Yahoo Finance, Technology Investment Services

The latest results roll call

Adobe

It was a record quarter with new Digital Media ARR US$504m, exiting RPO US$18bn +5% Y/Y, revenue +11% to US$5.41bn and cash flow US$2bn. Adobe repurchased c5.2m shares in the quarter Shantanu Narayen, Chair & CEO talked about the “groundbreaking advancements in AI across Creative Cloud, Document Cloud and Experience Cloud”.

Data & Analytics dashboard

Source: Company data, Technology Investment Services

Computacenter

H1 results were in line with the July Trading Update and the company reiterated FY guidance. However, given the H2 hurdle investors are unconvinced by ability to achieve the FY. The H1 results featured Gross profit -4.8% Y/Y, Adj PBT -26.8% Y/Y, Adj net funds +£116.8m to £401.9m with “solid” underlying performances in Germany and North America, softer UK market conditions. Mike Norris, CEO: “Our performance in the first half largely reflected the expected normalisation of Technology Sourcing volumes against an exceptionally strong comparative. At the same time, we have executed well against our strategy by adding seven ‘podium’ customers in the half, broadening our customer base in North America.”

Meanwhile it is all high drama . .

Computacenter has delivered 19 years of unbroken EPS growth, this year Mr Norris celebrates 30 years at the helm. Wouldn’t it be magical if the company was able to celebrate 20 years of EPS growth to coincide with Mr Norris’ anniversary. This means getting to 175p EPS, from 55p at H1 – it looks like climbing the Eiger. However, we note:

Computacenter is buying back shares and has a further c£140m to spend. This reduces the denominator so net/net the company can achieve EPS growth and report lower Y/Y profit.

Adjusted tax rate helps in H2,

Industry data (Gartner and IDC) points to the recovery in Infrastructure spending,

‘Budget flush’ season helps Computacenter as it sells a range of early rev/rec solutions,

as per company guidance “we have made an encouraging start to our Q3 and continue to expect stronger momentum in H2”.

this plan works as long as the share price remains suppressed - a rising share price increases the denominator. At least that part of the plan is working as long as the share languishes c2,450p.

IT Infrastructure Services dashboard

Source: Company data, Technology Investment Services

Eleco

Interim Results were pleasing from this sure-footed management team. ARR +31% to £25.8m, flattered by M&A but organic was still very strong at 21%. Recurring Revenue was 24%, Y//Y and is 74% of total which was + 21% to £16.3m. Operating profit was +36% to £1.5m and Adj EBITDA at £3.3m, from £2.6m Y/Y. Cash (30/6) £12.0m vs £9.4m at 31/12/23. From the product portfolio the company launched AstaGPTTM, GenAI support which was developed in-house, launched 3/ 24 and is now Shortlisted for the Innovation of the Year at the Digital Construction Awards 2024. This has a strong customer and company ROI. Jonathan Hunter, CEO: “The impetus on organic growth has made Eleco a more resilient business with greater revenue visibility and is expected to help the Group reach new heights as positive momentum develops. . . We continue to trade in line with expectations.”

NCC Group

A positive Trading update (four months to 30 September). August had better than expected performance in Cyber which results in raised guidance to Group revenue c£104m, +c.4% growth versus the equivalent period in 2023, with Adj operating profit c£6m. Prior guidance was revenue c£100m, Adj operating profit of c.£3.5m. Mike Maddison CEO: “Our transformation journey is ongoing, and we continue to build out our core Cyber Security capabilities and our separate Escode re-branded business, which both provide future growth opportunities to continue to enhance shareholder value."

Oracle

Shares soared in the aftermath of the results, +12%. There were good numbers, Cloud Services became Oracle’s largest business, and a MultiCloud agreement inked with AWS. The numbers featured: revenue +7% Y/Y to US$13.3bn, Total RPO +53% to US$99bn, Cloud revenue (IaaS plus SaaS) US$5.6bn +21% Y/Y, IaaS US$2.2bn, up 45% and NetSuite Cloud ERP revenue US$0.9bn +20% Y/Y. Operating income US$4.0bn, +20% Y/Y and free cash flow US$11.3bn. Larry Ellison, Chair and CTO: “Oracle has 162 cloud datacenters in operation and under construction around the world.

The largest of these datacenters is 800 megawatts and will contain acres of NVIDIA GPU Clusters for training large scale AI models. In Q1, 42 additional cloud GPU contracts were signed for a total of US$3bn.”

Up, up and away: Cloud Infrastructure revenue at Oracle

Source: Company data, Technology Investment Services

Rubrik

A banging beat and raise print as Q2 exceeded all guided metrics with Subscription ARR +40% Y/Y to US$919.1m, revenue +35% Y/Y to US$205m. Positive operational tailwind as “the long list of recent successful cyber attacks and IT outages is driving organizations to increasingly recognize the need for a robust cyber resilience plan to ensure business continuity in the face of cyber disruptions” said Bipul Sinha, CEO, Chairman, and Co-Founder. From the numbers we noted that GAAP gross margin, 73.1%, 76.6% Y/Y.

TPXimpact

A negative Trading Update informing that FY25 revenue growth expected to be flat (prior guidance like-for-like revenue growth of 10-15%), Adj EBITDA target maintained at £7- 8m. FY26 financial targets (revenue growth of 10-15%, Adj EBITDA margin of 10-12%) were re-affirmed. H1 revenues is to be down c.8-10% Y/Y with growth expected in H2 The reason for the downgraded revenue growth was additional approvals processes introduced following the Chancellor's announcement on 29 July 2024 of a £22bn "black hole". TPXimpact believes that these will continue until “at least the conclusion of the Government's Spending Review and the announcement of the Budget on 30 October 2024”. We note:

Revised guidance better aligns TPXimpact revenue growth and profitability to the cohort-wide trend (below).

New business won in the first two months of Q2 FY25 was £17m, vs £9m in Q1.

Possibly, hinting at a deeper issue, rather than simply navigating a temporary ‘hole’, TPXimpact has reduced staff costs and is to save £3m+, with an in-year FY25 benefit of around half this amount for restructuring costs c£1m.

Björn Conway, CEO: “Irrespective of the short-term market factors at play, we firmly believe that Digital Transformation will continue to be a major part of Central Government strategy, and public services more widely, for the foreseeable future."

We confess that we were side-blinded by this fault line in UK Public Sector procurement. A pause in spend is usual post an election. Given the state of public finances, we had been looking for some version of the ERG group (this was set up by the Conservative/Liberal coalition in 2010) which took a fresh look at procurement in the public sector. That was more transparent that the current government approach - which is in itself disappointing. In addition, TPXimpact is one of those SME suppliers who should be encouraged to bid for more Public Sector contracts. For us this pain should be felt by the Government Strategic Supplier list. They have been quiet on this issue, but may have stuffed pipeline deals ahead of the election.

IT Professional Services Dashboard

Source: Technology Investment Services

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.