Hitch your wagon to rising KPIs that show growth, not decline. Price your offer on KPIs that go higher, not lower. The tech industry once priced its products and services based on performance (MIPS), moved to site wide or Enterprise licenses, then in the SaaS era priced on ‘seats’ (more posteriors = more revenue). The move to consumption and Remaining Performance Obligations saw the price reflect growing consumption patterns and by lowering entry pricing to encourage wider adoption in a mature industry where ‘expansion’ sales at existing customers became more important than acquiring new logos. The model came with some unwelcome downside: recurring revenue diminished, cash arrived after consumption and so cash conversion suffered. One of the brewing themes in Q3 reporting is that as GenAI ROI is rooted in efficiency gains (i.e. not headcount growth) vendors (software and IT services), and their investors, need to re-visit pricing methodologies. Looking beyond the short term the sector has a new risk factor: pricing based on ex-growth KPIs.

Our latest results roll call includes: ActiveOps, Alibaba, Bouvet, Corero Networks, CyberArk, EPAM, Experian, Fadel Partners, Kainos, NRG, Rackspace, Reply, Smart Eye, TPXimpact, Winking Studios. Read on. Data insights inform our cohort dashboards and views of the global tech-economy.

Results Roll-call

IT Professional Services

Kainos: H1s mixed

Interim results were in line with the earlier Trading Update, which came before the more recent profit warning. Taken in the context of the cohort-wide news, Kainos is an outlier - sector KPIs have been turning positive for the past couple of quarters. This will discourage global tech investors.

We dispute the consensus analyst view of Kainos: the UK election purdah is to blame for the challenges, and a share buyback solves the challenge of generating shareholder value. The rationale is sophistry. Common with other European IT Professional Service companies, Kainos has an issue with blended pricing in a global marketplace (see below). The company will continue to suffer from “aggressive pricing” - it is structural not temporal. On the analyst call Kainos mentioned ‘globalise’ many times, but its economic model restricts its global ambitions. ‘Tech’ is a fungible skill so a C++ programmer in New York, London, Mumbai offer the same skills but have vastly different economics. Kainos is a superb company, highly cash generative (cash £151.6m +34% Y/Y) but with high unplanned staff attrition it is harder to move the staff pyramid. This is a great problem to have and relatively easy to solve.

We are reminded of FI Group (became Xansa, later became Steria) who bought IIS Infotech in India in 1997. For a paltry £22m (well, this was a long time ago), in a stroke FI was able to compete better globally and domestically. At the time Hilary Cropper, then FI CEO argued that the cost of employing an Indian graduate was a third lower than a UK graduate – that part has not changed.

Kainos is highly cash generative, sports some very strong cohort-leading KPIs, customers love the company (NPS: 58), but the soft economic backdrop forces customers to think with their budgets, not hearts. Kainos has a long successful M&A history and successful post-M&A integration model. For us it should put its balance sheet to work to protect its future and globalise its economic model.

As to the H1 print: The star was the Workday Products division where revenue grew 28% Y/Y, it now accounts for 19% of Group Revenue and Product ARR, £65.1m, was +18% Y/Y. The software portfolio is comprised of software for Workday’s Smart Test (automated testing), Smart Audit (compliance monitoring), Smart Shield (data masking) and Employee Document Management. H1 R&D spend was +31% Y/Y to £7.7m. At the analyst call, CEO Russell Sloan confirmed that there is a backlog of products in development. Bookings, £179.5m, were -11% Y/Y. From the Professional Services revenue streams (i.e. 81% of revenue) Workday Services revenue was-10% Y/Y and it accounts for 28% of Group revenue and the Digital Services division revenue was -11% Y/Y, and it accounts for 53% of revenue. The Public Sector is 64% of Digital Services and it was -15% Y/Y. Remember in 2024 citizens around the world voted out incumbent regimes. Now, all governments have change mandates, and customers (commercial and Public Sector) have tighter spending limits.

Our standouts from the H1 print:

International revenue was £75.4m +1% Y/Y and in the mix Workday Services was 77% of revenue from these customers – unchanged Y/Y.

The customer count increased to 1,022, from 892 Y/Y.

Kainos delivered >140 AI & Data projects across the public, healthcare and commercial sectors, and won <40 AI & Data contracts in H1/25.

TPXimpact: Positive trading update

UK Public sector supplier TPXimpact issued a positive trading update ahead of forthcoming Interim Results and informed that it had inked a digital transformation contract with Ministry for Housing, Communities and Local Government (MHCLG) worth up to £19m over three years. How does TPXimpact sign new contracts as Kainos warns? Answer: The law of big numbers, and small ones. Like Triad earlier, niche providers have engagement with specific customers, where like MHCLG TPXimpact has two years of working with the client.

As to Trading: TPXimpact stated that it anticipates H1 revenue in line with the 10 September update, i.e. revenue c£38m -9% Y/Y, Adj EBITDA margins c6%, 4.8% Y/Y. Of note: Q2 new business wins £26m, £9m in Q1 and Q3 to date is £24m. In addition, TPXimpact reiterated the FY52 outlook (flat revenue growth/Adj EBITDA target of £7-8m) and FY26 outlook (i.e. like-for-like revenue growth 10-15%/ Adj EBITDA margin 10-12% vs 5.5% in FY24). Said CEO Björn Conway: "I am pleased with our progress in the first half of FY25, despite a challenging market environment. The Chancellor's Budget announced on 30 October provided improved visibility in relation to Central Government spending plans for the next financial year, which should result in an uplift in activity in the second half of this financial year.” We should learn more at Interim results, 28 November.

Reply: “All economic indicators have substantially improved”

This was a strong result. The nine-month revenue grew to €1,666.9m, from €1,548.0m Y/Y, EBIT €224.2m, €187.7m Y/Y. Reply Chairman Mario Rizzante commented that “2023 was the year of artificial intelligence, with projects aimed at understanding where and how to introduce this new form of knowledge and data utilization. In these nine months of 2024, we have instead observed a heightened awareness among companies of the real impacts of artificial intelligence.” Note that the results followed the 30 October acquisition of UK Public Sector niche vendor Solirius. Among Solirius' clients are HMCTS (HM Courts & Tribunals Service), FCDOS (Foreign, Commonwealth & Development Office Services), DfE (Department for Education), and BDUK (Building Digital UK). Noting the importance of customer incumbency at TPXipact, this was a good move by Reply.

EPAM: Beat and Raise

Re-affirming why EPAM is a great home for the FD Technologies Professional Services business (expected to close in early December) EPAM reported a very strong Q3 result. Of the highlights here too revenue has turned with US$1.168bn, +1.3% Y/Y and EBIT margin 15.2%. The company raised Guidance: FY revenue range US$4.685 - $4.695bn, FD EPS range US$7.78 - $7.86. Arkadiy Dobkin, CEO & President commented “We continue to help our clients adapt and modernize their businesses, including deploying world-class solutions enabled by GenAI”.

Bouvet: Beat and Raise

More revenue growth: Q3 revenue NOK878.5m, vs NOK 777.9m Y/Y, +12.9%. Note also that Bouvet increased its charge out rates with the hourly rate +5% Y/Y. Bouvet reported “continued strong demand in the public sector” with public administration and defence sectors being 16.5% of Group revenue (the mainstay of revenue is from Norway’s Oil and Gas industry).

The numbers we track

Source: Company data, Technology Investment Services

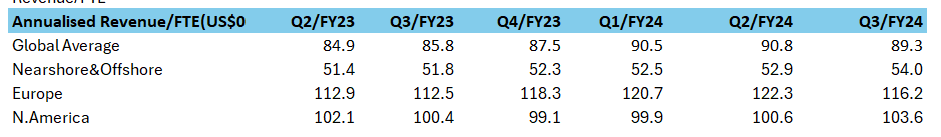

The structural disadvantage for European IT Professional Service vendors

Source: Company data, Technology Investment Services

IaaS

Alibaba: Continued IaaS growth, but Group has some disappointment

Growth in the Cloud business accelerated again with revenues from public cloud products growing in double digits and AI-related product revenue delivering triple-digit growth. For Q3 revenue from Cloud Intelligence Group was RMB29,610m (i.e. US$4,219 m) +7% Y/Y, driven by double-digit public cloud growth, including increasing adoption of AI-related products. AIrelated product revenue grew at triple-digits year-over-year for the fifth consecutive quarter. EBITDA growth (see below) as due to a shift in product mix toward higher-margin public cloud products including AI-related products and improving operating efficiency. Note (i) Group-wide results featured a 70% Y/Y fall in free cash flow to US$2bn due to cloud infrastructure investments and working capital changes. (ii) Adj EPS RMB15.06 ($2.15) beat consensus of RMB14.79 but was -4% Y/Y ad while revenue was up 5% Y/Y at RMB236.5bn it as shy of consensus forecast, RMB239.97bn.

Said Eddie Wu, CEO Alibaba Group: “We are more confident in our core businesses than ever and will continue to invest in supporting long-term growth. Our other businesses continued to improve their operating efficiency, with most of them continuing to increase their profitability or reduce losses.”

Alibaba: The numbers we track

Source: Company data, Technology Investment Services

Rackspace: Q3 was a beat, but numbers are still soft

Q3 revenue, US$676m, was -8% Y/Y of which Private Cloud, US$258m, was -14% Y/Y and Public Cloud, US$418m was -3% Y/Y. The hyperscalers continue to do well, but generic co-lo Rackspace remains a laggard. There was a net loss US$(187)m, an improvement on the net loss, US$(227)m, Y/Y. Operating cash flow US$52m. Common with the cohort, CapEx is up US$31m in Q3, vs US$28m Y/Y. Nonetheless the Q3 print exceeded the guidance midpoint for revenue, operating profit, and EPS. Bookings grew double digits, Public Cloud posting a record bookings quarter since the formation of the two business units. CEO Amar Maletira was “pleased with the steady progress we are making in both the businesses on multiple fronts.”

Rackspace: The numbers we track

Source: Company data, Technology Investment Services

Data & Analytics

ActiveOps

The H1 print was in line with prior guidance. The numbers sport some nice incremental sales, customer progress, new business, technology insertion and NRR. ActiveOps reiterated FY guidance, reminded of the slow “elongated” buying backdrop and flagged that a specific customer would lower seats in H2. There are opportunities from the expansion rate and a beefed-up sales team (it adds to H2 costs and investors should not anticipate new sales productivity until FY25). To us, the overall ‘look and feel’ of ActiveOps appears stronger than consensus may suggest.

Of the numbers (see table below) our standouts were

10% ARR growth,

32% rise in Adj EBITDA,

3 new customers secured (H1 FY24: two new customers), two with significant expansion potential

addition of five experienced sales executives with “further investment planned in H2”.

ActiveOps Executive Chair, Richard Jeffery, commented “we are confident the investment into our sales team, and the growing AI capabilities of our platform, provide us with a fantastic springboard”.

ActiveOps: The numbers we track

Source: Company data, Technology Investment Services

IoT

NRG Energy: Beat and (reiterated) Raise

NRG is a US-based home and power vendor, but the company is repositioning to home solutions. Hence we folded into our IoT universe. The company posted a strong Q3 and reaffirmed its recently raised 2024 guidance. “We had another excellent quarter, posting strong performance across the company,” said Larry Coben, NRG Chair, President & CEO. On September 25, 2024, NRG raised its 2024 Adj EBITDA guidance to US$3,525 - $3,675m from prior US$3,300 - $3,550m.

Smart Eye: Curate’s Egg

A mixed Q3 from Smart Eye yet in tune with the operational messages from the IoT cohort in the ‘driving’ segment. Sales, SEK79.1m were +2% Y/Y as Automotive sales were +35% Y/Y, Gross profit, SEK70.5m, from SEK70.2m Y/Y reflected an 89% gross margin from 90% Y/Y. EBITDA is on an improving trend, SEK -17.4m, from SEK-23.4m last year, with an operating loss of SEK-61.5m, a slight improvement on the SEK-63.1m last year. Cash and equivalents were SEK45.5m at the balance sheet date and the company has credit facilities SEK127,8m and after the period end Smart Eye got an additional SEK150m credit facility. Of particular note:

During Q3, Smart Eye announced 37 new design wins, estimated order value SEK735m.

Q3 saw the ramp-up of production programs in automotive, but a slowdown in the behavioral research market which resulted in slower than expected overall growth.

Automotive licenses grew with more than 100% Y/Y with the license growth rate to increase in Q4, followed by “even higher growth in 2025”. More than 67 car models had reached production by the end of Q3 with an expected 80 before year’s end. Next year the company guides that for an increased rate of ramp up of car models affected by GSR. The legislation also mandates bus manufacturers to install the new generation safety systems. Smart Eye is selected by 14 brands and production volumes are expected to start picking up in Q4. Smart Eye reiterated guidance of being EBITDA positive in early 2025 with positive cash flow following 2-3 quarters thereafter.

NRG and Smart Eye: The numbers we track

Source: Company data, Technology Investment Services

AI-RAG

Experian

We confess that we have been generally disappointed by progress with our AI-RAG list this year. Our AI-RAG cohort is comprised of companies with very strong domain and vertical market skills who have the potential to translate that into a very strong AI product. However, we acknowledge that much of the ability to execute on that opportunity may well depend on cultural factors.

The latest of the UK ‘RAGs” to report was Experian. Here we are encouraged by the strong sales execution but more so by the strengthening technology narrative - all is not lost on our AI-RAG cohort. We noted through the H1 print:

Consumer Services 9% Y/Y organic revenue growth. Experian serves >190m free members and continues to “grow membership and engagement and provide innovative tools for our members to navigate their financial lives”.

During H1, Experian completed the acquisition of Neuro-ID, Inc. a US leader in fraud-related behavioural analytics, in Brazil acquired Tex for insurance marketplace expansion, and after the period end acquired Clear Sale S.Aa, which is billed as a “leading provider of digital fraud prevention solutions” in Brazil.

Has “progressed in embedding Generative AI” capabilities across the organisation, i.e. rolled out GenAI productivity tools to all regions and recently launched a GenAI powered Experian Assistant within the Ascend Sandbox in North America.

Acquired NeuroID, an industry leader in behavioural analytics, which enhances the existing fraud prevention suite by providing new capabilities around digital behavioural signals and analytics.

Cyber

Corero Network Security: Q4 Trading Update

Corero (distributed denial of service/DDoS software) made “good progress” in Q4 2024 to date. The company reported “continued momentum” with the addition of new customer mandates and upselling into existing customers across multiple selling regions. The Total contract value secured Q4 2024 is US$1.7m which was comprise of (i) a new customer 3-year contract with an Icelandic IT services provider, (ii) New customer 1 year contract with an independent agency of the US federal government, (iii) Existing customer renewal and expansion: 3-year contract with a growing UK-based hosting provider, focused mainly on the UK and EU markets. (iv) Existing customer renewal and expansion with a 3-year contract with an EU government department. Carl Herberger, CEO reminded that Corero “already delivered both new customer mandates alongside strategic growth within our existing blue chip client base in key global territories.”

CyberArk: Beat and Raise

The world remains an uncertain place. CyberArk (Identity management) Q3 exceeded all guided metrics with Subscription ARR +46% Y/Y as Total ARR was +31% Y/Y to US$926m with Group revenue +26% Y/Y to a record US$240.1m. CyberArk raised FY guidance across all metrics. Matt Cohen, CEO commented: “We continue to deliver on our vision of securing every identity – human and machine – with the right level of privilege controls. Demand for our solutions remains strong as customers continue to embrace our industry leading solutions across workforce, IT, developer and machine identities.”

CyberArk: The numbers we track

Source: Company data, Technology Investment Services

UK list

Fadel Partners, Inc. Update to FY 24 Trading Expectations

FADEL (brand compliance, rights and royalty management software) warned on the timing of new business deal closings, new products entering the sales pipeline, and the variability in IPM Enterprise license revenue recognition. The company already told the investment community that it was hard to accurately forecast revenue. The new news is that it has since received notification of the loss of a significant RFP-based new customer opportunity that was anticipated to close in Q4-24 and the customer delays the spend into 2025. The company also stated that its Preliminary cash forecasts give it confidence that it has sufficient cash to fund business operations throughout the 2025 year. It reminded that it has an unused US$1m credit facility.

Note:

Fadel was the last of the 2023 IPO cohort to warn. All are now well below their IPO price (see below). Speaking of IPOs . . .

How LSE IPOs perform after the bell

Source: Company data, Yahoo Finance, Technology Investment Services

Games

Winking Studios: A new name for LSE

Shares in Winking Studios began trading on LSE this week. This followed a secondary in London which raised £7.9m from a mix of new and existing investors. This is a Singapore-based art and games services outsourcer.

The timing of the transaction is both favourable and unfavourable. Clients are having a hard time as the games industry continues to struggle. The de-listing of Keywords Studios means that London has a wealth of experience and knowledge investors in the games services market.

End notes & Disclaimer: Please read

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. This is not investment advice. Opinions contained in this report represent those of the author at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. The author is not liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained herein. The information should not be construed in any manner whatsoever as, personalized advice nor construed by any subscriber or prospective subscriber as a solicitation to effect, or attempt to effect, any transaction in a security. Any logo used in this report is the property of the company to which it relates, is used here strictly for informational and identification purposes only and is not used to imply any ownership or license rights between any such company and Technology Investment Services Ltd. Email addresses and any other personally identifiable information collected in the provision of the newsletter are only used to provide and improve the newsletter.

Need more

Let’s chat at Progressive Equity Research here where I am delighted to be a contributing analyst and my website here.

The ask

My name is George O’Connor. I am a tech investment and IT industry analyst. I explore shareholder value, its drivers, the best exponents, the duffers. The target readers are investors, companies, advisors, stakeholders and YOU. If you like this please subscribe and pass it on to colleagues and friends. That said, if you hate it - do the same. Thanks for dropping by dear investor.