The Enterprise Awards are unique. They celebrate the Entrepreneur. They support the WCIT Charity. There were super troopers aplenty yesterday as the Enterprise Awards marked the milestone of over 100 UK Tech Entrepreneurs honoured. The 13th Edition showcased some of the UK brightest companies in AI, scale-ups, fintech, and public sector. As a judge I know that some very worthy companies did not make the final list this year (mamma mia) but hope they will return next year.

In this issue we also explore the outlook for sector profitability, implications from the Great Restocking, the rumblings of a recovery in London small caps. Meanwhile the latest Tech Universe results span UK Software (Rosslyn, Quantexa, noted former EA winner); AI-RAG (Capita); IT Professional Services (Triad); IoT/Smart (Seeing Machines); UK Hardware (Oxford Metrics); Recruitment (Hays). Read on. Data insights (not navel gazing) inform our evolving views on the tech-economy.

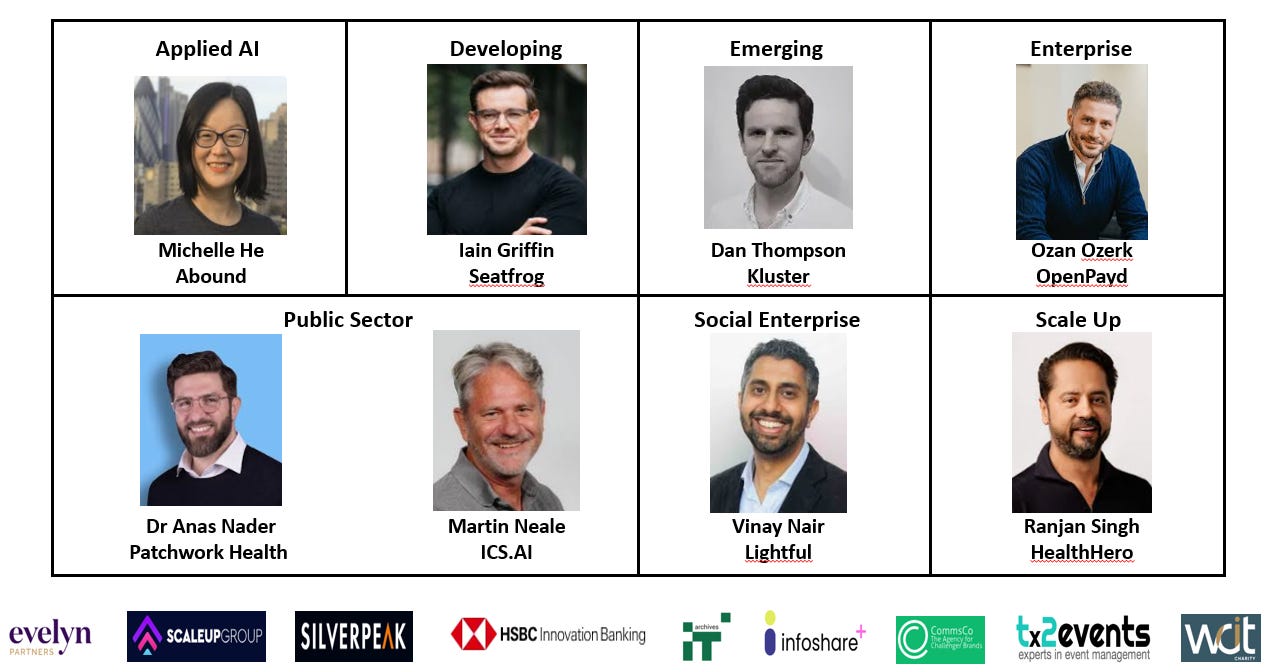

The Enterprise Awards 2025

The 13th edition of the Enterprise Awards happened last night at the Drapers’ Hall in the City of London. The Enterprise Awards celebrate excellence in innovation, leadership and growth recognising entrepreneurial achievement. Event chair Tola Sargeant commented: “The innovation, leadership, and resilience demonstrated by these entrepreneurs is truly inspiring. From early-stage disruptors to seasoned founders scaling global businesses, the breadth and depth of talent is outstanding.”

The Master of Ceremonies (Fernando, if you will), Awards Founder, Executive Chair at ScaleUp Group and noted philanthropist John O’Connell added: “We’re proud to have celebrated some of the most transformative leaders in UK tech—including the likes of Alastair Bathgate of Blue Prism, Vishal Marria of Quantexa, and Poppy Gustafsson of Darktrace, now Baroness Gustafsson, CBE. The 2025 winners carry that legacy forward with ambition, courage, and impact.” All event proceeds support the WCIT Charity. The WCIT Charity funds initiatives focused on IT education, digital inclusion, and the responsible use of technology.

Hat tip the sponsors: Evelyn Partners, ScaleUp Group, Silverpeak, HSBC Innovation Banking, and Infoshare+/Omni Partners. Archives of IT was the impact partner, CommsCo the media partner and, as always, the superbly managed by the team at tx2events.

The Enterprise Awards: Team photo

Source: ScaleUp Group

Through the event we chatted to industry luminaries including Richard Holway, Paul Excell, Rob Wirszycz, Natascha Scholten, Lisa Powis, Martin Fincham, Anthony Miller and Guy Rigby. Their message is that the UK tech sector remains vibrant, with no shortage of spend commitment and that the AI revolution is very much underway. The stumbling block is POCs being slow to turn into full contracts and a shortage of talent. In addition the opportunities being afforded by AI technology migration are not fully appreciated nor indeed fully baked into products. The entrepreneurs Terry Walby CEO of OpenDialog, Duane Jackson and Hellen Bowey CEO of Alcove spoke of the plethory of sales opportunities, yet for them there is a need for continuous product innovation - AI is evolving at pace. While there were rumblings about the anticipated impact on jobs (latest warning from Hays - below) for all AI developments reminded all of that disruptive period as Cloud replaced Desktop systems.

Enterprise Awards: The 2025 winners

The winners are:

Applied AI Entrepreneur: Michelle He, Abound

Ms He, PhD in machine learning, journeyed from Singapore to the UK 15 years ago. After six years consulting for HSBC, Ms He co-founded Abound (2020) where she is now COO. Abound is a credit technology company which addresses the issue of 'credit invisibility' which often affects migrants, students, and women. Abound uses real-time financial data and AI to assess affordability, enabling more inclusive lending decisions, and so widens reach and financial inclusion. The inspiration came from Ms He’s personal experience of being denied a loan due to a lack of UK credit history - she seems a safe bet now.

Developing Entrepreneur: Iain Griffin, Seatfrog

A comfortable career running VML (WPP’s biggest agency) out of the magical Sydney, wasn’t enough for Mr Griffin. An earworm told him to quit media. His passion: how to address the market of vacant business seats for airlines. But selling to airlines was very hard and so the passion changed. Mr Griffin approached Virgin Rail and asked if they could do upgrades for rail tickets. The lights came on. . . The whistle went tut-tut. Today, Seatfrog is a platform with customer facing app fully integrated to all the UK rail companies. It enables passengers (1.5m) to: book a ticket; upgrade to 1st class (unique); change tickets and refunds with a swipe. For the train operators they can better manage capacity and create additional demand (note: Trainline just enable ticket booking). Who knew that average annual UK train capacity utilisation is 17% - clearly Mr Griffin did as he gazed out over Sydney harbour.

Emerging Entrepreneur: Dan Thompson, Kluster

Mr Thompson was an actuarial consultant working in the reinsurance market building actuarial forecasting models for extreme events like hurricanes/floods etc. His clients included The White House and the Bank of England. He needed more excitement. Today, Kluster software helps sales and revenue leaders forecast, plan, and report on their top line performance. The client base is large international companies and PE firms. We confess that we are a little bit frightened that the strap line (“Private Equity-Grade Forecasting”) could become a promise but are encouraged seeing that Geoffery Finlay joined the company as Chair two years ago. Mr Finlay is well-known for creating global tech stars – an excellent partnership.

Enterprise Entrepreneur: Ozan Ozerk, OpenPayd

Mr Ozerk ran the largest social media business in Norway. However, he experienced problems when he needed a card payment ‘acquirer’ outside Norway for international payments acquiring and settlement account. He had an itch: move money across the globe instantly and securely, regardless of the currency and location. Mr Ozerk ventured into payments and led him to banding together 16 startups (a busy period: 2014 to 2016) to address any payment challenge with one API. Along the way Mr Ozerk de-camped to the UK. Today, Mr Ozerk offers single API accesses to the full financial ecosystem (banking, payments, trading, digital asset services) spanning borders, currencies and rails. It is programmable, scalable and “regulation ready”. Clients range from Fintechs, technology platforms, Web3 companies who gain from using a single platform that works globally and battled-hardened – and proven at scale - it processed US$130bn in y/e April. Mr OZerk wants OpenPayd to become the universal financial infrastructure for the digital economy.

Public Sector Entrepreneur: Dr Anas Nader, Patchwork Health

Dr Anas Nader is CEO and co-founder of Patchwork Health, a SaaS platform for NHS staffing. An NHS Doctor, Dr Nader moved to UK from Canada 16 years ago. The idea came to fruition from working as A&E doctor at Chelsea & Westminster Hospital. When first launched in A&E at Chelsea & Westminster Hospital, the hospital built a pool of 500 staff they could call on to work flexibly (instead of using agency staff) and immediately saved £1.2m a year.

Public Sector Entrepreneur: Martin Neale, ICS.AI

At a time when many buy a bicycle and some lycra, at 55 Mr Neale risked all. In 2019, he self-funded ICS.AI, funded by cashing in his pension. Yes, the family home was also at risk. But behind him Mr Neale had a 35-year stretch in the IT industry and 22 market innovations to his name. With ICS.AI his dream was to create secure, scalable generative AI solutions for the public sector, education, and healthcare markets. Today, ICS.AI is the UK’s leading AI Assistant provider for local government by market share, it delivers 24/7 AI-powered services that preserve human connection as the SMART: platform processes >3.9m AI transactions annually.

Social Enterprise Entrepreneur: Vinay Nair, Lightful

Originally, from India, Mr Nair grew up in Ireland before moving to London (a well-trodden path!). A sabbatical from JP Morgan led him to explore to intersection of impact investing and Community charitable activities. His belief is that business must be used as a force to good, deliver shareholder returns but also understand people, planet and community. That thinking led Mr Nair to set up a UK impact assessment fund (£50m) looking for where fab charities had a poor digital presence. And so he Co-founded Lightful in 2014. This is B Corp.

Scale Up Entrepreneur: Ranjan Singh, HealthHero

Mr Singh is a serial entrepreneur, but once he held down jobs at Expedia and ebookers. The corporate life inspired his move to entrepreneurialism. He started his own online travel company. Then, 2008 and GFC happened. While he raised US$8m (Series A) to keep the business going, he eventually sold to TUI and gifted them a business with a 5-year revenue CAGR of 100%. With HealthHero (started 2019), Mr Singh became an entrepreneur and investor; Healthhero is a virtual GP but to accelerate roll-out Mr Singh completed six acquisitions over nine months. That was during lockdown. Now, this is the largest digital clinic in Europe, and Mr Singh sees a global opportunity . . . yes, Americans get ill too.

Current industry debating points

1. Profitability outlook: Do lower input prices lower and Higher factory gate ones = higher profit?

After a very up/down period, EBIT margins are gently improving across the majority of our cohorts. The companies are getting some pricing power, and squeezing up prices (with some notable exceptions), salaries are continuing to slip and the increased National Insurance employer contributions is making for a weak employment market - note below Hays warns today. With Staff Attrition back to more normal levels (indicating that staff are ‘hanging around i.e. not leaving for a salary hike) the opportunity for companies is for profit upside ahead of expectations through FY25.

While investors might conclude that the opportunities are fewer as the increase pricing is more limited, however that sector gains from the efficiency gains from internal AI usage. The challenge being that any firm in staff augmentation (i.e. priced on FTE count) will have limited incentive - as the number of billables determines revenue.

The majority of EBIT margins are on the rise

Source: Company data, Technology Investment Services

UK tech salaries: Falling

Source: ITJobswatch.co.uk, Technology Investment Services

A slow hiring backdrop

Source: TrueUp.io, Layoff.fyi, Company data, Technology Investment Services

2 . As Inventory Great Restocking gathers pace, will the channel feel the pain of depressed FCF?

The theory says ‘yes’, however as we look at two of our US companies, Insight and CDW, the evidence there concludes that while inventory has been creeping upwards FCF generation has not been overly damaged. Ongoing FCF growth feeds dividends, share buy-backs or expansion M&A. While the sector’s positive cash surprises through 2024 may be smaller now the trend remains positive, for now.

Impact from the Great Restocking

Source: Company data, Technology Investment Services

3.The UK small cap recovery

Yes there are company specific examples but as an asset class there is no widespread recovery in smaller companies. That is what the data says. The conditions continue to favour bottom-up company specific investors. Be careful out there.

UK Tech TSR YTD - a mixed bag

Note: Priced 19/06, 09:30. Source: Company data, Yahoo Finance, Technology Investment Services

Latest Results Round-Up

IoT/Smart

IoT/Smart cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Seeing Machines: Announced an agreement to supply additional Guardian Backup-driver Monitoring Systems, BdMS, to a “world-leading North American self-driving car company” (unnamed). The contract (c.US$1.2m) sees BdMS deployed into the autonomous mobility company's test vehicles as they seek to expand across new sites and locations.

Autonomous mobility services promise greater efficiency, reduced operational costs, and enhanced accessibility for passengers, particularly in densely populated cityscapes. Moreover, these advanced systems ensure high levels of safety by minimising human error, which is traditionally a leading cause of accidents. With Guardian BdMS an core technology to monitor and support back-up drivers during the initial deployment phases Seeing Machines has a pivotal role with a technology which bridges the gap between fully autonomous operations and human oversight.

CEO Paul McGlone: "Around the world, regulators and automakers understand that driver and occupant monitoring technology will bridge the gap between the vehicles of today, where the driver is still in control, and the fully autonomous cars of tomorrow."

The numbers we track: Seeing Machines

Source: Company data, Technology Investment Services

AI-RAG

AI-RAG Cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Capita. Shares are +36% YTD (vs last year -36%) and maintaining the momentum, Capita issued an upbeat Trading update (five months ended 31 May). Pleasingly, Capita reiterated FY guidance, called out its product innovation (see below) as it continues to “deliver scalable and repeatable solutions” (i.e. this is how to unlock margin upside) around “evolving market opportunities” (for us, the comment telegraphs new opportunities in BPS, unlike the BPO of old, and starts to address any lingering concerns about TAM execution.

Capita flagged the 200+ AI use cases identified by its Capita AI Catalyst Lab which are to drive efficiencies and higher quality; number of products launched in H1 with further launches planned for H2.

CEO Adolfo Hernandez commented that client interest in agentic AI solutions has “grown exponentially” (agreed). Capita is reinvesting a portion of the efficiency savings into new technology solutions, particularly those underpinned by AI as it brings these technology solutions to more clients. “I’m pleased to see the positive response and impact our new AI solutions are having and look forward to sharing more detail at our H1 2025 results presentation on 5 August.” The current UK Government Labour party reforms present a large upside opportunity for Capita both in terms of the shape of government services, supplier bias and the importance that the UK administration ascribes to the role of AI in delivering Government Services. We concur with Mr Hernandez that Capita needs to “get smaller and get fitter to grow, and also get clearer”.

Financial update. In line with expectations, Adj revenue -4.5% Y/Y. Segments:

Capita Public Service +2.3% Y/Y from growth in Central Government contracts offset the impact of previously announced prior year losses including Electronic Monitoring Service and contracts in Local Public Service

Contact Centre -21.1% due to the impact of losses and subdued volumes on contracts in the telecommunication vertical - all old news. Guides for subdued telecommunications contracts to annualise in H2

Pension Solutions -1.1% Y/Y reflecting the completion of some short-term contracts which more than offset the benefit from a number of wins

Regulated Services business “actively engaged in exiting”, +6.4% Y/Y following a one-off benefit from a termination exit fee and deferred income release from a contract in the Mortgage Software business.

In the five months to 31 May, the Group won contracts with a Total Contract Value (TCV) of £969m, +24% Y/Y, with YTD TCV won up +70% in Capita Public Service, more than offset the 49% reduction in TCV won in the Contact Centre business.

Technology drives efficiency. AI is driving a significant technological revolution, and the refreshed operating model. The first priority is to improve Group operating margin by building a leaner organisation, reinvesting in the technology core of the business and deepen own AI skills, developing products and forging new partnerships. Cited Microsoft Copilot use and its Multiverse AI apprenticeship partnership. As at 13 June, Capita has achieved £185m of annualised cost savings with a goal to deliver the target of £250m annualised savings by December 2025. Of note:

Becoming ‘client zero’ to test solutions before rolling them out to customers. Transitioned to ServiceNow for our internal IT and people support for 25,000 colleagues.

One of the first companies in Europe to utilise Agentforce AI, powered by Salesforce, to drive volume recruitment and reduce the employee recruitment process from weeks to hours. This forms the first use of AI ‘Agents’ or agentic AI1 across the Group, which is an area we will be expanding on going forward. So far we have identified over 100 agentification opportunities across the Group.

Launched Capita AI Catalyst Lab, a dedicated internal team focused on identifying, testing and scaling AI solutions, both internally and externally. Since inception, over 200 use cases have been identified across all areas of the Group, with five products now launched and an additional five products in the detailed testing stage.

Over 10,000 digital learning courses completed by colleagues across the organisation and over 600 individuals have commenced a Management and Leadership apprenticeship to continue their professional development.

Financial guidance unchanged

Adj revenue to be “broadly flat in 2025”, with an improvement in operating margin driven by the ongoing £250m cost reduction programme.

Deliver the cost reduction programme by December 2025 with the margin benefit H2 weighted.

FY free cash outflow between £45 - £65m – it includes £55m cash cost to deliver the cost reduction programme. The FCF outflow is H1 weighted. Reiterates free cash flow positive from the end of 2025.

Group’s medium term Adj operating margin target of 6 – 8%.

Recap:

At the recent Salesforce Agentforce live event, Salesforces demo’d some Capita use cases showing a very efficient processing, use of intelligent agents and all in, a great customer experience. These were around hiring use cases. On a podium Q&A Capita CEO Adolfo Hernandez talked about the Agentforce deployment at Capita. Culturally, Mr Hernandez explained there was a fear of using AI agents in Capita, but staff now understand the notion of the ‘human in the loop’. The organisation better appreciates that humans are better at variety, complexity, better at escalation and have better ethical considerations. Mr Hernandez urges all to “grab the AI opportunity with both hands”. As Capita customers are Government and regulated industries establishing ‘Trust’ has been fundamental to success and AI roll-out has been helped because “Agentforce is grounded by data and this is the guardrails”.

Capita sees the potential for improved Citizen services and with it better productivity. In this, Mr Hernandez echoed the aims of the UK PM earlier in the week. In this Capita is lockstep with Salesforce, but more crucially with the UK Government as well. Concluded Mr Hernandez the “gloom is overdone” – if only the message penetrated the investor community.

Nerd corner AI-RAG vs agenticAI – who wins the bake-off?

RAG combines large language models (LLMs) with external data retrieval to generate grounded, accurate responses. This enhances generative AI with up-to-date, factual information from internal or external sources. It uses a retriever to fetch relevant documents and a generator (LLM) to synthesize an answer based on both the prompt and retrieved data. It is good for real-time, context-rich information, reducing hallucinations and improving accuracy for knowledge-based tasks.

AgenticAI are autonomous AI agents that can perceive, decide, plan, and act toward goals with minimal human intervention. These are capable of executing multi-step workflows, adapts in real time, and autonomously optimizes strategies or actions. It is composed of AI agents who are themselves capable of understanding context from diverse data, some reasoning and executing tasks autonomously. The gain is the continuously learning and adapting by using reinforcement learning and feedback. This improves over time and handling dynamic, complex environments.

The numbers we track: Capita

Source: Company data, Technology Investment Services

IT Professional Services

IT Professional Services: KPI Dashboard

Source: Company data, Technology Investment Services

Triad. After years of faltering, results have a consistently improving pattern. Revenue increased to £21.4m, from £14.0m last year on delivery of new contracts wins made in the previous year. PBT £1.5m reversed to loss of £1.3m last year. On most assignments the company has 10+ consultants deployed on many engagements. Revenue is £20m (out of £21.4m) is from Public Sector customers. Of note:

The cmercial highlight of the year was winning one of the four slots awarded by Integrated Corporate Services (ICS) to suppliers for technical and operational service support for digital projects at the Department for Energy Security and Net Zero (DESNZ) and Department for Science, Innovation and Technology.

Law enforcement continued to play a prominent role, both nationally and with local forces. Of the clients Cumbria Police and launched their new record management system (RMS), Mark 43.

The number of fee earning consultants had increased significantly and by the close of the year the number of fee earning consultants increasing to 147 (2024: 116). Total staff costs increased to £13.9m (2024: £10.7m) due to the increase in the average fee earning consultant number to 131 (2024: 95) and salary inflation. The ratio of fee earners to administration staff to 27:1 (2024: 23:1). Cash and cash equivalents (at 31 March) increased to £3.4m, £2.1m last year, following an operating cash inflow of £2.2m, reversing last year’s £1.5m outflow. Adrian Leer, MD: “We have good visibility of future work for existing clients, with further recruitment underway to match demand. We were delighted to start the new year with a substantial contract to continue providing resources and capabilities into OPSS.”

The numbers we track: Triad

Source: Company data, Technology Investment Services

UK Software

UK Software: KPI Dashboard

Source: Company data, Technology Investment Services

Quantexa. CEO Vishal Marria interviewed on Bloomberg flagged ARR growth to £120m and NRR over 120%. This is a 31 March year end company so we do not expect to see the audited numbers until Jan 2026. The mood music suggests continuing strong topline momentum.

The numbers we track: Quantexa

Source: Company data, Technology Investment Services

Rosslyn. Rosslyn (cloud-based spend intelligence) says that FY25 (30 April) ended in line with market expectations. Revenue £3.3m (FY 2024: £2.9m) and Adj EBITDA loss £1.7m, from £2.5m loss last year. Cash and equivalents c. £1.7m (30 April 2024: £0.6m), with cash burn rate £142k/month reduced from £218k last year. The revenue uptick followed development and professional services fees for the Company's major new client won in H1/25 – this un-named client is a “leading global technology company and household name”.

Guiding into FY26, Rosslyn comments the new FY FY (30 April ‘26) has increased momentum with a larger total and weighted pipeline. It guides for the monthly cash burn rate to be “further reduced significantly” in H1 and be cash generative on a monthly basis by the end of FY 2026. This is despite larger deals typically taking longer than initially anticipated. Delightful news from Rosslyn as the new CEO Paul Watts breaks and now re-builds the company.

UK Hardware

UK Hardware cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Oxford Metrics. It was a ‘no surprises’ H1 as revenue, £20.1m, was -14% Y/Y due to a strong compare. Adj EBIT (£0.4m) vs £3.0m last year. Net cash £39.9m (31/3/25) providing “substantial resources for further targeted M&A and capital returns”. Operating cash inflow of £2.8m, up from £2.2m last year. The company also strengthened its smart manufacturing division with the acquisition of Sempre, and appointed a dedicated smart manufacturing managing director, to drive our growth initiatives. Now, the immediate focus is bringing together the precision and distribution capabilities of Sempre and the vision capabilities of IVS, to build an engine to capture more of this substantial growth market.

CEO Imogen O'Connor said: "Oxford Metrics has made clear strategic progress in H1, and is reporting in line with management expectations, against an exceptionally strong comparator created by the fulfilment of our record order book last year”.

Trading in the second half has begun as expected, in line with previous years (reflecting the usual seasonal trading patterns) but is “mindful of external macro uncertainty”. As a diversified business, we are seeing improving activity for Vicon in South America, Asia Pacific and Europe, while recent policy change in the United States relating to the timing of approved funding is starting to impact institutional and academic customers, which is “a sizeable proportion of our US business”.

Follow Ian Robertson at Progressive Equity Research

The numbers we track: Oxford Metrics

Source: Company data, Technology Investment Services

Recruitment

Recruitment cohort: KPI Dashboard

Source: Company data, Technology Investment Services

Hays. A profit warning. Q4 activity (30 June) “reduced sequentially driven primarily by broad-based weakness in Perm markets” This was due to low levels of client and candidate confidence as a result of macroeconomic uncertainty. By contrast Temp & Contracting activity “continues to be more resilient”. Guides for Group like-for-like net fees -9% Y/Y in Q4 against a soft prior-year comparative: Perm -14% and Temp & Contracting -5%.

Given the largely fixed cost base there is a high drop-through of lower net fees so it guides to FY25 pre-exceptional operating profit of c.£45m vs £56.4m consensus. Shares off 13% as we scribble.

From the geographies: Germany -5% (stability in Contracting/weaker Perm and Temp, with a subdued Automotive sector); UK&I -13% net fee decline; ANZ net fees -9% Y/Y; RoW -9% Y/Y; EMEA ex-Germany net fees -13%; Asia -3% but “stable overall”; Americas (net fees -1%) with 5% Y/Y growth in North America which “remains stable”. The current challenging market conditions are to persist into FY26.

The numbers we track: Hays

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research where I am delighted to be a contributing analyst and my website.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.